Paypal Holdings Inc - Stock Analyst Research

| Target Price* | 83.00 |

| Recommendation | BUY› BUY |

| Market Cap* | - |

| Publication Date | 13 Feb 2024 |

*At the time of publication

PayPal Holdings Inc - Weak earnings guidance

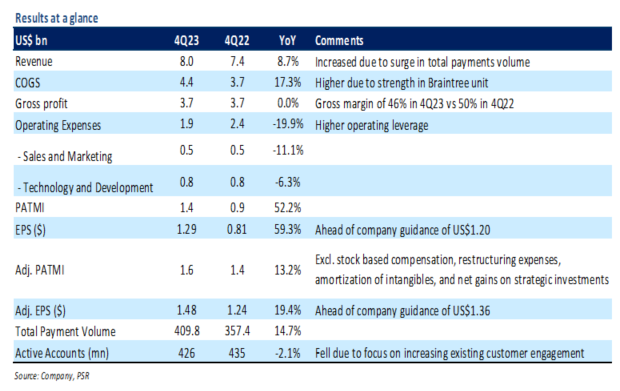

- FY23 revenue/adj. PATMI was in line with expectations at 101%/102% of our forecasts. 4Q23 revenue grew 9% YoY led by a 15% YoY rise in total payments volume. Adj. PATMI grew 13% YoY mainly due to higher operating leverage.

- For FY24e, PayPal expects adj. EPS of US$5.10 or flat compared to FY23. It also expects gross profit to remain flat YoY at US$13.7bn. This implies continued gross margin contraction due to the business-mix shift towards the Braintree unit.

- We maintain a BUY recommendation but lower our DCF target price to US$83.00 (prev. US$101.00), with an unchanged WACC of 7% and terminal growth rate of 4%. We cut our FY24e revenue/adj. PATMI estimates by 1%/13% as payments volume shift towards low-margin unbranded checkout solutions like Braintree. PayPal is well-positioned to benefit from its two-sided global network of 426 mn consumers and merchants, a secular shift to digital commerce, as well as new solutions like Fastlane by PayPal to enhance guest checkout, targeted marketing, digital invoicing, and business lending.

The Positives

+ Revenue beat on higher payments volume and user engagement. In 4Q23, PayPal’s total revenue rose 9% YoY to US$8.0b, which came ~2% ahead of the top end of company guidance. This was mainly driven by a 15% YoY rise in total payments volume (TPV) to US$409.8bn as consumer spending remained resilient on its platforms. PayPal’s branded checkout volumes grew 5% YoY, unbranded processing volumes (Braintree) grew 29% YoY, and Venmo volumes grew 8% YoY to US$68.9bn. Meanwhile, the number of payment transactions were up 13% YoY while the number of payment transactions per active account rose 14% YoY to 59x in 4Q23 from 51x in 4Q22.

+ Cost controls drive operating leverage. In 4Q23, PayPal’s OPEX fell by 20% YoY to US$1.9bn resulting in an operating margin of 22% (vs 17% in 4Q22). The improvement was mainly driven by cost-cutting measures including job cuts and lower sales-related costs. PayPal further plans to cut 2,500 jobs (9% of its workforce) this year to boost profitability.

The Negative

– Shrinking user base, Braintree continues to be a drag on gross margin. Active users fell by 2% YoY to 426mn as minimally engaged users continued to churn out, particularly in Latin America and Asia Pacific regions. In addition, the gross margin fell to 46% in 4Q23 from 50% in 4Q22 due to strength in its low-margin unbranded checkout solutions like Braintree. Management highlighted that unbranded processing volumes increased by 30% YoY in FY23 and now comprises about 35% of the total TPV (vs 30% in FY22).

JPMorgan Chase & Co - NII continues to rise, guidance maintained

JPMorgan Chase & Co - NII continues to rise, guidance maintained Trade of the Day - NVIDIA Corporation (NASDAQ: NVDA)

Trade of the Day - NVIDIA Corporation (NASDAQ: NVDA) Trade of the Day - Applied Materials, Inc. (NASDAQ: AMAT)

Trade of the Day - Applied Materials, Inc. (NASDAQ: AMAT) CapitaLand Ascott Trust - Occupancy to improve with ADRs stabilising

CapitaLand Ascott Trust - Occupancy to improve with ADRs stabilising