Sea Ltd. – First profitable quarter

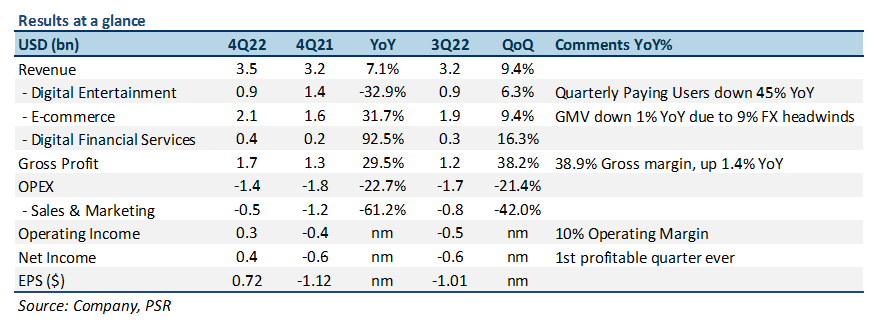

9 Mar 2023- 4Q22 revenue missed expectations slightly due to continued weakness in gaming revenue and FX headwinds; net income beat by ~US$1bn on significant reduction in overhead costs and sales & marketing expenses. FY22 revenue was at 96% our FY22e forecasts, with Net Loss ~US$1.2bn better than our FY22e forecasts.

- Positive net income for the first time, led by 7% topline growth, improved logistical efficiencies, and sharp reduction in sales & marketing expenses.

- Shopee was driving overall revenue growth, and was finally profitable due to higher take rates, reduction in expenses.

- We cut our FY23e revenue by 20% to reflect a continued decline in gaming revenue and slower e-commerce growth, while increasing FY23e PATMI/EBITDA by US$1.2bn/US$0.7bn respectively to reflect improving profitability trends. We forecast positive net income by FY24e. We maintain a BUY with a raised target price of US$120.00, using a WACC of 7.6%, and a terminal growth rate of 3.0%.

The Positives

+ Positive net income for the first time, driven by focus on improving efficiencies. SE announced a major milestone of US$423mn net income for the first time in a quarter, a ~US$1bn improvement from a year ago. This improvement was supported by several factors: 1) revenue growth of 7% YoY led by Shopee; 2) 8% YoY decrease in cost of revenue driven by improvements in logistics costs; 3) 61% YoY cut in sales & marketing expenses as the company looks to further optimize its expenses.

+ Shopee profitable for first time even as GMV and gross orders declined. SE’s e-commerce business, Shopee, announced 4Q22 operating income/adj. EBITDA (excl. share-based compensation) of US$109mn, and US$196mn, respectively, marking its first profitable quarter. Operating income was driven by 32% YoY growth in revenue due to higher take rates (>10%), a 55% YoY reduction in sales & marketing expenses, and more efficient logistics. This comes even as growth in GMV and gross orders moderated due to continued weakness in online consumption across most markets.

The Negative

– Garena continues to weaken due to moderating trends in gaming. Once regarded as SE’s most stable and profitable business, moderating trends in gaming and a download ban of its most popular game, Free Fire, in India have continued to hurt Garena. Both Quarterly Active Users (QAU), and Quarterly Paying Users (QPU) were down 26%/44% YoY as a result. Garena’s revenue decline also continued to accelerate, down 33% in 4Q22 to US$949mn. Operating income for the quarter was also down 53% YoY to US$400mn – 42% operating margin.

About the author

Jonathan Woo

Research Analyst

PSR

Jonathan covers the US technology sector focusing on internet companies. Formerly a national and professional athlete, he graduated from the University of Oregon with a Bachelor’s Degree in Social Sciences.

About the author

Jonathan Woo

Research Analyst

PSR

Jonathan covers the US technology sector focusing on internet companies. Formerly a national and professional athlete, he graduated from the University of Oregon with a Bachelor’s Degree in Social Sciences.

Alphabet Inc. - Growth accelerating across all segments

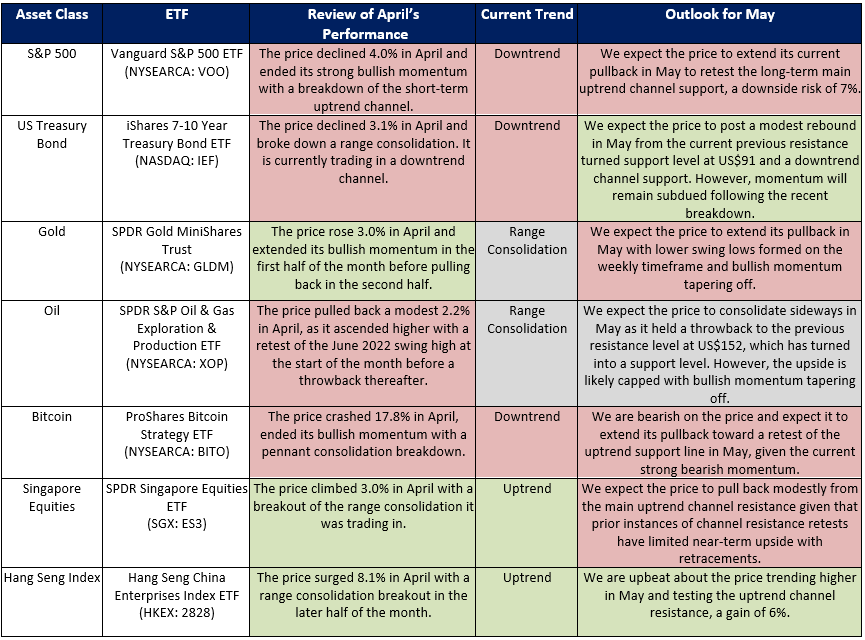

Alphabet Inc. - Growth accelerating across all segments ETF Monthly: Apr 24 - Lacklustre month expected for Bitcoin, Gold, and S&P 500. But stellar Hong Kong.

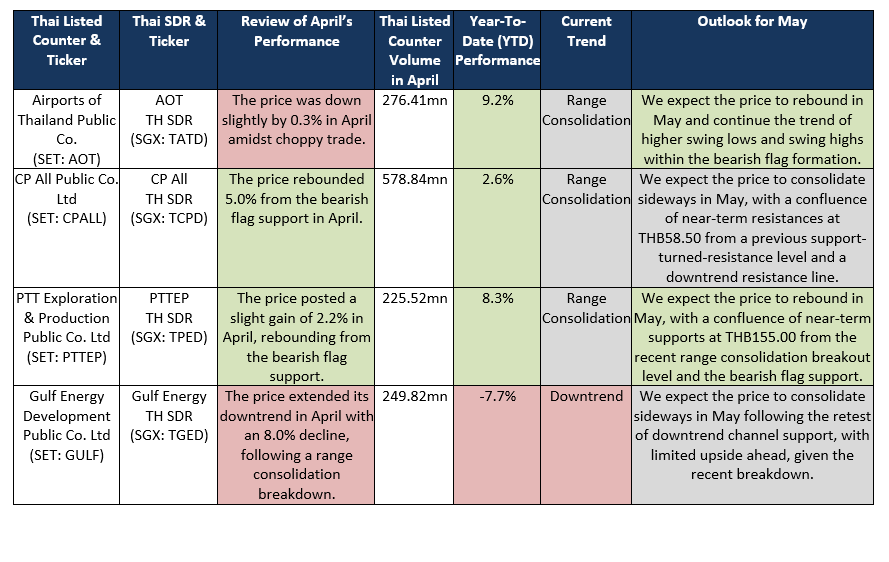

ETF Monthly: Apr 24 - Lacklustre month expected for Bitcoin, Gold, and S&P 500. But stellar Hong Kong. Thai SDR Monthly: Apr 24 - AOT, Kasikornbank and PTTEP to outperform

Thai SDR Monthly: Apr 24 - AOT, Kasikornbank and PTTEP to outperform DBS Group Holdings Ltd - NII and Fee Income boost earnings

DBS Group Holdings Ltd - NII and Fee Income boost earnings