Cash Plus Account

Brokerage rate is determined based on the previous day end’s Total Asset Value in the Account.

|

Asset Value Markets |

Starter SGD 0 – SGD29,999 |

Premier SGD30,000 – SGD249,999 |

Privilege SGD250,000 and above |

|

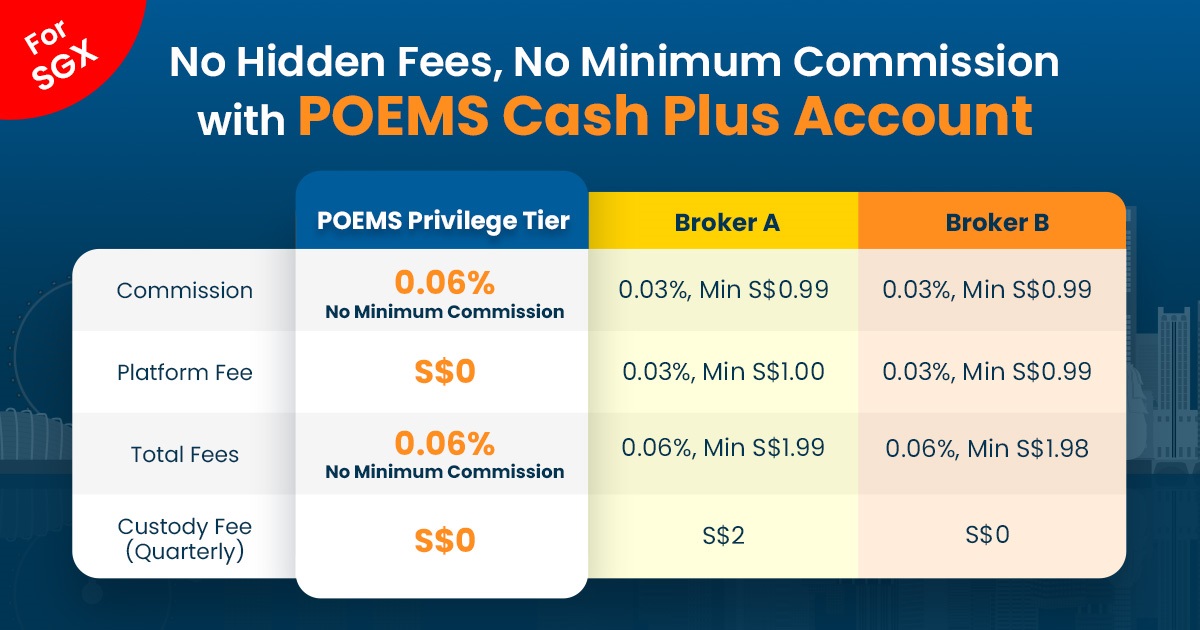

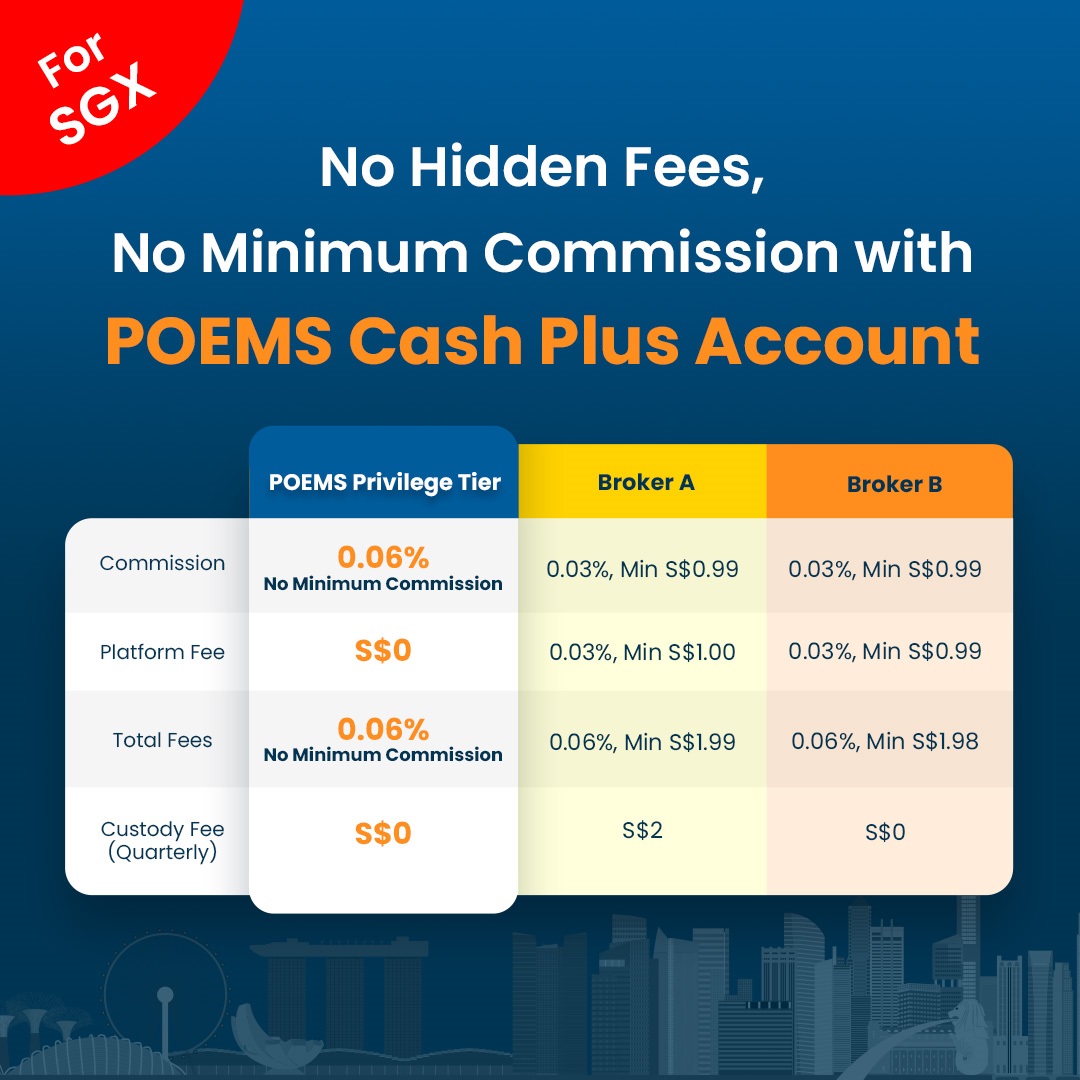

Singapore |

0.08%, No Min Comm |

0.07%, No Min Comm |

0.06%, No Min Comm |

|

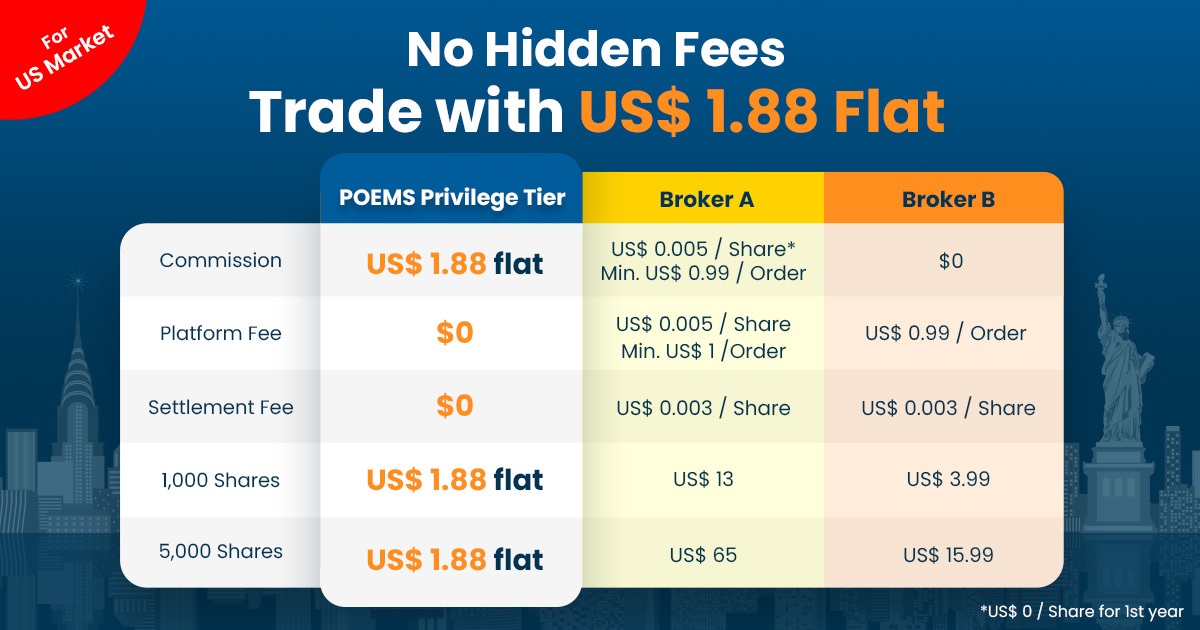

United States |

US$ 3.88 flat |

US$ 2.88 flat |

US$ 1.88 flat |

|

Hong Kong |

0.08%, min HKD 30 |

0.06%, min HKD 20 |

0.05%, min HKD 15 |

|

China |

0.12%, min CNH 60 |

0.10%, min CNH 50 |

0.08%, min CNH 40 |

|

Canada |

0.12% min CAD18 |

0.10% min CAD15 |

0.08% min CAD12 |

|

Malaysia |

0.12%, min MYR 30 |

0.10%, min MYR 25 |

0.08%, min MYR 8.80 |

|

Thailand |

0.18%, min THB 500 |

0.15%, min THB 400 |

0.12%, min THB 300 |

|

Indonesia |

0.18%, min IDR 250,000 |

0.15%, min IDR 200,000 |

0.12%, min IDR 150,000 |

|

Japan |

0.12%, min JPY 1200 |

0.10%, min JPY 1000 |

0.08%, min JPY 800 |

|

Australia |

0.12%, min AUD 18 |

0.10%, min AUD 15 |

0.08%, min AUD 12 |

|

United Kingdom |

0.12%, min GBP 18 |

0.10%, min GBP 15 |

0.08%, min GBP 12 |

|

Belgium |

0.18%, min EUR 20 |

0.15%, min EUR 12 |

0.12%, min EUR 8 |

|

France |

0.18%, min EUR 20 |

0.15%, min EUR 12 |

0.12%, min EUR 8 |

|

Netherlands |

0.18%, min EUR 20 |

0.15%, min EUR 12 |

0.12%, min EUR 8 |

|

Portugal |

0.18%, min EUR 20 |

0.15%, min EUR 12 |

0.12%, min EUR 8 |

|

Germany |

0.18%, min EUR 20 |

0.15%, min EUR 12 |

0.12%, min EUR 8 |

|

Turkey |

0.18%, min TRY 80 |

0.15%, min TRY 60 |

0.12%, min TRY 50 |

|

Other Markets |

As published |

As published |

As published |

| Other Fees & Charges | |||

|

Account Maintenance Fee (SGX) |

Waived1 |

Waived1 |

Waived |

|

Foreign Shares Custody Charges |

Waived2 |

Waived2 |

Waived |

|

Dividend Handling Fee (SGX) |

Applicable3 |

Applicable3 |

Waived |

| Interests | |||

|

Credit balance |

Applicable4 |

Applicable4 |

Applicable4 |

|

Debit balance |

Applicable5 |

Applicable5 |

Applicable5 |

For more details, please refer to the Cash Plus Account Infosheet

Note: Reduced rates are only applicable to ONLINE trades. For offline rates, please click here.

Why Cash Plus Account?

Multi-currency facility: Settle trades with 10 different currencies – SGD, USD, HKD, AUD, MYR, JPY, GBP, EUR, CNY, CAD

No US and HK Custody Fee, No Platform Fee

Complimentary live prices6 for US, Thailand, & Malaysia

Manage your idle cash into money market fund. *SGD 3.4848% p.a., US$ 4.5896% p.a.

Rates updated as of 17 Jul 2023

*Based on the average rate of annualised returns over the last rolling week.

Past performance is not necessarily indicative of future performance. View disclaimer

Financing available in 9 Currencies – SGD, USD, HKD, JPY, AUD, GBP, EUR, CNY & CAD

Your Trusted Broker since 1975, with a growing global presence in 15 countries

Our experienced technical and support teams are committed to ensure a seamless trading experience for you.

Receive insights from our timely market research to make your trading decisions.

0% Sales Charge, 0% Switching Fee, 0% Platform Fee over 2000+ Unit Trusts.

Start Small With Your Cash Plus Account

First in town – Recurring Plan for Dollars Cost Averaging

Recurring Plan gives you more control over your investments. It works similarly to the other plans, whereby it aims to manage market risk through the use of Dollar Cost Averaging. You gradually build your portfolio over a period of time with a fixed amount of regular investment that is determined by you, purchasing more units when the price is low and fewer units when price is high.

Frequently Asked Questions

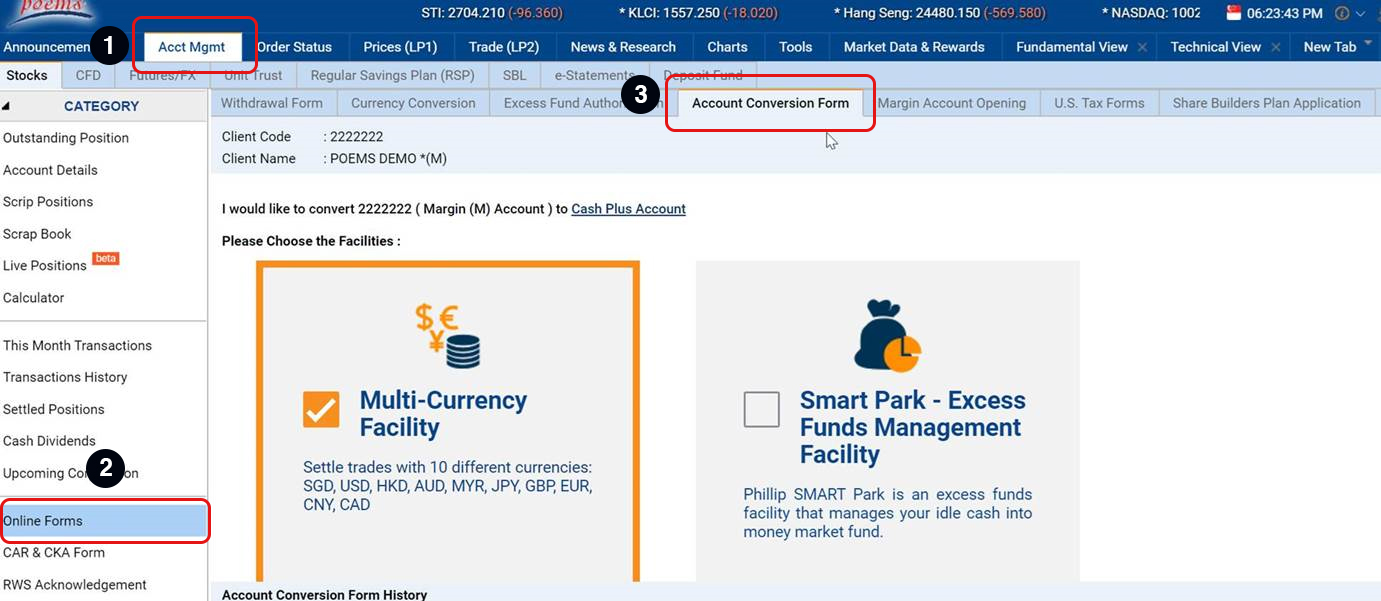

For POEMS 2.0:

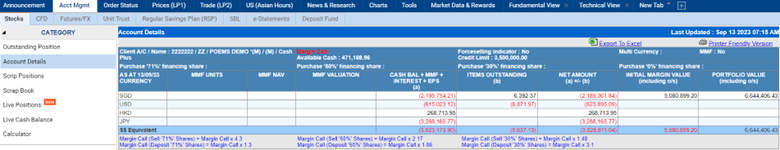

Login to POEMS 2.0 > Acct Mgmt > Stocks > Account Details or visit here

Login to POEMS 2.0 > Acct Mgmt > Stocks > Account Details or visit hereFor POEMS Mobile 3 App:

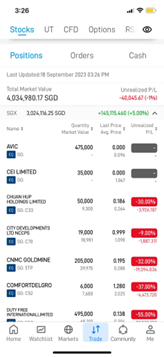

Login to POEMS Mobile 3 App > Trade tab or visit here

- manually via https://www.poems.com.sg/payment/

- via POEMS Mobile 3 App: Me > Deposit Funds > PayNow/eNets > Select your Cash Plus Account > Transfer!

If you have opted-in to SMART Park (MMF), you can grow your idle cash based on its return. SMART Park requires a minimum funding of $100 per market, in the respective currency (SGD, USD or HKD). You can withdraw anytime and use for payment for stocks, ETFs,and unit trusts seamlessly.

For more information on MMF and its rates, please refer to this website: Excess Funds Management – POEMS

SMART Park is an Excess Funds Management Facility that invests and manages your idle cash automatically, on a discretionary basis.

Make your money work HARDER and SMARTER at:

Return (7 Day) Annualised*

SGD

SGD USD

USDRates updated as of 5 September 2022

*Based on the average rate of annualised returns over the last rolling week.

Past performance is not necessarily indicative of future performance. View disclaimer

It depends on what you prioritise.

-

Commission Rates: Cash Plus Accounts are levied a significantly lower commission rate compared to Cash Management Accounts.

Click here for more information on commission rates.

-

CPF/SRS without prefund: Your Cash Management Account allows you to trade based on your trading limit accorded – no pre-funding is required. Your Cash Management Account is linked to your CDP account for the settlement of securities trades done on the Singapore Exchange (SGX).

With a Cash Plus Account, you can trade CPF and SRS funds at an attractive commission rate from 0.06% with no minimum. Take note, it is essential to ensure that there is sufficient available cash in your Cash Plus Account to place buy trades – notwithstanding if the trades are eventually settled using CPF or SRS.

For a more comprehensive overview, refer to this guide here.

Remember to withdraw your balance before closing your Account.

Please contact your Trading Representative (TR) or dealing team for further assistance.

For transferring of securities held in your CDP account to your Cash Plus or other trading Accounts, you may opt for the CDP Mass Transfer. Fees will be waived up till 20 Sep 2027.

Click here for more information on our CDP Mass Transfer promotion, and here for the instructions on the transfer process.

Click here to submit an internal transfer.

- If you have previously traded in SGX securities but have since become inactive, please note that the S$15 account maintenance fee will be levied if there is no trading activity for the preceding quarter, subject to GST.

- For Privilege Tier Cash Plus clients and clients that transferred in their CDP holdings using the CDP Mass Transfer, the account maintenance fee is waived regardless of trading activity done during the quarter.

- Yes, the margin facility will be automatically available to you when you sign up for a Cash Plus Account.

- Cash Plus Accounts come with a default credit limit of S$50,000. Should you require a review of your credit limit, please contact your Trading Representative (TR) or the Dealing Team.

- For more information regarding the margin factor, refer to our infosheet.

- No, you will need to transfer in your CDP holdings to your Cash Plus Account before selling. Refer to https://www.poems.com.sg/share-bond-unit-trust-transfer/ for the CDP transfer form and associated fees.

- We are currently running an exclusive promotion for the transfer of assets in your CDP account to your Cash Plus or trading account. For more information, please visit here.

It will be shown on the contract notes:

- e-statement > daily statement > select contract date in POEMS 2.0.

- Me > eStatement > select contract date in POEMS Mobile 3.

Amalgamation only applies to SGX, and does not apply to other markets. Amalgamated trades (BUY or SELL Trades of the same counter listed on SGX and HKEx respectively, that are placed on the same trading day on POEMS Trading Platforms using the same payment mode (cash, SRS, or CPF) with the same Account) are considered as one trade. This is due to the fact that we only charge one commission for such trade orders. Please refer to https://www.poems.com.sg/faq/trading/general/what-is-amalgamate/ for more information and available markets.

| Exchange Fee and Other Charges | |

| Clearing fee1 | 0.0325% |

| SGX Access Fee2 | 0.0075% |

| SGX Settlement Instruction (SI) Fee3 | SGD0.35 |

| Phillipines Stock Transaction tax (PH STT)/Fee4 | 0.63% (for sell orders only) |

and GST, which are mandatory across all brokerages regardless of brokers.

For relevant Unit Trusts, please refer to the link below:

CPF: https://www.poems.com.sg/fund-finder/?search_key=CPF

SRS: https://www.poems.com.sg/fund-finder/?search_key=SRS

For the list of Singapore Exchange-listed stocks you can invest in using CPF, please refer to the link below: https://www.sgx.com/securities/stocks-under-cpf-investment-scheme

For the list of Singapore Exchange-listed stocks you can invest in using SRS, please attain the SRS-approved list from the respective agent banks.

Terms and Conditions:

- Waiver condition is at least 1 trade per quarter for the Account. Otherwise, S$15.00 (subject to GST) per quarter is chargeable based on March, June, September and December month-end Account balance.

- Waived for US and HK Foreign Custody fee until 31 December 2027. Please refer to Cash Plus Account Infosheet for charges thereafter.

- Cash Dividend: 1% on net dividend, minimum of S$1.00 and capped at S$50.00 (subject to GST) + Foreign fees and taxes (if applicable).

- For more information, please refer to Cash Plus Account Infosheet. Alternatively, you may wish to opt-in for the Excess Funds Management facility to enjoy potentially greater returns on any surplus funds (credit balance) parked in your account.

- Interest on debit balance is applicable when you utilise the Margin facility. For more information, please refer to Cash Plus Account Infosheet.

- Only non-professionals are eligible for the complimentary live price subscription. For details, please visit https://www.poems.com.sg/complimentary-live-price-quotes/

HKD

HKD