iX Biopharma Ltd - Multiple share price catalyst

20 Oct 2021- Outlicensing of Wafermine for Phase 3 trials is a major share price catalyst for the company to enter the estimated US$19bn global opioid industry.

- Plans for a Hong Kong IPO could trigger a price discovery of at least a HK$1.5bn (S$260mn) market valuation for the pharmaceutical business.

- Our earnings forecast cut to a net loss in FY22e due to delay in new capacity. Our BUY recommendation is maintained. Our DCF (WACC 10%) TP is lowered to S$0.335 from S$0.445 following our earnings downgrade and rights issue.

Model update

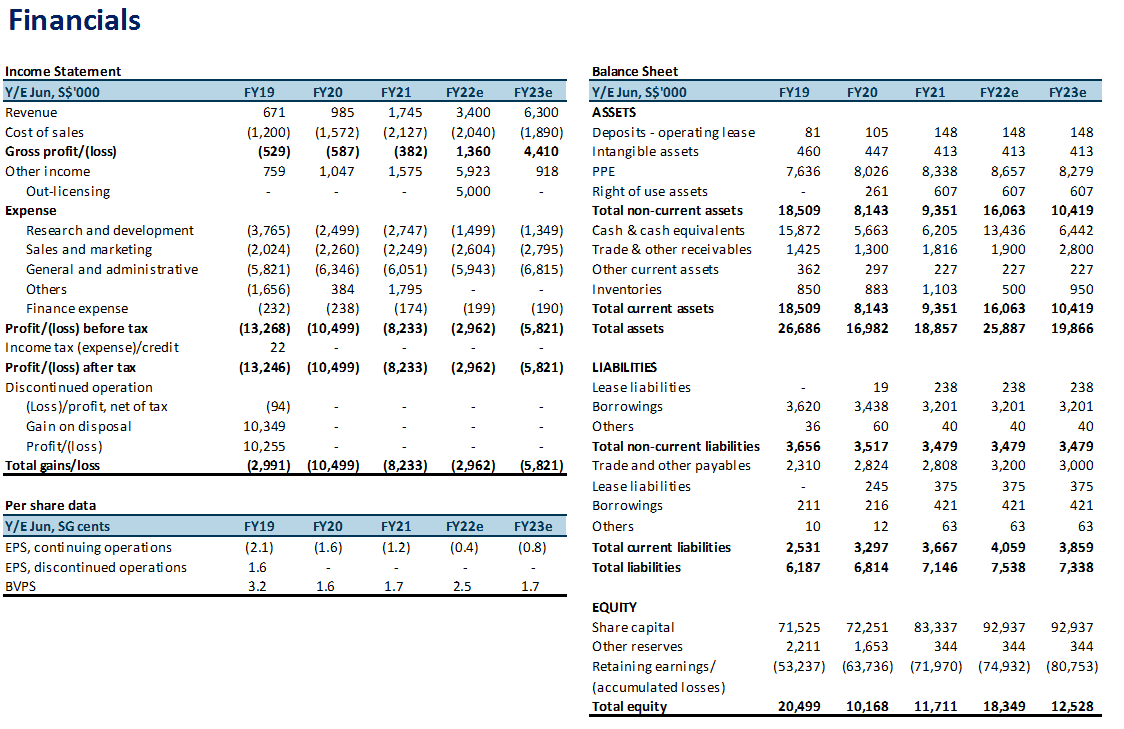

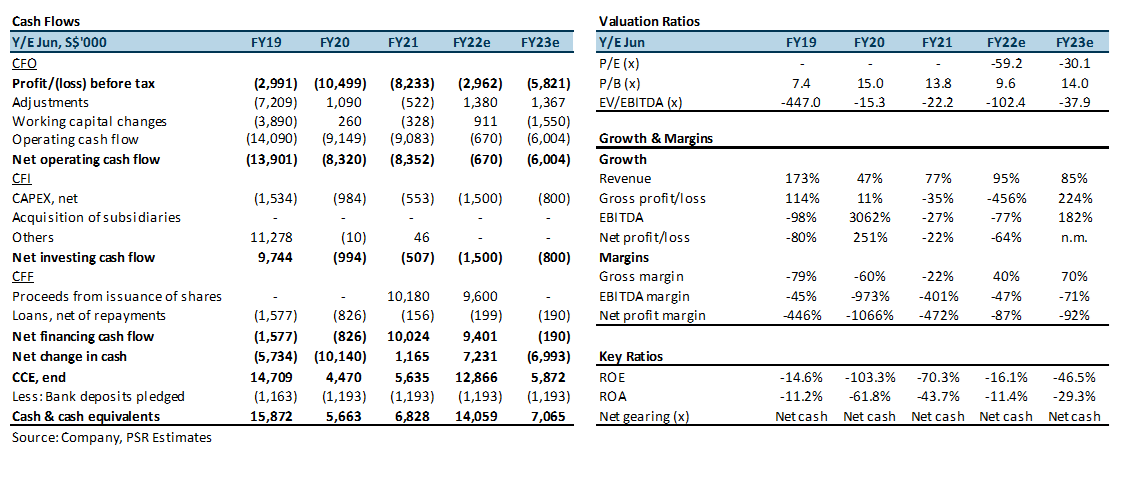

- Revenue is cut from S$12.8mn to S$3.4mn on account of slower Xativa sales and installation of only one freeze-drying machine. Our forecast was 3 machines in FY22e.

- Operating expenses are assumed largely stable.

- Lower other income to account for a possible delay in out-licensing. The global opioid market is around US$19bn. We assume a 5% market share or US$950mn by the licensee.

|

iX Biopharma Ltd Multiple share price catalyst

SINGAPORE | HEALTHCARE | UPDATE § Outlicensing of Wafermine for Phase 3 trials is a major share price catalyst for the company to enter the estimated US$19bn global opioid industry. § Plans for a Hong Kong IPO could trigger a price discovery of at least a HK$1.5bn (S$260mn) market valuation for the pharmaceutical business. § Our earnings forecast cut to a net loss in FY22e due to delay in new capacity. Our BUY recommendation is maintained. Our DCF (WACC 10%) TP is lowered to S$0.335 from S$0.445 following our earnings downgrade and rights issue.

Model update 1. Revenue is cut from S$12.8mn to S$3.4mn on account of slower Xativa sales and installation of only one freeze-drying machine. Our forecast was 3 machines in FY22e. 2. Operating expenses are assumed largely stable. 3. Lower other income to account for a possible delay in out-licensing. The global opioid market is around US$19bn. We assume a 5% market share or US$950mn by the licensee.

Oulook We narrow down the share price catalyst into 4 areas: a) Wafermine outlicensing: Wafermine is a drug that uses ketamine to treat pain (and depression). The difference is ketamine will be delivered sublingually through IXBIO’s WaferiX patented manufacturing process. Wafermine has completed Phase 2 FDA trials. The next phase is to license the drug for Phase 3 trials and commercialization. A licensing deal could involve IXBIO receiving one-off upfront payment from a licensee, followed by milestone payments on successful Phase 3 completion, sales milestone of revenue targets and percentage royalties from sales of the product. The timing of a licensing deal is unclear, especially with the disruption from the pandemic. The company engaged licensing consultants in March 2020, after the End-of-Phase 2 meeting with the FDA. Details of the Wafermine trial in our Gound view Magazine. b) Hong Kong IPO: In July 2021, IXBIO announced plans to list its pharmaceutical business on the Hong Kong Stock Exchange as a biotech company (Chapter 18A). A successful IPO will allow IXBIO to raise funds and trigger a price discovery of this segment of its business. The Chapter 18A listing rules require a minimum market cap of HK$1.5 billion (S$260mn). This is higher than the current market cap. c) Wafersil: A drug for male erectile dysfunction. Wafesil uses the active ingredient sildenafil which is found in Viagra®. Similar to Wafermine, the drug is administered sublingually. In September 2021, IXBIO announced a licensing, supply and distribution agreement in China with China Resources Pharmaceutical Commercial Group (CRPCG), 3rd largest pharmaceutical distributor in the country. CRPCG will register the product in China. Upon commercialization, CRPCG will purchase and pay licensing fees to IXBIO for Wafersil. The timeline depends on the requirements by China NMPA for product registration, a process that may take up to 3 years. d) Xativa: There are many types of cannabis products, but Xativa is unique because it is delivered sublingually. Sales in Australia commenced in April 2020. We expect medicinal cannabis to be the major contributor of revenue in FY22e. Sales have been affected by delays in securing manufacturing equipment and pandemic lockdowns in Australia. Export agreements have been signed with Brazil and New Zealand. The largest opportunity will be in exporting Xativa to key markets such as the U.S. and Europe. Recommendation Maintain BUY with a lower DCF TP of S$0.335 (previously S$0.445) due to lower earnings forecast and rights issue. |

About the author

Paul Chew

Head of Research

Phillip Securities Research Pte Ltd

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.

About the author

Paul Chew

Head of Research

Phillip Securities Research Pte Ltd

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.

Spotify Technology S.A. - Raised prices and subscribers still grew

Spotify Technology S.A. - Raised prices and subscribers still grew Suntec REIT - Higher-for-longer interest rate continue eroding DPU

Suntec REIT - Higher-for-longer interest rate continue eroding DPU Apr 25th - Things to Know Before the Opening Bell

Apr 25th - Things to Know Before the Opening Bell JPMorgan Chase & Co - NII continues to rise, guidance maintained

JPMorgan Chase & Co - NII continues to rise, guidance maintained