Ascott Residence Trust – Recovery and rebalancing

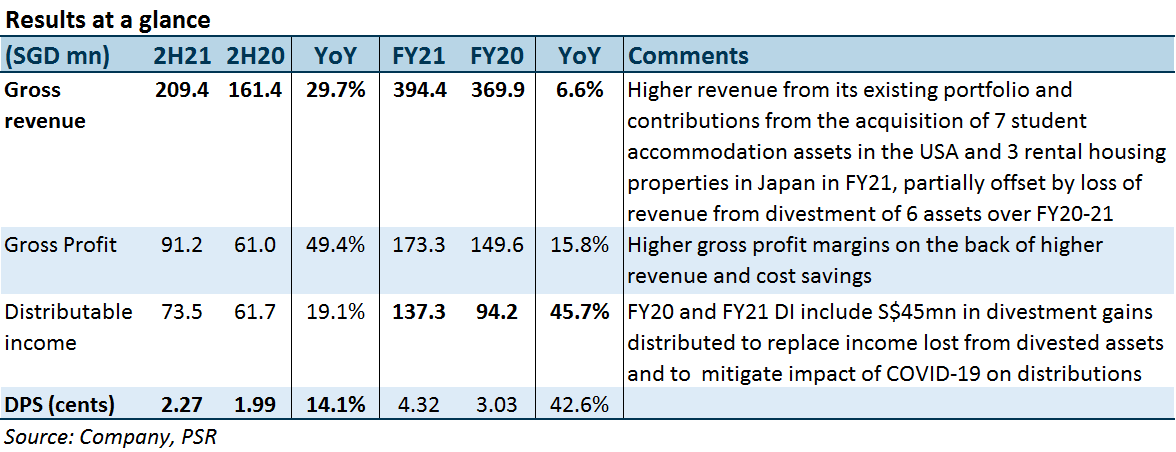

10 Feb 2022- FY21 DPU of 4.32 Scts (+17%) was in line, forming 99% of our forecast, supported by new acquisitions and recovery of existing portfolio.

- AUM in extended-stay segment increased from 5% to 16% following S$785mn in acquisitions in FY21. Medium-term target raised to 25-30% of AUM.

- Maintain ACCUMULATE, DDM-TP raised from S$1.19to S$1.22. FY22e-25e DPUs have been lowered by 9-11.5% as we push back recovery from FY23 to FY24. Despite a slight increase in cost of equity from 8.10% to 8.14%, our DDM-based TP rises from S$1.19 to S$1.23 as we roll forward our forecast. ART remains our top pick in the sector owing to its mix of stable and growth revenue and geographical diversification. Current share price implies FY22e/23e DPU yield of 5.0%/5.7%.

The Positives

- Sixth quarter of RevPAU recovery; FY21 gross profit up 15.8% YoY (Figure 1 and 2). 4Q21 RevPAU grew 24%/74% QoQ/YoY) on the back of higher occupancy and ADRs. Average portfolio occupancy improved QoQ from c.55% to c.60%. Demand from both corporate and leisure segments returned as travel restrictions were eased and economic activities picked up. Amongst ART’s key markets, US (-275.7%), UK (92.3%) and Australia (+54.2%) registered the strongest YoY gross profit growth. US reversed its S$7mn gross loss in FY20 and recorded FY21 gross profit of S$12mn, of which c.S$7mn or 57% was attributed to the acquisition of five student accommodation assets in FY21. The impact of reopening of borders and relaxation of domestic mobility was reflected in the 48% growth in gross profit from a management contract. Revenue and gross profit from master leases and MCMGI were stable, down 2-5% due to closure of two WBF properties in Japan, reclassification of Park Hotel Clarke Quay from master lease to management contract in 2H21, divestment of two properties in France and change in rent structure of French master leases, partially offset by the absence of rent abatement in FY21.

- Portfolio reconstitution into long-stay assets to shore up stable revenues. ART divested S$580mn in assets at exit yields of c.2% in FY20/21. In FY21, it invested S$785mn into the long-stay segment at higher EBITDA yields of c.5%. Long-stay assets acquisitions announced in FY21 included eight US student accommodation assets and three Japan rental housing assets. Apart from replacing divested income, these long-stay assets provide income visibility, providing a stable base of earning for ART.

The Negative

- Fragile recovery. Throughout the year, operations affected by the tightening and easing of restrictions. Restrictions were imposed and travel bubbles were delayed in various countries due to the emergence of the Delta and Omicron variants, resulting in softer demand in certain months. Demand for travel was evident from the uptick in bookings during periods when restrictions were eased. While more governments are adopting an endemic stance, knee-jerk effects from new, severe variants could still trigger the imposition of restrictions.

Trade of the Day - SATS Ltd (SGX: S58)

Trade of the Day - SATS Ltd (SGX: S58) Block Inc - Cost-cutting boost earnings

Block Inc - Cost-cutting boost earnings Trade of the Day - Oracle Corporation (NYSE: ORCL)

Trade of the Day - Oracle Corporation (NYSE: ORCL) Lendlease Global Commercial REIT - Rental upside to come from Sky Complex Milan

Lendlease Global Commercial REIT - Rental upside to come from Sky Complex Milan