ST Engineering - Stock Analyst Research

| Target Price* | 4.500 |

| Recommendation | ACCUMULATE› ACCUMULATE |

| Market Cap* | - |

| Publication Date | 4 Mar 2024 |

*At the time of publication

ST Engineering - Defence and security led earnings growth

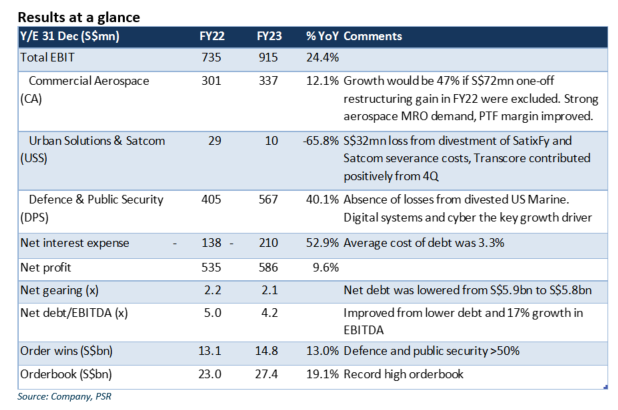

- FY23 net profit was in line with our expectations. Net profit was affected by several one-offs amounting to S$66mn. Excluding these, net profit would have grown by 23.7%.

- Defence and Public Security (DPS) (+40.1% YoY) led earnings growth, with digital sytems and cyber the largest growth engine. Commercial aerospace (CA) grew 47% YoY (excluding one-off items) with increased MRO demand and improved margins from passenger-to-freighter conversions. Urban solutions and Satcom (USS) incurred loss on divestment and severance costs on restructuring. Transcore turned profitable in 4Q23. Orderbook remained strong at S$27.4bn.

- We maintain our FY24e earnings forecast and TP of S$4.50. DPS would remain the key earnings driver in FY24e, underpinned by digital solutions, AI-enabled command and controls, and cybersecurity. Due to recent price appreciation, we downgrade our recommendation to ACCUMULATE from BUY.

The Positives

- Aerospace MRO revenue rose 41%, as demand surged in tandem with recovery in air travel. The passenger-to-freighter conversion business has also scaled the learning curve and is turning profitable. However, commercial aerospace FY23 EBIT margin fell 1.5% pt to 8.6% due to higher manpower costs.

- Defence and public security posted EBIT growth of 40%. Despite the flat revenue, EBIT margin gained 3.8% pt to 13.3% due to better product mix and absence of US Marine losses. The largest sub-segment, digital systems and cyber accounted for 39% of total revenue (FY22:35%).

- Net debt was marginally lower at S$5.8bn (Dec 22: S$5.9bn), but net debt to EBITDA improved to 4.2x, from 5.0x in Dec 22 due to stronger EBITDA. Management remains focused on paring down the debt. The dividend is expected to be maintained at 16 Sct/share.

The Negative

- Restructuring at Satcom and divestment of SatixFY resulted in a S$24mn loss at USS. On a positive note, Transcore turned profitable in 4Q23, and is expected to lift USS’ EBIT from FY24e.

About the author

Peggy Mak

Research Manager

PSR

Peggy has been a sell-side equity analyst for 22 years and a fund manager for 15 years.

About the author

Peggy Mak

Research Manager

PSR

Peggy has been a sell-side equity analyst for 22 years and a fund manager for 15 years.

Keppel Ltd - A slow quarter

Keppel Ltd - A slow quarter Frasers Centrepoint Trust - Robust operating performance in 1H24

Frasers Centrepoint Trust - Robust operating performance in 1H24 Spotify Technology S.A. - Raised prices and subscribers still grew

Spotify Technology S.A. - Raised prices and subscribers still grew Suntec REIT - Higher-for-longer interest rate continue eroding DPU

Suntec REIT - Higher-for-longer interest rate continue eroding DPU