Elite Commercial REIT - Attractive valuations with monetisation underway

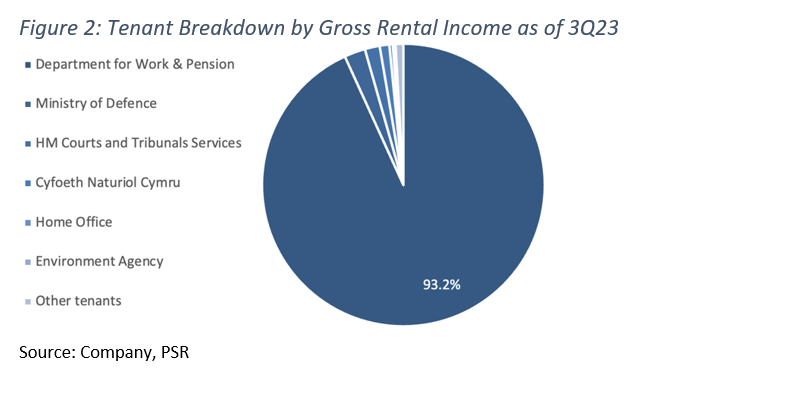

27 Nov 2023- The rental escalation of around 11% that is tied to CPI began in Apr23. We believe there is downside protection from the UK government department, contributing 93.2% of the total rental income, with no further break clause until FY28.

- ELITE is actively reducing leverage through divestments. As of 3Q23, the total proceed of £11.4mn reduced the gearing by 60bps to 45.4%. 4 assets, valued at c.£13.8mn, are ready for the next round of divestment, and they are expected to lower gearing by c.100bps further.

- At 0.59x P/NAV (FY23e, NAV:0.51), ELITE is currently trading at 1.13 SD below its mean of 0.93 P/NAV, and below the average SREIT historical valuation of 0.86x P/NAV. We initiate coverage with a BUY recommendation and a DDM-based target price of £0.36. ELITE is paying a dividend yield of 6%.

Company Background

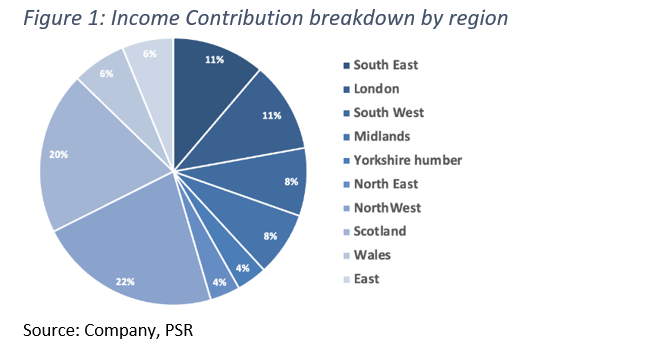

Elite Commercial Trust (ELITE) was listed on 6th Feb 2022. It specializes in commercial and real estate-related assets within the United Kingdom (UK). Its portfolio consists of 155 predominantly freehold commercial buildings located throughout the UK, with a combined valuation of £466.2mn as of Dec22. Over 99% of gross rental income originates from the UK Government, such as Department for Work and Pensions (DWP 93.2%), Ministry of Defense (2.4%) and National HM Courts and Tribunals Services (1.7%).

Key Investment Merits

- Stable income stream with CPI-tied escalation. In 3Q2023, DWP contributed a substantial 93.2% to the portfolio’s Gross Rental Income (GRI). The tenant is a government department, with a consistent record of paying 100% of rental a quarter in advance. ELITE also has 139 assets that are positioned to take advantage of the built-in rental escalations tied to the CPI, commencing in Apr23. The expected range for rental escalation across these assets spans from 11.0% to 15.4%.

- Divestment for monetisation. ELITE is actively working on the divestment plan to reduce gearing. As of 9M23, Openshaw Jobcentre in Manchester, Cardwell Place in Blackburn and Leeds Road in Bradford have been divested. These divestments, £3.4mn were executed at 12.2% above valuation, contributing to a total gross proceeds of £11.4mn and reducing gearing by 60 basis points to 45.4%. To account for a potential 5% decline in year-end valuations, ELITE may need to divest c.£10.8mn more in assets. Four assets have recently completed the dilapidation settlement (Crown House, Sidlaw House, Lindsay House, Ladywell House, or Hilden House) and are ready to be sold or re-let. If ELITE decides to divest them at book value, this could result in a divestment p roceedof c.£13.8mn to offset the deterioration in gearing. Buyers are observed to be end-users acquiring properties for their own use or private developers for residential development, as there is currently an undersupply of properties in the UK.

- Valuation near record low. Elite is trading at 0.59x P/NAV, which is 1.13 SD below its historical mean of 0.93, and is also below the average S-REIT of 0.86x P/NAV. Taking the industry average multiple and the NAV of 0.51, the implied share price would be £44. Much of the risk such as the potential gearing breach has been factored into the current share price and we belive the discount is attractive.

We initiate coverage with a BUY rating and a target price of £0.36 based on DDM valuation, COE of 10.89%, and terminal growth of 1%. We expect DPU of £4.97 cents for FY23e and £5.5 cents for FY24e, translating into yields of 16.58% and 18.35%, respectively.

Revenue

Gross revenue

In 3Q23, DWP made up for 93.2% of the portfolio’s Gross Rental Income (GRI). The tenant enables strong consistent rental collection of ~100% a quarter in advance. A total of 139 assets within the portfolio are designed to benefit from the built-in rental eslcation tied to the CPI starting in Apr23. The estimated range for rental escalation across these assets is between 11.0% and 15.4%.

Dilapidation settlement

Dilapidation assessment for vacating assets refers to claim for damages by the landlord against the tenant’s cost of repair. As of 3Q23, ELITE had completed 9 dilapidation settlements and received £1.9mn settlement fee and £0.4mn of lease surrender premium in 2Q23 and £8mn dilapidation fee in 3Q23. The settlements for 3 assets are still in progress. Divestment can only proceed upon completion of dilapidation settlement. So, we anticipate the next divestment is likely to be one of the 4 properties (Crown House, Sidlaw House, Lindsay House Ladywell House, or Hilden House) as the dilapidation settlement has already been completed.

Tenant Profile

DWP’s social services remains essential for UK citizens, as they continue to provide support over 22mn claimants as of Feb22. As the largest public service department under the UK Government, it is responsible for important services such as welfare, pensions, and child maintenance, DWP disbursed a total of £217 billion in benefits and pensions during FY21/22. Around 85.5% of the assets within the REIT’s portfolio that are occupied by DWP serve as front- of-house facilities, primarily operating as front-facing Jobcentre Plus offices. The remaining 14.5% of assets serve as back-of-house support services, encompassing call centers, claims processing, finance, accounts, and investigation functions. DWP tends to expand during the economic downturns along with raising unemployment as as it plays an important role in boosting employment and in-work progression, as well as delivering vital support and services to people in need in society.

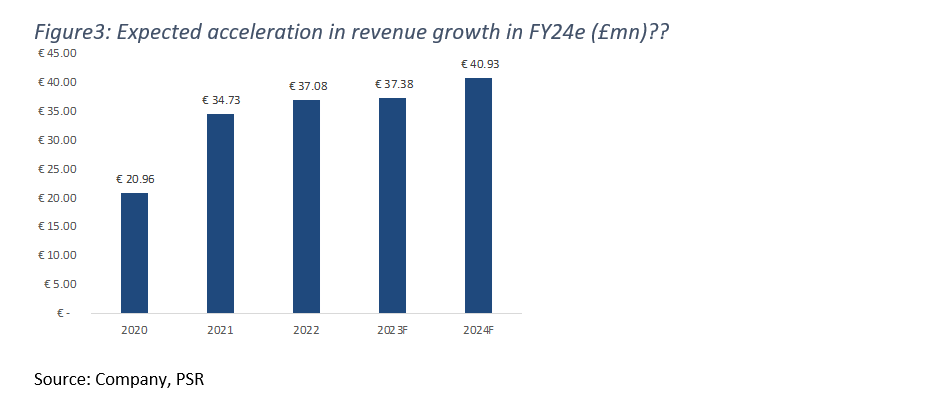

Revenue Growth

We expect 0.82% YoY revenue growth for FY23e, amounting to $37.38mn. The CPI-tied rental reversion of 13.1%, which took effect in April 2023, is expected to be partially offset by 12 vacant buildings and 11 rental reductions (c.30%), contributing to 2% of the FY22 income in the portfolio. Despite the current conservative economic outlook, we remain positive about the stable income stream provided by the major tenant, DWP, as there is no more break clause for further rental reduction or lease expiring until FY28.

Due to the low physical occupancy (an average of 50%) in the UK, 11 properties had reduced their rental, with 3 at 45% and 8 at 30%, contributing to a total of 2% revenue reduction. ELITE has been actively working on divesting the 8 vacant assets, which account for c.5% of the total rental income. The balance sheet has improved at the cost of eroding the topline. We continue to expect an improvement in sequential growth in 2H23, though we see risks from the depressing physical occupancy.

Expense

The operating expenses include, but are not limited to compliance with laws, regulations or policies, direct or indirect tax policies, laws or regulations, sub-contracted service costs, labour costs, and repair and maintenance costs.

About the author

Liu Miaomiao

Liu Miaomiao

PSR

Miaomiao mainly covers the Singapore REITs sector and graduated from Singapore Management University with a Bachelor’s degree in Business Management.

About the author

Liu Miaomiao

Liu Miaomiao

PSR

Miaomiao mainly covers the Singapore REITs sector and graduated from Singapore Management University with a Bachelor’s degree in Business Management.

ST Engineering Ltd - All engines roaring, but satellite no signal

ST Engineering Ltd - All engines roaring, but satellite no signal 信義光能 (968 HK) 光伏玻璃龍頭,產能擴張持續推進

信義光能 (968 HK) 光伏玻璃龍頭,產能擴張持續推進 May 13th - Things to Know Before the Opening Bell

May 13th - Things to Know Before the Opening Bell