US Fractional Shares Promo

Collect U.S. Stocks for Your Journey to Financial Freedom

Redeem your Free US Fractional Share Trades Today!

OPEN ACCOUNT NOW TRADE NOW

Collect US Stocks for Your Journey to Financial Freedom

Redeem your Free US Fractional Share Trades Today!

OPEN ACCOUNT NOW

TRADE NOW

OPEN ACCOUNT NOW

TRADE NOW

Feel that Trading in the U.S. Market is Too Expensive?

Feel that Trading in the U.S. Market is Too Expensive?

Get Your First 5 Free Trades

on Us, every Month!

Note: The 6th trade onward will be charged to the standard fractional standalone brokerages - US$0.88.

Feel that Trading in the US Market is Too Expensive?

Get Your First 5 Free Trades on us, every Month!

Note: The 6th trade onward will be charged to the standard fractional standalone brokerages - US$0.88.

Unsure which U.S. Companies to Trade?

Kickstart Your Portfolio with These Top Picks:

Unsure which U.S. Companies to Trade?

Kickstart Your Portfolio with These Top Picks:

Trade Now

Trade Now

Trade Now

Trade Now

Trade Now

Trade Now

Trade Now

Trade Now

Trade Now

Trade Now

Trade Now

Trade Now

Trade Now

Trade Now

Trade Now

Trade Now

Trade Now

Unsure which US Companies to Trade?

Trade Now

Unsure which US Companies to Trade?Kickstart your portfolio with these Top Picks:

TRADE NOW

TRADE NOW

TRADE NOW

TRADE NOW

TRADE NOW

TRADE NOW

TRADE NOW

TRADE NOW

TRADE NOW

TRADE NOW

TRADE NOW

TRADE NOW

TRADE NOW

TRADE NOW

TRADE NOW

TRADE NOW

TRADE NOW

TRADE NOW

Trade from as low as US$0.88 commission per fractional order*

Dedicated Specialist available

No Platform Fee

*Only for less than 1 share order quantity, else existing brokerage will apply.

Why Trade US Fractional Shares with POEMS?

Why Trade US Fractional Shares with POEMS?

Trade from as low as US$0.88 commission per fractional order*

Dedicated Specialist available

No Platform Fee

*Only for less than 1 share order quantity, else existing brokerage will apply.

New to POEMS?

Open an Account

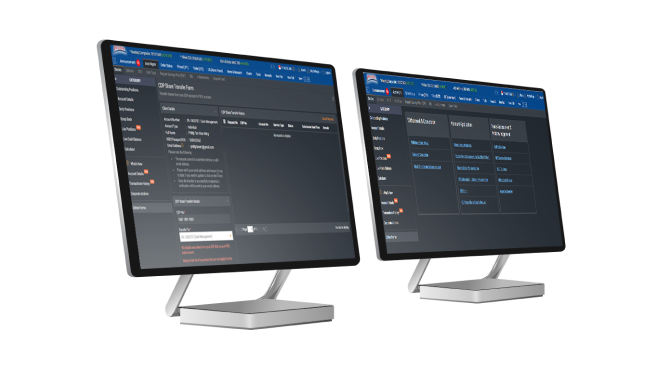

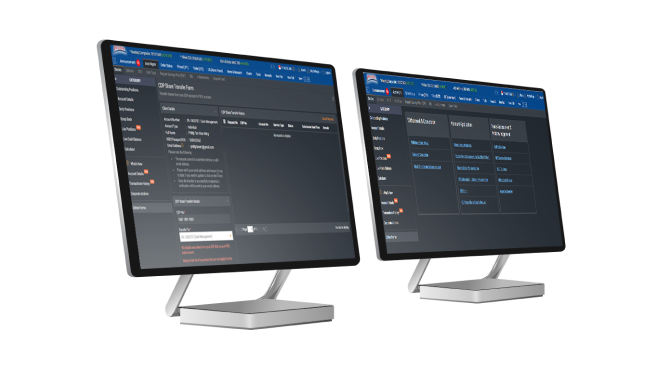

Login to POEMS 2.0/POEMS Mobile 3 App to opt-in to US Fractional Share

For POEMS 2.0:

Login to POEMS 2.0 > Head over to “Trade” Tab > “Stocks” tab Select any US Market (AMEX, NASDAQ, NYSE) in the drop down menu > Click on the button “Opt-in for Fractional Shares” to opt-in.

For POEMS Mobile 3 App:

Login to POEMS Mobile 3 App > Head over to “Me” Tab. Scroll below to the “Activations” section and select “Fractional Opt-in”.

OPEN ACCOUNT NOW Opt-in to US Fractional ShareExisting Customer

but did not opt-in to US Fractional Share?

Login to POEMS 2.0/POEMS Mobile 3 App to opt-in to US Fractional Share

For POEMS 2.0:

Login to POEMS 2.0 > Head over to “Trade” Tab > “Stocks” tab Select any US Market (AMEX, NASDAQ, NYSE) in the drop down menu > Click on the button “Opt-in for Fractional Shares” to opt-in.

For POEMS Mobile 3 App:

Login to POEMS Mobile 3 App > Head over to “Me” Tab. Scroll below to the “Activations” section and select “Fractional Opt-in”.

Opt-in to US Fractional ShareNew to POEMS?

Open an Account

Login to POEMS 2.0/POEMS Mobile 3 App to opt-in to US Fractional Share

For POEMS 2.0:

Login to POEMS 2.0 > Head over to “Trade” Tab > “Stocks” tab Select any US Market (AMEX, NASDAQ, NYSE) in the drop down menu > Click on the button “Opt-in for Fractional Shares” to opt-in.

For POEMS Mobile 3 App:

Login to POEMS Mobile 3 App > Head over to “Me” Tab. Scroll below to the “Activations” section and select “Fractional Opt-in”.

OPEN ACCOUNT NOW Opt-in to US Fractional ShareExisting Customer

but did not opt-in to US Fractional Share?

Login to POEMS 2.0/POEMS Mobile 3 App to opt-in to US Fractional Share

For POEMS 2.0:

Login to POEMS 2.0 > Head over to “Trade” Tab > “Stocks” tab Select any US Market (AMEX, NASDAQ, NYSE) in the drop down menu > Click on the button “Opt-in for Fractional Shares” to opt-in.

For POEMS Mobile 3 App:

Login to POEMS Mobile 3 App > Head over to “Me” Tab. Scroll below to the “Activations” section and select “Fractional Opt-in”.

Opt-in to US Fractional ShareRead this Market Journal on

How you can Benefit with US Fractional Shares!

READ NOWRead this Market Journal on

How you can Benefit with US Fractional Shares:

READ NOW

READ NOW

Watch our Tutorial Video on

US Fractional Shares

WATCH NOWWatch our Tutorial Video on

US Fractional Shares

WATCH NOW

WATCH NOW

Unwrap your Welcome Gifts

worth up to

S$2,025

Learn More

Unwrap your Welcome Gifts

worth up to

S$2,025

Learn More

Learn More

REFER

& EARN!

Receive Cash Credit up to S$680

Refer NowREFER & EARN!

Receive Cash Credit up to S$680

Refer Now

Refer Now

Terms and Conditions

Terms and Conditions- This Promotion is valid from 3 March 2025 to 31 December 2025.

- Eligible Customers:

- New and Existing Customers of Phillip Securities Pte Ltd (PSPL).

- All Account Types of PSPL:

- Cash

- Cash Management

- Margin

- Cash Plus

- Custodian

- Prepaid Custodian

- Aged 18 years old to 25 years old.

- Eligible Trades:

- 5 free trades per calendar month (Every 1st of the month). The 6th trade onward will be charged to the standard fractional standalone brokerages – US$0.88.

- Standalone US Fractional Shares only (<1 Share)

- BUY and Online trades on POEMS 2.0 and POEMS Mobile 3 App only.

- The following Customers are NOT eligible for this promotion unless approved by the management of PSPL:

- Corporate Accounts and Joint Account holders

- All employees of PSPL’s entities and its partners (e.g., trading representatives, financial advisors) and their immediate families (e.g., spouse and children).

- By taking part in the promotion, you agree and consent to PSPL sending relevant information to third-party service providers to facilitate the delivery and redemption of the Rewards.

- In the event of a dispute over the Customer’s eligibility to participate in this promotion, PSPL’s decision will be final.

- Notwithstanding anything herein contained, PSPL reserves the right at any time in its absolute discretion to (i) amend, add to, and/or delete these Terms and Conditions without prior notification (including eligibility; replacement of the prize; promotional mechanics, promotion duration without prior notification, qualifying terms and criteria), and all participants shall be bound by such amendments, additions and/or deletions when effected, or (ii) vary, withdraw, or cancel any items or the promotion without having to disclose a reason thereof and without any compensation or payment whatsoever. PSPL’s decision on all matters relating to the promotion shall be final and binding on all participants.

- This advertisement has not been reviewed by the Monetary Authority of Singapore.

FAQs

I am turning 26 years old in 2025 but my birthday is on the 6 June. Am I still eligible for the free US Fractional share trades before 6 June 2025?Yes. You will still be eligible for the free US Fractional share trades before your 26th birthday on 6 June 2025.

What are the Account types that are eligible for this promotion?Cash, Cash Management, Margin, Cash Plus, Custodian, and Prepaid Custodian Accounts are eligible for this promotion.

How do I opt-in to US Fractional Share?Please visit here.

Which are the POEMS trading platforms that US Fractional Shares are available to trade on?US Fractional shares are available for trading on POEMS 2.0 Web and POEMS Mobile 3 App.

What are the eligible order types to trade US Fractional Shares?US Fractional Shares can only support Market and Limit orders.

Amova MSCI AC Asia ex Japan ex China Index ETF

Amova MSCI AC Asia ex Japan ex China Index ETF

Initial Offering Period (IOP) from 17 to 20 March 2025

Invest Now

More About Amova MSCI AC Asia ex Japan ex China Index ETF

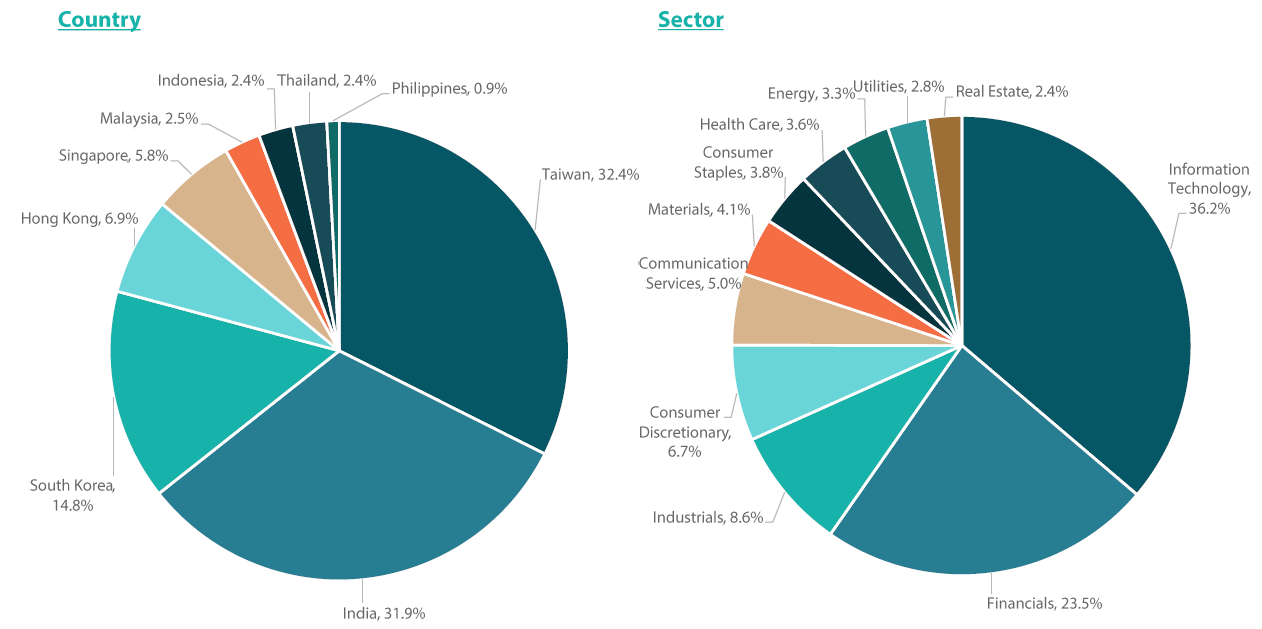

The Index is in line with the MSCI Global Investable Market Index methodology. It comprises large & mid market capitalisation (cap) companies in Developed & Emerging Markets (DM & EM) in Asia, excluding Japan and China.

Why Invest in Amova MSCI AC Asia ex Japan ex China Index ETF

Capture the best of Asia's growth story

India

- According to the IMF, Asia is set to drive 60% of global GDP growth in 2024, with India leading the way

- India is forecast by the OECD to grow at 6.9% in 2025—the fastest pace among G20 economies

South Korea & Taiwan

Both countries benefit from AI and the tech megatrend, leveraging strong hardware supply chains and software expertise

ASEAN

- Tap into the region’s diverse growth opportunities and the potential of its vibrant young population

- Key themes driving growth include industralisation, consumersation, as well as the diversification of global supply chains

Flexibility and control in your allocation to Asia

- The Index excludes China and Japan, Asia’s two heavyweight economies.

- Due to their economic scale, China and Japan often overshadow other high-growth Asian markets in conventional passive equity strategies

Gain targeted exposure to Asia’s high-growth markets

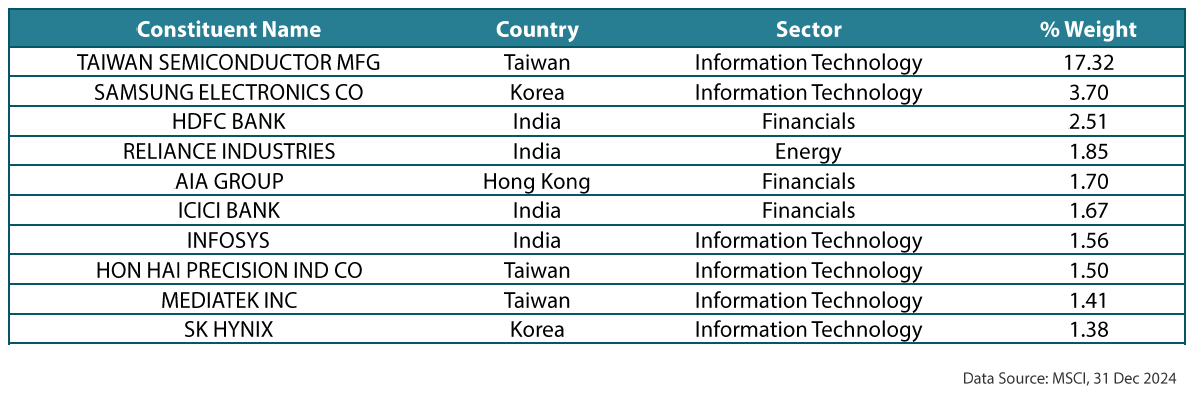

Top 10 index constituents

Index countries and sectors allocation

How to Subscribe to the ETF During the IOP via POEMS 2.0

- Log in to POEMS 2.0 , then navigate to ‘Account Management’ > ‘Online Forms’ > ‘IPO Subscription – Irrevocable Form’ or click here.

- Select the IPO you wish to subscribe to.

- Review and accept the Prospectus, and Terms & Conditions before subscribing to the Financial Product.

- Applications close at 5pm on Thursday, 20 March 2025.

- Ensure sufficient funds are available in your POEMS Account to complete the application process (including the subscription amount, transfer fees, and GST) by 5pm on Thursday, 20 March 2025.

Promotion

Receive up to S$500 Cash Credit to Your POEMS Account when you subscribe to the Lion-China Merchants Emerging Asia Select Index ETF!

Customers will receive S$20 in cash credits for every S$10,000 subscribed to the ETF.

Seminars Lineup

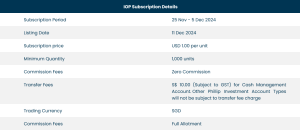

IOP Subscription Details| IOP Subscription Details | |

|---|---|

| Subscription Period | 17 March 2025 to 20 March 2025 |

| Listing Date | 2 April 2025 |

| Subscription Price | SGD 1.00 per unit |

| Minimum Quantity | 1,000 units |

| Commission Fees | Zero Commission |

| Transfer Fees | S$10.00 (subject to GST) for Cash Management Account. Other Phillip Investment Account Types will not be subject to transfer fee charge. |

| Trading Currency | SGD |

| Allotment | Full Allotment |

| Key Information | ||

|---|---|---|

| ETF Name | Amova MSCI AC Asia ex Japan ex China Index ETF | |

| Underlying Index | MSCI AC Asia ex Japan ex China Index | |

| Issue Price |

| |

| Initial Offer Period (IOP) |

| |

| Listing Date | 2 April 2025 | |

| Base Currency | SGD | |

| Trading Currency | SGD/USD | |

| SGX Code | A93 (Primary Currency: S$) A94 (Secondary Currency: US$) | |

| Trading Board Lot Size | 1 unit | |

| Management Fee | 0.50%per annum Up to a maximum of 1% per annum of the Sub-Fund Asset. | |

| Replication Strategy | Optimisation or Representative Sampling | |

| Classification Status | Excluded Investment Product | |

- The subscription period for Amova MSCI AC Asia ex Japan ex China Index ETF (“ETF”) is from 17 March 2025, Monday at 9am to 20 March 2025, Thursday at 5pm.

- The online subscription will close on 20 March 2025 at 5pm. No new applications, amendments, or withdrawals are allowed after this deadline.

- Eligible Accounts to subscribe for the ETF must be Cash Plus, Margin (M), Custodian (C), Prepaid Custodian (CC), Cash Management (KC) and Share Financing (V) Accounts. Cash Trading Accounts (T) are not eligible to participate in this subscription.

- An additional transfer fee charge of S$10 (subject to GST) per application for Cash Management Accounts will be applicable.

- Only one application is allowed per Account.

- Each ETF unit is priced at SGD 1 and the minimum order quantity is 1,000 units, with an incremental order size of 1,000 units.

- There are zero commission fees.

- The total amount payable is denominated in SGD. The settlement currency will be in SGD.

- Sufficient funds (including transfer fee and GST) must be present in the Customer’s Account by 20 March 2025 at 5pm.

- Applications will be rejected if the Account does not have or reflect sufficient funds after 20 March 2025 at 5pm.

- ETF units will be credited to the clients’ CDP or clients’ sub-account with Phillip Securities Pte Ltd by 2 April 2025.

- Customers will receive the full allotment of the number of ETF units that they subscribe to.

- Customers can start trading the ETF units when the ETF is listed on SGX on 2 April 2025 at 9am.

- Notwithstanding anything herein contained, PSPL reserves the right at any time in its absolute discretion to (i) amend, add and/or delete any time of these Terms & Conditions without prior notification (including eligibility and qualifying terms and criteria), and all participants shall be bound by such amendments, additions and/or deletions when effected, or (ii) vary, withdraw, or cancel any items or the promotion without having to disclose a reason thereof and without any compensation or payment whatsoever. PSPL’s decision on all matters relating to the promotion shall be final and binding on all participants.

- In the event of a dispute over the client’s eligibility to participate in this Promotion, PSPL’s decision will be final. PSPL shall not be obliged to give any reason on any matter concerning the Promotion and no correspondence or claims will be entertained.

- By taking part in this promotion, the customer acknowledges that he/she has read and consented to these Terms & Conditions.

- Customers will receive S$10 Cash Credit for every S$1,000 subscription into Amova MSCI AC Asia ex Japan ex China Index ETF, and successful subscribers to fulfill 2 months holding period after the listing date.

- The Campaign period is from 17 March 2025, Monday at 9am to 20 March 2025, Thursday at 5pm.

- The Cash Credit is capped at S$100 per POEMS Account.

- This promotion is limited and available on a first-come, first-served basis.

- The Cash Credit will be credited to your account within one month after the two-months holding period from the listing date (Listing Date: 2 April 2025).

- Notwithstanding anything herein contained, PSPL reserves the right at any time in its absolute discretion to (i) amend, add and/or delete any time of these Terms & Conditions without prior notification (including eligibility and qualifying terms and criteria), and all participants shall be bound by such amendments, additions and/or deletions when effected, or (ii) vary, withdraw, or cancel any items or the promotion without having to disclose a reason thereof and without any compensation or payment whatsoever. PSPL’s decision on all matters relating to the promotion shall be final and binding on all participants.

- In the event of a dispute over the client’s eligibility to participate in this Promotion, PSPL’s decision will be final. PSPL shall not be obliged to give any reason on any matter concerning the Promotion and no correspondence or claims will be entertained.

- By taking part in this promotion, the customer acknowledges that he/she has read and consented to these Terms & Conditions.

Events Lineup

17 Mar, Mon 2025 07:00 PM - 08:00 PM

ETFs

Mr Lai Yeu Huan | Joint Head of Asian Equity | Nikko Asset Management Asia Limited

Zoom

Lion-China Merchants CSI Dividend Index ETF

Lion-China Merchants CSI Dividend Index ETF

Initial Offering Period (IOP) from 10 to 21 March 2025

Invest Now

More About the Lion-China Merchants CSI Dividend Index ETF

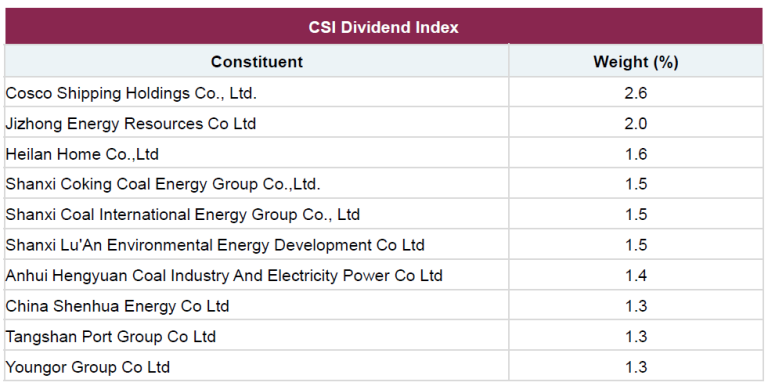

The Index comprises 100 Shanghai-listed or Shenzhen-listed A shares with (i) high cash dividend yields, (ii) stable dividends and (iii) a certain scale and liquidity, weighted based on their dividend yields to reflect the overall performance of the high-dividend stocks in the A-share market.

Why Invest in the Lion-China Merchants CSI Dividend Index ETF

Consistent

The index focuses on companies with a proven track record of consistent dividend payments for at least the past three years

Steady

Companies are selected based on their robust financial health. These companies typically have strong cash flows and high free cash flow to dividend coverage ratios.

Income

This ETF provides investors with access to a diversified portfolio of dividend-paying stocks, creating a passive income stream

Why Invest in China?

China is too big to ignore

- As of 2024, China is the world’s second largest economy and the largest economy in the Asia-Pacific

- China’s real GDP continues to grow faster than US’ and is projected to outpace both global and Asia-Pacific economies

China equities currently look attractive

- China’s 10-year yield is at an all-time low of 1.67% as of 31 Dec 2024

- A low risk-free rate is driving up the equity risk premium, making Chinese equities more attractive than bonds and US stocks

China’s commitment to stimulate economy

- The government is implementing proactive measures, stimulating the economy through monetary, housing, and fiscal policies

Top 10 Index Constituents

How to Subscribe to the ETF During the IOP via POEMS 2.0

- Log in to your POEMS 2.0 , then navigate to ‘Account Management’ > ‘Online Forms’ > ‘IPO Subscription – Irrevocable Form’ or click here.

- Select the IPO you wish to subscribe to.

- Review and accept the prospectus, terms, and conditions before subscribing to the financial product.

- Applications close at 5pm on 21 March Fri 2025.

- Ensure sufficient funds are available in your POEMS Account to complete the application process (including the subscription amount, transfer fees, and GST) by 21 March Fri 2025 at 5pm.

Seminars Lineup

IOP Subscription Details| IOP Subscription Details | |

|---|---|

| Subscription Period | 10 March 2025 to 21 March 2025 |

| Listing Date | 28 March 2025 |

| Subscription Price | SGD 1.00 per unit |

| Minimum Quantity | 1,000 units |

| Commission Fees | Zero Commission |

| Transfer Fees | S$10.00 (subject to GST) for Cash Management Account. Other Phillip Investment Account Types will not be subject to transfer fee charge. |

| Trading Currency | SGD |

| Allotment | Full Allotment |

| Key Information | |

|---|---|

| ETF Name | Lion-China Merchants CSI Dividend Index ETF |

| Underlying Index | CSI Dividend Index |

| Issue Price | SGD 1.00 per unit |

| Initial Offer Period (IOP) | 10 March 2025 to 21 March 2025 |

| Listing Date | 28 March 2025 |

| Base Currency | SGD |

| Trading Currency | SGD, CNH |

| SGX Code | INC (SGD), ICH (CNH) |

| Trading Board Lot Size | 1 unit |

| Management Fee | 0.50%per annum^ ^Up to a maximum of 0.99% per annum of the Net Asset Value of the Fund |

| Distribution Policy | Annual |

| Replication Strategy | Direct Replication or Representative Sampling |

| Classification Status | Excluded Investment Product |

- The subscription period for Lion-China Merchants CSI Dividend Index ETF (“ETF”) is from 10 March 2025, Monday at 9am to 21 March 2025, Friday at 5pm

- The online subscription will close on 21 March 2025 at 5pm. No new applications, amendments, or withdrawals are allowed after this deadline.

- Eligible Accounts to subscribe for the ETF must be Cash Plus, Margin (M), Custodian (C), Prepaid Custodian (CC), Cash Management (KC) and Share Financing (V) Accounts. Cash Trading Accounts (T) are not eligible to participate in this subscription.

- An additional transfer fee charge of S$10 (subject to GST) per application for Cash Management Accounts will be applicable.

- Only one application is allowed per Account.

- Each ETF unit is priced at SGD 1 and the minimum order quantity is 1,000 units, with an incremental order size of 1,000 units.

- There are zero commission fees.

- The total amount payable is denominated in SGD. The settlement currency will be in SGD.

- Sufficient funds (including transfer fee and GST) must be present in the Customer’s Account by 21 March 2025 at 5pm.

- Applications will be rejected if the Account does not have or reflect sufficient funds after 21 March 2025 at 5pm.

- ETF units will be credited to the clients’ CDP or clients’ sub-account with Phillip Securities Pte Ltd by 28 March 2025.

- Customers will receive the full allotment of the number of ETF units that they subscribe to.

- Customers can start trading the ETF units when the ETF is listed on SGX on 28 March 2025 at 9am.

- Notwithstanding anything herein contained, PSPL reserves the right at any time in its absolute discretion to (i) amend, add and/or delete any time of these Terms & Conditions without prior notification (including eligibility and qualifying terms and criteria), and all participants shall be bound by such amendments, additions and/or deletions when effected, or (ii) vary, withdraw, or cancel any items or the promotion without having to disclose a reason thereof and without any compensation or payment whatsoever. PSPL’s decision on all matters relating to the promotion shall be final and binding on all participants.

- In the event of a dispute over the client’s eligibility to participate in this Promotion, PSPL’s decision will be final. PSPL shall not be obliged to give any reason on any matter concerning the Promotion and no correspondence or claims will be entertained.

- By taking part in this promotion, the customer acknowledges that he/she has read and consented to these Terms & Conditions.

- Customers will receive a S$12 cash credit for every S$5,000 subscribed into the Lion-China Merchants CSI Dividend Index ETF, provided they successfully fulfill a one-month holding period after the listing date.

- The Campaign Period runs from 10 March 2025, Mon at 9.00am to 21 March 2025, Fri at 5.00pm.

- The Cash Credit is capped at S$600 per POEMS account.

- The Cash credits is to be provided to the first 500 eligible clients of PSPL who invest in the ETF during the IPO.

- The Cash Credit will be credited to your account within one month following the one-month holding period from the listing date (Listing Date: 28 March 2025).

- Notwithstanding anything herein contained, PSPL reserves the right at any time in its absolute discretion to:

- (i) Amend, add, or delete any of these Terms & Conditions without prior notice (including eligibility and qualifying terms and criteria), and all participants shall be bound by such amendments, additions and/or deletions when effected; or

- (ii) Vary, withdraw, or cancel any items or the promotion without having to disclose a reason thereof and without any compensation or payment whatsoever. PSPL’s decision on all matters relating to the promotion shall be final and binding on all participants.

- In the event of a dispute regarding a client’s eligibility to participate in this Promotion, PSPL’s decision will be final. PSPL shall not be obligated to give any reasons on any matter concerning the Promotion, and no correspondence or claims will be entertained.

- By taking part in this promotion, the customer acknowledges that he/she has read, understood, and consented to these Terms & Conditions.

Events Lineup

Riding China’s Rise: Unlocking Dividends as a Staple

10 Mar, Mon 2025 07:00 PM - 08:00 PM

Mr Ong Xun Xiang | Head of ETFs | Lion Global Investors

Phillip Investor Centre @ Raffles City Tower

Riding China’s Rise: Unlocking Dividends as a Staple

10 Mar, Mon 2025 07:00 PM - 08:00 PM

Mr Ong Xun Xiang | Head of ETFs | Lion Global Investors

Zoom

CDP Mass Share Transfer Request

Achieve Tailored Portfolio Planning

with Remisiers

in Today’s Evolving Markets!

__________________________________________________

Transfer your CDP Shares & receive up to S$588 worth of Lion-Phillip S-REIT ETF!

Remisiers are attuned to the Rhythm and Beats of markets.

Transfer your CDP Shares Now!Invest Smarter : Partner with a Remisier

Receive expert advice on

trading and corporate actions

Tap onto years of

stock market experience

Accumulate your wealth with

a closely monitored portfolio

Receive customised strategies

that align with your goals

How to Get Started!

Submit the CDP Mass Share Transfer Request Free of Charge!

List of Eligible Accounts- Cash Management

- Cash Trading

- Custodian

- Prepaid Custodian

- Cash Plus

- Margin

Enjoy the 5 Benefits

CDP Share Transfer Fee Click HereDividend Handling Fee(SGX-listed Securities)Click HereForeign Share Custody FeeClick HereCorporate Action Fee

(SGX-listed Securities)Click HereAccount Maintenance FeeClick Here

Until 30 Sep 2027

Get in touch with your Remisier now!

Don’t have one? Contact us at 65311555 or talktophillip@phillip.com.sg

Why Build a Portfolio with Us

Founded in 1975, with one of

the largest pools of Remisiers

in Singapore today

Comprehensive range of Financial Services from our multi-licensed Remisiers

(E.g. Licences in both portfolio management and financial advisory)

(E.g. Licences in both portfolio management and financial advisory)

24/7 access to your portfolio

via POEMS

Stay one step ahead with

Real-time Market Insights

Frequently Asked Questions

Accounts

What types of Accounts are included in this CDP Mass Share Transfer Request? Only Cash Management, Cash Trading, Custodian, Prepaid Custodian, Cash Plus or Margin Accounts are eligible. Upon submitting the Request, Cash Management or Cash Trading Accounts will be converted to Custodian Account. Are all securities eligible to be transferred in? Only SGX-listed securities (e.g. shares, ETFs and bonds) and T-bills are eligible to be transferred in. Which types of securities are not eligible for the CDP Mass Share Transfer Request? Below is a list of securities that are not eligible for the transfer:- Rights Shares

- Singapore Saving Bonds

- Securities that are in “Blocked” status (e.g. Moratorium, Charge)

- Securities that are on loan as part of SGX SBL programme

- Unlisted counters

Submission

How do I participate in this CDP Mass Share Transfer Request?You must opt-in for the transfer-in via login to POEMS Website at www.poems.com.sg.

Go to Account Mgmt > Stock > Online Form > Account Application> CDP Mass Share Transfer Request.

No. You must log in to the POEMS website and agree to the terms and conditions in order to proceed with the Request.

Can I transfer my shares from one CDP Account to multiple POEMS Accounts?No, you can only transfer all your securities and T-bills from one CDP account to one POEMS Account, namely Cash Management*, Cash Trading*, Custodian, Prepaid Custodian, Cash Plus, and Margin Account.

*Upon submission of the CDP Mass Share Transfer Request, Cash Management or Cash Trading Accounts will be converted to a Custodian Account. Learn more about Custodian Accounts here.

Can I transfer my shares from my individual CDP account to a joint POEMS Account?No, you can only transfer shares from your individual CDP account to an individual POEMS Account or Joint CDP to Joint POEMS Account. No change in beneficiary ownership is allowed.

If I have multiple POEMS Accounts, can I choose which POEMS Account to transfer to when I submit the CDP Mass Share Transfer Request?Yes, you will need to specify which POEMS account will be the recipient of the CDP Mass Share Transfer Request during the submission process. If you select either a Cash Management or Cash Trading account, it will be converted to a Custodian Account.

Fees

After the CDP Mass Transfer Request is completed, do I have to pay for any ongoing fees? Please click here for the table regarding fee waivers. Any fees accrued prior to the transfer will not be waived. For example, if there is an outstanding fee in the existing Custodian Account, the customer will still need to settle this fee. If I initiate the CDP Mass Share Transfer Request and later decide to move shares to another broking firm or back to CDP, will there be any fees imposed? The process for transferring shares back to CDP or to another broking firm may incur fees. Please refer to the link for Share Transfer Fees and procedures: https://www.poems.com.sg/share-bond-unit-trust-transfer/After the CDP Mass Share Transfer Request

Will my POEMS Trading Account numbers remain the same after the Mass Share Transfer Request is completed?Yes. Your POEMS Account numbers will remain the same.

After my Cash Management or Cash Trading Account is converted to a Custodian Account, will there be any changes to the brokerage rates, trading limits and contra facility?There will be no change to existing brokerage rates, trading limits and contra facilities.

What will happen to my Giro arrangement after the conversion from a Cash Trading Account to a Custodian Account?The GIRO linkage (if any) for the Cash Trading Account will be delinked after conversion. However, you can apply for EPS via POEMS login.

What will happen to my EPS arrangement after conversion from a Cash Trading Account to a Custodian Account?There will be no change to the payment arrangement.

What will happen to my CDP account when my Cash Management or Cash Trading Account is converted to a Custodian Account after the CDP Mass Share Transfer Request?The CDP linkage will be delinked from the Custodian Account but your CDP account will not be closed by CDP. Please note that you cannot sell new holdings kept with CDP unless you transfer the holdings into the Custodian Account again.

After the CDP Mass Share Transfer Request, can I still hold newly purchased shares in CDP through other broking firms?Yes, your CDP account will remain active. You can still purchase shares through other broking firms and keep the new holdings with CDP. However, you must remember to transfer the new holdings from CDP into your POEMS Account if you wish to sell the new holdings through us.

After the CDP Mass Share Transfer Request, can I sell the transferred-in holdings through other broking firms?No, you can only sell your holdings via the same POEMS Account

Can I apply for IPOs after the CDP Mass Share Transfer Request?You can continue to manage your assets that are not held under our custody and are able to apply for IPOs through the usual channels. However, allocation of shares will not be credited to your POEMS Account unless you initiate the Mass Share Transfer Request again.

After the CDP Mass Share Transfer Request, how will I be able to track my holdings with POEMS and CDP?You can view your holdings held under our custody via POEMS login.

To check your CDP holdings, login to the CDP portal.

For SGX-listed securities kept in your Custodian Account, there is a possibility of short-selling because our system will not check your local shareholdings in your accounts. However, you are unable to short-sell foreign shareholdings kept in your Custodian Account.

Can I apply for T-bills from my POEMS Account after the CDP Mass Share Transfer Request?Yes, please refer here for more information: SGS (Singapore Government Securities) T-Bills, SGS Bonds, U.S. Treasury available in POEMS

Can I cancel my Request after the CDP Mass Share Transfer Request is submitted?Yes, you can cancel the Request before 4.30pm on the same day.

How do I know that the CDP Mass Share Transfer Request is successful?You will receive an email notification once the CDP Mass Share Transfer Request is completed.

How long will the CDP Mass Share Transfer Request take?The CDP Mass Share Transfer Request may take effect within 2 business days, provided you do not have any outstanding positions in your CDP Accounts. You will receive an email notification after the transfer Request has been completed

If there is an outstanding position, can I submit the CDP Mass Share Transfer Request?You can still submit the Request, but it will be sent to CDP for processing after all outstanding positions are closed.

Terms & Conditions

- Eligible Assets are all SGX-listed securities (e.g. shares, ETFs and bonds) and T-bills.

- Customers are required to opt-in to the Excess Funds Management Facility (SMART Park).

- Eligible Accounts to submit the CDP Mass Share Transfer Request include: Cash Management, Cash Trading, Custodian, Prepaid Custodian, Cash Plus or Margin Account.

(Upon submitting the CDP Mass Share Transfer Request, Cash Management or Cash Trading Accounts will be converted to Custodian Accounts) - The total value of Eligible Assets transferred must be maintained in the Account for 3 months within Eligible Account.

- The quantity of ETF credited will be computed based on the trade execution day and will be rounded down.

- The following Customers are NOT eligible for these benefits unless approved by the management of PSPL:

- Customers who have closed an Eligible Account with PSPL before and including May 2025.

- All employees of PSPL’s entities and its partners (e.g. trading representatives, financial advisors) and their immediate families (e.g. spouse and children).

- By taking part in the promotion, you agree and consent to PSPL sending relevant information to third-party service providers to facilitate the delivery and redemption of the Rewards.

- In the event of a dispute regarding the Customer's eligibility to gain the fee waivers as part of this promotion, PSPL's decision will be deemed as final and binding.

- Notwithstanding anything herein contained, PSPL reserves the right at any time in its absolute discretion to (i) amend, add to, and/or delete these Terms and Conditions without prior notification (including eligibility; replacement of the prize; promotional mechanics, promotion duration without prior notification, qualifying terms and criteria), and all participants shall be bound by such amendments, additions and/or deletions when effected, or (ii) vary, withdraw, or cancel any items or the promotion without having to disclose a reason thereof and without any compensation or payment whatsoever. PSPL’s decision on all matters relating to the promotion shall be final and binding on all participants.

- This advertisement has not been reviewed by the Monetary Authority of Singapore.

Prosper with POEMS – Huat Time 2025

88888

aemes

bbs17

whcherng

tiongpeechor

silentbull

eugene

heng8888

https://www.poems.com.sg/downloads/Huat%20Time%20Selection%20of%20Winners.webm % chances earnedfrom trading

% chances earned

% chances earnedfrom trading

% chances earned

% chances earnedfrom trading

Updated as of 3 Feb 2025

Don't see your name after 3 working days?

Contact us directly at hello@phillip.com.sg

You could be walking away

with these attractive prizes!

Apple iPhone 16

1st Prize

Apple Watch Series 10

2nd Prize

JBL Flip 6 Bluetooth Speaker

3rd Prize

S$20 GrabGifts Vouchers

Consolation Prize

Apple Watch Series 10

2nd Prize

JBL Flip 6 Bluetooth Speaker

3rd Prize

S$ 20 GrabGifts

Consolation

Opt in to Huat TimeHow to earn chances?

Fund in

Trade, Like, Share, Create Posts

Stand a chance to win a prize!

Fund in

Trade

Like

Share

Create Post

Win Prize

Stocks Trades (BUY/SELL) in All Market

Earn Unlimited Chances

| Trade Amount | Chances | |

| <$10,000 | 5 | |

| $10,000 <x< $30,000 | 7 | |

| ≥ $30,000 | 10 |

Community

Earn up to 20 Chances

| Action | Chances | |

| Like a post | 1 | |

| Comment on a post | 2 | |

| Create a Post | 5 |

Terms and Conditions

- This Lucky Draw Campaign is valid from 1 January 2025 to 31 January 2025

- You will need a Community Profile to participate in Huat Time.

- Opt-in to the lucky draw by filling up the form on the Leaderboard Landing Page above, from 1 January 2025 onwards only.

- Opportunities to earn chances through Trades are unlimited, click here for the chance allocation.

- Trades are computed by cumulative of buy and sell contract values on the same trading day, regardless of the type of market (e.g. SGX, US, HKEx etc.), or payment mode (cash, SRS, or CPF).

- Only stock, bond and ETF trades will be eligible for the lucky draw.

- Chances earned through Community Actions are capped at 20 chances.

- The Leaderboard that displays users’ chances and chance statistics will be updated daily.

- Refer to the leaderboard landing page to browse through the lucky draw prizes.

- Amalgamated trades (BUY or SELL Trades of the same counter listed on SGX and HKEx respectively, that are placed on the same trading day on POEMS Trading Platforms using the same payment mode (cash, SRS, or CPF) with the same Account) are considered as one trade. This is due to the fact that we only charge one commission for such trade orders. Please refer to https://www.poems.com.sg/faq/trading/general/what-is-amalgamate/ for more information and available markets. Chances calculated from trades will follow this rule.

- The Winners will be selected on 5 Feb 2025. You will be contacted via email if you have won a prize!

- Each participant is only eligible to win 1 prize. Should a participant be picked again, PSPL reserves the right to replace the participant with a reserve winner who has not won a prize before.

FAQ

When will the winners be selected?They will be selected on 4 February 2025.

If I win a Huat Time prize, how do I redeem my reward?- GrabGifts Vouchers: The Voucher will be sent to your registered email within 10 days of the announcement of winners.

- Apple Watch Series 10, Apple iPhone 16 (128GB) or JBL Flip 6 Speaker: make your way down to 250 North Bridge Road #06-00, Raffles City Tower, 179101 during business days and hours (Mondays to Fridays, 9am to 6.30pm) to redeem your prize.

Please login to the POEMS Mobile 3 App and navigate to ‘Me’ Tab > Click on your profile picture > you will be prompted to set up a username.

What is the Grand Prize?The iPhone 16 128GB is the grand prize, stay tuned and all the best!

Can I customise my prize?No, customisation of prizes are not available.

App review campaign Dec 2024

Review on App Store

Review on App Store

Review on Google Play

Review on App Store

Review on Google Play

Review on Google Play

Review on App Store

Review on Google Play

About the campaign

Share Your Experience with POEMS Mobile 3 App on App Store or Play Store! Stand a chance to win a $300 Gift Certificate for The Ritz Carlton, Millenia Singapore for being one of the top 3 reviews!

Campaign Period: 16 Dec 2024 to 28 Feb 2025

How to participate

Simply follow the steps below during the campaign period to participate!

1. Download POEMS Mobile 3

2. Share your feedback on the Appstore / Playstore

Review on App Store

Review on App Store

Review on Google Play

Review on Google Play

Review on App Store

Review on Google Play

Review on App Store

Review on Google Play

How are the reviews assessed?

Reviews will be assessed by a panel of judges, who will select three(3) winners. The results will be revealed by 5 Mar 2025 via a reply to the selected winning reviews. Be sure to check back to see if you’ve won!

How do I claim my prize?

If you are selected as a “winner”, to claim your prize, all you have to do is email your:

- Full Name (as registered with POEMS)

- Contact Number (as registered with POEMS)

- POEMS Account Number

- Screenshot of your winning review

to hello@phillip.com.sg, after which you will receive an email from us with instructions on how to redeem your rewards.

Terms and Conditions- This campaign is open to POEMS Mobile 3 App Users (both POEMS Account Holders and Registered Users) who submit a review on either:

- POEMS Mobile 3 App – Play Store

- POEMS Mobile 3 App – App Store

- The campaign runs from 16 DEC 2024 – 28 FEB 2025 (“The Campaign Period”).

- Reviews will be assessed by a panel of judges, who will select a total of three (3) winners who have written comprehensive and thoughtful reviews on the POEMS Mobile 3 App – Play Store and POEMS Mobile 3 App – App Store during the campaign period.

- Winners will be notified by a reply to their review via email.

- Winners will be announced by 05 MAR 2025.

- Each Customer is only eligible to win once within the Campaign Period regardless of the number of Accounts held and reviews submitted.

- To claim the prize, winners have to write an email to hello@phillip.com.sg with their

- Full Name as registered with POEMS

- Contact Number as registered with POEMS

- POEMS Account Number

- Screenshot of their review within seven (7) working days after PSPL has replied the winners’ review informing them of their win.

- Once the winners have reached out to hello@phillip.com.sg with the necessary details, they will receive an email with details on the Rewards redemption.

- If a winner cannot be contacted within seven (7) working days or otherwise has his/her prize forfeited, PSPL reserves the right to select one (1) or more reserve winners to replace the disqualified winner. PSPL has the absolute discretion to exclude any otherwise eligible Customers from participating in the Draw or Promotion.

- The ‘Reward’ is a S$300 Gift Certificate for The Ritz-Carlton, Millenia Singapore (“Ritz-Carlton Hotel”). For more details of the Ritz-Carlton Hotel T&Cs and redemption instructions, please read here.

- In the event of a dispute over the Customer’s eligibility to participate in this promotion, PSPL’s decision will be final.

- PSPL reserves the sole right to refuse to award the tickets and/or prizes without prior notice to any contestant for any reason, in particular where contestants have behaved inappropriately, whether through posting inappropriate remarks or images or otherwise.

- PSPL reserves the right at any time in its absolute discretion to (i) amend, add and / or delete any time of these Terms and Conditions without prior notification (including eligibility and qualifying terms and criteria), and all participants shall be bound by such amendments, additions and / or deletions when effected, or (ii) vary, withdraw, or cancel any items or the campaign without having to disclose a reason thereof and without any compensation or payment whatsoever. PSPL decision on all matters relating to the campaign shall be final and binding on all participants.

- By entering into the campaign, contestants agree and consent to allow PSPL to use their name, photograph, or likeness in all matters related to this campaign including any advertising or publicity without additional compensation or notification.

- By taking part in this campaign, the participant acknowledges that he/she has read and consented to these Terms and Conditions.

Lion-China Merchants Emerging Asia Select Index ETF

Lion-China Merchants Emerging Asia Select Index ETF

Invest Now

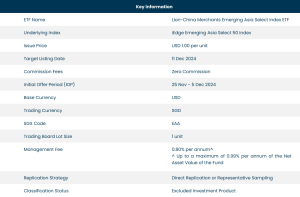

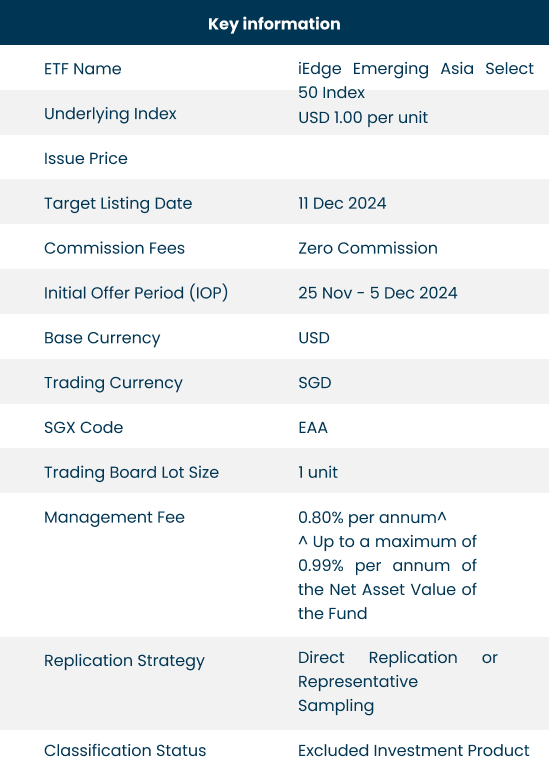

About the Lion-China Merchants Emerging Asia Select Index ETF

Tracks the 50 largest and most tradeable companies based on Foreign-Ownership-Adjusted Free-Float Market Capitalisation

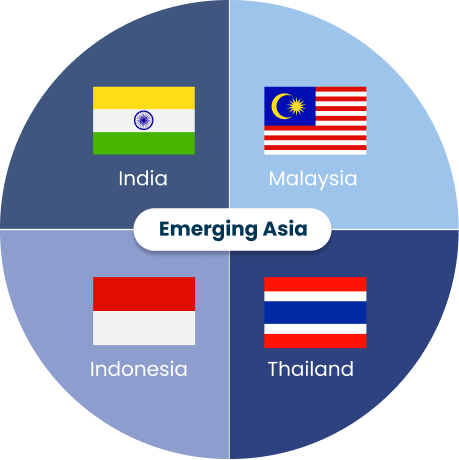

- Domiciled in Emerging Asia countries, namely India, Malaysia, Indonesia, and Thailand (IMIT)

Listed on relevant stock exchanges in IMIT countries or the US Exchanges

More About the ETF

The iEdge Emerging Asia Select 50 Index tracks the 50 largest and most tradeable companies based on Foreign-Ownership-Adjusted Free-Float Market Capitalisation. These companies are (i) domiciled in Emerging Asia countries; and (ii) listed in Emerging Asia countries or the US Exchanges, and is designed to provide access to growth in these Emerging Asia countries (i.e. IMIT).

For more information about the ETF, please click on the Pitch Book (EN/CN) and Brochure (EN/CN) links.

Why Invest in the Lion-China Merchants Emerging Asia Select Index ETF

Grow

Capitalise on the growth potential of India, Malaysia, Indonesia, and Thailand (IMIT) markets

Diversify

Achieve natural diversification across stocks, sectors, and countries^, with respective weightage caps of 7%, 40%, and 50%

^Refers to Countries of Domicile (i.e., India, Malaysia, Indonesia, and Thailand)

Portfolio

Build a portfolio consisting of the 50 largest and most tradable companies in IMIT

Why Invest in Emerging Asia?

Asian Tigers 2.0 - 4 Markets, 1 ETF.

A 4-in-1 opportunity to access the dynamic markets of Emerging Asia: India, Malaysia, Indonesia, and Thailand

Asian Tigers 2.0 – History Repeats with Four Emerging Markets

Among the world's top 40 economies by GDP, 16 are from Asia, including India (5th), Indonesia (17th), Thailand (28th), and Malaysia (38th).

Favourable labour costs and business-friendly environments have made these markets particularly attractive for foreign direct investments.

With the world's largest population and a rapidly growing economy, India is poised to attract significant foreign direct investment (FDI) into its manufacturing sector amidst the global shift towards trade diversification.

Indonesia, ASEAN’s largest economy and most populous nation, contributes 40% of the region’s GDP and population. It accounts for 42% of ASEAN’s land area and is the world’s largest producer of nickel and palm oil.

Malaysia has attracted significant investments from US and Chinese tech giants in data centres, cloud technology, and AI. Between 1 January 2024 to 31 October 2024, the FTSE Bursa Malaysia 100 Index gained 22.1% within 10 months in USD terms, outperforming the MSCI Emerging Markets Index and MSCI Emerging Markets Asia Index.

Thailand, Southeast Asia’s second-largest economy, relies heavily on tourism as a core driver. The country is experiencing a strong rebound in tourism, with 35–37 million arrivals projected for 2024, nearing its 2019 peak of 40 million.

How to Subscribe to the ETF During the IOP via POEMS 2.0

- Log in to your POEMS 2.0 account, then navigate to 'Account Management' > 'Online Forms' > 'IPO Subscription – Irrevocable Form'.

- Select the IPO you wish to subscribe to.

- Review and accept the prospectus, terms, and conditions before subscribing to the financial product.

- Applications close at 5pm on 5 Dec, Thur 2024.

- Ensure sufficient funds are available in your POEMS account to complete the application process (including the subscription amount, transfer fees, and GST) by 5 Dec, Thur 2024 at 5pm.

Promotion

Receive up to S$500 Cash Credit to Your POEMS Account when you subscribe to the Lion-China Merchants Emerging Asia Select Index ETF!

Customers will receive S$20 in cash credits for every S$10,000 subscribed to the ETF.

Seminar Recording

https://www.youtube.com/watch?v=HiKpX0D8LZE IOP Subscription Details

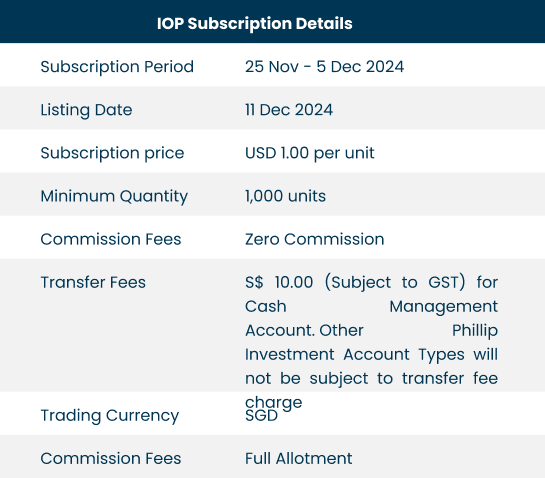

- The subscription period for Lion-China Merchants Emerging Asia Select Index ETF (“ETF”) is from 25 Nov, Monday at 9am to 5 Dec 2024, Thursday at 5pm

- The online subscription will close on 5 Dec 2024 at 5pm. No new applications, amendments, or withdrawals are allowed after this deadline.

- Eligible Accounts to subscribe for the ETF must be Cash Plus, Margin (M), Custodian (C), Prepaid Custodian (CC), Cash Management (KC) and Share Financing (V) Accounts. Cash Trading Accounts (T) are not eligible to participate in this subscription.

- An additional transfer fee charge of S$10 (subject to GST) per application for Cash Management Accounts will be applicable.

- Only one application is allowed per Account.

- Each ETF unit is priced at USD 1 and the minimum order quantity is 1,000 units, with an incremental order size of 1,000 units.

- There are zero commission fees.

- The total amount payable is denominated in USD. The settlement currency will be in USD.

- Sufficient funds (including transfer fee and GST) must be present in the Customer’s Account by 5 Dec 2024 at 5pm

- Applications will be rejected if the Account does not have or reflect sufficient funds after 5 Dec 2024 at 5pm.

- ETF units will be credited to the clients’ CDP or clients’ sub-account with Phillip Securities Pte Ltd by 11 Dec 2024.

- Customers will receive the full allotment of the number of ETF units that they subscribe to.

- Customers can start trading the ETF units when the ETF is listed on SGX on 11 Dec 2024 at 9am.

- Notwithstanding anything herein contained, PSPL reserves the right at any time in its absolute discretion to (i) amend, add and/or delete any time of these Terms & Conditions without prior notification (including eligibility and qualifying terms and criteria), and all participants shall be bound by such amendments, additions and/or deletions when effected, or (ii) vary, withdraw, or cancel any items or the promotion without having to disclose a reason thereof and without any compensation or payment whatsoever. PSPL’s decision on all matters relating to the promotion shall be final and binding on all participants.

- In the event of a dispute over the client’s eligibility to participate in this Promotion, PSPL’s decision will be final. PSPL shall not be obliged to give any reason on any matter concerning the Promotion and no correspondence or claims will be entertained.

- By taking part in this promotion, the customer acknowledges that he/she has read and consented to these Terms & Conditions.

- Customers will receive S$20 cash credit for every S$10,000 subscription into Lion-China Merchants Emerging Asia Select Index ETF, and successful subscribers to fulfill 1 month holding period after the listing date.

- The Campaign period is from 25 Nov, Monday at 9am to 5 Dec 2024, Thursday at 5pm

- The Cash Credit is capped at S$500 per POEMS account.

- The Cash credits is to be provided to the first 100 eligible clients of PSPL who invest in the ETF during the IOP.

- The Cash Credit will be credited to your Account in one month after the listing date.

- Notwithstanding anything herein contained, PSPL reserves the right at any time in its absolute discretion to (i) amend, add and/or delete any time of these Terms & Conditions without prior notification (including eligibility and qualifying terms and criteria), and all participants shall be bound by such amendments, additions and/or deletions when effected, or (ii) vary, withdraw, or cancel any items or the promotion without having to disclose a reason thereof and without any compensation or payment whatsoever. PSPL’s decision on all matters relating to the promotion shall be final and binding on all participants.

- In the event of a dispute over the client’s eligibility to participate in this Promotion, PSPL’s decision will be final. PSPL shall not be obliged to give any reason on any matter concerning the Promotion and no correspondence or claims will be entertained.

- By taking part in this promotion, the customer acknowledges that he/she has read and consented to these Terms & Conditions.

UOBAM ETFs with SRS

Receive up to S$200* Cash Credit

When you invest in UOBAM ETFs with your SRS

Plan your Retirement & Enjoy Tax Relief!

Open Account Invest NowReceive up to S$200* Cash Credit when you invest in UOBAM ETFs with your SRS

Plan your Retirement & Enjoy Tax Relief!

Open Account Invest NowWhy UOB Asset Management (UOBAM) for ETFs?

- UOBAM is one of Asia's leading asset managers, managing over S$35.3 billion in assets as of September 2024.

- With a presence in 9 Asian markets, including 6 in ASEAN, UOBAM leverages its onshore capabilities to provide investors with unique insights into the region’s investment landscape.

- Investors benefit from UOBAM’s diverse network of fund managers, analysts, and partners across major Asian markets, including Singapore, China, Malaysia, Indonesia, Taiwan, Thailand, and Vietnam.

List of Qualifying UOB ETFs Products:

Why invest in United SSE 50 China ETF? (JK8)The SSE 50 index is composed of the 50 most sizable and liquid stocks listed on the SSE, and is widely acknowledged and cited as a gauge of the China A-Shares market. Its objective is to mirror the performance of prominent, high-quality, and impactful large firms operating on the SSE.Why invest in UOB APAC Green REIT ETF? (SGD: GRN, USD: GRE)This fund offers the potential for both profit and capital appreciation. It aims to promote real estate operational and management practices focused on reducing carbon and other greenhouse gas emissions. The index includes 50 REITs with higher yields, listed within the region, that demonstrate comparatively superior environmental performance, as assessed by GRESB's real estate evaluation standards. Additionally, all selected REITs meet the minimum liquidity criteria.Why invest in UOBAM PingAn Chinext ETF? (SGD: CXS, USD: CXU)Take advantage of the growth prospects presented by China's 14th five-year plan, which aims to enhance the sustainability of economic expansion and improve the standard of living for its populace. Technological advancement, environmentally friendly energy sources and the welfare of its citizens, as well as certain industries that are positioned to benefit from the supportive policy environment. The ChiNext Index covers a broad spectrum of pioneering companies and industries that have the potential to capitalise on the realisation of these megatrends in the future. You can now gain exposure to Chinext Market which is less accessible to foreign retail investors! Previous slide Next slide Why invest in United SSE 50 China ETF? (JK8)The SSE 50 index is composed of the 50 most sizable and liquid stocks listed on the SSE, and is widely acknowledged and cited as a gauge of the China A-Shares market. Its objective is to mirror the performance of prominent, high-quality, and impactful large firms operating on the SSE.Why invest in UOB APAC Green REIT ETF? (SGD: GRN, USD: GRE)The fund has the potential to provide both profit and capital appreciation. It strives to promote real estate operational and management methodologies targeted at reducing carbon and other greenhouse gas emissions. The index picks and includes 50 REITs with higher yields that are listed in the region and exhibit comparatively superior environmental performance as determined by GRESB's real estate evaluation. Additionally, they meet the minimum liquidity criteria.Why invest in UOBAM PingAn Chinext ETF? (SGD: CXS, USD: CXU)Take advantage of the growth prospects presented by China's 14th five-year plan, which aims to enhance the sustainability of economic expansion and improve the standard of living for its populace. Technological advancement, environmentally friendly energy sources and the welfare of its citizens, as well as certain industries that are positioned to benefit from the supportive policy environment. The ChiNext Index covers a broad spectrum of pioneering companies and industries that have the potential to capitalise on the realisation of these megatrends in the future. You can now gain exposure to Chinext Market which is less accessible to foreign retail investors! Previous slide Next slide Trade United SSE 50 China ETF (JK8) Trade UOB APAC Green REIT ETF (SGD: GRN) Trade UOB APAC Green REIT ETF (USD: GRE) Trade UOBAM PingAn Chinext ETF (SGD: CXS) Trade UOBAM PingAn Chinext ETF (USD: CXU)Don't miss out!

Be one of the first 100 Eligible Customers to receive the Cash Credit!

| Requirement | |

S$20Cash Credit | Invest S$1,000 in UOBAM ETFs with SRS to earn S$20,up to a maximum of S$200 per Customer. |

Have a SRS Account but New to POEMS?

- Open a POEMS Account

- Once your POEMS Account is successfully opened, login to POEMS 2.0.

- Go to “My Settings” > “My Account”.

- Complete the details under “Bank A/C Information”.

Existing Customer but no SRS Account?

- Open a SRS account with one of the 3 bank operators:

- Once your SRS Account is successfully opened, login to POEMS 2.0.

- Go to “My Settings” > “My Account”.

- Complete the details under “Bank A/C Information”

Enjoy the Best of Both Worlds!

Invest with SRS to Unlock Potential Positive Returns & Enjoy Tax Savings

Contributions to SRS accounts only earn 0.05% when kept idle in banks. Investing your SRS funds is an effective way to put your money to work and potentially build wealth. Take advantage of this opportunity to strategically plan for your retirement.

Benefits of Investing Through Your SRS Account:

- Gain tax savings on every dollar saved into the account

- Accumulate tax-free returns from your SRS investments

- Enjoy the flexibility to invest in diverse assets, boosting your retirement savings

- Access your funds anytime

- Receive a 50% tax concession on withdrawals

For more information about how SRS gives you tax savings, please refer here.

Frequently Asked Questions

Which Account types are eligible for this promotion?Cash Plus, Cash Management, Margin, Custodian, and Share Financing Accounts.

What if I am a Cash Trading Account holder? Am I eligible for this promotion?No. Cash Trading Accounts are not eligible for this promotion. You may consider opening an eligible Account type or converting your Cash Trading Account to a Cash Management Account.

How do I convert my Cash Trading to Cash Management Account?Login to POEMS 2.0 Website > Acct Mgmt > Stocks > Online Forms. Cash Trading Account with existing GIRO facility has to be terminated before we are able to process the conversion of your existing Cash Trading to a Cash Management Account.

When will I receive the Cash Credit?The Cash Credit will be credited to the Customers’ eligible POEMS Accounts by the end of January 2025.

Terms and Conditions

Terms and Conditions

- This promotion is valid from 19 November 2024 to 31 December 2024, both dates inclusive.

- This promotion is open to all new and existing Customers of Phillip Securities Pte Ltd (“PSPL”).

- Qualifying Account types for this promotion:

- Cash Plus

- Cash Management

- Margin

- Custodian

- Share Financing

- Eligible Customer will receive S$20 Cash Credit for every S$1,000 invested successfully in UOBAM ETFs with SRS, up to a maximum of S$200 per Customer.

- Qualifying UOBAM ETFs Products:

- United SSE 50 China ETF (JK8)

- UOB APAC Green REIT ETF (SGD: GRN)

- UOB APAC Green REIT ETF (USD: GRE)

- UOBAM PingAn Chinext ETF (SGD: CXS)

- UOBAM PingAn Chinext ETF (USD: CXU)

- This promotion is only limited to the first 100 eligible PSPL Customers who fulfilled the requirements within the promotion period.

- The Cash Credit reward/s will be credited to eligible Customers’ POEMS Account by the end of January 2025.

- The following Customers are NOT eligible for this promotion unless approved by the management of PSPL:

- Corporate Accounts and Joint Account holders

- All employees of PSPL’s entities and its partners (e.g., trading representatives, financial advisors) and their immediate families (e.g., spouse and children).

- By taking part in the promotion, you agree and consent to PSPL sending relevant information to third-party service providers to facilitate the delivery and redemption of the Rewards.

- In the event of a dispute over the Customer’s eligibility to participate in this promotion, PSPL’s decision will be final.

- Notwithstanding anything herein contained, PSPL reserves the right at any time in its absolute discretion to (i) amend, add to, and/or delete these Terms and Conditions without prior notification (including eligibility; replacement of the prize; promotional mechanics, promotion duration without prior notification, qualifying terms and criteria), and all participants shall be bound by such amendments, additions and/or deletions when effected, or (ii) vary, withdraw, or cancel any items or the promotion without having to disclose a reason thereof and without any compensation or payment whatsoever. PSPL’s decision on all matters relating to the promotion shall be final and binding on all participants.

- This advertisement has not been reviewed by the Monetary Authority of Singapore.

Disclaimer

This advertisement is intended for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell any investment products mentioned herein. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs.

Investments are subject to investment risks including the possible loss of the principal amount invested. The value of any investments and the income from them may fall as well as rise. The risk of loss in leveraged trading can be substantial and you could lose in excess of your initial funds.

You may wish to obtain advice from a financial adviser before investing in any investment products mentioned herein. In the event that you choose not to obtain advice from a financial adviser, you should consider whether the investment product is suitable for you. You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement before trading in investment products.

SDR Promo Aug 2024

Zero Brokerage with Singapore Depository Receipts (SDR) from

1 Aug 2024 to 31 Mar 2025

Zero Brokerage with Singapore Depositary Receipts (SDR) from

1 Aug 2024 to 31 Mar 2025

Click on the logo or the counter name to read more about the company.

Meituan

Trade

Xiaomi Corporation

Trade Ping An Insurance (Group) Company of China, Ltd.

Trade

Ping An Insurance (Group) Company of China, Ltd.

Trade

Tencent Holdings Ltd

Trade

Tencent Holdings Ltd

Trade

Alibaba Group Holding Limited

Trade

BYD Electronic (International) Co., Ltd

Trade

Bank of China

Trade

Hongkong and Shanghai Banking Corporation

Trade Trade

Trade

Trade

Trade

PTT Exploration and Production

Trade Siam Cement

Trade

Siam Cement

Trade

Trade

Trade

Trade

Trade

Trade

Trade

Delta Electronics

Trade

Delta Electronics

Trade

Don’t have an Account?

Open An Account NowAlternatively, visit any of our Phillip Investor Centres or contact your trading representives.

Frequent Asked Questions

What is SDR?Singapore Depository Receipts (SDR) are instruments issued by the depository which represent beneficial interest of an underlying security listed on an overseas exchange. SDR facilitate investments into overseas listed companies without having to deal with the complexities of cross-border trading and settlement.

How does SDR work?SDR provide investors beneficial interest in an overseas listed security without having to purchase the security directly on an overseas exchange. SDR is issued by the depository and each SDR is represented by a specific number of underlying securities, held with a custodian in the home market on trust for SDR holders.

What overseas markets and instruments are SDR are issued on?Currently, there are SDR issued on Non-Voting Depository Receipts (NVDR) on shares of a company listed on the Stock Exchange of Thailand (SET). An NVDR is an instrument issued by the Thai NVDR Co., Ltd (Thai NVDR), a subsidiary of the SET, to facilitate trading by reducing barriers of foreign ownership limits. Generally, NVDR share the same prices and benefits as its underlying shares but do not carry any voting rights.

Who can invest in SDR?SDR are classified as Excluded Investment Products (“EIP”) and are generally for investors who expect low to moderate likelihood of loss of principal investment amount, with generally smaller potential returns. Investors who invest in this product should have a basic understanding of financial instruments with standardised terms and no unusual or complicated features.

Investors should refer to the SDR programme disclosure document provided by the depository for the features, and characteristics including a description of how corporate actions or distributions will be handled, as well as risks and other information. The SDR programme disclosure document is provided on https://www.singaporedr.com/.

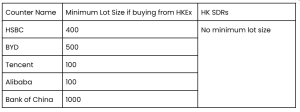

Why should I buy SDRs, instead of HK Stocks directly?Trading HK SDRs offers several advantages over buying HK stocks directly.* There is no minimum lot size, allowing for greater flexibility. You can manage all positions on a single platform, trading alongside other SGX-listed HK DLCs, structured warrants, and ETFs, all in SGD during SGX trading days and hours. Additionally, SDRs are custodised with CDP, with dividends paid in SGD. You’ll benefit from lower brokerage fees, no FX charges, and no custody fees for direct CDP accounts. Finally, SDR trading allows you to trade ahead of the Hong Kong market opening, with overlapping hours for US pre-market trading.

*Minimum lot size for individual counter

You can find the counter details by clicking on each individual name. (AOT, CPALL, PTTEP, SCG, KBANK, GULF, AIS, DELTA, HSBC, BYD, Tencent, Alibaba, BOC)

For more FAQs, you might refer here.

Terms & Conditions

Terms and Conditions- This promotion offers a commission rebate to trade Singapore Depository Receipt (“SDR”) with 0 brokerage from 1 Aug 2024 to 31 March 2025.

- SDR trades must be executed on our suites of the POEMS platform.

- Customers will be required to pay the prevailing SGX clearing fee, SGX access fee and other related fees, and the associated GST.

- Eligible Accounts used for trading of SDRs must be Cash Plus, Margin (M), Custodian (C), Prepaid Custodian (CC), Cash Management (KC) and Share Financing (V) Accounts.

- The rebate will be paid to your Trading Account in February 2025 when you trade before 31 Dec 2024; the rebate will be paid to your Trading Account in May 2025 when you trade between 1 Jan to 31 Mar 2025.

- The following persons are not eligible to participate in those promotions unless approved by the management of Phillip Securities Pte Ltd (“PSPL”):

a. PSPL institutional Customers and Corporate Customers

b. PSPL Account holders whose Accounts have been suspended, canceled or terminated - Notwithstanding anything herein contained, PSPL reserves the right at any time in its absolute discretion to (i) amend, add and/or delete any time of these Terms & Conditions without prior notification (including eligibility and qualifying terms and criteria), and all participants shall be bound by such amendments, additions and/or deletions when effected, or (ii) vary, withdraw, or cancel any items or the promotion without having to disclose a reason thereof and without any compensation or payment whatsoever. PSPL’s decision on all matters relating to the promotion shall be final and binding on all participants.

- In the event of a dispute over the client’s eligibility to participate in this Promotion, PSPL’s decision will be final. PSPL shall not be obliged to give any reason on any matter concerning the Promotion and no correspondence or claims will be entertained.

- By taking part in this promotion, the customer acknowledges that he/she has read and consented to these Terms & Conditions.

Don’t miss this opportunity!

Trade Now Open an Account

Don’t miss this opportunity!

Trade Now Open an AccountFor more information about Singapore Depository Receipts (SDR), please refer here.

CDP Mass Share Transfer Request

Fast Track Your Wealth

with Remisiers

Transfer your CDP Shares & receive up to S$588!

Your shares deserve the ultimate pit crew to go the distance.

Transfer your CDP Shares Now!Invest Smarter : Partner with a Remisier

Receive expert advice on trading and corporate actions

Tap onto years of stock market experience

Accumulate your wealth with a closely monitored portfolio

Receive customised strategies that align with your goals

How to Get Started!

Submit the CDP Mass Share Transfer Request Free of Charge!

List of Eligible Accounts- Cash Management

- Cash Trading

- Custodian

- Prepared Custodian

- Cash Plus

- Margin

Ride the WAIVED Fees Now!

| CDP Share Transfer Fee | Waived |

| Dividend Handling Fee (SGX-listed Securities) | Waived |

| Corporate Action Fee (SGX-listed Securities) | Waived |

| Account Maintenance Fee | Waived |

| Foreign Share Custody Fee | Waived |

| *Applicable to participants of cdp mass shares transfer page | |

| Fee Waiver Table (Applicable to Participants of CDP Mass Share Transfer Request) | |

| CDP Share Transfer Fee | Waived |

| Dividend Handling Fee (SGX-listed Securities) | Waived |

| Corporate Action Fee (SGX-listed Securities) | Waived |

| Account Maintenance Fee | Waived |

| Foreign Share Custody Fee | Waived |

Until 30 Sep 2027

CDP Share Transfer Fee Click HereDividend Handling Fee (SGX-listed Securities)Click HereForeign Share Custody FeeClick HereCorporate Action Fee (SGX-listed Securities)Click HereAccount Maintenance FeeClick HereGet in touch with your Remisier now! Don’t have one? Contact us at 65311555 or talktophillip@phillip.com.sg

Why Build a Portfolio with Us

Founded in 1975, with one of the largest pools of Remisiers in Singapore today

Comprehensive range of Financial Services from our multi-licensed Remisiers (E.g. Licences in both portfolio management and financial advisory)

24/7 access to your portfolio via POEMS

Stay one step ahead with Real-time Market Insights

Exclusive Promotion

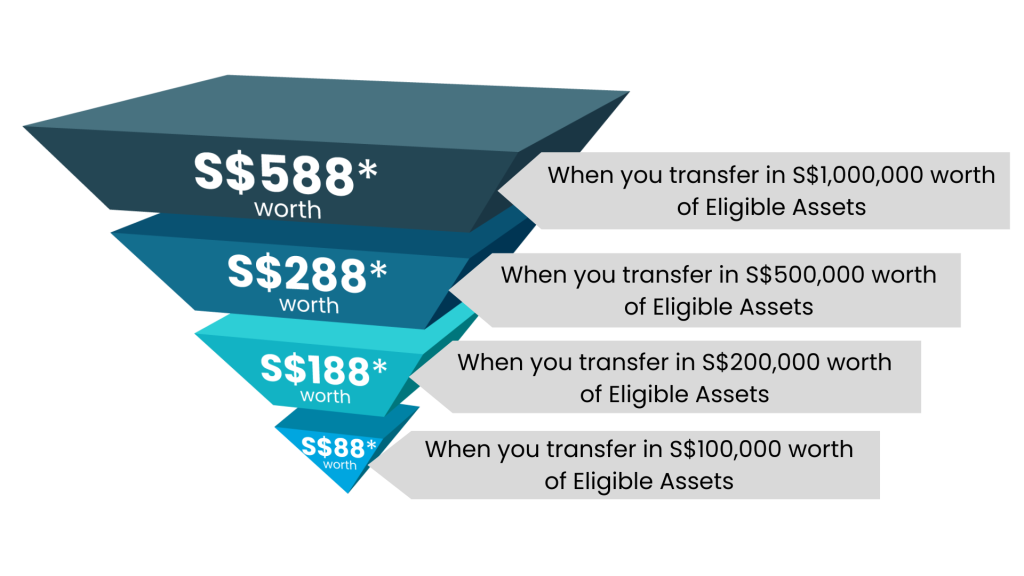

Transfer your CDP shares fully to your POEMS Account to enjoy the following SMART Park Credits rewards:

Unlock your Rewards!

*T&Cs Apply.

Unlock your Rewards!

*T&Cs Apply.

View Terms & Conditions for the Promotion

Freuquent Asked Questions

Accounts What types of Accounts are included in this CDP Mass Share Transfer Request? Only Cash Management, Cash Trading, Custodian, Prepaid Custodian, Cash Plus or Margin Accounts are eligible. Upon submitting the Request, Cash Management or Cash Trading Accounts will be converted to Custodian Account. Are all securities eligible to be transferred in? Only SGX-listed securities (e.g. shares, ETFs and bonds) and T-bills are eligible to be transferred in. Which types of securities are not eligible for the CDP Mass Share Transfer Request? Below is a list of securities that are not eligible for the transfer:- Rights Shares

- Singapore Saving Bonds

- Securities that are in “Blocked” status (e.g. Moratorium, Charge)

- Securities that are on loan as part of SGX SBL programme

- Unlisted counters

Terms & Conditions

SMART Park Credits Reward (Mar-May 2025 Promotion)- The promotion is only limited to the first 200 unique Customers who transfer in Eligible Assets from CDP fully to Eligible Accounts from 1 March 2025 to 31 May 2025, both dates inclusive.

- Customers who previously participated in our previous CDP Mass Share Transfer promotion in Oct 2024 – Dec 2024 will not be eligible to participate in this promotion again.

- Eligible Customers will receive Excess Funds Management SMART Park credit of:

- S$88 for transferring S$100,000 worth of Eligible Assets

- S$188 for transferring S$200,000 worth of Eligible Assets

- S$288 for transferring S$500,000 worth of Eligible Assets

- S$588 for transferring S$1,000,000 worth of Eligible Assets

- Eligible Assets are all SGX-listed securities (e.g. shares, ETFs and bonds) and T-bills.

- Customers are required to opt-in to the Excess Funds Management Facility (SMART Park) by 31 May 2025.

- Eligible Accounts for submitting the CDP Mass Share Transfer Request include: Cash Management, Cash Trading, Custodian, Prepaid Custodian, Cash Plus, or Margin Account. (Upon submitting the CDP Mass Share Transfer Request, Cash Management or Cash Trading Accounts will be converted to Custodian Accounts)

- The total value of Eligible Assets transferred must be maintained in the Account for 90 calendar days.

- SMART PARK Credits will be credited in July 2025.

- All employees of PSPL’s entities and its contractual representatives (e.g. trading representatives, financial advisors) and their immediate families are not eligible for this promotion unless approved by the management of PSPL.

- By taking part in the promotion, you agree and consent to PSPL sending relevant information to third-party service providers to facilitate the delivery and redemption of the Rewards.

- In the event of a dispute over the Customer’s eligibility to participate in this promotion, PSPL’s decision will be final.

- Notwithstanding anything herein contained, PSPL reserves the right at any time in its absolute discretion to (i) amend, add to, and/or delete these Terms and Conditions without prior notification (including eligibility; replacement of the prize; promotional mechanics, promotion duration without prior notification, qualifying terms and criteria), and all participants shall be bound by such amendments, additions and/or deletions when effected, or (ii) vary, withdraw, or cancel any items or the promotion without having to disclose a reason thereof and without any compensation or payment whatsoever. PSPL’s decision on all matters relating to the promotion shall be final and binding on all participants.

- This advertisement has not been reviewed by the Monetary Authority of Singapore.