CapitaLand Investment Limited - Lodging business is the star performer

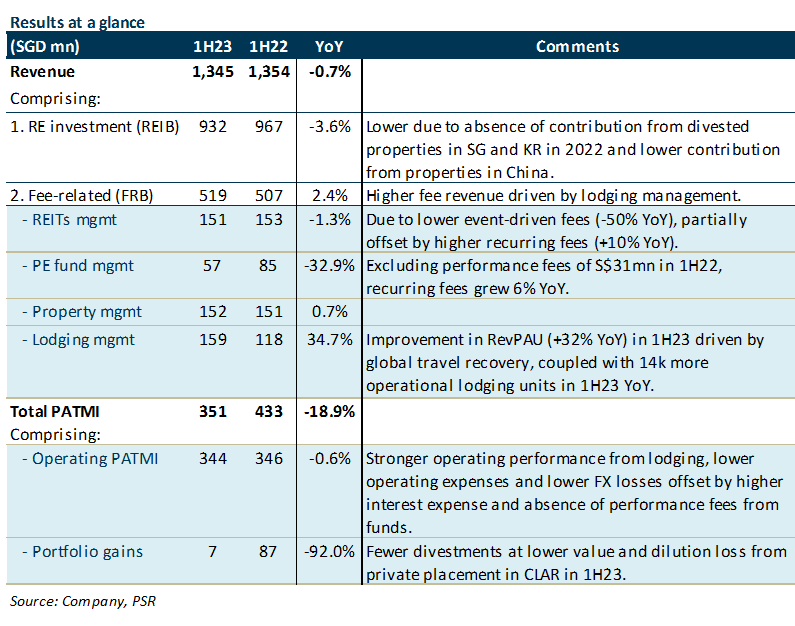

18 Aug 2023- 1H23 revenue of S$1.345bn (-0.7% YoY) was slightly below our estimates, forming 41% of our FY23e forecast. This was due to a 3.6% decline in contribution from the Real Estate Investment Business (REIB) as there was loss of contribution from properties divested in 2022, as well as lower contribution from properties in China. It was partially offset by higher Fee Income-related Business (FRB), which was up 2.4% YoY supported by stronger fees from lodging management.

- 1H23 PATMI of S$351mn (-18.9% YoY) was below our FY23e estimates at 28% due to lower portfolio gains from asset recycling, higher finance costs and absence of event-driven performance fees from two private funds exited in 1H22.

- Upgrade to BUY with a lower SOTP TP of S$3.68. We lower FY23e/24e earnings by 17% to account for higher finance costs, lower portfolio gains, and lower margins from FRB. Our SOTP-derived TP of S$3.68 represents an upside of 22.9% and a forward P/E of 15x. We like CLI for its robust recurring fee income stream and asset-light model. Immediate catalyst for CLI is a stronger China recovery.

The Positives

+ Lodging segment star performer. 1H23 lodging management fee-related income grew 35% YoY to S$159mn due to higher room rates as well as improved occupancy across the portfolio. Portfolio RevPAU grew 32% YoY to S$87 and was 106% of 1H19 pre-COVID levels. CLI has a target to reach S$500mn in lodging management fees within five years.

+ Recurring fund management fees grew 10% YoY to S$183mn in 1H23. This alleviates the impact of lower event-driven fees (-65% YoY) in a market that is less conducive for deal-making. CLI has S$1.3bn in acquisitions from listed and private funds yet to be reported in Funds Under Management (FUM), as well as S$8.5bn in committed but undeployed capital in private funds that could lift fee income if deployed; it has a current FUM of S$89bn.

+ Managed to raise funds in a market battered by high interest rates. CLI raised S$3.2bn of committed equity for its private funds YTD (S$2.5bn for whole of FY22) – it established a new fund, CapitaLand India Growth Fund 2, mandated to invest in Grade A business parks in India.

It also raised S$986mn of new equity in its CapitaLand China Opportunistic Partners Programme and S$150mn in its CapitaLand Open End Real Estate Fund.

The Negative

– REIB revenue declined 3.6% YoY to S$932mn, due to lower contribution from China properties and absence of income contribution from properties divested in 2022. It is unlikely that CLI will be able to hit its S$3bn divestment target for FY23 with only S$839mn of divestments YTD in this challenging environment.

About the author

Darren Chan

Research Analyst

PSR

Darren has over three years of experience on the buy-side as a fund manager. During his time as fund manager, he has managed multiple funds and mandates including dividend income, growth, customised, Singapore focused and regionally focused funds. He graduated from the University of London with a First-Class Honours degree in Banking and Finance.

About the author

Darren Chan

Research Analyst

PSR

Darren has over three years of experience on the buy-side as a fund manager. During his time as fund manager, he has managed multiple funds and mandates including dividend income, growth, customised, Singapore focused and regionally focused funds. He graduated from the University of London with a First-Class Honours degree in Banking and Finance.

Alphabet Inc. - Growth accelerating across all segments

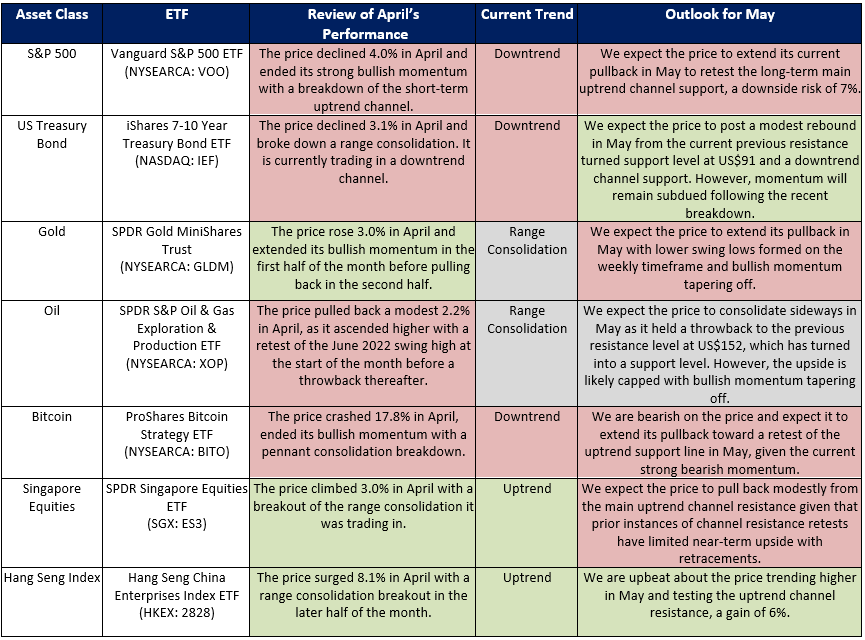

Alphabet Inc. - Growth accelerating across all segments ETF Monthly: Apr 24 - Lacklustre month expected for Bitcoin, Gold, and S&P 500. But stellar Hong Kong.

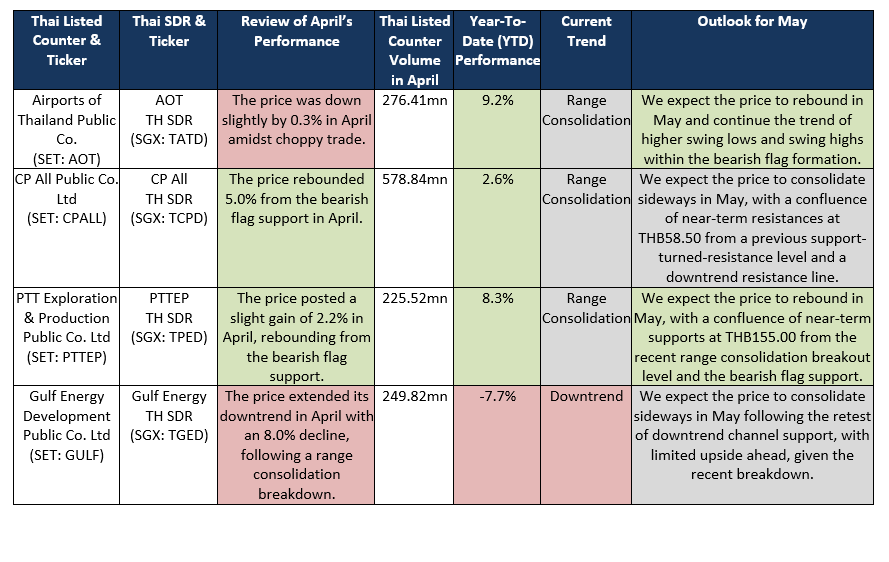

ETF Monthly: Apr 24 - Lacklustre month expected for Bitcoin, Gold, and S&P 500. But stellar Hong Kong. Thai SDR Monthly: Apr 24 - AOT, Kasikornbank and PTTEP to outperform

Thai SDR Monthly: Apr 24 - AOT, Kasikornbank and PTTEP to outperform DBS Group Holdings Ltd - NII and Fee Income boost earnings

DBS Group Holdings Ltd - NII and Fee Income boost earnings