Sheng Siong Group Ltd - Lagged impact from inflation

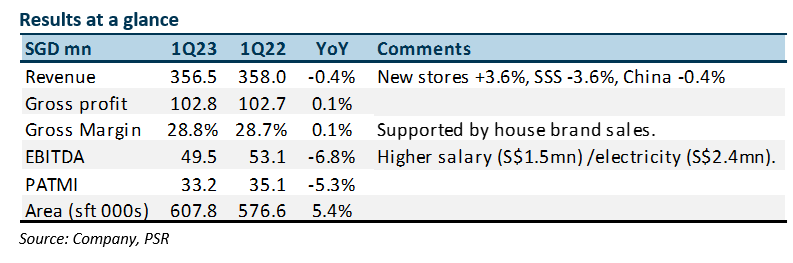

8 May 2023- 1Q23 results were within expectations. Revenue and PATMI were 26%/25% of our FY23e forecast. PATMI declined 5.3% due to higher operating expenses namely electricity and staff cost.

- Sales were generally stable, despite a 3.6% fall in same-store sales growth. New stores contributed to 3.6% points of revenue growth.

- Revenue growth is still normalising post-re-opening. The weakness in same-store sales has improved from a decline of 3.6% in 1Q23 to 1H22 negative 7.0%. Higher electricity expenses of an annualised S$10mn will be a significant drag on operating margins in FY23e. The offset will be higher interest income. We maintain our FY23e earnings. But downgrade our recommendation from BUY to ACCUMULATE due to the recent performance of the share prices. The target price is maintained at S$1.98. Valuation is pegged to 22x PE, a 10-15% discount to the 5-year historical average of 25x PE. New stores remain the source of growth as tendering activity picks up pace.

The Positive

+ New stores and interest income supported earnings. New stores added 3.6% points of growth to revenue. There was 1 new store added in late March this year and another is under review. Available for tendering by HDB are another 11 stores till 2024. Finance income spiked by S$2.3mn YoY in 1Q23 to S$2.7mn. SSG’s cash hoard is benefiting from higher interest rates. The cash is parked in fixed deposits.

The Negative

– Lagged negative effects of inflation. Electricity expenses increased by S$2.4mn YoY in 1Q23. The new utility rates were signed at the end of last year. The total drag on earnings compared to last year can be an annualised S$10mn. Wages also experienced a S$1.5mn YoY rise in 1Q23, in part due to the progressive wage model but most of the wages are variable.

Outlook

We forecast modest growth in FY23e. The negative same-store sales growth from re-opening and household dining out will filter out for the rest of the year. New stores be the main engine of revenue growth. Gross margin will be supported by increased contribution of house brands and supplier support.

China was a modest 0.4% points drag in sales in 1Q23. Sales declined due to more consumers dining out with the re-opening. The focus is on fresh products and convincing customers to shop away from the wet markets. SSG can be the one-stop shop for all their requirements. Another key focus is building up the pool of human capital to operate the stores.

About the author

Paul Chew

Head of Research

Phillip Securities Research Pte Ltd

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.

About the author

Paul Chew

Head of Research

Phillip Securities Research Pte Ltd

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.

Magnificent 7 Monthly: April 24 - Growth dragged by Apple and Tesla

Magnificent 7 Monthly: April 24 - Growth dragged by Apple and Tesla Airbnb Inc - Solid results overshadowed by weak guidance

Airbnb Inc - Solid results overshadowed by weak guidance May 9th - Things to Know Before the Opening Bell

May 9th - Things to Know Before the Opening Bell Trade of the Day - Pfizer Inc. (NYSE: PFE)

Trade of the Day - Pfizer Inc. (NYSE: PFE)