Sea Ltd. – Buying market share

16 Nov 2023

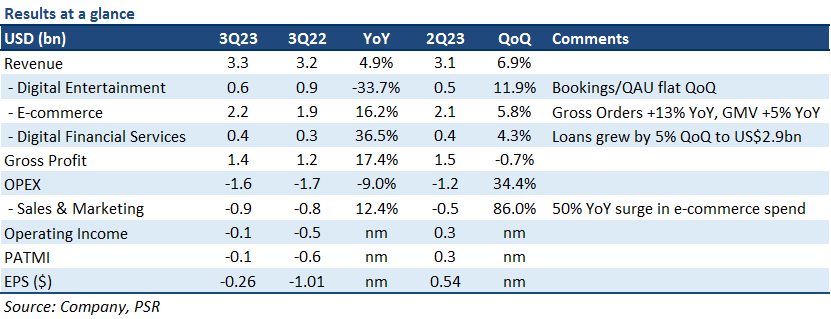

- 3Q23 revenue was in line with expectations, while the -US$144mn net loss was a disappointment due to a 50% YoY surge in e-commerce sales and marketing (S&M) spend. 9M23 revenue/PATMI were at 71%/68% of our FY23e forecasts.

- Shopee is gaining market share against its competitors as GMV and gross orders return to strength, driven in part by Shopee Live. Market share gains have come at the cost of profitability. Garena user trends negatively impacted by back-to-school seasonality.

- We cut our FY23e/FY24e EBITDA by 19%/16% to reflect a ramp-up of investments in Shopee. FY23e PATMI is cut by 46% as a result. Even as its near-term outlook is clouded by increasing spend and competition, we still believe SE is well-positioned to capture e-commerce growth in many under-penetrated emerging markets due to its scale and logistics infrastructure. We expect FY24 to be profitable given comments from SE regarding its commitment to not overspend on Shopee, plus profitability contribution from Garena and SeaMoney. We maintain BUY with a reduced DCF target price of US$61 (prev. US$87), and an unchanged WACC/growth rate of 7.6%/3%.

The Positive

+ Investments in Shopee paying off; gains market share. Shopee saw sequential increases in its GMV/gross orders, with both growing 11%/24% QoQ as a result of a reacceleration in investments into the business. In addition, active buyers also increased 11% QoQ as SE made a strong push into e-commerce livestreaming (Shopee Live). Core marketplace revenue (transaction-based fees and advertising) was up 32% YoY to US$1.3bn.

The Negatives

– Disappointing gaming trends impacted by seasonality. Bookings and QAUs for Garena were flat QoQ, impacted by a return to school for many of its users. This was slightly disappointing given expectations of user growth following the release of its new game Undawn in Jun 23. On a YoY basis, QAU decline (-4%) seems to be moderating, although bookings are still down 33% YoY, implying still present near-term headwinds for gaming as its largest and most profitable game, Free Fire, continues to decline in popularity.

– 3Q23 net loss driven by increasing Shopee spend. On a group level, 3Q23 net loss was US$144mn, reversing 3 quarters of profitability. The net loss was mainly due to a 50% YoY (US$286mn) surge in Shopee S&M spend, as SE reaccelerated its investments in Shopee for market share gains. SE said that spending into 4Q23e will continue – as it is seasonally the best time to acquire new users and gain market share, while we further expect spending to persist into FY24e as SE attempts to penetrate deeper into its LATAM markets.

GMV: Gross Merchandise Value, QAU: Quarterly Active User, QPU: Quarterly Paying User

About the author

Jonathan Woo

Research Analyst

PSR

Jonathan covers the US technology sector focusing on internet companies. Formerly a national and professional athlete, he graduated from the University of Oregon with a Bachelor’s Degree in Social Sciences.

About the author

Jonathan Woo

Research Analyst

PSR

Jonathan covers the US technology sector focusing on internet companies. Formerly a national and professional athlete, he graduated from the University of Oregon with a Bachelor’s Degree in Social Sciences.

Alphabet Inc. - Growth accelerating across all segments

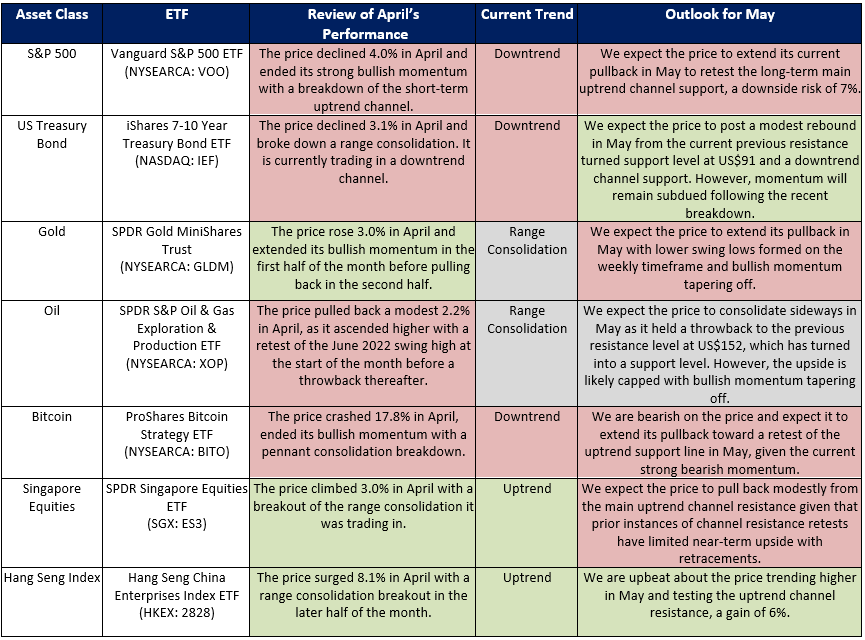

Alphabet Inc. - Growth accelerating across all segments ETF Monthly: Apr 24 - Lacklustre month expected for Bitcoin, Gold, and S&P 500. But stellar Hong Kong.

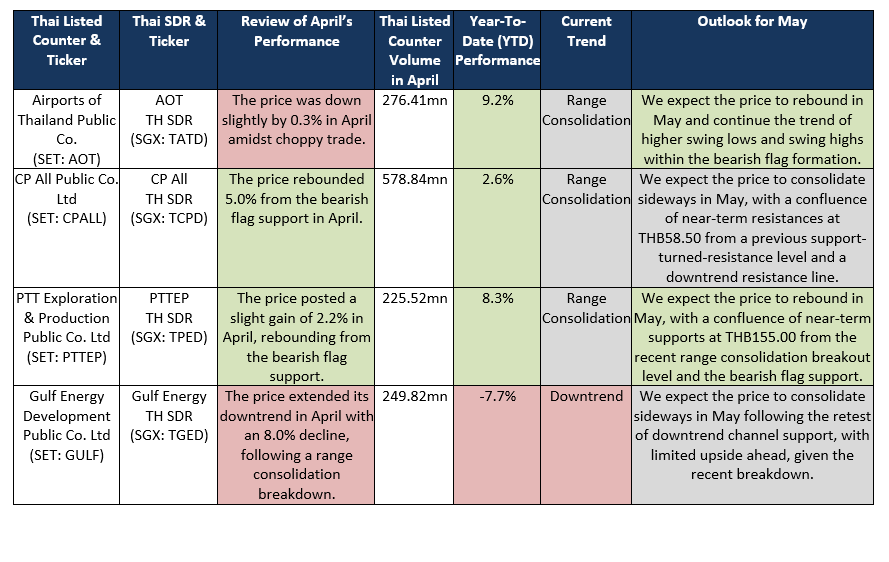

ETF Monthly: Apr 24 - Lacklustre month expected for Bitcoin, Gold, and S&P 500. But stellar Hong Kong. Thai SDR Monthly: Apr 24 - AOT, Kasikornbank and PTTEP to outperform

Thai SDR Monthly: Apr 24 - AOT, Kasikornbank and PTTEP to outperform DBS Group Holdings Ltd - NII and Fee Income boost earnings

DBS Group Holdings Ltd - NII and Fee Income boost earnings