China Aviation Oil (Singapore) - Lift-off in international flights

30 Oct 2023- International passenger traffic in China is up 18 fold YTD September 2023 and only 33% of pre-pandemic levels. We expect international travel volume recovery to gain pace in FY24e, fuelling demand for jet fuel at international airports.

- China’s jet fuel consumption has risen by CAGR of 8.4% over the last 10 years. More airports have been added over the years to cope with the rise in air travel demand. We think CAO could potentially expand its footprint to international airports in other Chinese cities.

- We initiate coverage with a BUY recommendation and discounted cash flow TP of S$01. We expect earnings to double over the next two years and around 64% of the market cap is in net cash of US$308mn (as at end 2022).

Background

China Aviation Oil (Singapore) Corporation Ltd (CAO) supplies imported jet fuel to the civil aviation industry in China. CAO is 51.3%-owned by state-owned China National Aviation Fuel Group Limited, which holds the mandate to supply all jet fuel requirements in China. CAO also markets jet fuel to airports outside China, and engages in international trading of jet fuel and other oil products, as well as carbon credits. It has a 33% stake in Shanghai Pudong International Airport (SPIA). SPIA accounted for 62% of net profit in FY22.

Highlights

- China air travel demand rebounded after borders re-opened in early 2023. Air travel volume surged by 80% YoY in the first eight months of 2023, after the lifting of Covid mobility restrictions, thereby pushing up consumption of jet fuel. The recovery is led by domestic travel. International flights are still at 20-30% of pre-Covid levels. As more international flights are restored, we expect jet fuel demand at the major international airports in China to return to pre-Covid levels by FY25e. About 60% of petroleum and refined products are imported.

- CAO could potentially supply jet fuel to more international airports in China. China’s jet fuel consumption has risen at a 10-year CAGR of 8.4% from 2011-2021, and 9.7% if year 2020 were excluded, mirroring the growth in air travel demand. Correspondingly, China has been adding airports at a CAGR of 3.4% over the last 10 years. CAO mainly supplies to the five key international airports currently, but we think it has potential to expand its footprint to international airports in other Chinese cities.

- The three major Chinese carriers plan to grow their fleet by 6-18.5% in the next three years. Air China, China Eastern Air and China Southern Airlines together account for two-thirds of China air transport volume. We think the fleet expansion plan signals optimism that rising affluence and mobility and increased urbanization will underpin demand for air transport.

Initiate coverage with a Buy recommendation and TP of S$1.01.

Our TP is based on the discounted cash flow model. Its operations are asset-light. The balance sheet comprises mainly cash (as at Dec 22: S$0.49/share), investments in associates and working capital. We expect ROIC to rise to 10% in FY23e and 14.4% in FY24e (FY22: 5.6%).

Background

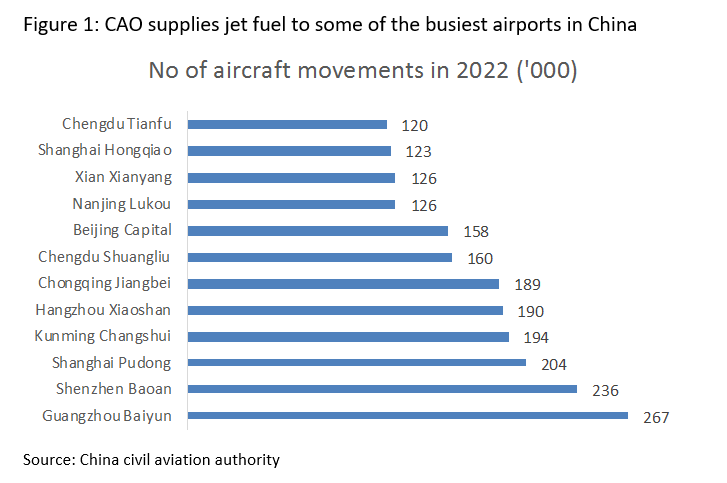

China Aviation Oil (Singapore) Corporation Ltd (CAO) supplies imported jet fuel to the civil aviation industry in China. It buys and sells physical products to the major international aiports, including Guanzhou Baiyun International Airport, Shenzhen Baoan International Airport, Shanghai Pudong International Airport, Beijing Capital International Airport and Shanghai Hongqiao International Airport, which are amongst the busiest airports in terms of aircraft movements in China in 2022. (Figure 1)

The supply contracts with the airlines are on a cost-plus basis. The fuel is sourced mainly from Asian markets such as Japan, South Korea and Taiwan.

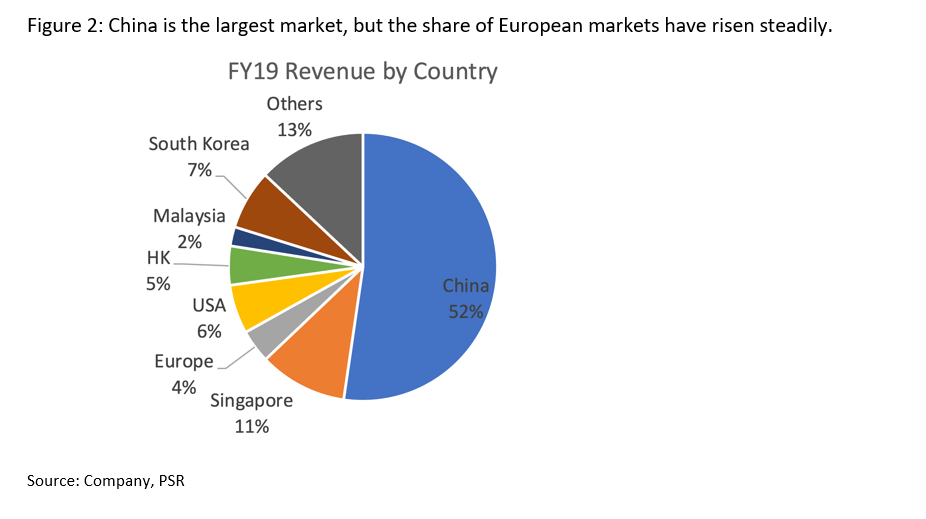

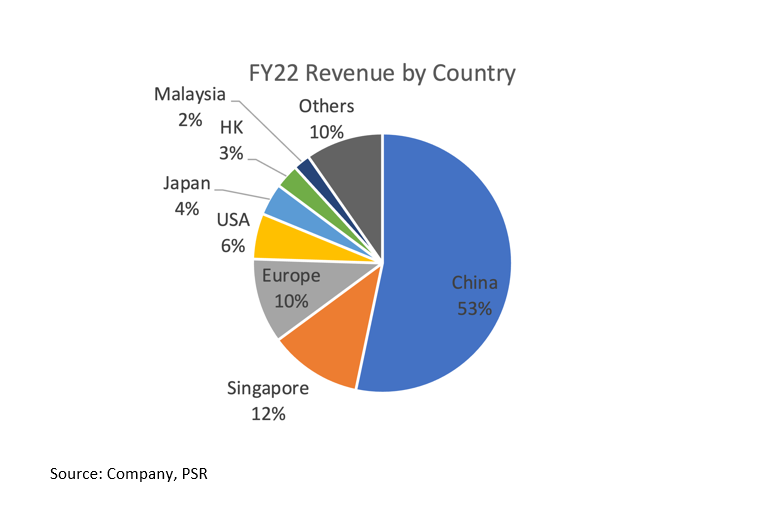

CAO also markets and supplies jet fuel to airports outside China. While China accounts for the lion’s share of 53% of revenue, the share of the European markets have been rising steadily as it steps up its presence through a trading arm in the UK and a 12.5% stake in a concession holder at the Amsterdam Schipol Airport. The breakdown in revenue by geography is as shown in Figure 2.

Associates and joint ventures

Through associates and joint ventures, it owns a portfolio of assets that provide storage, pipeline transportation, and re-refuelling facilities to manage the storage and distribution of jet fuel. (Figure 3). These assets are the critical infrastructure that underpin CAO’s entrenched position as the largest physical jet fuel trader in Asia Pacific. The investments in associates account for 28.7% of net assets of the group.

About the author

Peggy Mak

Research Manager

PSR

Peggy has been a sell-side equity analyst for 22 years and a fund manager for 15 years.

About the author

Peggy Mak

Research Manager

PSR

Peggy has been a sell-side equity analyst for 22 years and a fund manager for 15 years.

Magnificent 7 Monthly: April 24 - Growth dragged by Apple and Tesla

Magnificent 7 Monthly: April 24 - Growth dragged by Apple and Tesla Airbnb Inc - Solid results overshadowed by weak guidance

Airbnb Inc - Solid results overshadowed by weak guidance May 9th - Things to Know Before the Opening Bell

May 9th - Things to Know Before the Opening Bell Trade of the Day - Pfizer Inc. (NYSE: PFE)

Trade of the Day - Pfizer Inc. (NYSE: PFE)