Spotify - Stock Analyst Research

| Target Price* | 340.00 |

| Recommendation | BUY› BUY |

| Market Cap* | - |

| Publication Date | 26 Apr 2024 |

*At the time of publication

Spotify Technology S.A. - Raised prices and subscribers still grew

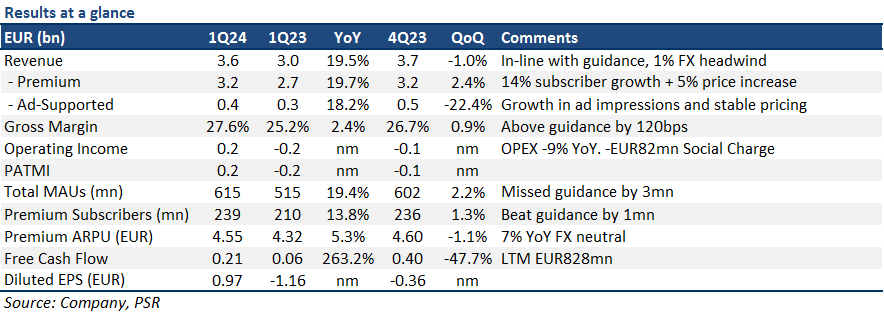

- 1Q24 revenue was within expectations, while PATMI was above due to lower-than-expected costs. 1Q24 revenue/PATMI was at 23%/33% of our FY24e forecasts.

- Growth driven by a combination of subscriber gains and price increases (ARPU 5% YoY). Leveraging scale for meaningful cost benefits through better royalty agreements, improving gross margin 240bps YoY to 27.6%.

- We raise our FY24e PATMI by 26% on lower costs and higher operating leverage while keeping our revenue forecast unchanged. SPOT continues solidifying its position as the industry leader in audio streaming with its growing subscriber base, lower cost structure, and pricing power. We upgrade to BUY from ACCUMULATE with a raised DCF target price of US$340 (prev. US$270) to reflect our assumptions. Our WACC/growth rate of 7.5%/4% remains unchanged.

The Positives

+ Premium revenue growth is accelerating, a sign of improving monetisation. Price hikes (ARPU 5% YoY) towards the back end of FY23 and broad-based growth in subscribers (14% YoY) across all regions drove Premium subscriber revenue growth of 20% YoY (21% FX neutral) in 1Q24 – 3% point increase in growth vs 4Q23. SPOT also expects another quarter of sequential ARPU growth in 2Q24e as it remains focused on improving monetisation of its users after several years of driving user growth. We remain positive about SPOT’s ability to keep churn low while raising prices as it delivers incremental value to its users through new products (Audiobooks, AI DJ, music videos) and platform improvements.

+ Meaningful cost benefits from reaching scale. SPOT has a variety of cost models for its different audio products, with most of its cost base comprised of revenue sharing (royalties) agreements with labels, and fixed content costs for podcasts. We believe that SPOT is beginning to see meaningful cost benefits from reaching scale as it: 1) leverages its distribution for more favourable agreements with its music partners and 2) continues to be more efficient with removing underperforming podcasts. Its 27.6% gross margin for 1Q24 (90/240bps QoQ/YoY) beat its own guidance by 120bps, with Premium gross margin of 30.2% and ad-supported gross margin of 6.4%.

The Negative

– 615mn MAU fell short of SPOT’s 618mn guidance. SPOT under-delivered on its MAUs for 1Q24, with 615mn MAUs and 3mn under its own guidance. The company attributed this to 3 main factors: 1) sequential slowdown in momentum after a very strong FY23, 2) slight disruption in BAU operations from its workforce reduction (-17% reduction) in Dec 23, 3) excessive pullback in marketing spend throughout FY23 (which has since been corrected).

About the author

Jonathan Woo

Research Analyst

PSR

Jonathan covers the US technology sector focusing on internet companies. Formerly a national and professional athlete, he graduated from the University of Oregon with a Bachelor’s Degree in Social Sciences.

About the author

Jonathan Woo

Research Analyst

PSR

Jonathan covers the US technology sector focusing on internet companies. Formerly a national and professional athlete, he graduated from the University of Oregon with a Bachelor’s Degree in Social Sciences.

Singapore Telecommunications Ltd - Accounting spring cleaning, sprinkled with cash

Singapore Telecommunications Ltd - Accounting spring cleaning, sprinkled with cash Far East Hospitality Trust - Higher RevPAR by ramping up occupancy

Far East Hospitality Trust - Higher RevPAR by ramping up occupancy Microsoft Corp - Azure strength fuels revenue growth

Microsoft Corp - Azure strength fuels revenue growth Trade of the Day - Aztech Global Ltd (SGX: 8AZ)

Trade of the Day - Aztech Global Ltd (SGX: 8AZ)