EliteComREIT GBP - Stock Analyst Research

| Target Price* | GBP 0.34 |

| Recommendation | BUY› BUY |

| Market Cap* | - |

| Publication Date | 20 Feb 2024 |

*At the time of publication

Elite Commercial REIT - De-risked with stable cash flow till FY28

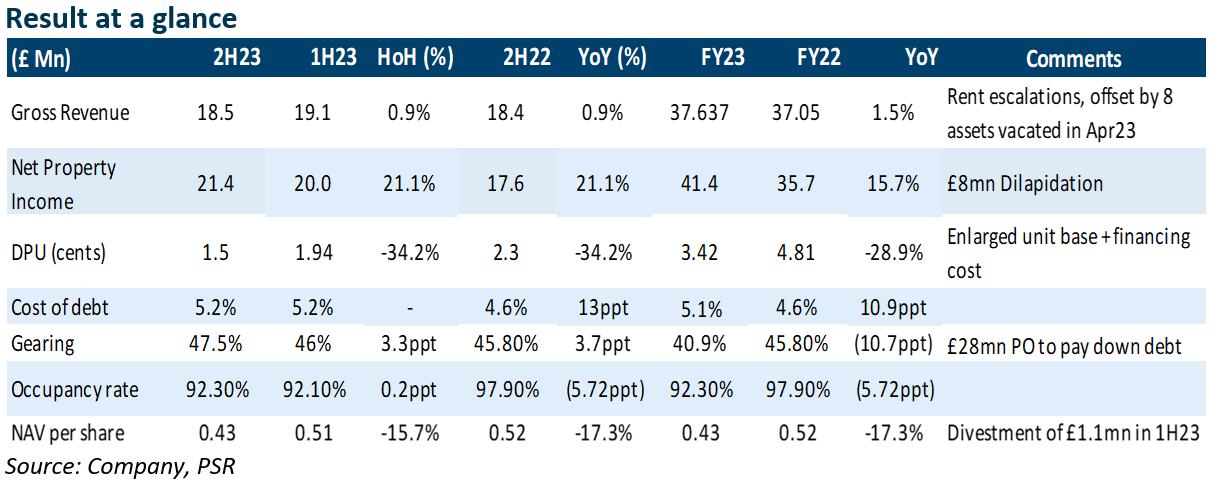

- Gross revenue for FY23 was within expectation and increased by 1.5% YoY to £6mn due to rental escalation but offset by eight assets vacated in Apr23. NPI surpassed estimates by 9%, summing to £41.4mn due to the £8mn dilapidation settlement with respect to vacated assets.

- DPU within our expectations after retaining 10% of distribution. DPU down to 3.42 pence (-28.9YoY). ELITE planned to retain a 10% distribution in the face of macroeconomic uncertainty; the actual distribution after retention was 3.07 pence.

- We reiterate our BUY recommendation with a lower DDM-TP of £0.34 (prev. £0.36) and FY24e-25e DPU forecasts of 3.89 pence to 4.61 pence. ELITE has been largely de-risked with healthier gearing at 40.9% and stable cash flow till 2028 since there’s no more break clause. ELITE is currently trading at FY24e dividend yields of 14.97% and 0.68x P/NAV.

The Positives

+ De-risked after preferential offering. With the £28mn proceeds from the preferential offering, gearing slid to 40.9%. This strategy will result in a pro forma interest expense savings of £1.1mn in FY24e, consequently improving DPU as financing costs heavily eroded it.

+ Interest rate trajectory may reverse. U.K. inflation remained stable in Jan24, contrary to expectations of a rise, which has prompted speculation about the potential rate cut by the Bank of England. ELITE anticipates a rate cut from 2Q/3Q24.

+ Potential redevelopment plan. Elite has identified a few redevelopment plans to convert the vacant offices into higher-yield assets such as student accommodation and data centers. Asset value is expected to increase to c.20% upon completion. Furthermore, ELITE is also collaborating with tenants to invest jointly in energy-efficient and sustainable features that could further enhance asset value and competitiveness in the market.

The Negatives

– Further downtime due to vacant assets. In FY23, there were 12 vacant assets, and five of them were divested at prices above book value. We expect that more time will be needed for re-letting, with four properties expected to be filled by the middle of FY24. In the meantime, the dilapidation settlement fee will cover the revenue shortage resulting from vacancies.

– The payout ratio is expected to be maintained at 90%. ELITE plans to restore the payout ratio to 100% once macroeconomic conditions normalize. We expect this to occur in FY25, so DPU in FY24e will be subdued.

Outlook

ELTE reports that the demand in the UK real estate market is currently driven by local owner-occupiers and potential buyers seeking properties for redevelopment due to the shortage of residential units. With interest rate trends heading downward, a pick-up in transaction activity is expected, paving the way for on-track asset monetization. Furthermore, ELTE is expected to deliver stable cash flow until 2028. This stability is bolstered by the absence of any remaining break clauses, which previously allowed for early termination and rental reductions.

Maintain BUY with a lower TP of £0.34 (previous £0.36)

ELITE currently trades at an attractive FY24e dividend yield of 14.97% and a P/NAV ratio of 0.68. We believe this valuation is attractive. Due to the lack of a clear growth catalyst, our DDM-adjusted target price has been lowered to £0.34 (prev. £0.36) with forecast FY24-25e DPU of 3.89 -4.61 pence, assuming 100% payout.

About the author

Liu Miaomiao

Liu Miaomiao

PSR

Miaomiao mainly covers the Singapore REITs sector and graduated from Singapore Management University with a Bachelor’s degree in Business Management.

About the author

Liu Miaomiao

Liu Miaomiao

PSR

Miaomiao mainly covers the Singapore REITs sector and graduated from Singapore Management University with a Bachelor’s degree in Business Management.

Keppel Ltd - A slow quarter

Keppel Ltd - A slow quarter Frasers Centrepoint Trust - Robust operating performance in 1H24

Frasers Centrepoint Trust - Robust operating performance in 1H24 Spotify Technology S.A. - Raised prices and subscribers still grew

Spotify Technology S.A. - Raised prices and subscribers still grew Suntec REIT - Higher-for-longer interest rate continue eroding DPU

Suntec REIT - Higher-for-longer interest rate continue eroding DPU