Sembcorp Industries - Investing S$14bn to build renewable portfolio

8 Nov 2023- SCI announced a capex plan of S$14bn from 2024-2028, 75% of which would be invested in renewable energy assets to raise gross installed capacity to 25GW from 8.7 GW currently. This will be funded by operating cash flow from existing gas-based energy assets (50%), project debt (30%), corporate debt, capital recycling, and private credit from third parties. There is no need for equity raising at SCI level.

- EMA’s proposal to centralise gas procurement for the country will have minimal impact due to the long-term contracts it has secured for both procurement and sale.

- Maintain ACCUMULATE and TP of S$6.00. We estimate the renewable portfolio could account for 50% of net profit by FY28e. Though these assets generate lower ROE of 10% (vs 15% for conventional energy), the higher valuation multiples accorded to these assets could lift SCI’s valuation further down the road.

Investor Day Highlights

- SCI plans to invest S$14bn from 2024-2028, of which 75% (S$10.5bn) will be invested in renewable energy assets, to raise gross installed capacity to 25 GW, from 8.7 GW currently. Another S$1.4bn will be spent on decarbonization solutions, S$0.7bn on integrated urban solutions, S$1.1bn on investments into hydrogen-ready assets, and S$0.3bn for replacement capex. This amount will be funded by operating cash flow from existing energy assets (50%), project debt (30%), capital from recycling and third parties. This implies continued strong operating cash flow (>S$1.4bn per year) from existing energy assets. There is no need for equity raising at SCI level.

- Minimal impact from Energy Market Authority’s proposal to centralise gas procurement for Singapore. The proposal, which is under consultation, does not affect existing gas supply contracts. SCI has entered into long-term gas procurement contracts. It has also locked in 95% its generating capacity with downstream customers, 72% are for more than 5 years. These contracts priced in a dollar-spread above cost, thus providing predictable income and stable cash flow. Management estimated earnings from conventional energy to post a 6-year CAGR growth of -2%, suggesting efficient control over costs in the current inflationary environment.

- A larger renewable portfolio could lift the valuation. Management projects renewable earnings to grow at 6-year CAGR of 25%, backed by the additional capacity and greenfield projects that become operational. Going by management’s estimate of a blended ROE of 12% for FY28e, we estimate renewable earnings could account for 50% of group’s earnings in FY28 (FY22: 20%). Though these assets generate lower ROE of 10% (vs 15% for conventional energy), they command higher valuation multiples and could lift SCI’s valuation as their earnings contribution rises.

Outlook

We maintain our earnings estimates for FY23e and FY24e. The energy earnings are intact, while earnings at integrated urban solutions remain muted due to the lukewarm Vietnam property market. Maintain ACCUMULATE and TP of S$6.00.

About the author

Peggy Mak

Research Manager

PSR

Peggy has been a sell-side equity analyst for 22 years and a fund manager for 15 years.

About the author

Peggy Mak

Research Manager

PSR

Peggy has been a sell-side equity analyst for 22 years and a fund manager for 15 years.

Alphabet Inc. - Growth accelerating across all segments

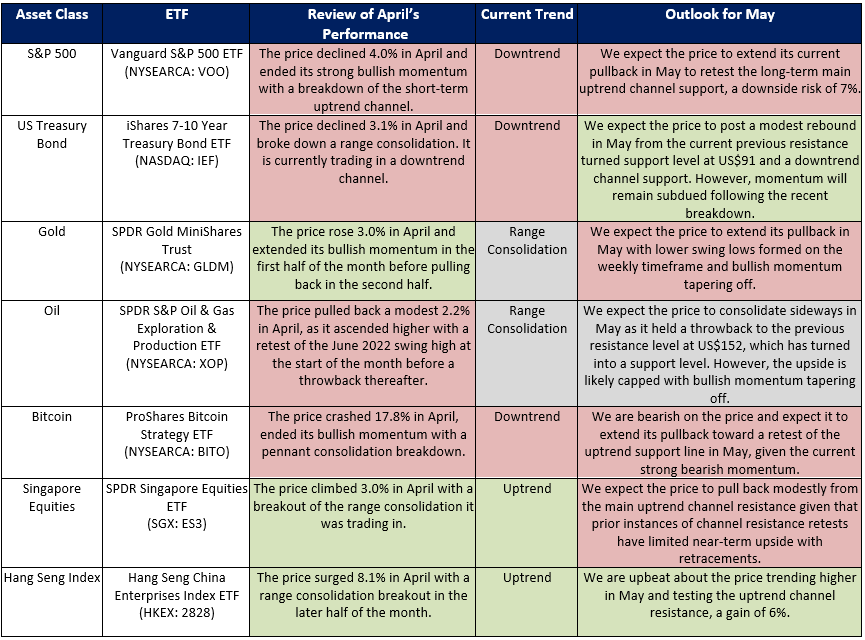

Alphabet Inc. - Growth accelerating across all segments ETF Monthly: Apr 24 - Lacklustre month expected for Bitcoin, Gold, and S&P 500. But stellar Hong Kong.

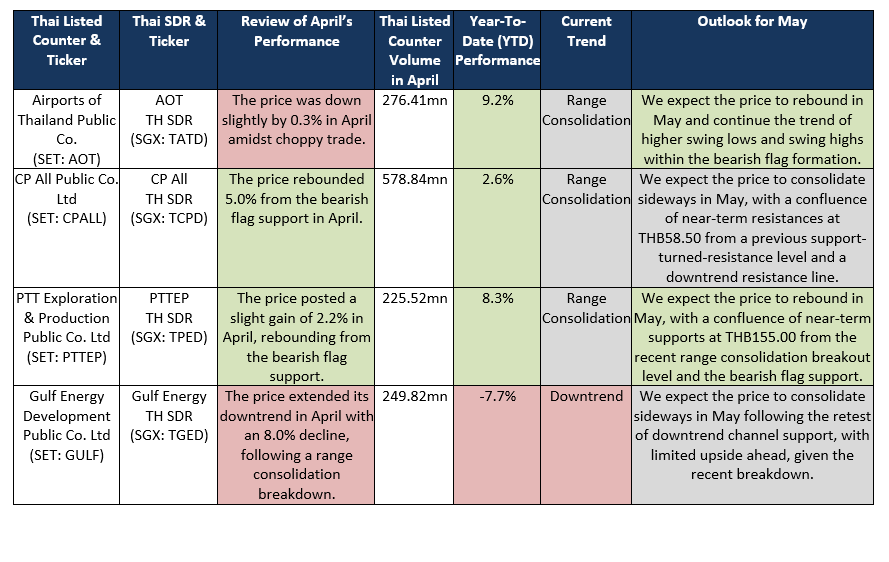

ETF Monthly: Apr 24 - Lacklustre month expected for Bitcoin, Gold, and S&P 500. But stellar Hong Kong. Thai SDR Monthly: Apr 24 - AOT, Kasikornbank and PTTEP to outperform

Thai SDR Monthly: Apr 24 - AOT, Kasikornbank and PTTEP to outperform DBS Group Holdings Ltd - NII and Fee Income boost earnings

DBS Group Holdings Ltd - NII and Fee Income boost earnings