Wells Fargo & Co - Stock Analyst Research

| Target Price* | 60.83 |

| Recommendation | NEUTRAL› NEUTRAL |

| Market Cap* | - |

| Publication Date | 29 Apr 2024 |

*At the time of publication

Wells Fargo & Company - NII decline hurt earnings

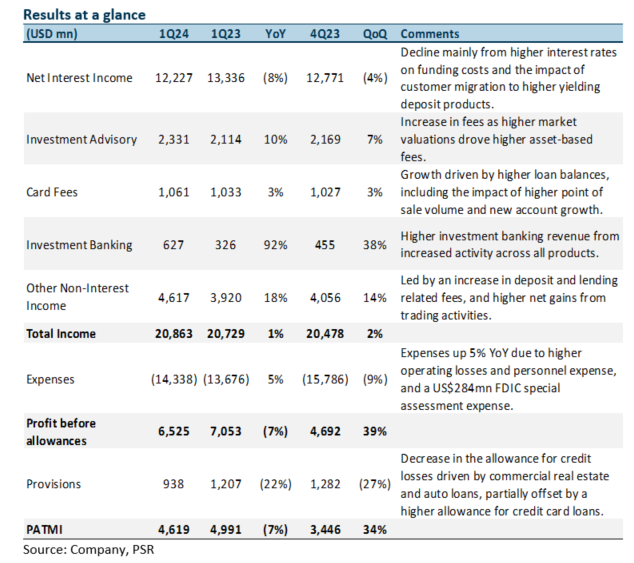

- 1Q24 PATMI was 25% of our FY24e forecast and met our estimates. WFC recorded higher investment advisory, card, and investment banking fees offset by lower net interest income and higher expenses. DPS raised 17% YoY to US$0.35, and 1Q24 common stock net repurchases rose 53% YoY to US$6.1bn.

- NII fell 8% YoY from higher rates on funding costs and movement to higher-yielding deposits, while loans dipped 2% YoY. Non-interest income grew 17% YoY from increased investment advisory, card fees, and investment banking. WFC maintained its FY24e guidance, with NII expected to decline by ~7-9% and non-interest expense of ~US$52.6bn (excluding FDIC special assessment).

- Downgrade to NEUTRAL with an unchanged target price of US$60.83. We downgrade to Neutral with an unchanged target price of US$60.83 as we account for recent share price performance. Our FY24e estimates remain unchanged. Our GGM valuation assumes 1.21x FY24e P/BV and an ROE estimate of 13%. Earnings will be hurt by the decline in NII from higher funding costs, which will be offset by continued growth in non-interest income. A continued increase in share buybacks will benefit EPS.

The Positives

+ Noninterest income grew 17% YoY. Total noninterest income growth came mainly from higher investment advisory fees and brokerage commissions (+8% YoY) as elevated market valuations lifted asset-based fees, deposit and lending-related fees (+6% YoY), net gains from trading activities (+8% YoY), and other noninterest income (+107%) from net gains from equity securities.

+ Investment banking growth lifted CIB revenue. Corporate and investment banking revenue rose 2% YoY to US$5bn, mainly from investment banking fees, which surged 92% YoY from increased activity across all products and higher markets revenue (+2% YoY) driven by higher revenue in structured products, credit products, and foreign exchange, partially offset by lower revenue in rates and commodities. However, this was offset by lower treasury management revenue from higher deposit costs and lower Commercial Real Estate (CRE) revenue, including lower loan balances, partially offset by higher commercial mortgage-backed securities volumes.

+ Provisions fell 22% YoY. Provisions for credit losses fell 22% to US$938mn, which includes net charge-offs of US$1.2bn and allowance for credit losses of –US$219mn (1Q23: net charge-offs of US$564mn and allowance of credit losses of US$643mn). The decline in allowance for credit losses was driven by CRE and auto loans, partially offset by a higher allowance for credit card loans. Net charge-offs rose 105% YoY due to an increase in credit card and commercial & industrial loans partially offset by a decline in CRE and auto. The total net charge-off ratio rose 24bps YoY to 0.50%.

The Negatives

– NII and loans fell YoY. NII fell 8% YoY to US$12.2bn due to the impact of higher interest rates on funding costs, including the impact of customer migration to higher yielding deposit products, as well as lower loan balances, partially offset by higher yields on earning assets. NIMs fell by 39bps YoY to 2.81% as the rise in deposit costs (+91bps YoY) outpaced the growth in loan yield (+69bps YoY). Average loans fell 2% YoY with declines across most loan categories, partially offset by higher credit card loans.

– Expenses up 5% YoY. Noninterest expense rose 5% YoY to US$14.3bn, mainly from higher operating losses (+137%) driven by customer remediation accruals for historical matters, a FDIC special assessment expense of US$284mn for the quarter, and higher personnel expense (+1% YoY) from higher revenue-related compensation expense mainly in Wealth and Investment Management, partially offset by the impact of efficiency initiatives. These increases were offset by lower non-personnel expenses (-2% YoY) from lower professional and outside service expenses.

About the author

Glenn Thum

Research Analyst

PSR

Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.

About the author

Glenn Thum

Research Analyst

PSR

Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.

信義光能 (968 HK) 光伏玻璃龍頭,產能擴張持續推進

信義光能 (968 HK) 光伏玻璃龍頭,產能擴張持續推進 May 13th - Things to Know Before the Opening Bell

May 13th - Things to Know Before the Opening Bell BRC Asia Ltd - Bountiful five years ahead

BRC Asia Ltd - Bountiful five years ahead