Paypal Holdings Inc - Stock Analyst Research

| Target Price* | 75.00 |

| Recommendation | ACCUMULATE› ACCUMULATE |

| Market Cap* | - |

| Publication Date | 3 May 2024 |

*At the time of publication

PayPal Holdings Inc - Consumer spending remains resilient

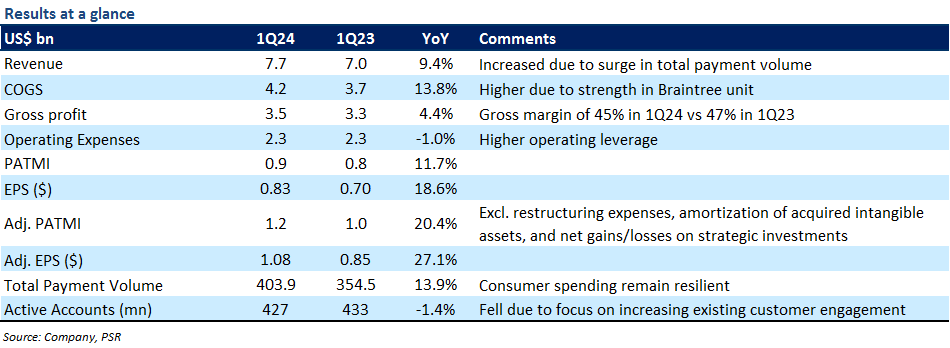

- 1Q24 revenue/PATMI was within expectations at 24% of our FY24e forecasts. Revenue grew 9% YoY, which was led by a 14% YoY rise in total payment volume on its platforms. PATMI grew 12% YoY due to higher operating leverage.

- PayPal’s active users fell 1% YoY to 427mn, while the number of payment transactions per active user grew by 13% YoY. Gross margin contracted by 200bps YoY to 45% due to the business-mix shift towards the low-margin Braintree unit. For 2Q24e, PayPal expects revenue growth of 6.5% YoY to US$7.8bn.

- We downgrade PayPal to ACCUMULATE (from BUY) and lowered our DCF target price to US$75.00 (prev. US$83.00), with an unchanged WACC of 7% and a terminal growth rate of 4%. Our FY24e revenue estimates remain unchanged, while we lower our EBITDA by 2% to account for higher expenses. PayPal benefits from its two-sided global network of 427mn users and a secular shift to digital commerce.

The Positives

+ Payment volume and engagement trends continue to be healthy. In 1Q24, PayPal’s total revenue rose 9% YoY to US$7.7bn, which came 3% ahead of the company guidance. The upside to revenue was driven by a 14% YoY increase in total payment volume (TPV) to US$404bn as consumer spending remained resilient on its platforms. Management highlighted that branded checkout volumes grew 7% YoY (+200bps sequentially), unbranded processing volumes (Braintree) jumped 26% YoY, and Venmo volumes grew 8% YoY. Meanwhile, the number of payment transactions was up 11% YoY, while the number of payment transactions per active user rose 13% YoY to 60x in 1Q24 from 53x in 1Q23.

+ Operating margins expanded on higher operating leverage. In 1Q24, PayPal’s OPEX fell by 1% YoY to US$2.3bn, resulting in an operating margin expansion of 100bps YoY to 15%. The margin improvement was mainly due to top-line upside and higher operating leverage. Sales and marketing expenses fell by 3% YoY to US$421mn, and general and administrative expenses fell by 8% YoY to US$464mn. We expect margin contraction going forward as the company intends to reinvest its earnings into the business for continuous product enhancements.

The Negative

– Continuation of gross margin contraction. In 1Q24, the gross margin fell by 200bps YoY to 45%, though the margin contraction rate continued to slow down compared to the previous quarters (-400bps in 4Q23 and -600bps in 3Q23). The reduction is mainly due to the business-mix shift towards low-margin unbranded checkout solutions like Braintree. Unbranded processing volumes increased by 26% YoY in 1Q24 and now comprise about 37% of the total TPV (vs 33% in 1Q23).

Sea Ltd. - Growth Supported by Spending

Sea Ltd. - Growth Supported by Spending Singapore REITs Monthly: April24 - Pricing in higher-for-longer interest rates

Singapore REITs Monthly: April24 - Pricing in higher-for-longer interest rates May 17th - Things to Know Before the Opening Bell

May 17th - Things to Know Before the Opening Bell Trade of the Day - Boeing Co. (NYSE: BA)

Trade of the Day - Boeing Co. (NYSE: BA)