Campaign

ZERO Commission on US Stocks – INVEST Fair 2023

Exclusively for INVEST Fair 2023 ZERO* COMMISSION ON US STOCKS

Why Choose POEMS Cash Plus Account?

ZERO Platform Fee

Multi-currency facility

Settle trades with 10 different currencies – SGD, USD, HKD, AUD, MYR, JPY, GBP, EUR, CNY, CAD

ZERO Custody Fee

Complimentary live prices

For US, Thailand, Malaysia, & Indonesia

ZERO Settlement Fee

Financing available in 9 Currencies

SGD, USD, HKD, JPY, AUD, GBP, EUR, CNY & CAD

ZERO Platform Fee

ZERO Custody Fee

ZERO Settlement Fee

Multi-currency facility

Settle trades with 10 different currencies – SGD, USD, HKD, AUD, MYR, JPY, GBP, EUR, CNY, CAD

Complimentary live prices

For US, Thailand, Malaysia, & Indonesia

Financing available in 9 Currencies

SGD, USD, HKD, JPY, AUD, GBP, EUR, CNY & CAD

NO HIDDEN FEE

Open POEMS Cash Plus Account NowNO HIDDEN FEES

Open POEMS Cash Plus Account NowTerms & Conditions

Terms & Conditions- Promotion period:

- This promotion is valid from 14 August 2023 to 31 December 2023 (both dates inclusive).

- Qualifying Criteria:

- This promotion is only valid and exclusive for those who visited the PhillipCapital booth during INVEST Fair 2023 on 12 August 2023 and/or 13 August 2023.

- This promotion is only applicable to new Cash Plus Accounts.

- This promotion is only applicable to all Phillip Securities Pte Ltd (“PSPL”) Customers who have not opened a POEMS Account, based on the Client’s unique NRIC/FIN number.

- Each Customer is entitled to ONE reward per NRIC/FIN number.

- Reward:

- Zero commission for US Stocks.

- Redemption:

- Eligible Customers who

- visit the PhillipCapital booth (A2) during the INVEST Fair 2023 and open a POEMS Cash Plus Account to enjoy the Zero Commission promotion OR

- wish to open a POEMS Cash Plus Account at any of our Phillip Investor Centres between 14 August 2023 to 19 August 2023. They are required to bring along the namecard of a the PhillipCapital advisory representative / staff with the Phillip Securities stamp.

- Eligible Customers who

- The following persons are not eligible to participate in this promotion unless approved by the management of PSPL:

- PSPL existing Account holders who did not open Accounts at INVEST Fair 2023.

- PSPL Institutional Customers and Corporate Customers.

- PSPL Joint Accounts

- PSPL Account holders whose Accounts have been suspended, canceled or terminated.

- PSPL and its associated entities and subsidiaries (direct or indirect), e.g. Staff, Trading Representatives and Financial Adviser Representatives, including their spouse and direct family members.

- PSPL reserves the right at any time in its absolute discretion to (i) amend, add to, and/or delete at any time of these Terms & Conditions without prior notice (including eligibility and qualifying terms and criteria), and all Customers shall be bound by such amendments, additions and/or deletions when effected, or to (ii) vary, withdraw, and/or cancel any items or the promotion itself without having to disclose a reason, and without any compensation or payment whatsoever. PSPL’s decisions on all matters relating to the promotion are final and binding on all Customers.

- PSPL and its affiliates and their respective employees and agents shall not be liable to any person for any loss, damage, injury, costs or expenses incurred, suffered, borne or arising from this promotion.

- By redeeming this item, you acknowledge that you have read and consented to these Terms and Conditions.

Mobile Capture- smart cap

Request a Call Back

Submit your contact details, our customer support executive will reach you as soon as possible. (Customer support work timing - Weekdays: 9 am to 5 pm SGT)

Request a Call Back

Submit your contact details, our customer support executive will reach you as soon as possible. (Customer support work timing - Weekdays: 9 am to 5 pm SGT)

Copyright © 2023. Brought to you by Phillip Securities Pte Ltd (A member of PhillipCapital) Co. Reg. No. 197501035Z. All Rights Reserved.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Disclaimer Privacy & Security Risk Disclosure Terms & Conditions Guide & Cautionary Note Best Execution Policy Security Advisory

SDR Promo Aug 2023

Zero Brokerage with Singapore Depository Receipts (SDR) from

7 August to 25 October 2023

Zero Brokerage with Singapore Depositary Receipts (SDR) from

7 August to 25 October 2023

Zero Brokerage with Singapore Depository Receipts (SDR) from

7 August to 25 October 2023

Zero Brokerage with Singapore Depositary Receipts (SDR) from

7 August to 25 October 2023

AOT Airports of Thailand

Trade

AOT Airports of Thailand

Trade

CP ALL

Trade

CP ALL

Trade

PTT Exploration and Production

Trade

Don’t have an Account?

Open An Account Now

Alternatively, visit any of our Phillip Investor Centres or contact your trading representives.

Terms & Conditions

Terms and Conditions

PTT Exploration and Production

Trade

Don’t have an Account?

Open An Account Now

Alternatively, visit any of our Phillip Investor Centres or contact your trading representives.

Terms & Conditions

Terms and Conditions

- This promotion offers a commission rebate to trade Singapore Depository Receipt (“SDR”) with 0 brokerage from 7 August to 25 October 2023.

- SDR trades must be executed on our suites of the POEMS platform.

- Customers will be required to pay the prevailing SGX clearing fee, SGX access fee and other related fees, and the associated GST.

- Eligible Accounts used for trading of SDRs must be Cash Plus, Margin (M), Custodian (C), Prepaid Custodian (CC), Cash Management (KC) and Share Financing (V) Accounts.

- Each Customer can only claim the rebate once. Customer(s) with multiple Accounts will not qualify for the rebate again.

- The rebate will be paid to your Trading Account in October 2023.

- The following persons are not eligible to participate in those promotions unless approved by the management of Phillip Securities Pte Ltd (“PSPL”): a. PSPL institutional Customers and Corporate Customers b. PSPL Account holders whose Accounts have been suspended, canceled or terminated. c. PSPL and its associated entities and subsidiaries (direct or indirect), e.g. Staff, Trading Representatives and Financial Adviser Representatives including their spouse and direct family members.

- Notwithstanding anything herein contained, PSPL reserves the right at any time in its absolute discretion to (i) amend, add and/or delete any time of these Terms & Conditions without prior notification (including eligibility and qualifying terms and criteria), and all participants shall be bound by such amendments, additions and/or deletions when effected, or (ii) vary, withdraw, or cancel any items or the promotion without having to disclose a reason thereof and without any compensation or payment whatsoever. PSPL’s decision on all matters relating to the promotion shall be final and binding on all participants.

- In the event of a dispute over the client’s eligibility to participate in this Promotion, PSPL’s decision will be final. PSPL shall not be obliged to give any reason on any matter concerning the Promotion and no correspondence or claims will be entertained.

- By taking part in this promotion, the customer acknowledges that he/she has read and consented to these Terms & Conditions.

Don’t miss this opportunity!!

Trade Now

Open an Account

Don’t miss this opportunity!!

Trade Now

Open an Account

Don’t miss this opportunity!!

Trade Now

Open an Account

For more about Singapore Depository Receipts (SDR), you might refer to here.

Don’t miss this opportunity!!

Trade Now

Open an Account

For more about Singapore Depository Receipts (SDR), you might refer to here.SMART Park Bonus Returns

Guaranteed

Return!

*Terms & Conditions Apply

Guaranteed

Return!

*Terms & Conditions Apply

Celebrating National Day with SMART Park!

Deposit within August 2023 for a 30-day Period!

Guaranteed Returns

5.8% p.a.

Deposit Amount

Start from S$1,000

Earn Up to

S$238 for S$50,000 deposit

Guaranteed Returns

5.8% p.a.

Deposit Amount

Start from S$1,000

Earn Up to

S$238 for S$50,000 deposit

Celebrating National Day with SMART Park!

Deposit within August 2023 for a 30-day Period!

Guaranteed

Returns

5.8 % p.a.

Deposit Amount

Start from S$1,000

Earn Up To

S$238 for S$50,000 deposit

Don't have a POEMS Account?

Don't have a POEMS Account?

Already have POEMS Account?

Fund with SMART Park

Guaranteed

Returns

5.8 % p.a.

Deposit Amount

Start from S$1,000

Earn Up To

S$238 for S$50,000 deposit

Don't have a POEMS Account?

Don't have a POEMS Account?

Already have POEMS Account?

Fund with SMART Park

Why SMART Park

SMART Park is an Excess Funds Management Facility that invests and manages your idle cash automatically, on a discretionary basis.Make your money work HARDER and SMARTER!No lock-in period Withdraw anytime! Cash will be back into your linked bank account on the same day! Real Return, Not Projection Rates illustrated are real returns!

Real Return, Not Projection Rates illustrated are real returns!

Trusted with S$ 1+ Billion

One of the Largest^ retail SGD MMF, consisting of high quality, short-term instruments, including

Trusted with S$ 1+ Billion

One of the Largest^ retail SGD MMF, consisting of high quality, short-term instruments, including

- High quality government and corporate bonds

- Commercial bills and fixed deposits

Did you know?

Beyond this promotional period, you can enjoy our prevailing SMART Park rates on a long-term basis. This excess funds management facility lets you grow your idle cash during quiet periods, and gives you the flexibility to trade when you spot a potential investment opportunity! Learn More >> Good Things Must Share!

Refer your Friends & Family!

Good Things Must Share!

Refer your Friends & Family!

Good Things Must Share!

Refer your Friends & Family!

Rewards for you

S$68

Cash Credit

Rewards for your Friends & Family!

Good Things Must Share!

Refer your Friends & Family!

Rewards for you

S$68

Cash Credit

Rewards for your Friends & Family!

- 5.8% p.a. Guaranteed Return

- S$20 NTUC E-Voucher

- Zero Commissions on US stocks for 1 month (Cash Plus Account Only)

- 5.8% p.a. Guaranteed Return

- S$20 NTUC E-Voucher

- Zero Commission on US stocks for 1 month (Cash Plus Account only)

Frequently Asked Questions

Which are the Account types that are eligible for the promotion? Individual Cash Plus, Cash Management, Margin, Prepaid, Custodian and UT advisory wrap accounts. What if I am a Cash Trading or a Share Financing Account holder? Am I eligible for this promotion? No. Cash Trading and Share Financing Accounts are not eligible for this promotion. You may consider opening an eligible account type or converting your Cash Trading account to a Cash Management Account. How do I convert my Cash Trading or Share Financing Account to Cash Management Account? Login to POEMS 2.0 Website > Acct Mgmt > Stocks > Online Forms. Cash Trading Account with existing GIRO facility has to be terminated before we can process the conversion to Cash Management Account. I have deposited S$10,000 into my Account. Can I use my funds for investment purposes? Yes. You are allowed to use the funds to trade on POEMS. However, to be eligible for the promotion, only the net balance of deposits at the end of each day of the 30-day period will be calculated for the 5.8% p.a. returns. Can I deposit and withdraw within a few days apart, and still be eligible for the promotion? Only the net balance of deposits at the end of day of the 30-day period will be calculated for the 5.8% p.a. returns. Am I allowed to make multiple deposits of S$10,000? E.g. S$10,000 for the first deposit and S$15,000 for the second deposit. Yes, you can make multiple deposits. The 5.8% p.a. returns is calculated on the net balance of each day’s deposit over a 30-day period. The maximum deposit cap to enjoy the 5.8% p.a returns is S$50,000. Can I top up more than S$50,000 to SMART Park? Yes, you can top up more than S$50,000 to SMART Park. Your deposit(s) up to S$50,000 will enjoy 5.8% p.a. returns and excess deposits will earn from SMART Park returns. How is the 5.8% p.a bonus returns calculated? For example : Client A funded S$50,000 and held a consistent positon of S$50,000 over 30 days.He will get : S$50,000 X [(5.8%/365) X 30] = S$238.35.(Including Phillip Money Market Fund’s actual returns and PSPL’s topping up on the difference). The difference to be made up by Phillip Securities Pte Ltd (PSPL) will be calculated based on the funded amount held by a client in his account each day in 30-day period. The bonus reward (i.e. difference between 5.8% p.a. and the underlying fund return) will be credited in lump sum to your PSPL trading account as cash bonus within 30 business days after the 30-day period ends. Where do I see SMART Park rates? SMART Park Rates shown on the website are based on 7-days annualised return with net income and dividends reinvested and calculated on a single pricing basis (NAV/NAV prices). Returns shown are net of fund expenses. Past performance is not necessarily indicative of future performance.Terms & Conditions

Terms & Conditions Celebrate National Day with 5.8% p.a. Guaranteed Returns! 1) Promotion Period: 1 Aug 2023 (0000 hrs.) to 31 Aug 2023 (2359hrs.), both dates inclusive. 2) This promotion is open to all Phillip Securities (PSPL) Customers. If you do not have any account with us, New Customers : a) Trading accounts : Please open an account at https://www.poems.com.sg/open-an-account/, opt in and provide your consent to “Excess Funds Management Facility (SMART Park). b) Unit Trust Advisory Wrap accounts : Please approach our Phillip Investor Centres https://www.phillip.com.sg/sg/investor-centres/ or Find your Specialist https://www.phillip.com.sg/sg/talktophillip/findadviser/ to open UT advisory wrap account. Existing Customers: c) For trading accounts: Opt in and provide your consent to “Excess Funds Management Facility (SMART Park)”.- Via P2 Web:

- Via Phillip MyWealth Mobile App

24 Hours US Trading Symposium

About Towards 24 Hours US Trading Symposium

Intrigued in using our latest special feature on POEMS platforms in trading the US Market during the Asian Hours but unsure how to make good use of it?

Now here is your chance! Tune in our Towards 24 hours US Trading Symposium webinar on 5 July 2023, Wednesday, from 12pm to 2pm on Zoom to understand more about our US Asian Hours trading feature and the strategies to tackle it!

What's even better in store? You will also get to listen to the main key person, Hitoshi Shimoyama, who started this unique feature project in this webinar!

So what are you waiting for? Register with us now!

SAVE THE DATE

- 5 July 2023, Wednesday

- 12:00pm to 2:00pm

- Zoom Webinar

Programme Outline

12:15pm to 12:30pm

Opening Address & Keynote Speech – POEMS

Luke Lim, Managing Director

As the Managing Director of Phillip Securities Pte Ltd (PSPL), Luke oversees PSPL’s daily operational businesses, strategic directions and executes management decisions for performance-driven results in consultation with the board of directors. He honed his management leadership style having been responsible for various roles in the PhillipCapital Group of companies since 2004. His experience covers research solutions, overall strategy and business development.

12:30pm to 1:30pm

Sharing of Trading ideas using POEMS towards 24 Hours US Trading

1) US Stocks Picks by Paul Chew

- Insights and recommendations for key IT stocks namely Amazon, Salesforce and many others!

2) New Opportunities towards 24 Hours US Trading by Lawrence Lee

- How to make use of trends and news to trade US Asian Hours, ahead of the US opening.

3) Trade with Volatility towards 24 hours US Trading by Hitoshi Shimoyama

- How to seek for opportunities in trading uptrend, sideway, or downtrend markets with QQQ.

4) Trade US American Depositary Receipts (ADRs) in US Asian Hours: All the things you should know by Jason Fu

- Investors can now trade US ADRs such as Alibaba and Baidu round the clock with US Asian Hours from 9am (SG time). How can you “up” the game by making use of the news flow in Asian hours and trade into these US ADRs? The speaker will share on the link between the US ADRs and its domestic market trading activities.

Our Speakers:

Hitoshi Shimoyama, Executive Director

Hitoshi Shimoyama has more than 40 years of experience in the financial industry. He ran Phillip Securities Japan as the CEO for 11 years and currently serving as the executive director of Phillip Securities Singapore. He is the project manager who started the idea of US Asian Hours, which is the first launch in Singapore, and 24 hours US trading. He graduated from University of Tokyo.

Paul Chew, Head of Phillip Securities Research

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

Lawrence Lee, Head of Corporate Development

Lawrence has more than 13 years of experience in the stockbroking industry with in-depth knowledge of Dealing, Sales and Business Development. He ran the Business for Business Department which service Corporate and institutional customers. He passed his CFA Level 3 Examination in 2016 and graduated from Royal Melbourne Institute of Technology with a Bachelor of Business in Economic and Finance.

Jason Fu, Deputy Head of Global Markets

Jason has more than 17 years of experience in the stockbroking industry with in-depth knowledge in dealing, sales and product development. He previously ran the Global Markets sales team which services retail, high net worth, corporate as well as B4B customers. He also heads the ETF team where they work with global ETF issuers and exchanges to raise the profile of ETFs as an investment product. He graduated from Singapore Institute of Management (SIM) with a Bachelor of Science in Finance.

1:30pm to 2pm

Q&A Session

Interested in the event?

Register NowFrequently Asked Questions

Do I need a Zoom Account to join this webinar?You do not need a Zoom account to join the webinar. Please click on the link in the confirmation email and join the session via Zoom Web Client (works best on Chrome) or download Zoom on desktop or mobile before the session starts.

Will I receive a reminder to join the webinar?You will receive an email reminders 1 day, and 1 hour prior to the webinar. Do check your email for the link to join.

Will the webinar be recorded?Yes. The webinar will be recorded and will be uploaded on PhillipCapital YouTube Channel.

How does Q&A work?We are using the up-vote system where Q&A will start from questions with the highest number of votes. Due to time constraint, similar questions will only be answered once. Also, speakers will only answer questions specific to the presenting market. We will clear off all the questions after each session so as not to confuse the next speaker.

POEMS UOBAM ETF PROMO

Limited Time Only! From 1 June 2023 - 31 July 2023

How to Qualify for this Promotion?

Fulfil a minimum of S$10,000 Gross Traded Value for Buy trades in total for any of these 3 selected ETFs:

Fulfil a minimum of S$10,000 Gross Traded Value for Buy trades in total for any of these 3 selected ETFs:

UOBAM PingAn Chinext ETF

(SGD: CXS, USD: CXU)UOB APAC Green REIT ETF

(SGD: GRN, USD: GRE)United SSE 50 China ETF

(JK8)

Ensure that your trades are done from 1 June 2023 to 31 July 2023 with a minimum one month holding period.

Ensure that your trades are done from 1 June 2023 to 31 July 2023 with a minimum one month holding period.

Fulfil a minimum of S$10,000 Gross Traded Value for Buy trades in total for any of these 3 selected ETFs:

Fulfil a minimum of S$10,000 Gross Traded Value for Buy trades in total for any of these 3 selected ETFs:

UOBAM PingAn Chinext ETF (SGD: CXS, USD: CXU)

UOB APAC Green REIT ETF (SGD: GRN, USD: GRE)

United SSE 50 China ETF (JK8)

Ensure that your trades are done from 1 June 2023 to 31 July 2023 with a minimum one month holding period.

Ensure that your trades are done from 1 June 2023 to 31 July 2023 with a minimum one month holding period.

For more information refer to Terms and Conditions below.

Why invest in UOB AM PingAn Chinext ETF? (SGD: CXS, USD: CXU)Take advantage of the growth prospects presented by China's 14th five-year plan, which aims to enhance the sustainability of economic expansion and improve the standard of living for its populace. Why invest in UOB AM APAC Green REIT ETF? (SGD: GRN, USD: GRE)The fund has the potential to provide both profit and capital appreciation. It strives to promote real estate operational and management methodologies targeted at reducing carbon and other greenhouse gas emissions. The index picks and includes 50 REITs with higher yields that are listed in the region and exhibit comparatively superior environmental performance as determined by GRESB's real estate evaluation. Additionally, they meet the minimum liquidity criteria.Why invest in United SSE 50 China ETF? (JK8)The SSE 50 index is composed of the 50 most sizable and liquid stocks listed on the SSE, and is widely acknowledged and cited as a gauge of the China A-Shares market. Its objective is to mirror the performance of prominent, high-quality, and impactful large firms operating on the SSE. Previous slide Next slide Sources:- https://www.uobam.com.sg/our-funds/highlights/uobam-ping-an-chinext-etf/index.page

- https://www.uobam.com.sg/sustainability/solutions/uob-apac-green-reit-etf.page#whyinvest

- https://www.uobam.com.sg/china-etf/index.page

What's even better?

Achieve the Highest Gross traded value for Buy trade to receive the

Ultimate Grand Prize - S$500 Cash Rebate

![]()

![]()

![]()

![]()

T&Cs Apply.

Use this Opportunity to build your ETF Portfolio!

Trade UOBAM PingAn Chinext ETF (SGD: CXS) Trade UOBAM PingAn Chinext ETF (USD: CXU) Trade UOB APAC Green REIT ETF (SGD: GRN) Trade UOB APAC Green REIT ETF (USD: GRE) Trade United SSE 50 China ETF (JK8) Trade UOBAM PingAn Chinext ETF (SGD: CXS) Trade UOBAM PingAn Chinext ETF (USD: CXU) Trade UOB APAC Green REIT ETF (SGD: GRN) Trade UOB APAC Green REIT ETF (USD: GRE) Trade United SSE 50 China ETF (JK8)Frequently Asked Questions

Which Account types are eligible for this promotion?Cash Plus, Cash Management, Margin, Prepaid, Custodian, and Share Financing Accounts.

What if I am a Cash Trading Account holder? Am I eligible for this promotion?No. Cash Trading Accounts are not eligible for this promotion. You may consider opening an eligible account type or converting your Cash Trading account to a Cash Management Account.

How do I convert my Cash Trading to Cash Management Account?Login to POEMS 2.0 Website > Acct Mgmt > Stocks > Online Forms. Cash Trading Account with existing GIRO facility has to be terminated before we are able to process the conversion of your existing Cash Trading to a Cash Management Account.

I have a combined gross traded value for buy trades of S$10,000 across the three selected ETFs during the campaign period (1 June 2023 to 31 July 2023). Is it guaranteed that I will receive a cash rebate of S$20?No, the consolation prize of S$20 will be awarded to the 50 clients who gather the highest gross traded value for buy trades within 2 months from the start of the campaign period, 1 June 2023.

Will I still be eligible for the cash rebate if I meet the S$10,000 minimum gross traded value for buy trade eligibility criteria, but have sold away the ETF shares before the 1-month holding period?Customers who do not meet the 1-month holding period will automatically be withdrawn from the campaign.

Will I be qualified for the campaign if I purchase S$3000 of UOB AM PingAn Chinext ETF and S$8000 of UOB APAC Green REIT ETF?Yes, the minimum S$10,000 gross traded value for buy trades can be combined across any of the 3 selected ETFs.

In this instance, it will be S$3000 + S$8000. Assuming that you fulfil the minimum holding period, you will be qualified for the campaign. Consolation prize of S$20 cash rebate will be awarded to the 50 clients who gather the highest gross traded value for buy trades (excluding the top 3 highest), within 2 months from the start of the campaign, 1 June 2023.

Will I be automatically qualified for the 1st, 2nd or 3rd prize if my gross traded value for buy trade is S$50,000?The winners for the 1st, 2nd, or 3rd prize will be selected based on the highest gross traded value for buy trades across the eligible pool of customers respectively.

When will I receive the rebate?The rebates will be disbursed to the Customers’ eligible Accounts by end of September 2023.

Terms and Conditions

Terms and Conditions

- This promotion period is valid from 1 June 2023 to 31 July 2023, both dates inclusive.

- Qualifying account types for this promotion:

- Cash Plus

- Cash Management

- Margin

- Prepaid

- Custodian

- Share Financing

- Qualifying criteria to be eligible for the Cash Rebate Prizes:

- Customers will need to execute online Buy trades traded through POEMS Trading Platforms (POEMS 2.0, POEMS Mobile 2.0, POEMS Mobile 3, and POEMS Pro) for the three selected ETFs listed below:

- Eligible types of Buy trades:

- SRS

- Cash

- Customers will need to fulfill the minimum gross traded value for buy trades of S$10,000 within two months from the start of the promotion (promotion period: 1 June 2023 to 31 July 2023) with a minimum of 1-month holding period.

- The minimum S$10,000 gross traded value for buy trades per Customer can be combined across the selected three ETFs.

- The Cash Rebates Prizes will be given to the top 53 Customers (top 3 and 50) with the highest gross traded value for buy trades within 2 months from the start of the promotion, 1 June 2023, and will be awarded accordingly to their gross traded value for buy trades:

- 1st Prize: S$500 Cash Rebate

- 2nd Prize: S$300 Cash Rebate

- 3rd Prize: S$200 Cash Rebate

- Consolation Prize (50 winners): S$20 Cash Rebate

- Each Customer is only eligible to receive one-time cash rebate throughout the whole campaign.

- Notification of the Prizes:

- The winners will be announced through email notification in September 2023.

- The Cash Rebate will only be credited to the eligible Customers’ POEMS Accounts after the one month holding period.

- In the event of a dispute over the Customer’s eligibility to participate in this promotion, PSPL’s decision is final.

- Notwithstanding anything herein contained, PSPL reserves the right at any time in its absolute discretion to amend, add and/or delete these Terms and Conditions without prior notification (including eligibility; replacement of the reward; promotional mechanics, promotion duration without prior notification, qualifying terms and criteria), and all participants shall be bound by such amendments, additions and / or deletions when effected, or vary, withdraw, or cancel any items or the promotion without having to disclose a reason thereof and without any compensation or payment whatsoever. PSPL’s decision on all matters relating to the promotion shall be final and binding on all participants.

- The following persons are not eligible to participate in those promotions unless approved by the management of Phillip Securities Pte Ltd (“PSPL”):

- Cash Trading Account holders

- PSPL institutional Customers and corporate Customers.

- PSPL Account holders whose Accounts have been suspended, canceled or terminate

- All employees of PSPL and its associated entities; PSPL and all its subsidiaries.

- Joint Account holders.

- By taking part in this campaign, the participant acknowledges that he / she has read and consented to these Terms & Conditions.

- This advertisement has not been reviewed by the Monetary Authority of Singapore.

LIMITED TIME ONLY

Optimise your ETF Portfolio to receive more!

Open a POEMS AccountCommunity Chest Donation Voucher

Use your POEMS Reward Points to donate for a better cause with Community Chest

What is a Community Chest Donation Voucher?

Community Chest Donation Voucher

The Change for Charity programme by Community Chest, the philanthropy and engagement arm of the National Council of Social Service, invites everyone to seamlessly weave giving into their daily routines. Community Chest has partnered with forward-thinking businesses to integrate giving into your everyday transactions.

All donations raised goes towards supporting over 50 critical programmes across 2 causes:

For more information about Change for Charity, visit www.comchest.gov.sg/changeforcharity.

Where appropriate, Community Chest may share necessary data with other Government agencies, so as to improve the discharge of public functions, and to serve you in the most efficient and effective way unless such sharing is prohibited by law. Please write to ncss_comchest@ncss.gov.sg for any queries.

How to Donate?

- Login to POEMS 2.0 Web > Head to Markets & Data Rewards tab.

- Navigate to the S$50 ComChest Donation Voucher under the “Voucher” section.

- Tick the checkbox to redeem S$50 ComChest Donation Voucher using your 2,500 POEMS Reward Points respectively, and click the “Submit” button.

S$50 ComChest Donation Voucher can be redeemed with 2,500 POEMS Reward Points

Redeem NowFrequently Asked Questions

Why am I not able to redeem Community Chest Donation vouchers?

This can happen for one of two reasons:

- Each Customer may only redeem 1 x S$50 Community Chest Donation per month. You may have hit the maximum redemption value for the month.

- You have insufficient POEMS Reward Points for redemption.

The confirmation email will be sent to the email address registered to your POEMS Account within 5 working days from the date of redemption. If you have yet to receive the voucher after 5 working days, kindly check your junk or spam folder.

IMPORTANT: Please ensure that the email address registered to your POEMS Account is accurate.

Is the donation entitled for tax deduction submission?Yes, the donation voucher is tax deductible. Please note that you can enjoy a tax deduction on the total amount you have redeemed for donation, not the matching amount by the government or PSPL.

What is the process for tax deduction submission?No action is required. NCSS will submit your personal information and donation amount to IRAS at the following tax assessment year on your behalf.

How do I know if the donation amount is being submitted to IRAS?Your donation amount will be reflected in your following years’ tax statement. Should there be any dispute about the donation amount, please contact NCSS at ncss_comchest@ncss.gov.sg for clarification. Please keep the donation voucher redemption email confirmation for record purpose.

Terms and Conditions

Terms and Conditions- This donation campaign is valid from 1 April 2025 to 31 March 2026.

- Each Customer holding a Cash Plus, Cash Management, Cash Trading, Margin, Prepaid, Custodian or Share Financing Account may redeem S$50 worth of Community Chest Donation voucher per month.

- The voucher, once redeemed, will be donated to the Community Chest Fund new initiative – Change for Charity Fund.

- The voucher is not refundable or exchangeable for cash.

- The voucher redemption confirmation will be sent to the Customer’s registered email address (registered to the Customer’s POEMS Account) within 5 working days from the date of redemption.

- Phillip Securities Pte Ltd (PSPL) reserves the right to change the terms and conditions at any point of time.

- In case of dispute, the decision of PSPL shall be final.

- PSPL, its affiliates and their respective employees and agents shall not be liable to any person for any loss, damage, injury, costs or expenses incurred, suffered, borne or arising from this promotion.

- By redeeming this item, you agree to share your personal information (Name, ID, email address) with our third-party community service provider, National Council of Social Service, for the purpose of submitting your donation for tax deduction and conducting surveys or promoting initiatives to you.

- Where appropriate, Community Chest may share necessary data with other Government agencies, so as to improve the discharge of public functions, and to serve you in the most efficient and effective way unless such sharing is prohibited by law. Please refer to www.comchest.gov.sg/privacy for further details and write to ncss_comchest@ncss.gov.sg for any queries.

- By redeeming this item, you acknowledge that you have read and consented to these Terms and Conditions.

Option Trading

Options Trading

Why trade options Basics Strategy Brokerage Trading Details How to Trade FAQ Why trade options Basics Strategy Brokerage Trading Details How to Trade FAQWhy Trade Options

Generating Income Regardless of Whether the

Markets Are Bullish or Bearish

Bullish on a particular stock? Buy a call option and earn when the stock prices grow.

What about when you feel bearish on a particular stock? Buy a put option and earn when stock prices fall.

Diversify Your Portfolio with Options

We are all too familiar with the ‘don’t put all your eggs in one basket’ term. With options, you have access to more sectors and a more diverse spread and exposure for a smaller amount of capital, even within your preferred sector.

In addition, diversifying your exposure will also assist in hedging against losses mentioned in the above stated scenarios.

Position Hedging to Minimise Potential Downside Risk and Limit Potential Losses on Other Open Positions

For example, if you own some stocks in your POEMS Account and are concerned about the fluctuation in pricing of this particular stock, or if the markets will turn bearish, you can consider using options to hedge.

In this scenario, buying a put option, with the strike price near the stock entry price covers some losses(or stock current trading price to protect the gains), while risking the cost of buying the put option only.

Limited Risk

When you buy options, you limit your risk to just the premium that you pay, which is a fraction of the cost of the underlying stock. Furthermore, it also helps to reduce the cost of holding a stock by allowing you to sell higher call options to earn premium.

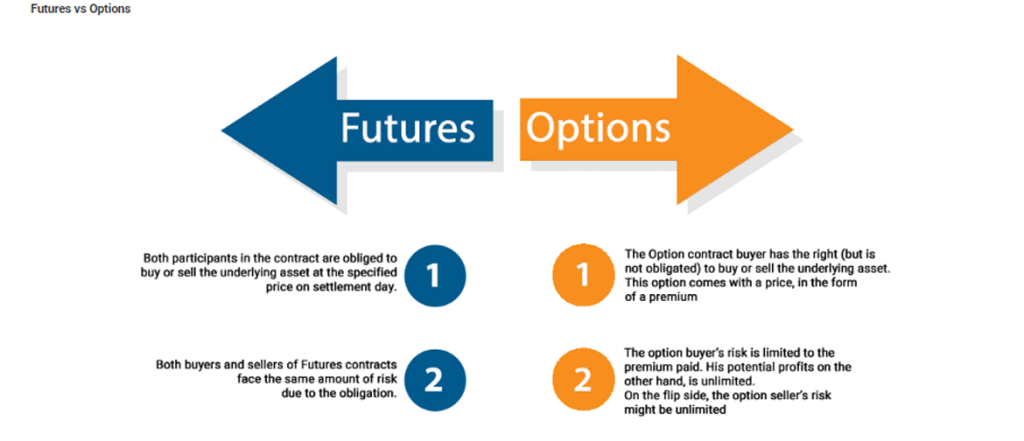

What is an Option?

When you buy options, you limit your risk to just the premium that you pay, which is a fraction of the cost of the underlying stock. Furthermore, it also helps to reduce the cost of holding a stock by allowing you to sell higher call options to earn premium.

The buyer of the option has the right but not the obligation to buy or sell the underlying asset within the specified time.

The seller of an option does not have such rights and can only assume the obligation as stipulated in the contract.

An Example

When purchasing a new car, you would have to purchase precautionary insurance plans before driving in it.

When you purchase an insurance policy — be it an automobile, health, life or homeowner’s insurance — you will need to pay a premium for the protection it provides.

This mimics that of an option buyer.

However, just like what we experience in life, we end up not putting the insurance to use, resulting in the profiting of the Insurance firm,

This mimics that of an Option Seller

Basic Options Strategies

Long Call A long call gives you the right to buy the underlying stock at strike price. Calls may be used as an alternative to buying stock outright. You can profit if the stock rises, without taking on all of the downside risk that would result from owning the stock. It is also possible to gain leverage over a greater number of shares than you could afford to buy outright because calls are always less expensive than the stock itself.

There are two potential outcomes when a long call is taken:

It is also possible to gain leverage over a greater number of shares than you could afford to buy outright because calls are always less expensive than the stock itself.

There are two potential outcomes when a long call is taken:

- The stock falls below the strike price of the call and the call option expire worthless.

- The stock trade above the strike price and either

- exercise the option and buy the stock at the strike price and profit from the higher current market

- close out the long call position in a profit.

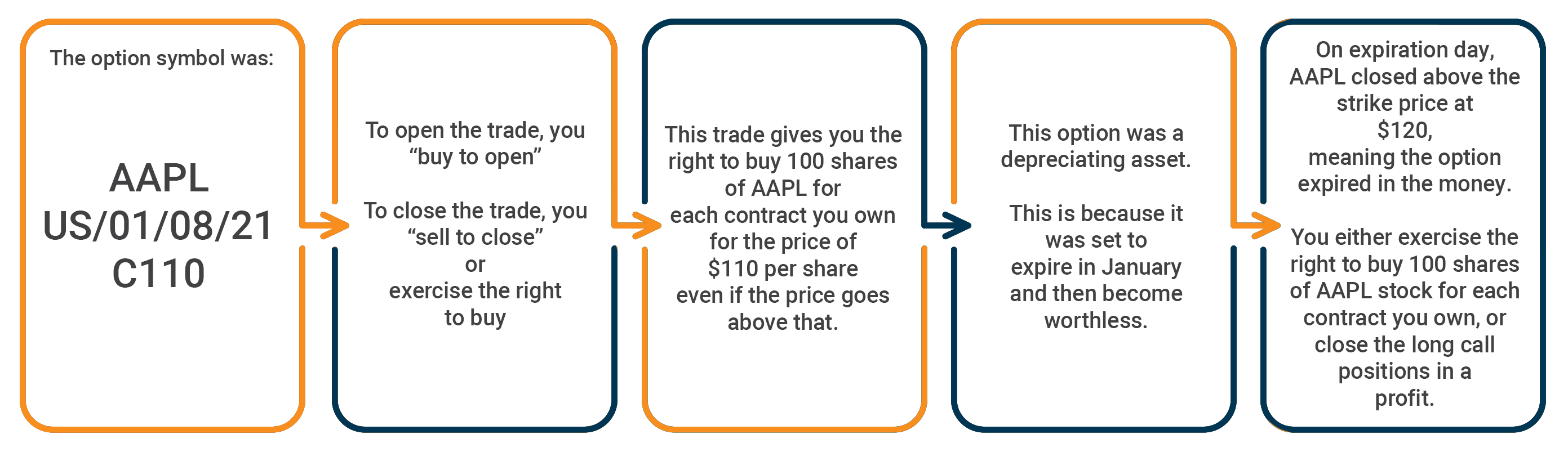

Long Call Trade Example

The trade was the Apple (AAPL) January 8th $110 Long Call (AAPL US 01/08/21 C110). You paid $139 ($1.39 x 100 shares) when you long the call and, at expiration, the option was in the money. The seller is obligated to sell the stock to us on Jan. 8, 2021, or you may close the long call position in a profit. Below are the details of the trade broken down step-by-step.

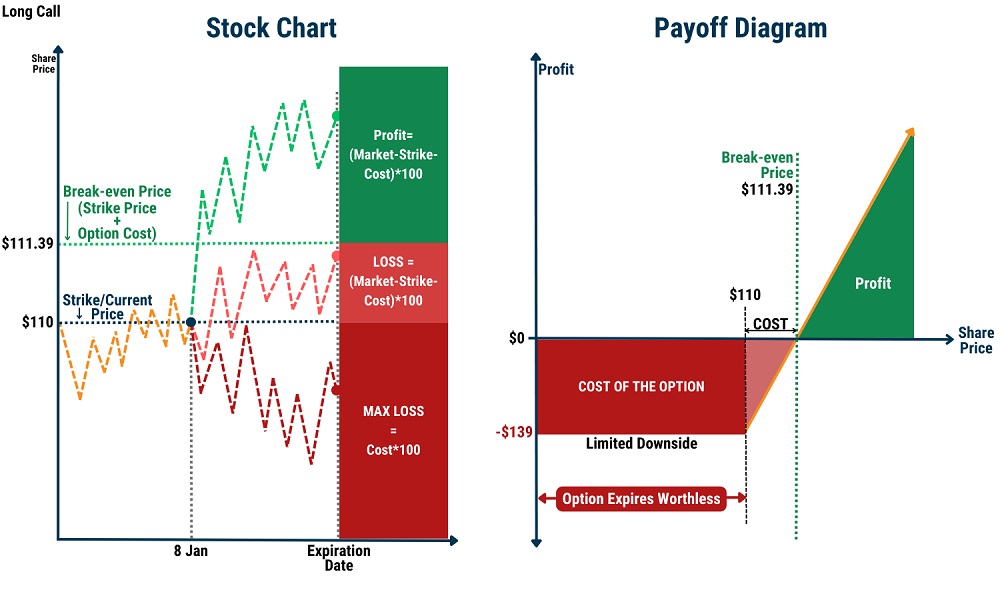

Long Call Stock Chart and Payoff Diagram

The Calls below can be employed with a Long Call Strategy:

The Calls below can be employed with a Long Call Strategy:

- Deep OTM Call

- The option will be cheap as it is deeply OTM. The investor may employ this low cost strategy to profit when the option moves ITM.

- The risk that the option will expire worthless is great but therein lies the potential for a large return.

- Deep ITM Call

- This is an alternative to buying the shares outright while profiting from the same underlying stock price movement.

- A Call that is deep ITM has delta value that is close to 1, which means it will mimic the price movement of the underlying closely i.e. if the price of the underlying moves by $1, this will result in a very similar price movement in the option value as well.

- The investor may employ this strategy to benefit from the leveraging nature of options, you may also see LEAPS below.

There are two potential outcomes when a long put is taken:

There are two potential outcomes when a long put is taken:

- The stock trades above the strike price of the put and the put option expire worthless.

- The stock fall below the strike price and

- exercise the option and sell the stock at the strike price and profit from the lower current market

- close out the long put position in a profit.

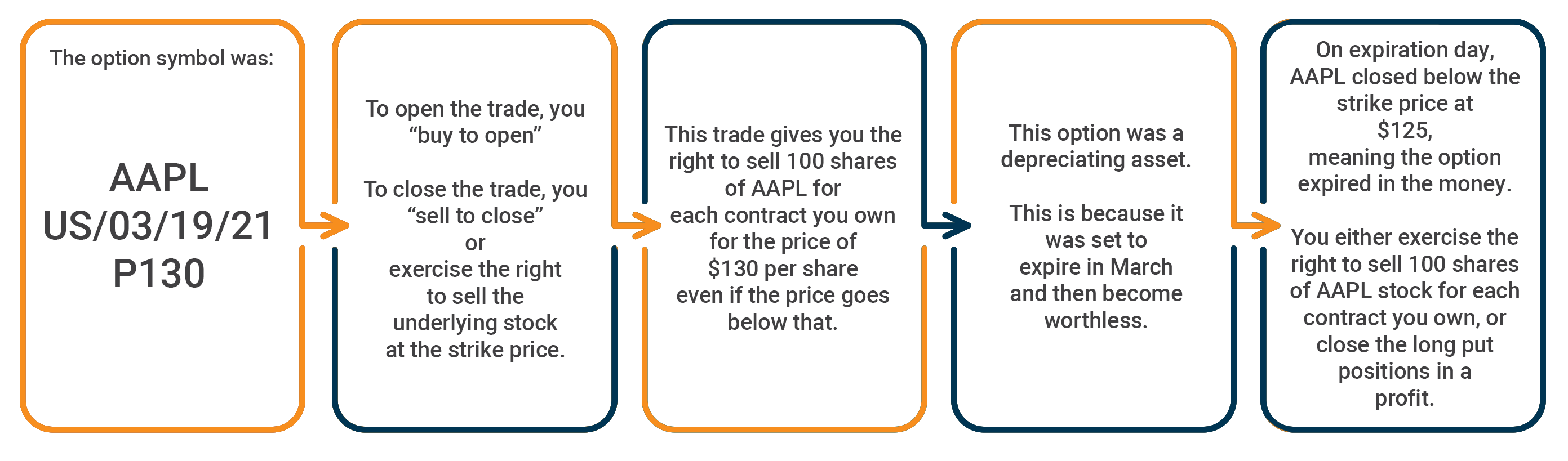

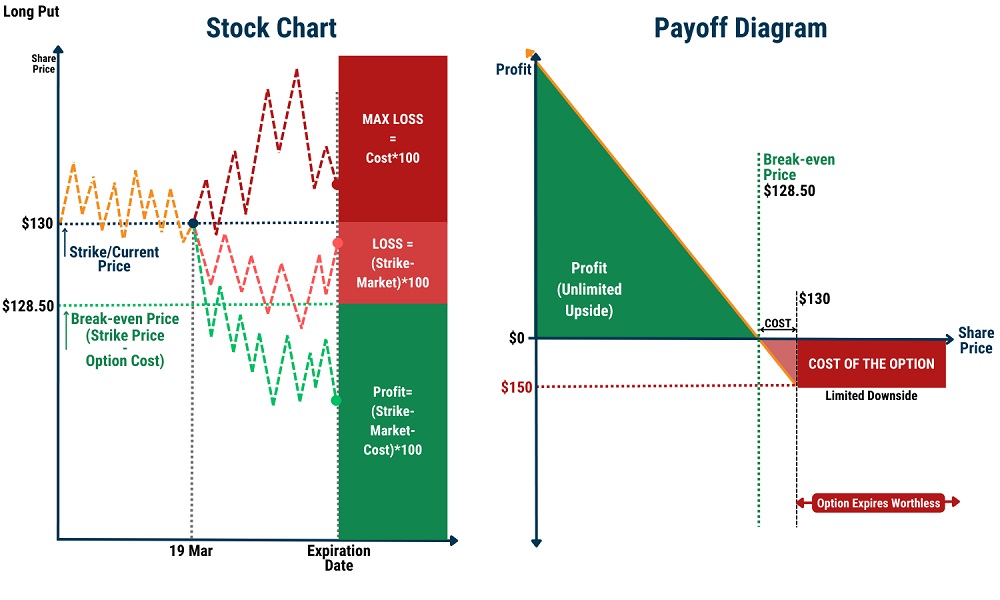

Long Put Trade Example

The trade was the Apple (AAPL) March 19th $130 Long Put (AAPL US 03/19/21 P130). You paid $150 ($1.50 x 100 shares) when you long the put and at expiration, the option was in the money. The seller is obligated to buy the stock from us on Mar. 19, 2021, or you may close the long put position in a profit. Below are the details of the trade broken down step-by-step.

Long Put Stock Chart and Payoff Diagram

Protective Put

Protective Put

A long put can be combined with a stock purchased previously to form a Protective Put.

This is a form of insurance against a decline in stock price which may result from events such as poor Earning Release or short-term bearish sentiment on the stock.

Protective Put Trade Example

Trade: Apple (AAPL), 19 March, $130 Long Put (AAPL US 03/19/21) bought and combined with the underlying stock holding of 100 shares of AAPL trading at $130. Near-term volatility or bearish sentiment may cause AAPL stock price to decline below $130 and cause a loss in the investment of the AAPL stock.

This decline however, will result in the AAPL Long Put to be more valuable and ITM hence offsetting the loss. Investors may close out the long put position in profit or “put” 100 shares of AAPL to the obligated seller at the exercise price of $130.

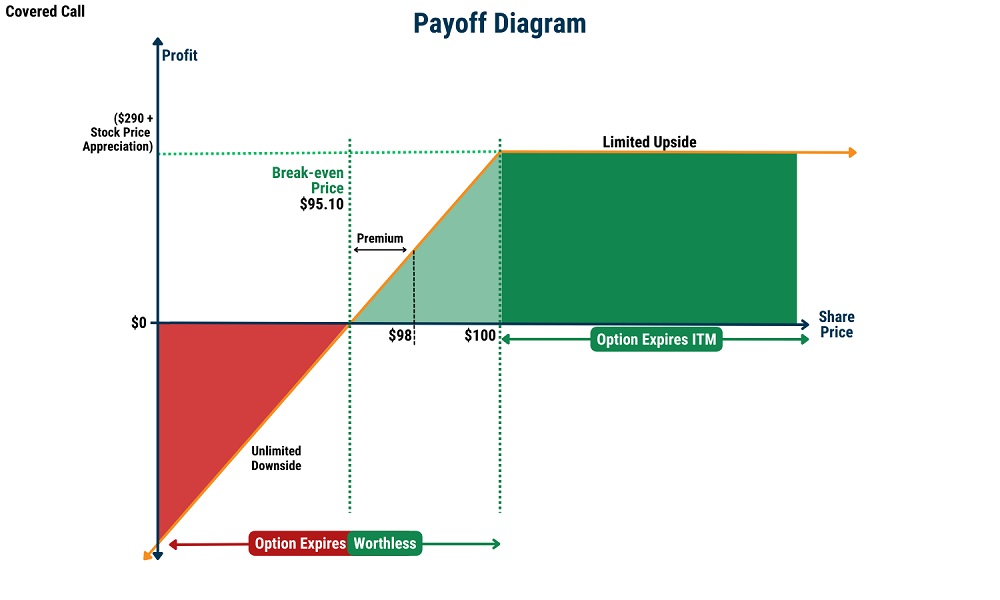

Covered callA covered call strategy involves selling an option to collect premium as income. For this strategy you will need to have the underlying stock before executing the strategy. Selling a call obligates you to sell 100 shares of a stock, which would be a bad idea if you don’t already own the stock. After all, you’d have to go out and buy 100 shares on the open market and then sell them back to the option buyer. But if you already own shares of the underlying stock, you wouldn’t have to buy shares to sell to the call buyer.

The shares you already own would “cover” the call you sold, hence the term “covered call.” Covered calls are ideal for generating income on stocks you already own. Rather than letting the stocks sit idle in your equity account, it can be used to generate extra income by doing covered calls on top of also profiting from the increase in price of the underlying stocks.

Stocks with high volatility (such as Tesla, Alibaba,) are great with generating more income due to the volatility priced into the option premium. This strategy can be utilise to generate constant income by rolling forward on the covered call contracts (ie. Extending the expiry date). Do take note if the covered calls expired ITM, the underlying needs to be delivered at the exercise price.

There are two potential outcomes when selling a call option:

- The stock rises past the strike price and the call seller is obligated to sell 100 shares of the stock for the strike price.

- The stock does not rise past the strike price and the call expires worthless, allowing the seller to keep the entire premium. Most of the time, we will buy back a call write that is out of the money and has lost most of its value.

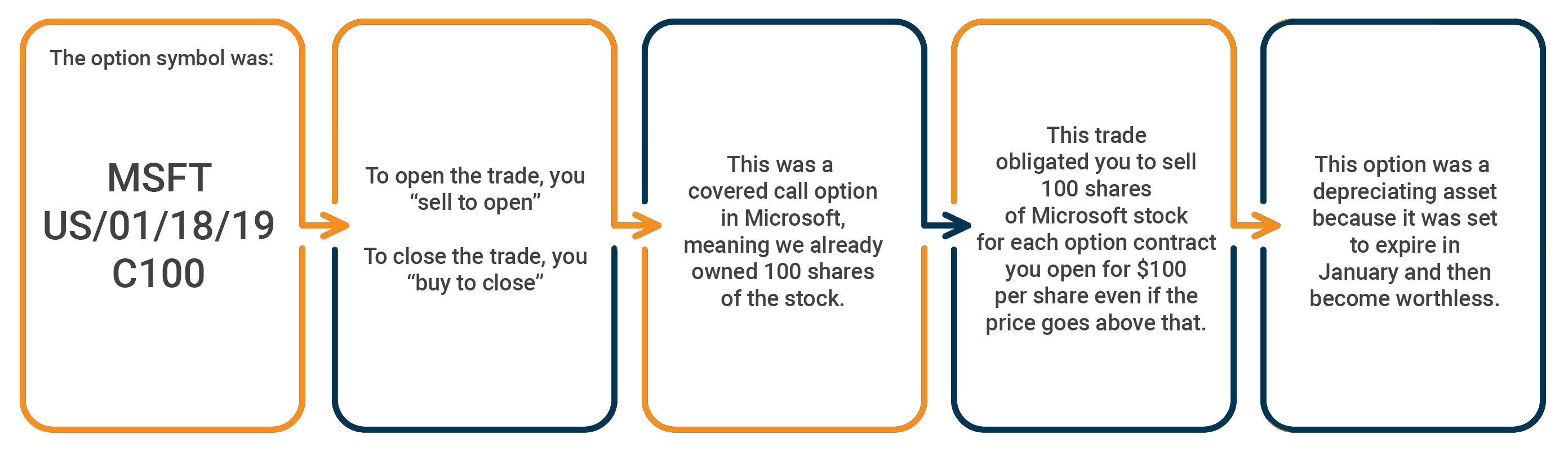

Covered Call Trade Example

(1)The trade was the Microsoft (MSFT) January 18th $100 Covered Call while your average cost for MSFT stock is at $98. You earned ($2.90×100 shares) when we sold the covered call and, at expiration, the call expire worthless if MSFT trade below $100.

Below are the details of the trade broken down step-by-step. The trade was a covered call trade in Microsoft with an expiration date of Jan. 18, 2019. We expected the stock stay below $100 through expiration.

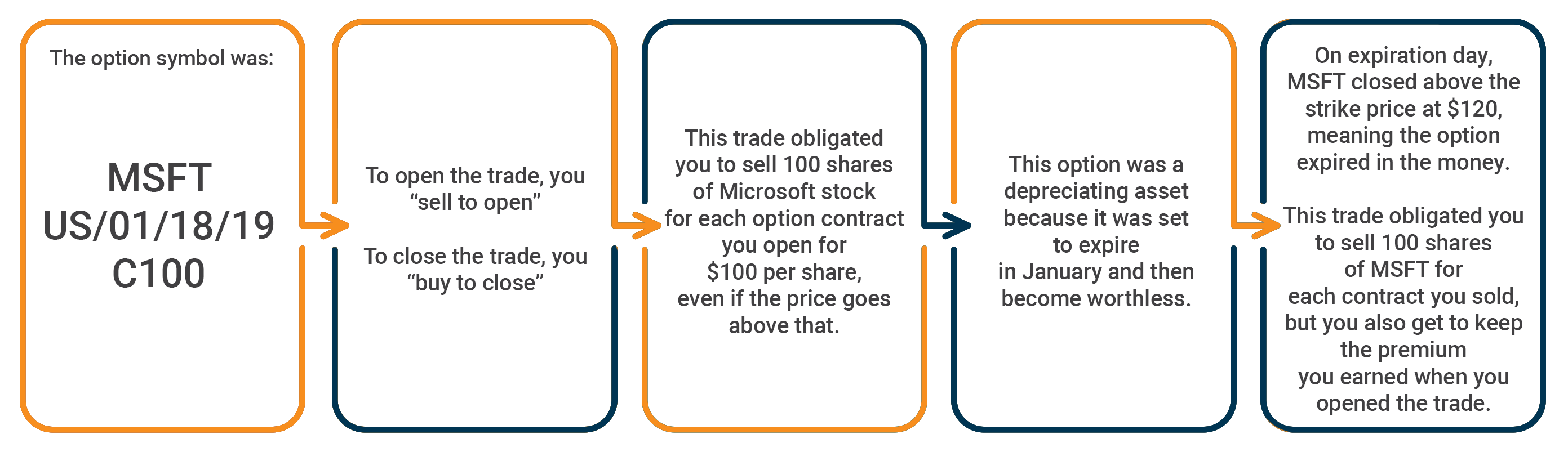

(2) The trade was the Microsoft (MSFT) January 18th $100 Call Write while your average cost for MSFT stock is at $98. You earned ($2.90×100 shares) when you sold the covered call and, at expiration, the option was in the money.

The buyer call the stock from us on Jan. 18, 2019, but we still got to keep the $290 in premium we received for selling the option.

Below are the details of the trade broken down step-by-step.

Covered Call Payoff Diagram

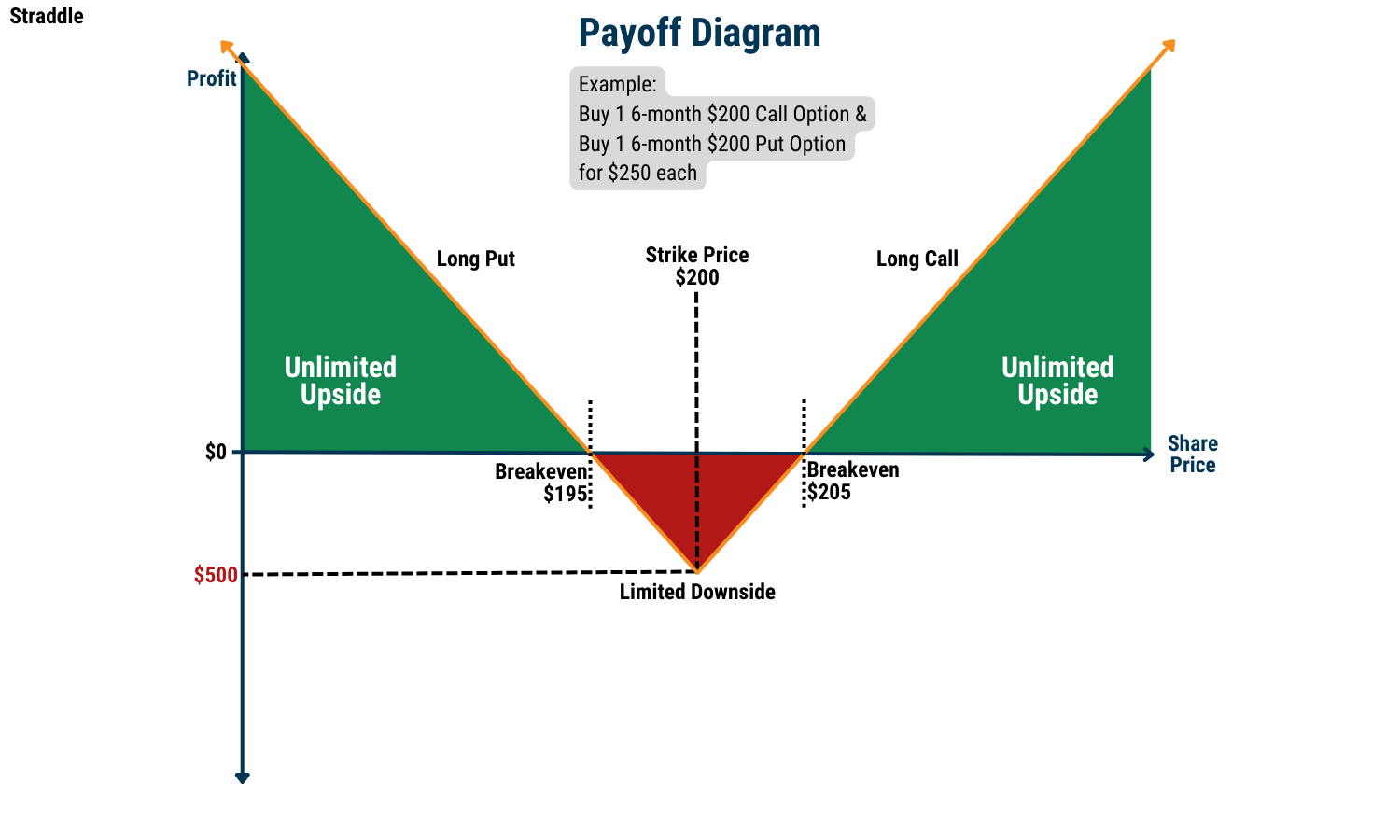

Straddle

A long straddle strategy involves both a Long Put and Call on the same underlying same strike price with the same expiration date.

The primary motivation behind this strategy is to profit from drastic movement (in either direction) of the stock price. This can take place during Earnings Announcements, where results might be unpredictable, potentially resulting in a huge impact on the stock price, causing it to deviate greatly.

Straddle Trade Example

Trade: Tesla (TSLA), 28 April, Long Call (TSLA US 04/28/23 C200) and Long Put (TSLA US 04/21/23 P200) bought with the underlying stock price of TSLA trading at around $200. On 27 April, TSLA announced a better (or worse) than expected Earnings results, causing TSLA stock price to move drastically.

This movement caused the Long Call (or Put) to be deep ITM, the position can be closed out in profit. Due to the drastic changes in price, the position that was deep ITM will cover for the initial investment in both Long Call and Put.

*Do note that volatility spikes that take place prior to earnings announcements will mean that the cost of options are usually more expensive and the resultant volatility post-announcement may result in a loss even though the options position moved ITM.

Straddle Payoff Diagram

Straddle Variants

There are multiple variants to the Straddle Strategy:

Strangle

Buy both Long Call and Long Put, with the strike price of the Call HIGHER than that of the Put. This will result in a lower premium paid (OTM options are cheaper than ATM/ITM options). The drawback to this would be that the price movement would have to be even more drastic for the position to be profitable.

Strip

Buy both a Long Call and Long Put with the quantity of the Put HIGHER than that of the Call (e.g. Long 1 Call and 2 Puts). This strategy relies on drastic stock price movement(s), biased towards a decrease in stock price.

Strap

Buy both a Long Call and Long Put with the quantity of the Put LOWER than that of the Call (e.g. Long 2 Calls and 1 Put). This strategy relies on drastic stock price movement(s), biased towards an increase in stock price.

LEAPSLEAPS – Long-term Equity Anticipation Securities

LEAPS are long-term options that are still at least a year from expiration. They behave identical to that of other options, only difference being the longer expiration date. Besides the longer shelf life, LEAPS will also be deep ITM with a delta value of 0.80 or higher (-0.80 for Puts) at the chosen strike price. The high delta value essentially allows the LEAPS option to behave similarly to a stock in terms of price movement, for example a 0.80 delta option will move $0.80 for a $1 move of the underlying stock.An Example of LEAPS

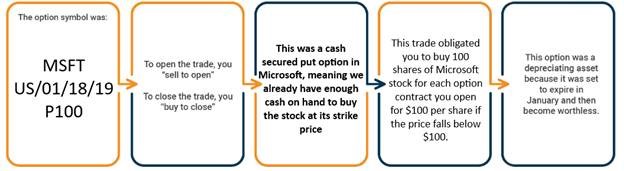

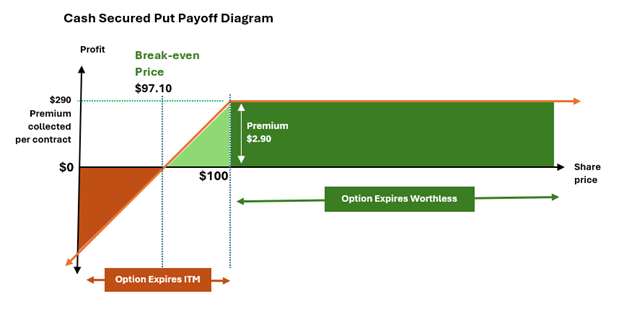

AMZN stock is currently trading at $100, a LEAP option will be one where the expiry date is a year or more away and the option strike price chosen has a delta of 0.8 or more. For example, if today is 10 February 2023, the chosen AMZN call option has an expiry at 10 December 2025, a strike price of $50, delta value at 0.93 and currently trades at $60. Whenever the stock price moves $1, the option will move $0.93 or more depending on the delta. We see that the option price moves with a 93% similarity to the stock itself and investors using much less capital for the position. Cash Secured PutCash Secured Put

A cash-secured put strategy involves selling a put option to collect premium as income while ensuring you have enough cash on hand to buy the underlying stock if assigned. For this strategy, you will need to set aside sufficient capital to purchase 100 shares of the stock at the strike price before executing the trade. Selling a put obligates you to buy 100 shares of the stock if the option is exercised. If you don’t have the necessary funds, you might face liquidity issues or be forced to close the position at a loss.

Cash-secured puts are ideal for investors looking to generate income while potentially acquiring stocks at a discount. If the stock price remains above the strike price by expiration, you keep the premium without having to buy the shares. If the stock drops below the strike price and you are assigned, you purchase the shares at the agreed-upon price, often at a lower effective cost due to the premium received.

There are two potential outcomes when selling a put option:

1. The stock falls below the strike price, and the put seller is obligated to buy 100 shares of the stock at the strike price, regardless of its lower market value.

2. The stock stays above the strike price, and the put expires worthless, allowing the seller to keep the entire premium.

Most of the time, traders will buy back a put option that is out of the money and has lost most of its value to lock in profits and free up capital for new trades.

Cash-Secured Put Trade Example

Scenario 1: Put Expires Worthless

The trade was the Microsoft (MSFT) January 18th $100 Cash-Secured Put while you were willing to buy MSFT stock at $100. You earned ($2.90 × 100 shares = $290) when you sold the put option. At expiration, if MSFT trades above $100, the put expires worthless, and you keep the entire premium without having to buy the stock.

Below are the details of the trade broken down step-by-step. The trade was a cash-secured put in Microsoft with an expiration date of Jan. 18, 2019. We expected the stock to stay above $100 through expiration.

Scenario 2: Assigned the Stock

The trade was the Microsoft (MSFT) January 18th $100 Cash-Secured Put while you were willing to buy MSFT stock at $100. You earned ($2.90 × 100 shares = $290) when you sold the put option. At expiration, the option was in the money, meaning MSFT traded below $100, and the put buyer assigned the stock to us at $100 per share. However, we still kept the $290 in premium received for selling the option, effectively lowering our cost basis on the purchased shares.

Below are the details of the trade broken down step-by-step.

Brokerage

Commission and Brokerage Charges

| Commission | $0.88 per contract subjected to minimum $2.88 per order |

|---|---|

| Securities and Exchange Commission (SEC) Fee | 0.00% (sell trades effective date 13 May 2025) |

| Trading Activity Fee | Applicable only sale of an option at $0.00329 per contract. Applicable only for sell trades at $0.000195 per share, subject to maximum of $9.79 (for Assigned calls/ Exercised Puts on the underlying) |

| Option Regulatory fee (ORF) | $0.02097 per contract |

| OCC Clearing Fees | $0.025 per contract’, effective January 1st, 2025 |

| Exercise/Assignment Fee | $2.00 per exercise/assignment. |

Note: Goods & Services Tax (GST) will be applied to commission charges and pass through fees. Commission and exchange fees may be subject to change without prior notice.

Trading Details

Minimum trade size: 1 contract which generally covers 100 underlying shares

| Action | Requirement |

|---|---|

| Long Call | Option premium |

| Long Put | Option premium |

| Short Call | Underlying asset |

| Short Put | 100% of strike price x 100 in available cash |

For positions unable to meet the obligations of options contracts (including auto-exercise) where the exposure risk is deemed excessive, one of the following actions will occur. Any proceeds will be credited/debited to the client prior to the contract’s expiry.

⦁ Liquidate Options prior to the expiration date

⦁ Allow the Options to lapse

⦁ Allow delivery and liquidate the underlying shares

All open positions should be rolled forward or closed before expiry if the client does not intend to exercise. Otherwise, they will be subject to one of the above actions. Force liquidations related to expiration typically commence two hours before market close, although we reserve the right to initiate this process earlier or later depending on prevailing conditions.

Manual exercising of options is available for positions that can meet the required obligations. Please submit the exercise request with the options contract details (symbol, expiration date, type of options, strike price, and quantity) by sending us an email at globalnight@phillip.com.sg no later than 2:00 A.M. SGT (3:00 A.M. SGT for non-DST). Any request submitted after the cutoff time will be handled on a best-effort basis.

The US Stock Option tab will only reflect positions and balance relating to US Stock Option(s). All trades are denominated in USD.

Order details

| Order Placement |

Via 1) POEMS 2.0 Web 2) POEMS Mobile 3 |

|---|---|

| Trading lot(Minimum trade size) | 1 contract which generally covers 100 underlying shares |

| Live price | Via POEMS Mobile 3 or Poems Web (live Option price quote) |

| Order Type | Limit Order only |

| Minimum bid size | 0.01 (some subject to 0.05 increment bid) |

Trading Hours

| Singapore Time | 09:30pm – 04:00am (Daylight Savings Time) |

|---|---|

| 10:30pm – 05:00am (Non-Daylight Savings Time) | |

| US(Eastern) Time | 09:30am – 04:00pm |

*Order placement are allowed only during regular trading hours. Orders submitted outside of regular trading hours will be rejected, these includes orders in ETFs that trades an additional 15 minutes after regular close.

Settlement

| Settlement Date 1 | T+1 market days |

|---|---|

| Order Amalgamation | No |

| Settlement Currency | USD only |

1. Should the due date coincide with Singapore public holiday/s – The due date will follow the traded market’s due date

Transfer Timeline

|

Stock to Option |

|

|

Cash transfer |

Same day processing if request is made before 10am SGT, else T+1 |

|

Stock transfer |

Same day processing if request is made before 3pm SGT, else T+1 |

|

Option to Stock |

|

|

Cash transfer |

T+1 processing if request is made before 10am SGT, else T+2 |

|

Stock transfer |

T+1 processing if request is made before 3pm SGT, else T+2 |

US Options Live Prices

US Options Live Price feed is available for subscription FOR FREE on the web portal if you are a non-professional investor. Each subscription will go on for 12 months, and is not auto-renewed. After a 12-month subscription period, your US Options Live Price Feed will expire. Users will have to re-subscribe if they want to continue enjoying the US Options Live Price Feed for the next 12 months (at no additional cost).

For professional investors, you can subscribe to our US Options Live Price feed at SGD $45 monthly.

Please note: if you do not subscribe to the Live Price Feed, Option prices displayed are delayed by 15-30 minutes.

Only Option prices are live. In order to have accurate IV/Delta/Gamma, investors are advised to subscribe to both US Equities and Options live prices.

Options Price Increments

There may be instances where your Option order has invalid price increments.

Below is a summary of how Option price increments are determined.

In general, most Options trade in either nickel or dime increments depending on the price of the option.

| Nickel and Dime Increments Options | |

|---|---|

| Options Price | Price Increment |

| Below US$3 | US$0.05 |

| Above US$3 | US$0.10 |

However, there are some options that trade in increments of a penny or a nickel depending on the price of the option.

| Penny Program Pricing Increments | |

|---|---|

| Options Price | Increment |

| Below $3 | $0.01 |

| Above $3 | $0.05 |

The Options Clearing Corporation (OCC) maintains a list of equity options that are part of the Penny Program.

The list can be downloaded from the OCC website here.

How to start?

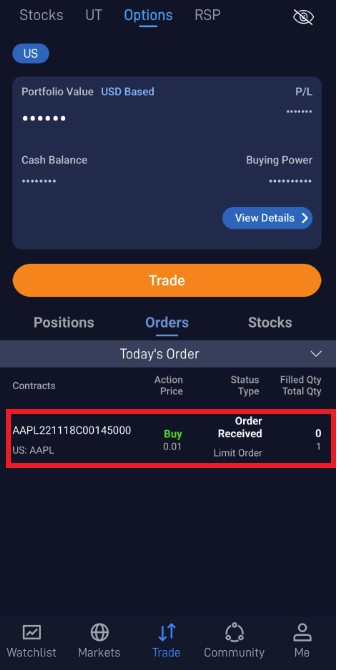

How to activate stock options account (POEMS MOBILE 3 )

Video Guide

Screenshot Guide

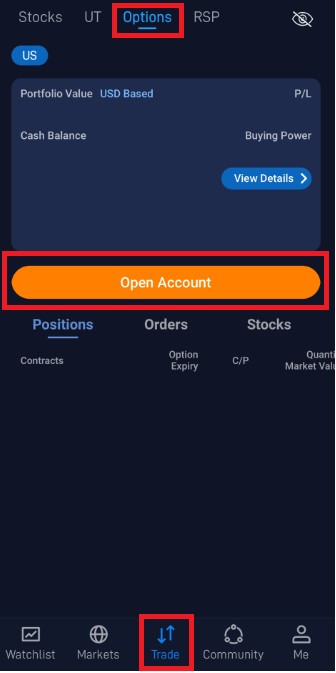

Step 1:

Navigate to (1)Trade > (2)Options and click on (3)Open Account

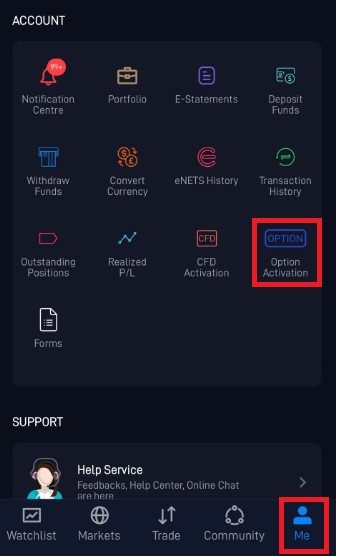

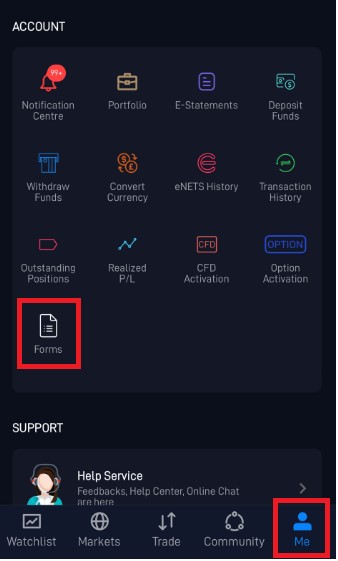

VYou can also navigate to (1)Me > (2)Option Activation to open Stock Option account

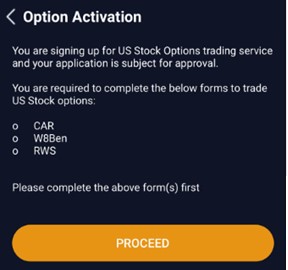

Step 2(inactive CAR/W8Ben/RWS):

Validation page for CAR/W8Ben/RWS. Click (1)Proceed to being filling up the respective forms

On click of respective forms, you will be redirected to fill up the forms.

*Do note CAR form can only be completed online on POEMS Web.

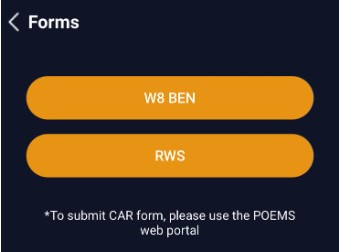

You may also submit W8Ben and Risk Warning Statement(RWS) under (1)Me > (2)Forms

Step 3(active CAR/W8Ben/RWS):

Redirect to acknowledge Option’s Risk Declaration Statement under ‘Option Activation’

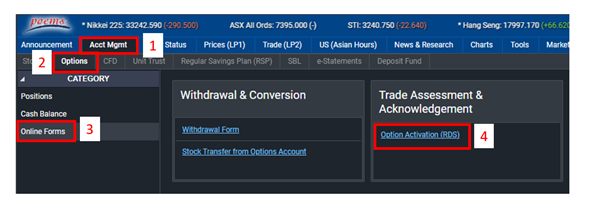

How to activate stock options account (POEMS WEB)

Screenshot Guide

Step 1: Acct Mgmt > Options > Online Forms > Options Activation (RDS)

Step 2: Upon clicking Options Activation (RDS) you will be prompt to acknowledge the risk disclosure for Options

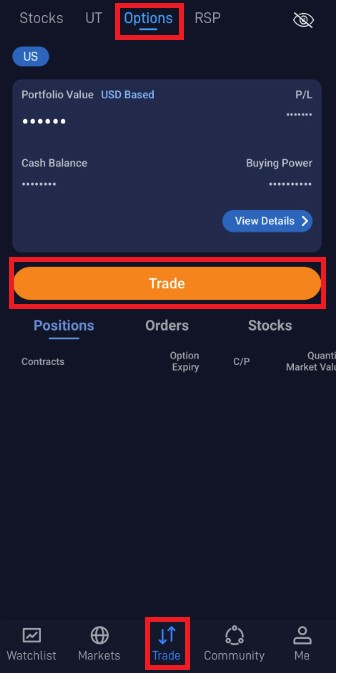

How do I place a trade? (POEMS MOBILE 3)

Video Guide

Screenshot Guide

Step 1:

To place a trade, navigate to (1)Trade > (2)Option > (3)Trade

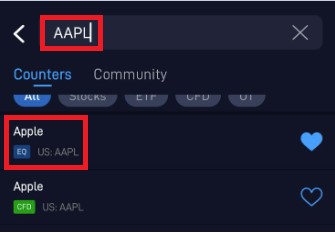

In the search bar, (1)search for the underlying counter > (2)Select the specific counter under EQ – Equity or ETF – Exchange Traded Funds respectively

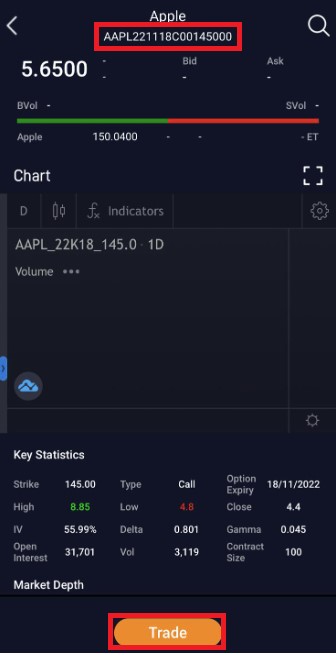

Select (1)Option and under the option page, you may choose for the (2)Options types ie. Call or Put to displayed separately or All to be displayed together. (3)Select the expiry date and the (4)Strike price respectively

(1)Show the option symbol and click on (2)Trade

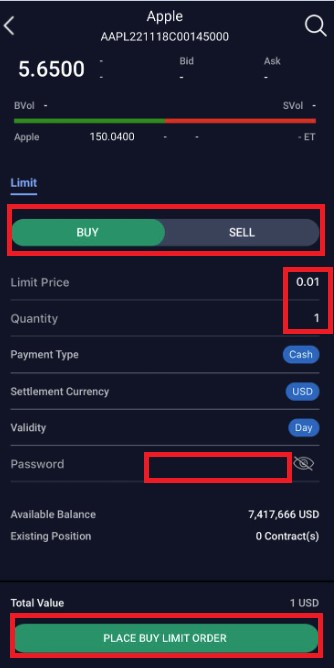

Select (1)Buy or Sell > (2)Input the limit price and quantity respectively > (3)Key in password > (4)Click on place order to submit order

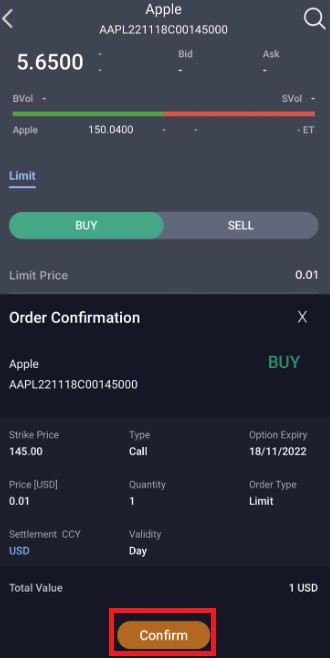

Order confirmation shown here, (1)Click on confirm to submit order

(1)Submitted order will be reflected under today’s order

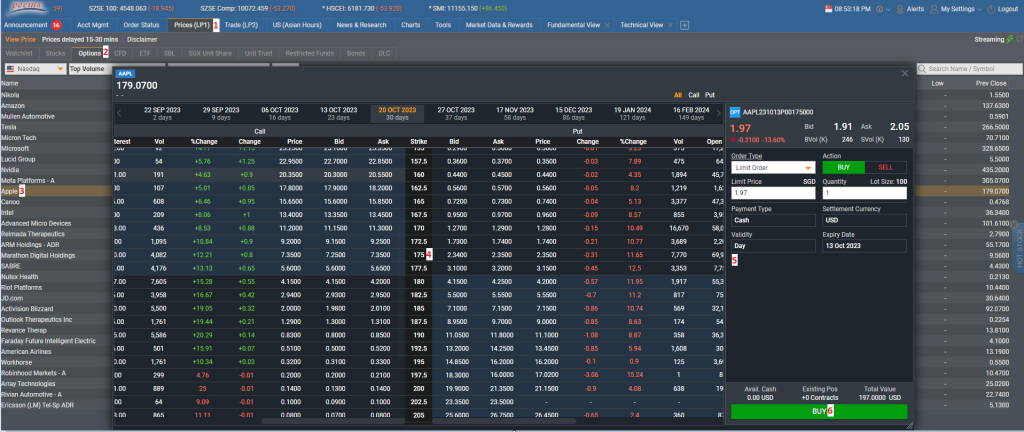

How do I place a trade? (POEMS WEB)

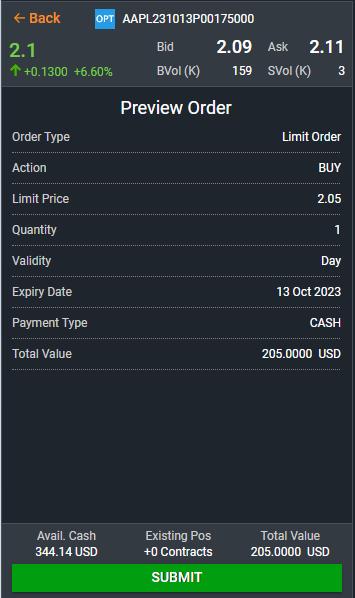

Screenshot Guide

Step 1: Prices > Options > Select stock to launch Option Chain > Select contract to launch Trade Ticket > Fill in order details > Submit order

Step 2: Review order details and submit order

Corporate Actions

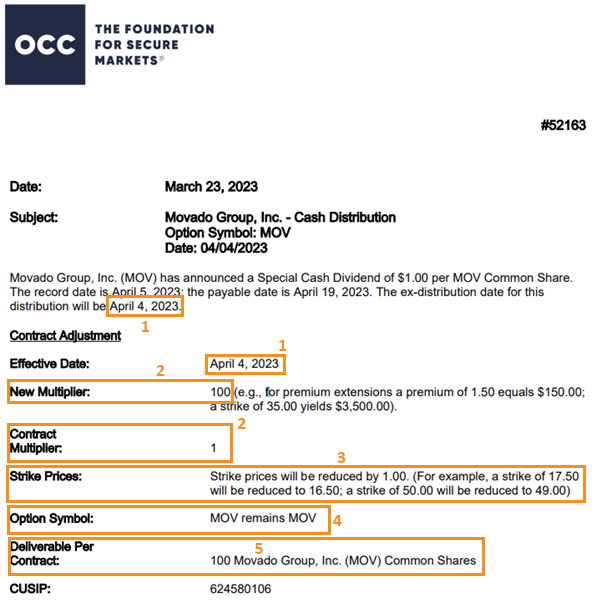

Special Cash Dividend

When a special cash dividend is issued, there are normally two scenarios.

Scenario A

The strike price of the options contract decreases accordingly.

The memo from OCC on MOV.US is explaining the following:

1. Options opened before 4 April 2023 will be adjusted

2. Multipliers remain unchanged

3. Strike price will all be reduced by $1.00

4. Option symbol remains unchanged

5. Deliverable remains unchanged

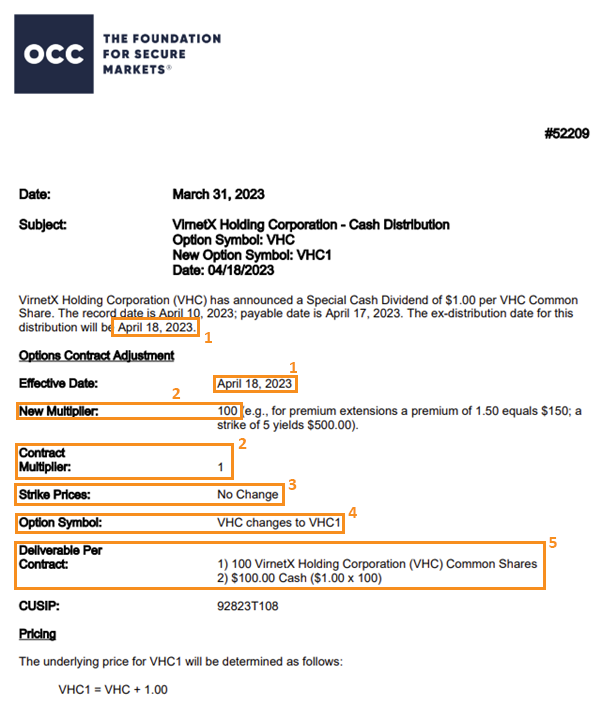

Scenario B

Strike price will remain unchanged with a change in option symbol and an additional deliverable of the cash distribution.

The memo from OCC on VHC.US is explaining the following:

1. Options opened before 18 April 2023 will be adjusted

2. Multipliers remain unchanged

3. Strike price will remain unchanged

4. Option symbol change from VHC to VHC1

5. Contract deliverable per contract will consist of:

a. 100 VHC.US common shares

b. $100 cash per contract.

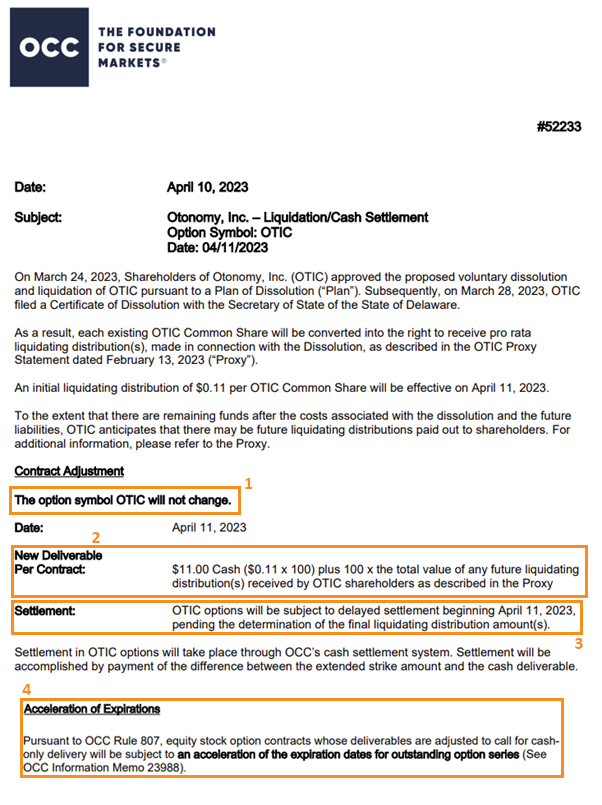

Liquidation

When the underlying stock liquidates and ceases trading in the market, the shares that make up the contract will turn into the cash-per-share amount the company allocates. Thus, the contract will be valued 100 times more than the company’s chosen pay out for each share.

Both the Symbol and Strike price will not change, but the Options Clearing Corporation (OCC) will bring forward the expiration date for the contract.

The memo from OCC on OTIC.US is explaining the following:

1. Option symbol will remain unchanged

2. Contract deliverable per contract will be $11.00 ($0.11 x 100) plus any future liquidating distributions.

3. There will be a delay in settlement from 11 April 2023

4. The expiry date of the option will be brought forward

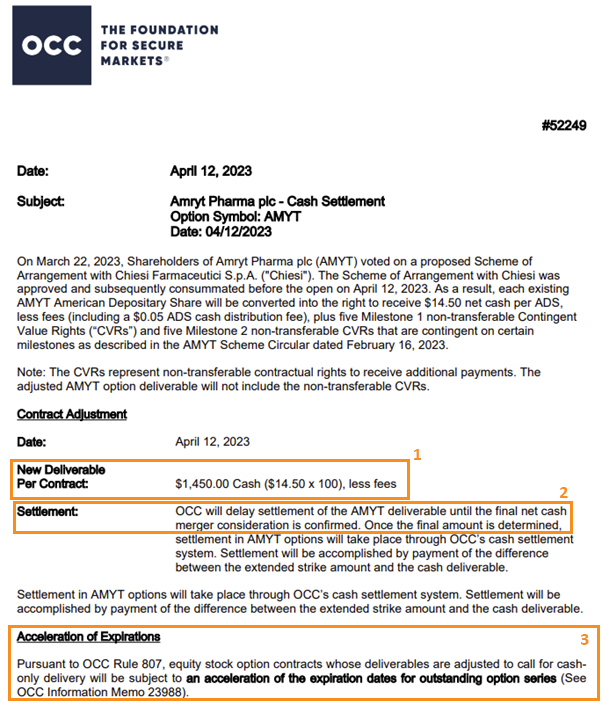

Acquisition

When the underlying stock gets acquired and ceases trading in the market, the expiration will be accelerated with the shares that make up the contract, turning into the cash-per-share amount that the company allocates.

The memo from OCC on AMYT.US is explaining the following:

1. Contract deliverable per contract will be $1,450.00 ($14.50 x 100) less fees

2. Settlement will be delayed until the final net cash merger consideration is confirmed

3. The expiry date of the option will be brought forward

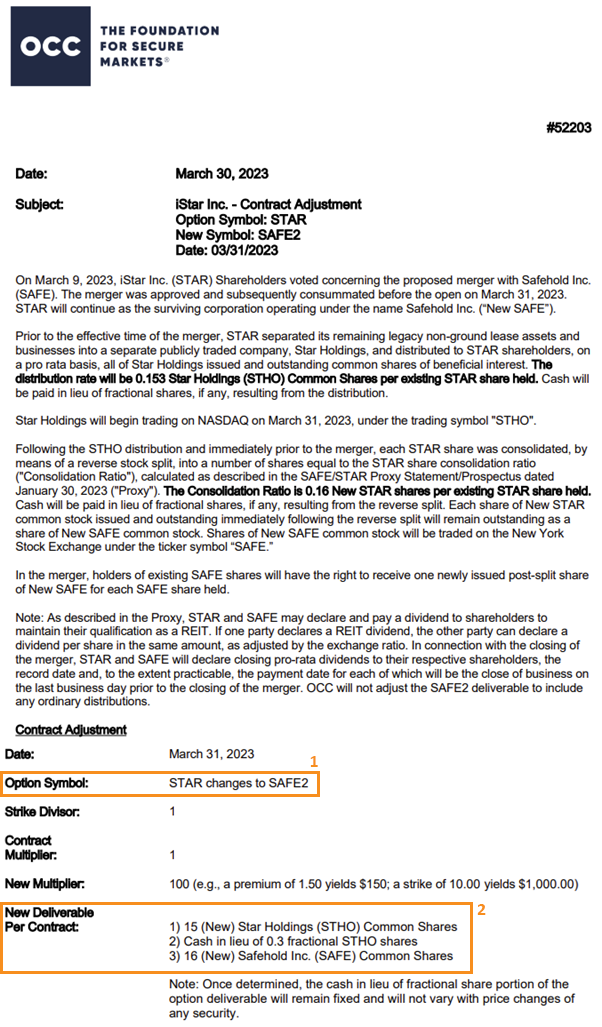

Cash and Stock Merger

In the event of a cash and stock merger, please note that the ticker of the options contract will change. The number of shares in the contract will also vary based on the merger conditions and deliverables that may include shares along with cash. Both the Strike price and Expiration date will however remain the same.

The memo from OCC on STAR.US is explaining the following:

1. Option symbol will change to SAFE2

2. Contract deliverable per contract will be:

a. 15 STHO.US common shares

b. Cash in lieu of 0.3 fractional STHO.US common shares

c. 16 SAFE.US common shares

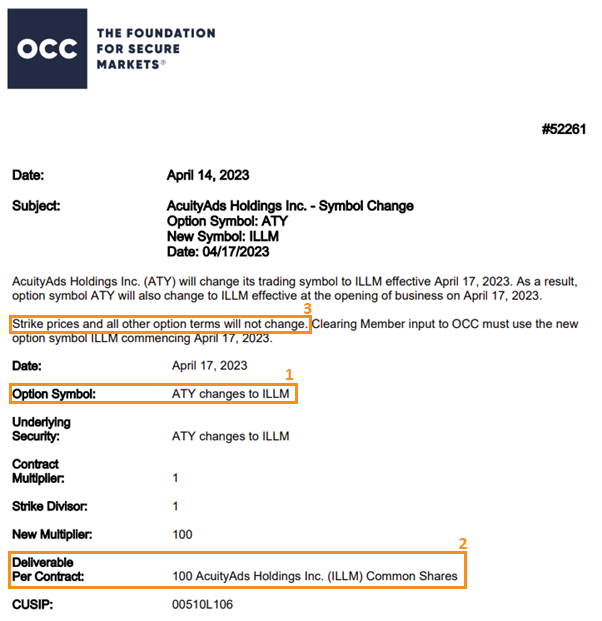

Ticker Change

During a ticker change, the Options contract will change to reflect the new ticker of the underlying stock. Both the Strike price and Expiration date will however, remain unchanged.

The memo from OCC on ATY.US is explaining the following:

1. Option symbol will change to ILLM

2. Contract deliverable per contract will be 100 ILLM.US shares

3. Strike price and other options terms will remain.

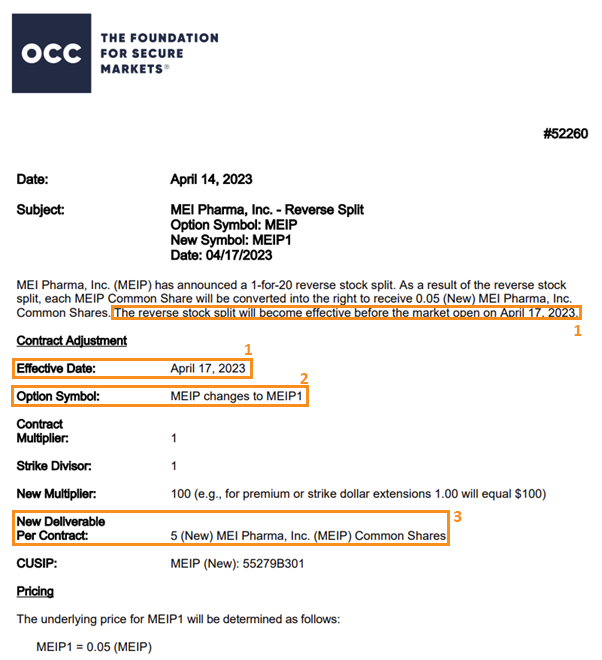

Reverse Split

During a reverse split, there will be a number that is added to the ticker of the Options contract. The number of shares in the contract will decrease based on the conditions of the reverse split. Both the Strike price and Expiration date will however, remain unchanged.

The memo from OCC on MEIP.US is explaining the following:

1. Options opened before 17 April 2023 will be adjusted

2. Option symbol will change to MEIP1

3. Contract deliverable per contract will be 5 (new) MEIP.US shares

Forward Split

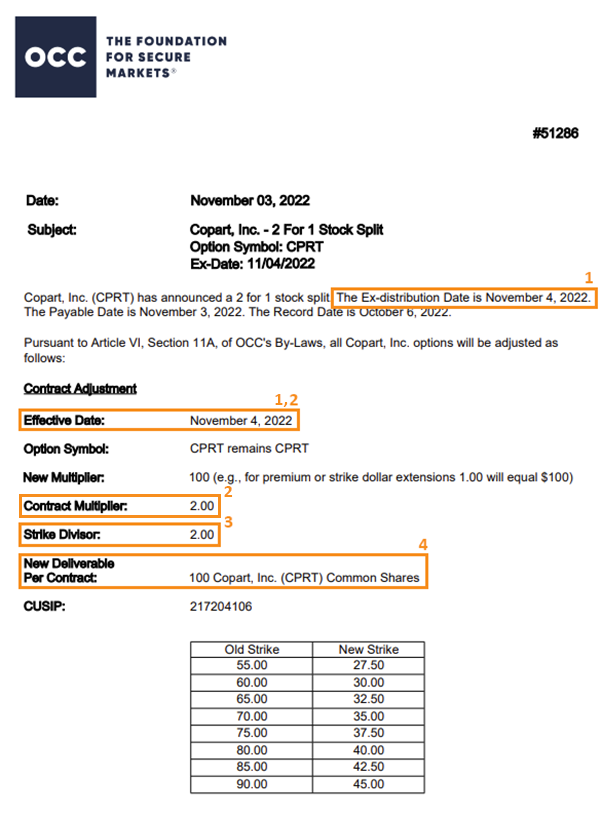

Forward splits are the division of the outstanding shares of a company into a larger number of shares. When a forward split occurs, there are normally two types of possible scenarios:

Scenario A

When the forward split results in a round number. (e.g. 2 for 1, 5 for 1, 10 for 1)

⦁ The ticker and expiration date will remain the same if you have Options on a stock that undergoes a forward split. The Strike price however, will be divided by the forward split multiplier.

The memo from OCC on CPRT.US is explaining the following:

1. Options opened before 4 Nov 2022 will be adjusted

2. Holders of the contract before 4 Nov 2022 will hold double the number of option contract

3. Strike price will be divided by 2. E.g. the old options contract with a strike price of $55 is adjusted to $27.50 ($55/2)

4. Contract deliverable per contract will still be 100 CPRT.US shares

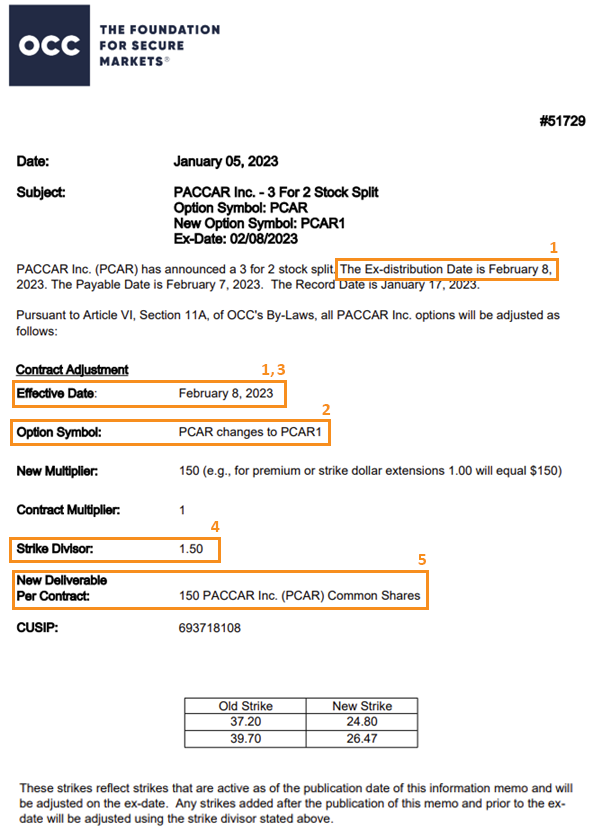

Scenario B

When the forward split does not result in a round number (5 for 4, or 3 for 2):

⦁ There is a change in symbol

⦁ Number of contracts remain the same but the deliverable of the contracts increase according to the forward split multiplier

⦁ Strike price decreases by the strike divisor

The memo from OCC on PCAR.US is explaining the following:

1. Options opened before 8 Feb 2023 will be adjusted

2. The option symbol is changed to PCAR1

3. Holders of the contract before 8 Feb 2022 will hold same number of option contract

4. Strike price will be divided by 1.5. E.g. the old options contract with a strike price of $37.2 is adjusted to $24.80 ($37.2/1.5)

5. Contract deliverable per contract will increase to 150 PCAR.US shares

Stock Dividend

When the firm pays a stock dividend, the Option’s strike price will lower and the number of deliverable shares in the contract will increase by the amount of the dividend. There will be a number that is added to the ticker of the Options contract if the firm of the underlying stock is issued a stock dividend.

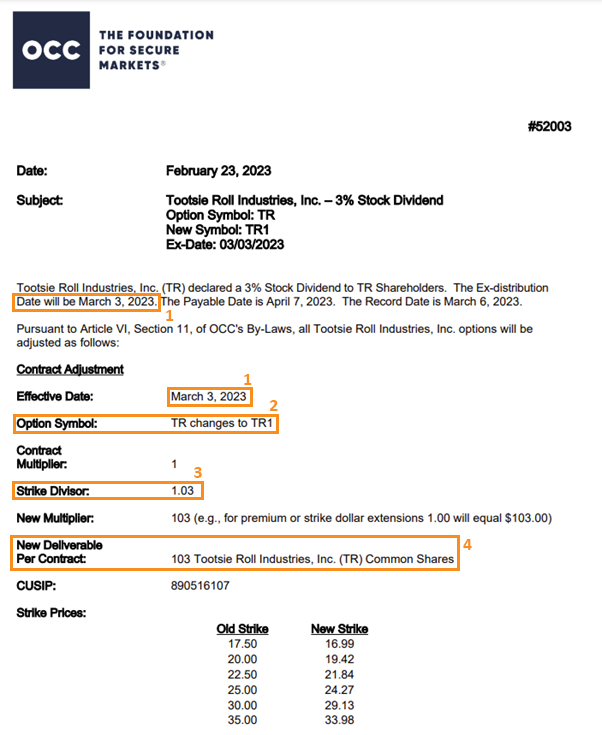

The memo from OCC on TR.US is explaining the following:

1. Options opened before 3 Mar 2023 will be adjusted

2..The option symbol is changed to TR1

3. Strike price will be divided by 1.03. E.g. the old options contract with a strike price of $17.50 is adjusted to $16.99 ($17.50/1.03)

4. Contract deliverable per contract will increase to 103 TR.US shares

Spinoff

When the firm of the underlying stock executes a spinoff, the number of shares in the contract will remain the same. In addition to the existing shares, the new shares paid out by the issuing firm will be included in your contract. During a spinoff, there will be a number that is added to the ticker of the options contract.

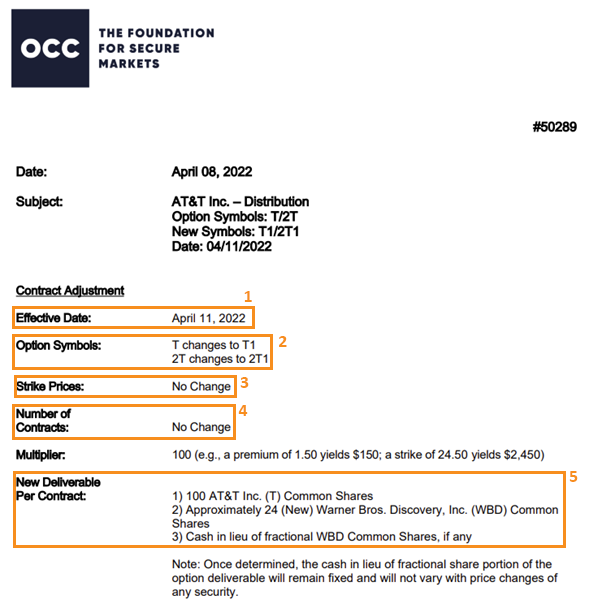

The memo from OCC on T.US is explaining the following:

1. Options opened before 11 Apr 2022 will be adjusted

2. The option symbol is changed to T1 and 2T1

3. Strike price remain unchanged

4. Number of contracts remain unchanged

5. Contract deliverable per contract will consist of;

a. 100 T.US shares

b. 24 WBD.US shares

c. Cash in lieu

Frequently Asked Questions

Options 101

How can I check for Options Corporate Actions?

You can check for options corporate actions by visiting the Options Clearing Corporation (OCC) website. In the memo section, search for the specific stock to find the latest updates on corporate actions and the corresponding deliverables per contract.

How are options classified?

Options are broadly classified into ‘Call’ and ‘Put’

Call: Is a contract that allows the option buyer (after paying an option premium) to have the right but not the obligation to buy the underlying asset (typically 100 shares) at the strike price within a specified time. The seller of the option (after receiving an option premium) is obligated to sell the underlying asset to the buyer at the exercise price if the buyer exercises his right.

Put: Is a contract that allows the option buyer (after paying an option premium) to have the right but not the obligation to sell the underlying asset (typically 100 shares) at the strike price within a specified time. The seller of the option (after receiving an option premium) is obligated to buy the underlying asset from the buyer at the exercise price if the buyer exercises his right.

How do I make sense of an option symbol?

AAPL211903P00120000

or

AAPL US 03/19/21 P120

- AAPL US: the symbol of the underlying asset (Ordinary APPLE shares)

- 03: month of expiration

- 19: day of expiration

- 21: year of expiration

- P:Put (C if it is Call)

- 120: strike price of the contract

What are the moneyness of options?

ITM: In-the-money options are those options that have intrinsic value if exercise

- Calls with strikes below where the underlying is currently trading

- eg. Call strike: 100, Current underlying price: 120 (Call < Underlying)

- Puts with strikes above where the underlying is currently trading

- eg. Put strike: 100, Current underlying price: 80 (Put > Underlying)

ATM: At-the-money options are those options that have a strike price closest to where the underlying asset is currently trading at

- Call/Put with strikes roughly the same where the underlying asset is currently trading at

OTM: Out-of-money options are those options that have no intrinsic value if exercise

- Calls with strikes above where the underlying is currently trading at

- eg. Call strike: 120, Current underlying price: 100 (Call > Underlying)

- Puts with strikes below where the underlying is currently trading at

- eg. Put strike: 80, Current underlying price: 100 (Put < Underlying)

What are the Greeks in option trading?

Delta: measure the change in the price of an option with a $1 change in the price of the stock. Delta for call range between 0 to 1 while for put range between 0 to -1.

- E.g. Delta of 0.5 means if the underlying stock increase in price by $1, the option price will rise by $0.5.

Gamma: reflects the rate of change in the delta in response to a $1 change of the underlying stock price.

- E.g. Gamma of 0.1 means if the underlying stock price increasse by $1, the option delta will increase by a corresponding 10%.

Vega: measure the price sensitivity of an option to changes in the volatility of the underlying stock.

- E.g. Vega of 0.2 means if the implied volatility of the option increase by 1%, the option price will increase by a corresponding $0.2.

Theta: also known as time value of option measure the rate of decline in the value of an option due to the passage of time.

- E.g. Theta of 0.9 means the option price will decrease by $0.9 per day till expiration.

Rho: measure the rate at which the price of an option changes relative to a change in the risk-free rate of interest i.e. U.S Treasury bill’s risk-free rate.

- E.g. Rho of 0.2 means the option price will increase by 0.2 for 1% increase in the risk-free rate.

Greeks are dynamic and will change throughout up till expiration of the option.

What are the risks involved in trading options?

The risks from buying Options (if you decide not to sell them before expiration) are that they will expire worthless, assuming they are out-of-the-money. On expiry, if the Option is ITM by 0.01 or more, it will be auto-exercised by the OCC. Post auto-exercise, the underlying stock price may have drastic price movement(s) during the extended hours trading hours, which in normal circumstances warrant the position to be OTM. As such, for positions that are delivered/taken, delivery may experience a loss instead (even if the auto-exercise was ITM).

Aside from buying Options, many investors get excited about selling Options because they get paid upfront for their trades.

Investors that sell short puts and covered calls are taking on specific risks. In the case of a cash secured put write, you risk being put stock, which we have mentioned above. Let’s look at the Microsoft (MSFT) 21 December 2022 US$110 Put Write, which expired in-the-money, again.

If we sold one contract, we would be required to purchase 100 shares for US$110 per share at expiration, costing US$11,000. Every put write carries the risk of exercise. However, this is unlikely to happen, hence selling too many options that expire in the money can be costly.

In the case of a covered call strategy, the risk lies with the possibility of the buyer calling your stock away.

Assuming you bought 100 shares of Microsoft for US$110 per share, your invested capital is US$11,000. You decided to engage in a covered call strategy. If your covered call expires in-the-money, you would have been required to sell your 100 shares for US$100. The buyer would have paid US$10,000, resulting in loss in money on our trade although the premium from the selling of the call option will still belong to you.

When selling covered calls, you risk losing money from your stock position at times.

What happens after I've entered into an options position?

Exiting of an Option position

There are two ways to close out an open option:

⦁ Let the option lapse (for options that are not ITM of US$0.01 or more which are subjected to auto-exercise by the OCC)

⦁ Enter into an opposing option to net off the position

Example:

⦁ Short a call with the same underlying asset and expiration date to exit an open position in a long call

⦁ Long a put with the same underlying asset and expiration date to exit an open position in a short put

Assignment

The Options Clearing Corporation (OCC) randomly assigns the exercise notices it receives to the open interests of its clearing members as part of their processing sequence. The clearing member then randomly assigns these exercise notices (via an automated assignment algorithm) to those short positions of that particular notice. Seller of Options have no control over the assignment and will have to fulfil the obligation as per the Option contract.

Auto-exercise

Positions expiring in the current month that are ITM as per below threshold, will be subjected to auto-exercise by the OCC without the need for any explicit instructions. Auto-exercise happen only on option expiration only. Intention to avoid the auto-exercise by the OCC for the Options held must have the position closed off prior to expiry.

⦁ Stock Options that are $0.01 or more ITM

Stock prices may experience huge price movement(s) during extended trading hours which may warrant the Option auto-exercised to be OTM in normal circumstances.

(PSPL will close off any ITM option positions prior to auto-exercise – refer to ‘Trading Details for more info)

Corporate action

Any change to an Option caused by a corporate action will be handled by the OCC and will be published on the company’s website. All affected Options will be automatically adjusted based on the notification from OCC.

Stock Options Account Matters

Are there any forms required prior to trading Options?

- Active W8Ben

- Acknowledged Risk Warning Statement (RWS)

- Passed Customer Account Review (CAR)

- Acknowledged Option Risk Disclosure Statement (Option RDS)

What are the eligible account types to trade Options?

The eligible account types are Cash Management (KC), Margin/Cash Plus (M), Prepaid (CC), and Custodian (CU) accounts.

Additionally, the trading account should also be opted in for e-statement.

How long is the approval process for Option Activation?

If acknowledgement of Options RDS is done before 6.15pm SGT, the option sub-account will be activated the next business day (T+1) by 4.00pm SGT, otherwise it will take up to 2 business days (T+2), excluding any SG/US holidays.

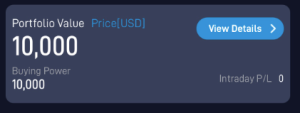

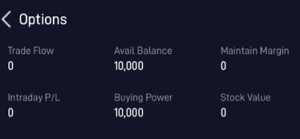

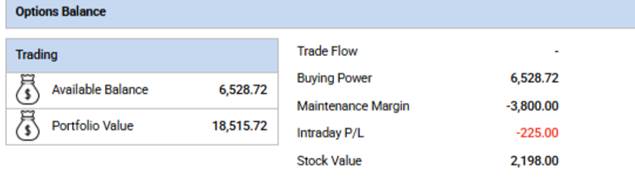

How do I read the Option Portfolio balance?

· Portfolio Value: Total portfolio valuation which is the aggregate of all positions(Equities and Options) and cash balance.

· Buying Power: Amount available for trading. It is calculated as SOD Cash Balance +(Sell added upon fill) OR -(Buy to open deducted upon order placement) premiums for option trades.

· Intraday P/L: P/L for all option positions. It is calculated based on the mid price of bid & ask quotes with previous close as reference price.

· Trade Flow: Intraday total cash flow from option trades. It is calculated as negative for buy trades and positive for sell trades.

· Avail Balance : Amount available for trading. It is calculated as SOD Cash Balance +(Sell added upon fill) OR -(Buy deducted upon order placement) premiums for option trades.

· Maintain Margin: Margin requirement for option positions.

· Intraday P/L: P/L for all option positions. It is calculated based on the mid price of bid and ask quotes with previous close as reference price.

· Stock Value: Market value of stock positions

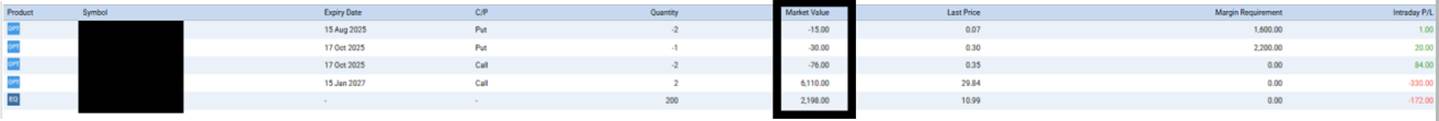

Example to calculate Portfolio Value

Available Balance = Buying Power = Cash available for trading = 6,528.72

Maintenance Margin = Cash earmarked for cash secured puts position = 3,800

Stock Value = 2,198

Options Value (Market Value) = (-15) + (-30) + (-76) + 6,110 = 5,989

Portfolio Value = Available Balance/Buying Power + Maintenance Margin + Stock Value + Options Value

18,515.72 = 6,528.72 + 3,800 + 2,198 + 5,989

Why are Exercise/Assignment activities not shown on the same day of the e-statements?

As exercise/assignment activities are processed after the market has closed, it will only be shown on the e-statements on T+2.

Do note however, portfolio balances and positions are updated accordingly prior to market open on T+1.

What are some of the common reasons for order rejection?

• Account does not have enough position: The order quantity must be equal to or less than your current position as the account does not have sufficient holdings. No splitting of orders.

• Account does not have enough balance: The Buy open gross amount should be equal or less than the available balance.

• Insufficient Stock position to cover: Sell to Open positions will be rejected if not covered by the underlying stock i.e. Covered Call.

• Short Put Option is not allowed.

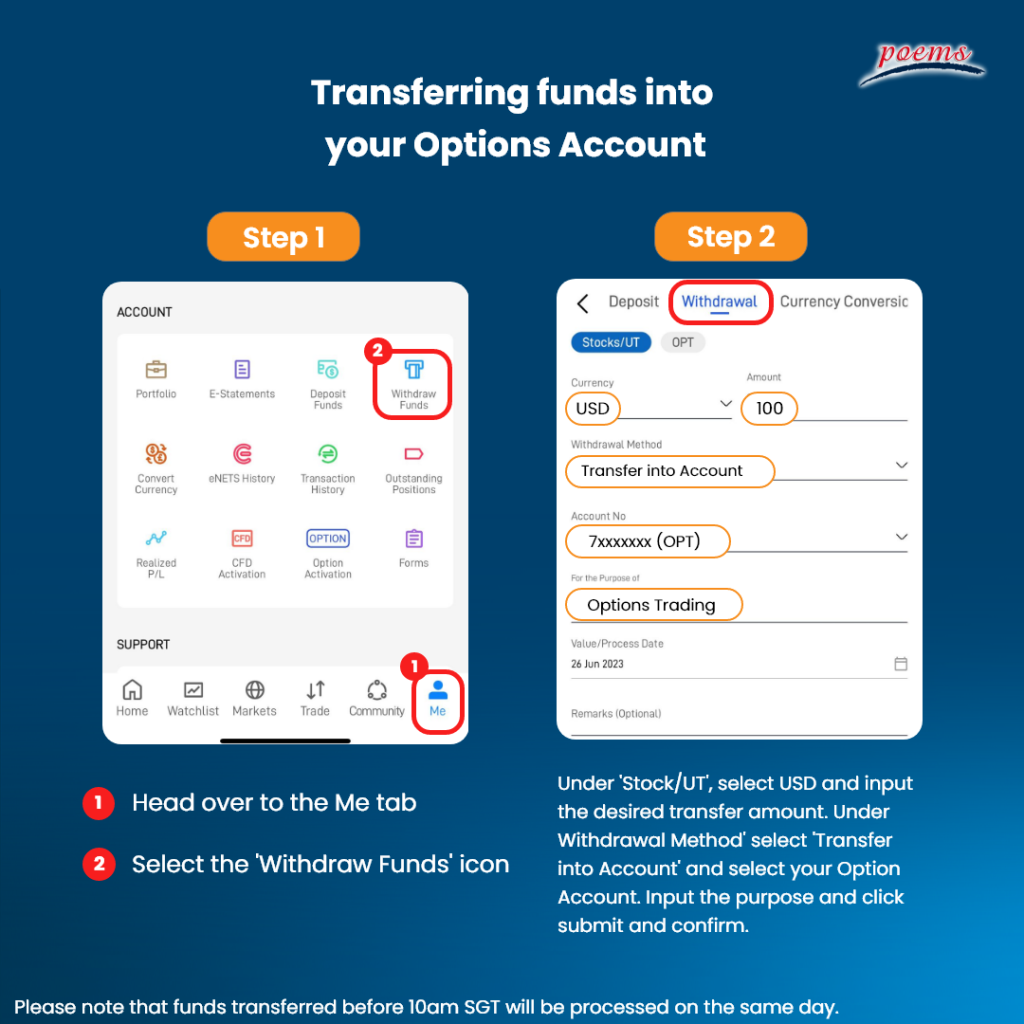

How do I transfer funds into my Options Account? (Video Guide)

How do I transfer funds into my Options Account?

Transfers can be done via the POEMS Mobile 3 App and there will be no applicable charges for transfers between these accounts. For detailed steps, please refer to the image below:

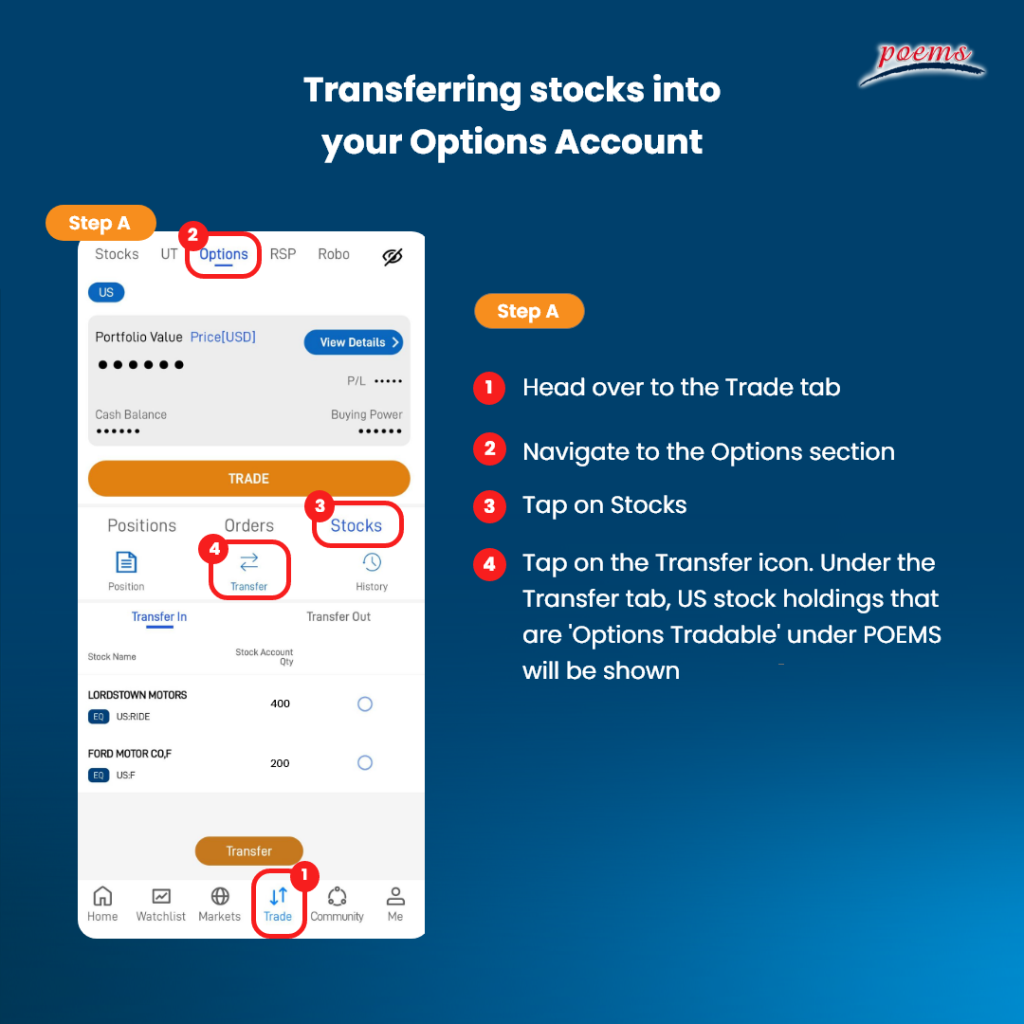

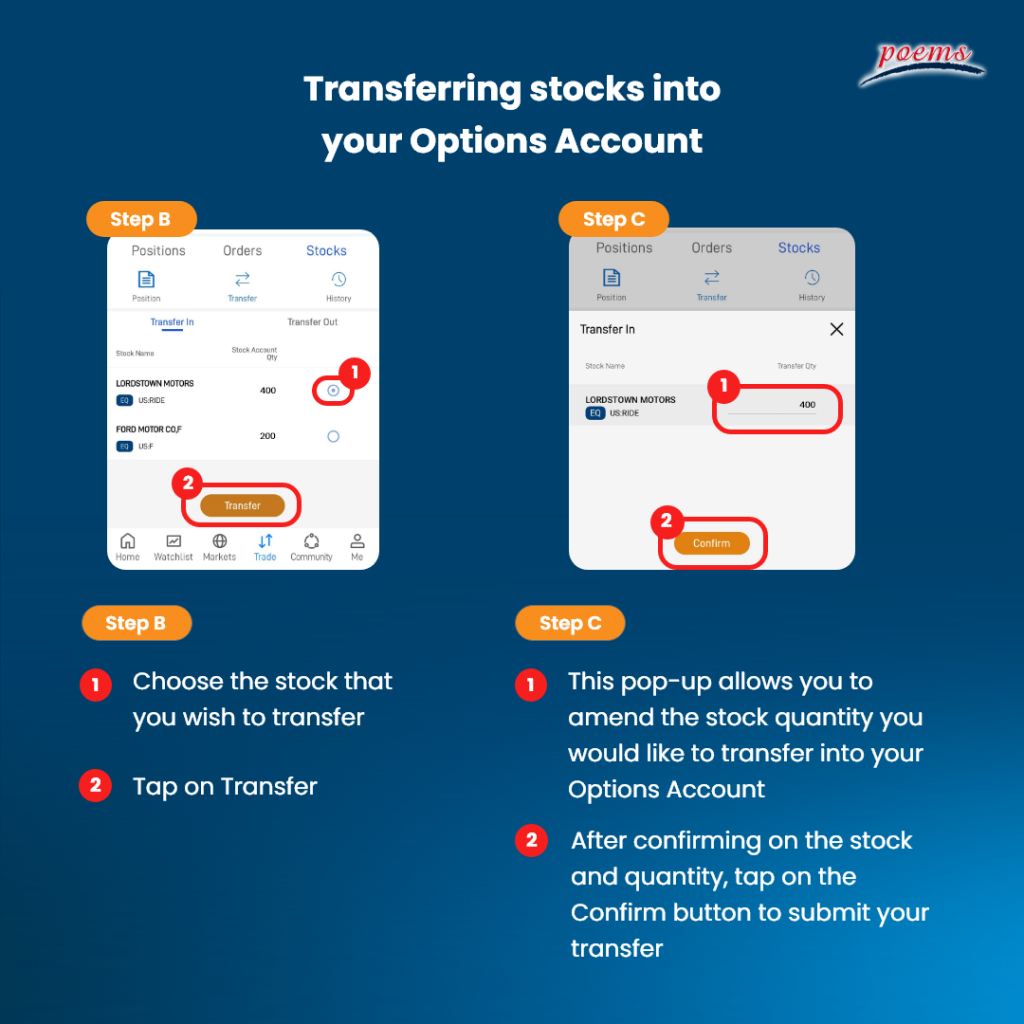

How do I transfer stocks into my Options Account? (Video Guide)

How do I transfer stocks into my Options Account?

Transfers can be done via the POEMS Mobile 3 App and there will be no applicable changes for transfers between these accounts. For detailed steps, please refer to the image below:

Why is there a need to transfer funds/stocks prior to trading options?

Option ledger is kept separately from the main Poems equity account ledger, as such option sub-account will only have activities related to options only. Any liquidation of shares in the option sub-account will need to be transferred back to the main Poems equity account.

Others

Does POEMS support option strategies?

POEMS currently does not support the combination of option strategies i.e. Spreads.

All strategies have to be executed separately.

What are the supported platforms?

Options trading will only be supported on the POEMS Mobile 3 App and POEMS web.

It is not available on POEMS Mobile 2 and POEMS Pro.

Is there US Extended Trading for options?

US Extended Trading is only available for Equities trading.

The trading hours for Options are from 9.30pm to 4.00am (SGT) during daylight savings and 10.30pm to 5.00am (SGT) during non-daylight savings.

What are the tradable counters available for options?

Constituents of S&P 500, S&P ADR, Nasdaq 100, Russell 3000 and popular traded ETF options such as SPY, QQQ, IWM are included in our list of supported counters.

Client may call in Night desk at 6531 1225 to request for any stocks to be listed as option tradable.

What happens if the underlying share is delisted onto OTC?

POEMS will only allow manual closing of the related option positions when the underlying shares are delisted onto OTC markets. You may place the order via the Night Desk by calling 6531 1225.

Glossary

General

Ask – The price at which a seller is offering to sell an option or stock. When a quote is obtained, the ask is always the higher nuber (on the right-hand side).

Bid – The price at which a buyer is willing to buy a security (buy it from you). Whenever a quote is obtained, the bid is always the lower number (on the left-hand side).

Chicago Board Options Exchange (CBOE) – The Chicago Board Options Exchange; the first national exchange to trade listed stock options.