United Overseas Bank Limited - NIM growth stagnates while fee income recovers

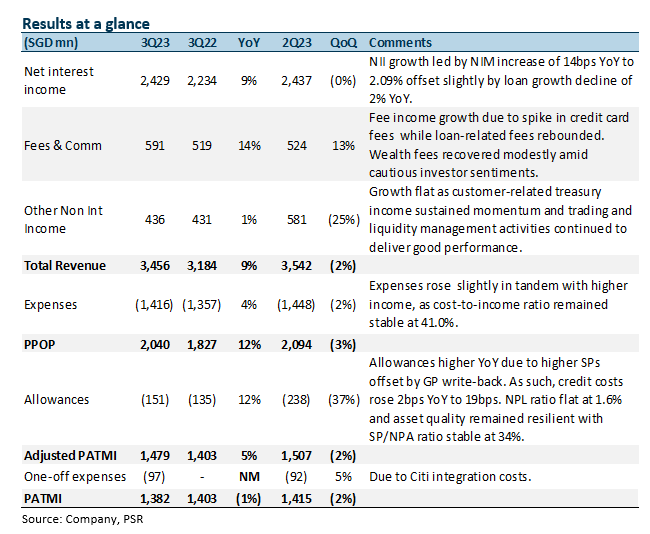

30 Oct 2023- 3Q23 adjusted earnings of S$1,479mn were slightly above our estimates due to higher fee income and higher NII offset by lower-than-expected other non-interest income growth and higher allowances. 9M23 adjusted PATMI was 77% of our FY23e forecast.

- Positives include NII growth of 9% YoY and fee income rising by 14% YoY, while negatives were the flat other non-interest income growth and allowances increasing 12% YoY. Management has maintained its FY23e guidance, while providing FY24e guidance of mid-single digit loan growth from a growing customer franchise and focus on high-quality customers, NIM to remain at current levels as funding costs have stabilised and expectations for rates to maintain till 2H24, double-digit fee income growth from the Citi acquisition, stable cost-to-income ratio and credit cost at around 25-30bps.

- Maintain BUY with an unchanged target price of S$35.90. Our FY23e estimates remain unchanged. We assume 1.48x FY23e P/BV and ROE estimate of 12.9% in our GGM valuation. Continued NIM and NII improvement and fee income recovery will boost earnings.

The Positives

+ NII and NIM continue to grow YoY. NII grew 9% YoY, despite a decline in loan growth of 2% YoY, while NIM rose 14bps YoY to 2.09% but declined 3bps QoQ due to lower margin on excess liquidity. Loan growth decline was from Singapore and Indonesia offset by growth in the rest of ASEAN. UOB has maintained its loan growth guidance for FY23e at low to mid-single digit and is guiding for a mid-single digit loan growth for FY24e.

+ Fee income recovers to near an all-time high. Fees grew 14% YoY largely due to higher credit card fees which hit a new record of S$104mn (+89% YoY) while loan-related fees rebounded and grew 5% YoY. Wealth management fees recovered modestly amid cautious investor sentiment. On a QoQ basis, fee income rose 13% from broad-based growth across all segments. Fee income now makes up 17% of total income (3Q22: 16%).

+ New NPAs fall 27% QoQ. New NPA formation fell by 27% QoQ to S$267mn as asset quality stabilised during the quarter. The NPL ratio remained stable QoQ but rose by 10bps YoY to 1.6%. Asset quality remained resilient with SP/NPA increasing slightly to 34%. 3Q23 NPA coverage is at 102% and unsecured NPA coverage at 205%.

The Negatives

– Other non-interest income growth flat YoY and declined QoQ. Other NII growth was flat YoY as customer-related treasury income sustained momentum while trading and liquidity management activities continued to deliver good performance. However, other NII fell 25% QoQ as growth in customer-related treasury income was more than offset by lower valuation on investments due to market volatility.

– Credit costs increase due to higher SPs despite GP write-back. Total allowances rose by 12% YoY to S$151mn mainly due to specific allowance increasing by 80% YoY to S$229mn despite a general allowance write-back of S$78mn for the quarter. The increase in specific allowance was a pre-emptive move to rebalance collateral value in US and Hong Kong/China. Management said that the accounts were not distressed or non-performing. This resulted in credit costs increasing by 2bps YoY to 19bps. Nonetheless, total general allowance for loans, including RLARs, was prudently maintained at 0.9% of performing loans. UOB has maintained its guidance for credit cost of around 25bps for FY23e and has guided for 25-30bps for FY24e.

– Expenses up 4% YoY. Excluding one-offs, expenses rose 4% YoY to S$1,416mn. The increase was across the board, including staff costs, revenue-related and IT-related expenses. Nonetheless, the cost-to-income ratio (CIR) improved 1.6% points YoY to 41.0% on the back of strong income growth. UOB has guided for cost-to-income ratio to remain stable in FY24e and for the one-time costs from the Citigroup acquisition to substantially roll off.

About the author

Glenn Thum

Research Analyst

PSR

Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.

About the author

Glenn Thum

Research Analyst

PSR

Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.

Singapore Telecommunications Ltd - Accounting spring cleaning, sprinkled with cash

Singapore Telecommunications Ltd - Accounting spring cleaning, sprinkled with cash Far East Hospitality Trust - Higher RevPAR by ramping up occupancy

Far East Hospitality Trust - Higher RevPAR by ramping up occupancy Microsoft Corp - Azure strength fuels revenue growth

Microsoft Corp - Azure strength fuels revenue growth Trade of the Day - Aztech Global Ltd (SGX: 8AZ)

Trade of the Day - Aztech Global Ltd (SGX: 8AZ)