SDR Coupon

What is SDR?

Singapore Depository Receipts (SDR) are instruments that represent the beneficial interest of an underlying security listed on an overseas exchange. An SDR is issued for trading on the securities market of the Singapore Exchange (SGX-ST) on an unsponsored basis by an intermediary, referred to as a SDR issuer, who does not have a formal agreement with the underlying company.

Available Counters

Meituan

Xiaomi Corporation

Ping An Insurance (Group) Company of China, Ltd.

Alibaba Group Holding Limited

BYD Electronic (International) Co., Ltd

Bank of China

Hongkong and Shanghai Banking Corporation

Tencent Holdings Ltd

AOT Airports of Thailand

CP All

PTT Exploration and Production

Siam Cement

The KASIKORNBANK

Advanced Info Service

Delta Electronics

SMIC

JD.com

PetroChina

Bangkok Dusit Medical Services

CP Foods

Gulf Development

CATL

Pop Mart

BBCA

Indofood

Telkom

Baidu

Trip.com

Laopu Gold

Horizon Robotics HK SDR

China Mobile HK SDR

Zijin Gold HK SDR

For more information about Singapore Depository Receipts (SDR), please refer here.

How to Redeem?

Simply login to POEMS Mobile 3 App > Head to "Me" Tab > Visit "Rewards" to Redeem your S$10 SDR Coupon!

Redeem NowAre you ready? Scan the QR code and redeem now!

(The Coupons are only redeemable via POEMS Mobile 3 App, scan and download now if you haven't done so)

Terms & Conditions

Terms and Conditions- The S$20 SDR (Singapore Depositary Receipts) Coupons, purchasable with five POEMS coins, can be redeemed for a S$20 Cash Credit upon Successful Trades.

- Successful Trades refer to the purchase of any listed SDR on SGX, with a minimum contract value of at least S$2,000 and must be executed within the same month of redemption (to receive the S$20 Cash Credit).

- 100 S$20 SDR Coupons will be released on the first day of each month from August to October on the POEMS Mobile 3 App Rewards page. Coupons will remain available until 11:59 PM on the last day of the respective month, or while stocks last – whichever comes first.

- The S$20 SDR Coupon redemption on the POEMS Mobile 3 Rewards will be on a first come first serve basis.

- The Five POEMS Coin used to purchase the SDR will not be refunded once the SDR Coupon is redeemed.

- Each Customer is eligible to redeem one S$20 SDR coupon per month using the POEMS coins during the Promotion period.

- The S$20 Cash Credit will be credited to your Account within the second week of the following month after redeeming the coupon and completing Successful Trades.

- E.g. Customer redeems the S$20 SDR Coupon on 15 Aug 25 and makes Successful Trades by 31 Aug 25. The Customer will receive the S$20 Cash Credit in his/her Account by the second week of Sep.

- E.g. Customer redeems the S$20 SDR Coupon on 10 Sep 25 and makes Successful Trades by 30 Sep 25. The Customer will receive the S$20 Cash Credit in his/her Account by the second week of Oct.

- The S$20 SDR Coupon is not refundable, exchangeable for cash nor transferable to other Account holders.

- This Promotion is not applicable to

- Cash Account(s)

- Joint Account(s)

- PSPL institutional Customers and corporate Customers

- PSPL and its associated entities and subsidiaries (direct or indirect), e.g. Staff, Trading Representatives and Financial Adviser Representatives.

- Phillip Securities Pte Ltd (“PSPL”) reserves the right at any time in its absolute discretion to (i) amend, add to, and/or delete at any time of these Terms & Conditions without prior notice (including eligibility and qualifying terms and criteria), and all Customers shall be bound by such amendments, additions and/or deletions when effected, or to (ii) vary, withdraw, and/or cancel any items or the promotion itself without having to disclose a reason, and without any compensation or payment whatsoever. PSPL’s decisions on all matters relating to the promotion are final and binding on all Customers.

- PSPL and its affiliates and their respective employees and agents shall not be liable to any person for any loss, damage, injury, costs or expenses incurred, suffered, borne or arising from this promotion.

- By redeeming this item, you acknowledge that you have read and consented to these Terms and Conditions.

- S$10 SDR Coupons will be released on the first day of each month on the POEMS Mobile 3 App Rewards page, from 2 February 2026 to 31 July 2026. Coupons will remain available until 11:59 PM on the last day of the respective month, or while stocks last – whichever comes first.

-

Eligibility Criteria:

- BUY trades only

- SDR (Singapore Depositary Receipts) listed in SGX

- Cash trades only

- Online trades only

- Minimum contract value of S$2,500

- Each Coupon, exchangeable with 5 POEMS Coins, can be redeemed for a $10 Cash Credit upon completion of a successful eligible trade.

- The availability of this Coupon listed on the POEMS Mobile 3 Reward Shop will be on a first come first serve basis.

- Each Customer is eligible to redeem only one S$10 SDR Coupon using POEMS coins during the Promotion period.

- The 5 POEMS Coins used to exchange for this Coupon will not be refunded once the Coupon is exchanged.

- This Coupon is valid for one-time use only and is non-refundable, non-transferable, and cannot be exchanged for cash.

- This Coupon will expire at the end of the month. You are required to redeem the Coupon and execute the eligible trade within the Coupon validity period.

- Once activated, the Coupon cannot be deactivated or reissued.

- This Coupon will be automatically applied to the first successful eligible trade executed, after the Coupon redemption and before its expiry.

- The S$10 rebate will be credited to the eligible Account within the following month.

- If the Coupon is not redeemed and/or a successful eligible trade is not executed within the validity period, the coupon will be forfeited, and no rebate will be issued.

- If there are multiple Stock Coupons active, the one which has a nearer expiration date will be used up first by default. If the Coupons have the same expiry date, the Coupon that was activated first by the Customer will be used by default.

- If the Customer holds multiple trading Accounts, the Account that performs the first successful eligible trade will receive the S$10 rebate, regardless of which Account the Coupon was activated in. For example: Customer has Account A and Account B. Customer activates the Coupon in Account A, but later performs a successful eligible trade using Account B. In this case, Account B will be awarded the S$10 rebate.

-

This Promotion is not applicable to

- Cash Account(s)

- Joint Account(s)

- PSPL institutional Customers and corporate Customers

- PSPL and its associated entities and subsidiaries (direct or indirect), e.g. Staff, Trading Representatives and Financial Adviser Representatives.

- Phillip Securities Pte Ltd (“PSPL”) reserves the right at any time in its absolute discretion to (i) amend, add to, and/or delete at any time of these Terms & Conditions without prior notice (including eligibility and qualifying terms and criteria), and all Customers shall be bound by such amendments, additions and/or deletions when effected, or to (ii) vary, withdraw, and/or cancel any items or the promotion itself without having to disclose a reason, and without any compensation or payment whatsoever. PSPL’s decisions on all matters relating to the promotion are final and binding on all Customers.

- PSPL and its affiliates and their respective employees and agents shall not be liable to any person for any loss, damage, injury, costs or expenses incurred, suffered, borne or arising from this promotion.

- By redeeming this Coupon, you acknowledge that you have read and consented to these Terms and Conditions.

SocGen US Stock DLCs

From 7 October 2024 to 28 February 2025

By executing any 2 BUY trades of SocGen US Stock DLCs online

Trade NowWhat is a DLC?

A Daily Leverage Certificate (DLC) is a form of structured financial instrument issued by banks and traded on the securities market. DLCs offer investors fixed leverage of 3 to 7 times the daily performance of an underlying index, be it a rising or falling market. The basic principle is simple – if the underlying index moves by 1% from its closing price of the previous trading day, the value of the 3x DLC will move by 3%.

SGX is Asia’s first venue to offer trading in DLCs, allowing investors to gain fixed leveraged exposure to developed Asian market indices and single stocks. This comes without the features impacting pricing for options such as implied volatility, time decay or margin calls.

DLCs were first introduced in Europe in 2012, where they are also called constant leverage products or factor certificates. They received wide interest from investors in Europe shortly after their launch.

Don't have an Account yet?

Open an Account NowAlternatively, visit any of our Phillip Investor Centres or contact your trading representives.

Why Trade DLCs?

Leverage up to 7 times the daily performance of an underlying index

Flexibility to trade both rising and falling markets

Low capital outlay and loss is limited to invested amount

No margins. No implied volatility impact. No time decay impact.

Transparent pricing due to tradability of the products on exchange

For more about Daily Leverage Certificates (DLCs), you might refer to here.

14 New US Stock DLCs to be listed are tabled below:

| DLC Code | DLC Name | Underlying US Stock | Type | Leverage | Listing Date | Issue Price (SGD) |

| TSYW | TESLA 3xLongSG261006 | Tesla | Long | 3x | 4 Oct | 5.00 |

| TSXW | TESLA 3xShortSG261006 | Tesla | Short | -3x | 4 Oct | 5.00 |

| NVIW | NVDA 3xLongSG261006 | NVIDIA | Long | 3x | 4 Oct | 5.00 |

| NVDW | NVDA 3xShortSG261006 | NVIDIA | Short | -3x | 4 Oct | 5.00 |

| MACW | APPLE 3xLongSG261006 | APPLE | Long | 3x | 4 Oct | 4.00 |

| PODW | APPLE 3xShortSG261006 | APPLE | Short | -3x | 4 Oct | 4.00 |

| USAW | AMZN 3xLongSG261006 | AMAZON | Long | 3x | 8 Oct | 4.00 |

| USBW | AMZN 3xShortSG261006 | AMAZON | Short | -3x | 8 Oct | 4.00 |

| USDW | META 3xLongSG261006 | META | Long | 3x | 8 Oct | 4.00 |

| USFW | META 3xShortSG261006 | META | Short | -3x | 8 Oct | 4.00 |

| USGW | MSFT 3xLongSG261006 | MICROSOFT | Long | 3x | 8 Oct | 4.00 |

| USHW | MSFT 3xShortSG261006 | MICROSOFT | Short | -3x | 8 Oct | 4.00 |

| USJW | ALPHAB 3xLongSG261006 | ALPHABET | Long | 3x | 8 Oct | 4.00 |

| USPW | ALPHAB 3xShortSG261006 | ALPHABET | Short | -3x | 8 Oct | 4.00 |

For more information of US Stock DLCs, please check out HERE.

Frequent Asked Questions

How do I qualify for the S$88 Cash Credit?You must be a POEMS Customer who trades SocGen US Stock DLCs from 7 October 2024 to 28 February 2025, and executes at least TWO “BUY” trades on the DLC issued by Societe Generale (SocGen).

What are the benefits of trading DLCs ?As a leverage product, Daily Leverage Certificates (DLC) give investors increased exposure to an underlying asset with the potential for higher returns. The leverage of a DLC can be 3, 5 or 7 times. Based on 5x leverage, if the underlying asset, typically a single stock or index, moves 2% in favour from its previous closing price, you earn a 10% gain on the DLC (2% * 5 = 10%). However, if the underlying asset moves in the direction against your position, you could experience a -10% loss. With the newly established US Stock DLCs, you can gain exposure to the S&P 500, NASDAQ-100 and DOW JONES indices.

How do I identify if the DLC listed is issued by Societe Generale?You can identify the Issuer by the name of the DLC. Let’s use the counter Tencent for example. The Tencent DLC name is DIHW – Tencent 5xLongSG231214

DIHW | Counter Code |

Tencent | Underlying |

5x | Leverage Factor |

Long | Long/Short |

SG | Issuer (SG = Societe Generale) |

231214 | Expiry Date (YYMMDD) |

Do note that only Societe Generale DLCs will be counted for this promotion.

I have multiple POEMS Accounts, can I claim the rewards more than once?No. Each Customer is only eligible to claim Cash Credit once despite having multiple Accounts. Please see the following example.

Client A has Accounts 1234567 & 2345678 with POEMS. Client A executed 2 “buy” trades of SocGen US Stock DLCs on Account 1234567 on 7 October 2024 and executed another 2 “buy” trades of SocGen US Stock DLCs on Account 2345678 on 11 November 2024. Assuming that both Accounts are meeting other conditions, Customer A will qualify for Cash Credit based on the Account that first traded the SocGen DLCs. In this case, Customer A will receive S$88 into his POEMS Account 1234567.

Terms & Conditions

Terms and Conditions- This promotion is for Customers who traded Daily Leverage Certificates (“DLCs”) tracking US Single Stocks issued by Societe Generale (“SocGen US Stock DLCs”) from 7 Oct 2024 to 28 February 2025 (the Promotion Period).

- Eligibility Criteria for the promotion:

o Accounts used for trading of SocGen US Stock DLCs must be Cash Plus, Margin (M), Custodian (C), Prepaid Custodian (CC), Cash Management (KC) and Share Financing (V) Accounts.

o At least TWO BUY trades on SocGen US Stock DLCs must be executed.

o BUY or SELL Trades of same counter listed in SGX are placed on the same trading day on POEMS Trading Platforms using the same payment mode (cash/SRS) with the same Account are considered as one trade. This is due that we only charge one commission for such trade orders. Please refer to HERE for more information.

- The Reward is capped at S$88 per Customer, regardless of the number of Eligible Accounts through which the Customer places SocGen US Stock DLCs trades during the Promotion Period.

- The reward is limited to the first 200 Customers participating in the campaign.

- Each Customer can only claim the reward once. Customer(s) with multiple Accounts will not qualify for the reward again.

- For Customers who traded between 7 Oct and 31 Dec 2024, the Reward will be credited to Eligible Accounts by 28 Feb 2025. For Customers who traded between 1 Jan and 28 Feb 2025, the Reward will be credited to Eligible Accounts by 30 Apr 2025.

- The following Customers are not eligible for this promotion, unless approved by the management of “PSPL”:

o PSPL institutional Customers and corporate Customers

o PSPL Account holders whose Accounts have been suspended, cancelled or terminated

o PSPL and its associated entities and subsidiaries (direct or indirect), e.g. Staff, Trading Representatives and Financial Adviser Representatives including their spouse and direct family members.

- In the event of a dispute over the Customer’s eligibility to participate in this promotion, PSPL’s decision will be final.

- PSPL reserves the right at any time in its absolute discretion to (i) amend, add to, and/or delete at any time of these Terms & Conditions without prior notice (including eligibility and qualifying terms and criteria), and all participants shall be bound by such amendments, additions and/or deletions when effected, or to (ii) vary, withdraw, and/or cancel any items or the promotion itself without having to disclose a reason, and without any compensation or payment whatsoever. PSPL’s decisions on all matters relating to the promotion are final and binding on all participants.

- By taking part in this promotion, the participant acknowledges that he/she has read and consented to these Terms & Conditions.

Don't miss this opportunity!

Trade Now Open an Account Open an Account

Trade Now

Open an Account

Trade Now

SSP 2Q25 SG Event

Your Favourite Event with POEMS Returns!

Days Hours Minutes Seconds

Days Hours Minutes Seconds

Join us at SGX Auditorium to meet our esteemed speakers and participate in fun games

Sign Up for Seminar

|

Can't make it in person? Join us via Zoom

Sign Up for Webinar

About

Strategy & Stock Picks is a quarterly event organised specially for investors to gain professional insights into the outlook of the SG, MY, CN & HK, TH, ID, US, and JP markets and their stocks recommendation. Through these curated sessions, we aim to empower you with insights to better plan and develop your personal investment strategies for your financial goals.

Our SG session will be held on 5 April, Sat, 10am at the SGX Auditorium.

Join us at this exclusive event to hear from our speakers, and network with peer investors.

Programme

9.00 AM - 10.00 AM

Exclusive to participants at the SGX Auditorium

Registration & Booth Activities

Complete interesting tasks and get stamps to receive the door gifts!

Moderator: Huan Zi Teo | Dealing Manager | Phillip Securities Pte Ltd

10.00 AM - 12.00 PM

Strategy & Stock Picks 1Q2025

Paul Chew | Head of Research | Phillip Securities Research and his research analysts

Expand for synopsisIn this turbulent ocean of rising geopolitical tension and the threat of a trade war, Singapore equities remain a sea of calm. Companies are returning capital to shareholders at record levels through increased dividend payouts and share buybacks. The government is increasing fiscal spending and setting up a S$5bn fund to support equities. Sectors favoured by our analysts that are experiencing growth include banks, construction, defence, power, real estate and oil and gas services.

12.00 PM - 12.10 PM

Seizing Short-term Market Opportunities with Daily Leverage Certificates

Marcus Ng | Vice President, Cross Asset Listed Distribution, Asia Pacific | Societe Generale

Expand for synopsisGain exposure to Singapore, Hong Kong and US key indices and single stocks with the 3x, 5x and 7x DLCs that allow you to trade both directions of the market. Hear from the issuer Societe Generale on the key product features and how the DLCs stand out compared to other leverage products.

Kahoot Game #1

Capitaland Vouchers worth S$30/S$20/S$10 to be won!

12.20M - 12.30 PM

Use less capital with Warrants to hedge your portfolio

Jamie Chung | Head of Warrants Macquarie Group

Expand for synopsisKahoot Game #2

Capitaland Vouchers worth S$30/S$20/S$10 to be won!

12.40M - 12.50 PM

Rethinking Asia: A Modern Approach to Regional Investing

Hou Yi Dan | ETF Business Development Associate | Nikko Asset Management Asia Limited

Expand for synopsisFor decades, the Asia equity landscape has been constrained by Japan’s dominance and China’s outsized influence. Investors looking for Asian equity exposure had to choose between broad Asia indices or single-country funds. Is there a better way to harness gains from the bright spots in Asia while mitigating concentration risk? The Amova MSCI AC Asia ex Japan ex China Index ETF offers investors a more precise way to capture long-term growth drivers within Asia and provides a more balanced representation of Asia’s emerging and developed markets. Join our speaker from Nikko AM to find out more about the shifting trends in Asia.

Kahoot Game #3

Capitaland Vouchers worth S$30/S$20/S$10 to be won!

1.00 PM

Exclusive to participants at the SGX Auditorium

Grand Lucky Draw

Join our event for a chance to be one of the 3 lucky winners to walk away with 1 Gram Pamp Suisse Lady Fortuna Gold Bar!

*Image is for illustration purpose only.

Lunch and Networking

Sign Up for Seminar|

Sign Up for WebinarFeatured Speakers

Paul Chew

Head of Research Phillip Securities Research Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as a fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds. He graduated from Monash University and has completed both his Chartered Financial Analyst and Australian CPA programme.

Glenn Thum

Senior Research Analyst Phillip Securities Research Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.

Darren Chan

Senior Research Analyst Phillip Securities Research Darren has over three years of experience on the buy-side as a fund manager. During his time as fund manager, he has managed multiple funds and mandates including dividend income, growth, as well as customised, Singapore focused and regionally focused funds. He graduated from the University of London with a First-Class Honours degree in Banking and Finance.

Zane Aw

Research Analyst Phillip Securities Research Zane analyses the stock market and conducts technical analysis to provide investment recommendations. He graduated from Nanyang Technological University with a Bachelor of Accountancy (Honours).

Miaomiao Liu

Research Analyst Phillip Securities Research Miaomiao mainly covers the Singapore REITs sector and graduated from Singapore Management University with a Bachelor's degree in Business Management.

Huan Zi Teo

Dealing Manager Phillip Securities Pte Ltd Huan Zi graduated from Nanyang Technological University (NTU) in 2014 with a Bachelor’s degree in Business, majoring in Banking and Finance. He currently serves as a dealing manager with a team of more than 10 equity specialists. Additionally, he frequently conducts seminars and webinars to empower his clients with financial and investment knowledge, including fundamental analysis and technical analysis.

Marcus Ng

Vice President, Cross Asset Listed Distribution, Asia Pacific Societe Generale Marcus is responsible for the product management, sales and marketing of the Daily Leverage Certificates in Singapore, together with Warrants and Callable Bull/Bear Contracts (CBBCs) in Hong Kong. Prior to this role, Marcus spent over seven years at SGX, managing the range of structured products listed on the securities market and driving the distribution of research content after graduating from the SGX Management Associate programme.

Jamie Chung

Head of Warrants Macquarie Group Jamie has been educating investors on Singapore warrants market for 15 years now. With her unique blend of warrant market-making and sales responsibilities, she is equipped to provide attendees with information about warrants in order to better understand the product, as well as market insights and also address various warrant queries.

Hou Yi Dan

ETF Business Development Associate Nikko Asset Management Asia Limited Yi Dan is a Business Development Associate in the Asia ETF Business Development team based in Singapore. As an ETF Business Development Associate, Yi Dan is responsible in assisting the team to drive the growth of Nikko Asset Management's ETFs business in Southeast Asia. She also works with brokers and liquidity providers to ensure efficient trading of Nikko AM ETFs both on exchange and over the counter.Frequently Asked Questions

What is the maximum capacity of the seminar?Seats are limited and registration is on a first-come, first-served basis. If the registration of the seminar reaches full capacity, you can still join the event online via Zoom.

Do I need a Zoom account to join the webinar?You do not need a Zoom account to join the webinar. Simply click the link in the confirmation email to join the session using the Zoom Web Client (works best on Chrome). Alternatively, you can download Zoom on your desktop or mobile device before the session begins.

Will I receive a reminder to join the webinar?Yes, you will receive email reminders 1 day, and 1 hour prior to the webinar. Do check your email for the link.

Will the webinar be recorded?The recorded webinars will be available on our YouTube channel.

How does Q&A session work?At the physical event, our moderator will pass the microphone to the audience for questions raised on the spot. For the zoom session, an up-vote system will be used and the questions with the highest number of votes will be answered first. Due to time constraint, similar questions will be answered only once. The speakers will address only those questions that are specific to the topics being presented. All questions will be cleared after each session to avoid confusion for the next speaker.

Sponsors

Subscribe to our newsletter for the latest news.

By submitting your question, you agree to receive email communication from POEMS, including recent news, events and seminars, promotions, articles.

Disclaimer

Please note that by providing your personal data to register for this event, you give consent to (Phillip Securities Pte Ltd(“PSPL”)), its employees and agents, and/or third-party service providers (whether in or out of Singapore) to collect, use, and/or disclose your personal data for the following purposes:

- To administer your participation in the event;

- To send information and/or updates by post, email, text messages or social media about our events or those of third parties that we think may interest you.

You also acknowledge that photography and videography may be taken during the event, and you give consent to PSPL to collect, use and/or disclose your photograph, voice, likeness and image in any broadcasts of this event for marketing, advertising, and/or administrative purposes.

Referral Program Be our influencer with POEMS

Refer Your Family & Friends, and Receive Cash Credit up to

S$680*

*Refer to 10 new Account holders

Refer Your Family & Friends, and Receive Cash Credit up to

S$680*

*Refer to 10 new Account holders

Start Inviting Your Friends & Family!

Generate your referral link now! Rewards for Your Family & Friends Account Opening Rewards Rewards for Your Family & Friends

Account Opening Rewards

Rewards for Your Family & Friends

Account Opening Rewards

Fund & Trade Rewards

Make a Deposit, and Buy Stocks/ ETFs/ Unit Trusts to Receive Attractive Rewards

Tier 1Deposit S$3,000 + 3 BUY Trades

US$20 Worth of Free Shares

8,888 POEMS Coins

- Make an initial deposit of at least S$3,000 within 14 days of Account opening.

- Hold the funds in your Account for at least 30 days without withdrawal.

- Execute at least 3 BUY Trades of Stocks/ ETFs/ Unit Trusts within 90 days of Account opening.

Deposit S$10,000 + 5 BUY Trades

US$88 Worth of Free Shares

10,888 POEMS Coins

- Make an initial deposit of at least S$10,000 within 14 days of Account opening.

- Hold the funds in your Account for at least 30 days without withdrawal.

- Execute at least 5 BUY Trades of Stocks/ ETFs/ Unit Trusts within 90 days of Account opening.

Bonus

(For Cash Plus Accounts only)

*Capped at S$50,000 and for a 30 days period.

Reach a min. of S$20,000 within the first 14 days of Account Opening

*Capped at S$50,000 and for a 30 days period.

Reach a min. of S$20,000 within the first 14 days of Account Opening

How It Works

You (Referrer)

Existing POEMS Account Holder

- Share your referral link.

- Your friend uses your referral link to open an Account. Kindly note that your friend must be NEW to Phillip Securities to qualify.

- Your friend funds at least S$3,000 to the Account within 14 days of Account Opening with a holding period of 30 days.

Your Friends (Referee)

New to Phillip Securities

- Opens an Account with your unique link and opt-in to Excess Funds Management (SMART Park). Afterwhich, they can redeem the Account Opening Reward.

- By funding at least S$3,000 to the Account within 14 days of Account opening (without withdrawing the funds for 30 days)

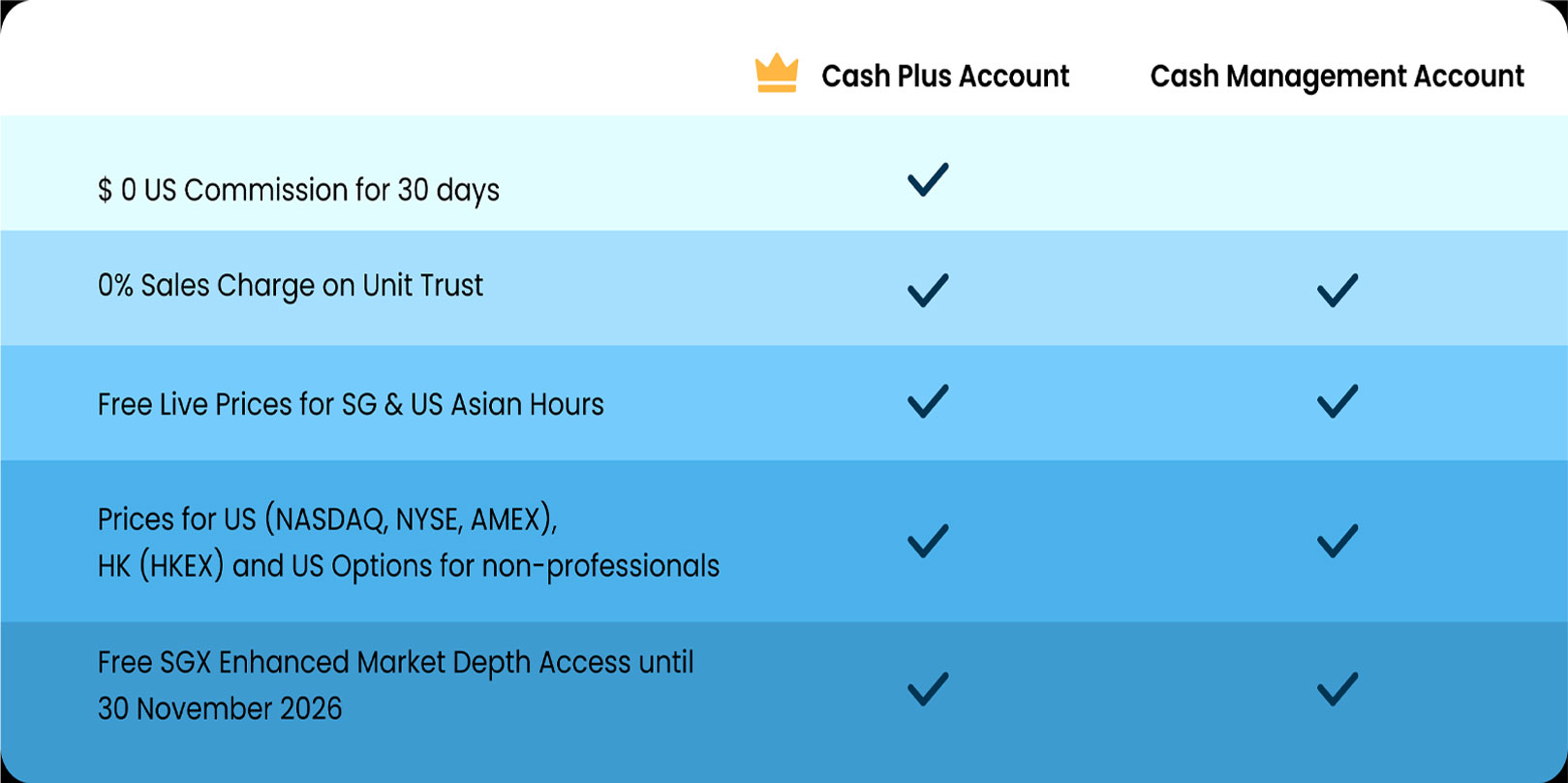

For Referees, who open a Cash Plus Account, they can enjoy $0 US commission for 30 days.

You (Referrer)

Existing POEMS Account Holder

You (Referrer)

Existing POEMS Account Holder

- Share your referral link

- Your friend uses your referral link to open an Account *Your friend must be NEW to Phillip Securities

- Your friend funds at least S$3000 to the Account within 14 days of Account Opening with a holding period of 30 days.

Your Friends (Referee)

New to Phillip Securities

Your Friends (Referee)

New to Phillip Securities

- Opens an Account with your unique link and opt-in to Excess Funds Management (SMART Park). They can redeem Account Opening Reward above.

- Upon funding at least S$3,000 to the Account within 14 days of Account Opening (without withdrawing the funds for 30 days) and make at least 3 BUY Trades of Stocks/ ETFs/ Unit Trusts within 90 days of Account opening, they can redeem Fund and Trade Rewards above.

Start Inviting Your Friends & Family!

Send your personalised referral link to your friend! Share your referral linkFrequently Asked Questions

What will I receive when I refer a friend to POEMS? You will receive a S$68 Cash Credit when the following has been verified: (a) Your friend is new to Phillip Securities, has successfully opened a Cash Plus Account or Cash Management Account, and has opted in to Excess Funds Management (SMART Park) (b) Your friend has funded at least S$3,000 into their Account within 14 days of Account opening. (c) Your friend does not withdraw the funds for 30 days Am I eligible to be a referrer/referee? All existing POEMS Account Holders with any of the following Accounts can be referrers:- Cash Plus Account

- Margin Account

- Cash Management Account

- Prepaid Account

- Custodian Account

- Share Financing Account

Terms & Conditions

T&Cs for Cash Plus Account Referral Programme- Referral Programme (“Programme”) is valid for existing POEMS Account holders (“Referrer”) who refer Customer(s) new to Phillip Securities Pte Ltd (“PSPL”) to open a Cash Plus Account (“Referee”), from 26 December 2024 to 9 March 2025, both dates inclusive.

- Within this context, “Referrers” refer to Customers with any of the following Accounts: Cash Plus, Cash Management, Margin, Prepaid, Custodian or Share Financing Accounts (“Qualified Accounts”).

- A referral will only be considered successful when the Referee opens a Cash Plus Account using a unique referral link generated by Referrer, opts in to Excess Funds Management (SMART Park) and fulfils these terms and conditions.

- If the Referee uses referral link(s) to open multiple Accounts, only the first successfully opened and funded Account will be considered as successful referral.

- Referrers will only receive S$68 Cash Credit ONCE for each unique Referee, even if the Referee opens multiple Accounts (regardless of Account type).

- Only the first 10 referred Accounts (regardless of Account type) will be considered as successful referrals.

- Referee consents to the disclosure of his or her name and referral status to the Referrer.

- Rewards for Referrer

- The Referrer will be entitled to a S$68 Cash Credit when his/her Referee

- Successfully opens a Cash Plus Account, opts in to Excess Funds Management (SMART Park) and deposits at least S$3,000 into the Account within 14 calendar days from the Account opening date.

- Does not withdraw this minimum amount for a period of at least 30 days

- Please note that the credits are non-transferable and non-withdrawable.

- The Referrer will be entitled to a S$68 Cash Credit when his/her Referee

- Rewards for Referee

- Referees will receive:

- Account Opening Rewards at poems.com.sg/welcome-gifts

- Fund & Trade Rewards at poems.com.sg/welcome-gifts

- SMART Park 5% p.a. Guaranteed Returns at poems.com.sg/welcome-gifts

- Referees will receive:

- The following Customers are NOT eligible for this Programme unless approved by the management of Phillip Securities Pte Ltd (“PSPL”)

- Referees who have any type of existing Accounts with PSPL, including joint and corporate Accounts.

- Referees who have closed any Accounts with PSPL

- Referrers and Referees who have already benefited from or will benefit from similar programmes or promotions, including PhillipCFD’s Refer A Friend.

- All employees of PhillipCapital’s entities and its partners (e.g., trading representatives, financial advisors) and their immediate families (e.g., spouse and children).

- In the event of a dispute over the Customer’s eligibility to participate in this promotion, PSPL’s decision will be final.

- PSPL reserves the right at any time in its absolute discretion to (i) amend, add to, and/or delete at any time of these Terms & Conditions without prior notice (including eligibility and qualifying terms and criteria), and all participants shall be bound by such amendments, additions and/or deletions when effected, or to (ii) vary, withdraw, and/or cancel any items or the promotion itself without having to disclose a reason, and without any compensation or payment whatsoever. PSPL’s decisions on all matters relating to the promotion are final and binding on all participants.

- By taking part in the promotion, you agree and consent to PSPL sending relevant information to third-party service providers to facilitate the delivery and redemption of the Rewards.

- In the event of a dispute over the Customer’s eligibility to participate in this promotion, PSPL’s decision will be final.

- This advertisement has not been reviewed by the Monetary Authority of Singapore.

- Referral Programme (“Programme”) is valid for existing POEMS Account holders (“Referrer”) who refer Customer(s) new to Phillip Securities Pte Ltd (“PSPL”) to open a Cash Management Account (“Referee”), from 26 December 2024 to 9 March 2025, both dates inclusive.

- Within this context, “Referrers” refer to customers with any of the following Accounts: Cash Plus, Cash Management, Margin, Prepaid, Custodian or Share Financing (“Qualified Accounts”)

- A referral will be considered successful only when the referee fulfils all of the following:

- Opens a Cash Management Account using a unique referral link generated by the referrer

- Opts into Excess Funds Management (SMART Park)

- Does not change the account type during the promotion period

- Abides by the terms and conditions

- If the Referee uses referral link(s) to open multiple Accounts, only the first successfully opened and funded Account will be considered as successful referral.

- Referrers will only receive S$68 Cash Credit ONCE for each unique Referee, even if the Referee opens multiple Accounts that fulfil clause 12 (regardless of Account type)

- Only the first 10 referred Accounts (regardless of Account type) will be considered as successful referrals

- Referee consents to the disclosure of his or her name and referral status to the Referrer

- The following Customers are NOT eligible for this Programme unless approved by the management of Phillip Securities Pte Ltd (“PSPL”):

- Referees who have any type of existing Accounts with PSPL, including joint and corporate Accounts.

- Referees who have closed any Accounts with PSPL.

- Referrers and Referees who have already benefited from or will benefit from similar programmes or promotions, including PhillipCFD’s Refer A Friend.

- All employees of PhillipCapital’s entities and its partners (e.g., trading representatives, financial advisors) and their immediate families (e.g., spouse and children).

- In the event of a dispute over the Customer’s eligibility to participate in this promotion, PSPL’s decision will be final.

- PSPL reserves the right at any time in its absolute discretion to (i) amend, add to, and/or delete at any time of these Terms & Conditions without prior notice (including eligibility and qualifying terms and criteria), and all participants shall be bound by such amendments, additions and/or deletions when effected, or to (ii) vary, withdraw, and/or cancel any items or the promotion itself without having to disclose a reason, and without any compensation or payment whatsoever. PSPL’s decisions on all matters relating to the promotion are final and binding on all participants

- By taking part in this promotion, the participant acknowledges that he/she has read and consented to these Terms & Conditions.

- 0% Sales Charge on Unit Trust

- Free Live Prices for SGX and US Asian Hours

- Free Live Prices for US (NASDAQ, NYSE, AMEX), Malaysia (BURSA), Thailand (SET), and US Options for non-professionals

- Free SGX Enhanced Market Depth Access until 30 November 2026. For more information, please refer to poems.com.sg/sgx-enhanced-market-depth.

- Fractional Shares Coupons (value US$20)

- Coca Cola (Worth US$10)

- NVIDIA (Worth US$10)

- POEMS Coins: 8,888 (Worth S$8.88)

- Fractional Shares Coupons (value US$88)

- Coca Cola (Worth US$22)

- NVIDIA (Worth US$22)

- McDonalds (Worth US$22)

- Meta (Worth US$22)

- POEMS Coins: 10,888 (Worth S$10.88)

- Customers must ensure that their Net Cumulative fund amount does not fall under S$3,000/S$10,000 to be eligible for the Fund & Trade Rewards based on the tier respectively.

- Net Cumulative fund refers to accumulated fund amount calculated from the day the Customers make and maintain their initial deposit for 30 days Capital gains and losses are excluded.

- The calculation of Net Cumulative funds is done daily. All withdrawals made during the holding period will reduce the Customers’ daily Net Cumulative Deposit.

- Once the daily Net Cumulative fund falls below S$3,000, the Customers will no longer be eligible to receive any Rewards.

- Activation and Crediting of Rewards:

- 0% Sales Charge on Unit Trust will be granted upon Account opening.

- Free Live Prices for SGX and US Asian Hours will be granted upon Account opening.

- Free Live Prices for US (NASDAQ, NYSE, AMEX), Malaysia (BURSA), Thailand (SET), and US Options for non-professionals. To activate the Free Live Prices, click here

- Free subscription for SGX Enhanced Market Depth Access would be granted automatically

- based on the date that you fulfil the requirements and

- You must complete the following items in order to receive the free US Fractional shares into their Account within 90 days from Account opening:

- Opt-in to US Fractional Shares & acknowledge the disclosure

- W8 BEN form

- Risk Warning Statement (RWS) form

- Customers are required to claim the Tier 1 and Tier 2 Free Shares Reward within 30 days of becoming eligible. Failure to do so, will result in the forfeiture of the reward.

-

- Customers who have any existing Accounts with PSPL

- Customers who have closed any Accounts with PSPL before

- Corporate Accounts and Joint Account holders

- All employees of PSPL’s entities and its partners (e.g., trading representatives, financial advisors) and their immediate families (e.g., spouse and children).

Mid Autumn Giveaway 2024

2024 Mid-Autumn Festival Instagram Giveaway campaign

Stand a chance to win Magnificent Seven * Fractional Shares (worth S$1000) on POEMS this coming Mid-Autumn

Magnificent Seven* Fractional Shares

- Alphabet Inc Fractional Share (NASDAQ: GOOGL) (worth S$150)

- Amazon.com Inc Fractional Share (NASDAQ: AMZNL) (worth S$150)

- Apple Inc Fractional Share (NASDAQ: AAPL) (worth S$150)

- Meta Platforms Inc Fractional Share (NASDAQ: META) (worth S$250)

- Microsoft Corp Fractional Share (NASDAQ: MSFT) (worth S$100)

- NVIDIA Corp Fractional Share (NASDAQ: NVDA) (worth S$100)

- Tesla Inc Fractional Share (NASDAQ: TSLA) (worth S$100)

How it works : (Follow, Like, Tag, Comment and Win!)

- 👉 Follow IG accounts: @investingwithphillipcapital and/or @phillipcapital. Double your chances by following both accounts and completing the steps below on both!

- ❤️Like this 2024 Mid-Autumn Festival Instagram Giveaway campaign post.

- 🤝Tag 5 friends in the Comments Section.

- 💬 Comment and tell us which stock you would invest in with just a dollar.

Terms and conditions:

- Giveaway Period: 16 Aug 2024 (Fri) 1200 hours (SGT) – 17 Sep 2024 (Tue) 2359 hours (SGT)

- Eligibility Criteria:

To participate in this Instagram giveaway, participants are required to perform all of the following actions within the giveaway period from 16 Aug 2024 (Fri) 1200 hours (SGT) to 17 Sep 2024 (Tue) 2359 hours (SGT) (hereafter referred to as the ‘Giveaway Period’)

- 👉 Follow IG accounts: @investingwithphillipcapital and/or @phillipcapital. Double your chances by following both accounts and completing the steps below on both!

- ❤️Like this 2024 Mid-Autumn Festival Instagram Giveaway campaign post.

- 🤝Tag 5 friends in the Comments Section.

- 💬 Comment and tell us which stock you would invest in with just a dollar.

This giveaway is open to all.

However, if the winner does not have a POEMS account, he/she has to open a POEMS account before 30 Oct 2024 to receive the prize.

Please see below for valid account types for the purpose of the giveaway:

- Valid Account Types:

- Cash Management Account

- Cash Plus Account

- Margin Account

- Prepaid Account

- Custodian Account

- Share Financing Account

- Invalid Account Types:

- Cash Account

- Managed Account

- Securities Borrowing and Lending (SBL) Account

- Entries submitted after the giveaway period will not be accepted. Phillip Securities Pte Ltd (PSPL) reserves all rights to disqualify any incomplete submissions or submissions that do not abide by the Instagram guidelines.

- The following persons are not eligible for this promotion, unless approved by the management of Phillip Securities Pte Ltd (“PSPL”):

- PSPL institutional Customers and corporate Customers

- PSPL Account holders whose Accounts have been suspended, cancelled or terminated

- PSPL and its associated entities and subsidiaries (direct or indirect), e.g. Staff, Trading Representatives and Financial Adviser Representatives

- How To Enter:

- 👉 Follow IG accounts: @investingwithphillipcapital and/or @phillipcapital. Double your chances by following both accounts and completing the steps below on both!

- ❤️Like this 2024 Mid-Autumn Festival Instagram Giveaway campaign post.

- 🤝Tag 5 friends in the Comments Section.

- 💬 Comment and tell us which stock you would invest in with just a dollar.

*Multiple entries are allowed

- Winner Selection:

- The most interesting answer will be chosen and ranked by our panel of judges.

- Prize Distribution:

- The winner’s IG handle will be announced on the PhillipCapital Instagram (@phillipcapital) and @investingwithphillipcapital page on 25 Sep 2024.

- The winner will be contacted 3-5 business days after the announcement (24 Sep 2024) by Instagram Direct Message for reward redemption details.

- Should the winner be uncontactable by 11 Oct 2024, his/her prize will be forfeited. PSPL reserves the right to decide on one (1) or more reserve winner to replace the disqualified winner. PSPL has the absolute discretion to exclude any otherwise eligible persons from participating in the Giveaway.

- Prize: One Winner will walk away with S$1000 worth of fractional shares as below:

- Alphabet Inc Fractional Share (NASDAQ: GOOGL) (worth S$150)

- Amazon.com Inc Fractional Share (NASDAQ: AMZNL) (worth S$150)

- Apple Inc Fractional Share (NASDAQ: AAPL) (worth S$150)

- Meta Platforms Inc Fractional Share (NASDAQ: META) (worth S$250)

- Microsoft Corp Fractional Share (NASDAQ: MSFT) (worth S$100)

- NVIDIA Corp Fractional Share (NASDAQ: NVDA) (worth S$100)

- Tesla Inc Fractional Share (NASDAQ: TSLA) (worth S$100)

- General:

- Participants of this Giveaway are bound by the promotional guidelines of Instagram: https://www.facebook.com/help/instagram/179379842258600 and exempts PSPL from any liability arising from any act, omission or default in connection with the use and operation of the operating platforms for Instagram over which PSPL has no control over. This Giveaway is in no way sponsored, endorsed or administered by, or associated with Instagram. The information collected from this Giveaway will belong solely to PSPL.

- In the event of a dispute over the Customer’s eligibility to participate in this Giveaway, PSPL’s decision will be final.

- PSPL reserves the sole right to refuse to award the aforementioned prizes without any prior notice to any participants for any reasons, particularly when participants have behaved inappropriately, whether through posting inappropriate remarks or through unconventional means or otherwise.

- PSPL reserves the right at any time in its absolute discretion to (i) amend, add and / or delete any of these Terms and Conditions without prior notification (including eligibility and qualifying terms and criteria), and all participants shall be bound by such amendments, additions and / or deletions when effected, or (ii) vary, withdraw, or cancel any items of the Giveaway without having to disclose a reason thereof and without any compensation or payment whatsoever. The decision of PSPL on all matters relating to the Giveaway shall be final and binding on all participants.

- By entering the Giveaway, participants agree and consent to allow PSPL to use their Instagram ID, photograph, or likeness in all matters related to this Giveaway including any advertising or publicity without additional compensation or notification.

- By taking part in this Giveaway, participants acknowledge that he/she has read and consented to these Terms and Conditions.

- This advertisement has not been reviewed by the Monetary Authority of Singapore.

- This is intended for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment products mentioned. It does not have any regard to your specific investment objectives, financial situation or particular needs. Investments are subject to investment risks including the possible loss of the principal amount invested. You may wish to obtain advice from a financial adviser before making a commitment to purchase any investment products mentioned herein. In the event that you choose not to obtain advice from a qualified financial adviser, you should consider whether the investment product is suitable for you.

ECICS

Exclusive to ECICS Tesla Motor Insurance Holders

Redeem Free Tesla Shares

Claim Now

Get in Touch

To receive FREE Tesla Fractional Shares

[contact-form-7 id="56f12df" title="ECICS Contact Form"]

Get in Touch

For next step to receive FREE

TESLA Fractional Shares

To receive Free Tesla Fractional Shares

For questions about ECICS Tesla Insurance, please contact ECICS at 6206 5588 or visit www.ecics.com

For questions about crediting of Tesla Fractional Shares, please contact our Customer Experience Unit at

65311555 or talktophillip@phillip.com.sg

Don’t have a

POEMS Account yet?

Open an Account and submit your details, to receive S$100 value of Tesla Fractional Shares!

Open an AccountDon’t have a

POEMS Account?

Open an Account and submit

your details, to receive S$100

value of Tesla Fractional Shares!

Open an Account Now

Welcome Gifts for

New Account Opening

Enjoy Free Trading & Live Prices on Popular Markets (worth S$350+)

Receive Free US Fractional Shares (worth S$240*)

Receive Free Share CFD (worth S$540*)

Receive Free Exclusive NFT

Welcome Gifts for New Account Opening

- Enjoy Free Trading & Live Prices on Popular Markets (worth S$350+)

- Receive Free US Fractional Shares (worth S$240*)

- Receive Free Share CFD (worth S$540*)

- Receive Free Exclusive NFT

Learn More

Open an Account

Why ECICS Tesla Insurance?

1 in 3 Tesla Car Owners in Singapore is insured by ECICS

Free Fractional Shares

For a limited time only!

Waiver of Excess

Offering excess

waiver up to S$1,500

Access Tesla’s

Distributor Workshop

Partner with Optima Werkz

FAQ

How can I claim the Telsa Fractional Shares?

Step 1: Purchase or renew your ECICS Tesla Motor Insurance

Step 2: You will receive the email from ECICS, which will direct you to this page

Step 3: Fill in your details under the “Get in Touch” section and press “submit”

How long does it take to receive Tesla Fractional Shares?

It will take approximately 3 months after the policy is activated, with further details are provided on this site. Please take note this is different from the purchase date of your policy.

How much the Tesla Fractional Shares will I receive?

If you are opening a POEMS account for the first time, you will receive Tesla Fractional Shares valued at S$100

If you are existing POEMS Account holder, you will receive Tesla Fractional Shares valued at S$50a

Are there any fees involved in claiming Tesla Fractional Shares?

No, there are no administrative or processing fees associated with claiming your Tesla Fractional Shares.

What happens if I cancel the ECICS Tesla Insurance policy after receiving the Tesla Fractional Shares?

If you cancel the policy, you will retain your Tesla Fractional Shares. However, to qualify for these shares, we recommend maintaining your policy for at least three months. This period allows for the necessary reconciliation process. Additionally, your policy must be active when the shares are credited to your POEMS Account.

Disclaimer

The complimentary Tesla fractional shares to be awarded under this promotion are provided as a result of your participation and eligibility in the online campaign “Tesla Motor Insurance Fractional Shares” which is jointly organized by ECICS Limited and Phillip Securities Pte Ltd. The crediting of the complimentary Tesla fractional shares is a promotional benefit and do not constitute a recommendation or solicitation to invest.

By participating in this promotion and accepting the promotional shares, you acknowledge and agree that Phillip Securities Pte Ltd ("PSPL") shall not be liable for any outcomes or losses arising from the receipt, holding, or subsequent trading of these shares. This includes, but is not limited to, market price fluctuations, corporate actions, changes in market conditions, trading restrictions, liquidity risks, or any financial losses incurred.

You further acknowledge that investing in equities involves inherent risks and agree that you are solely responsible for all investment decisions made in relation to the promotional shares. PSPL makes no warranties or representations regarding the future performance or value of the awarded shares. By participating in this promotion, you confirms that you understand and accept all risks associated with holding and trading the promotional shares. You are solely responsible for ensuring compliance with all applicable tax laws and regulations in your respective jurisdiction, and PSPL shall not be liable for any tax consequences arising from the crediting, holding, or disposal of the promotional shares.

ETF Symposium July 2024

The Largest ETF Event with POEMS in 2024!

Days Hours Minutes Seconds

Days Hours Minutes Seconds

Join us at SGX Auditorium to meet our esteemed speakers and participate in fun games

Sign Up for SeminarSold out!

|

Join us via Zoom for ease of participation

Sign Up for WebinarAbout

The ETF Symposium 2024 is an event designed to provide investors and professionals with in-depth insights into the dynamic world of Exchange-Traded Funds (ETFs). The symposium will cover a wide range of topics such as macroeconomic trends, market opportunities, portfolio diversification strategies, dollar cost averaging and the latest developments in the ETF landscape. Attendees will have the opportunity to engage with experts and acquire the knowledge and tools to navigate the evolving investment environment with confidence.Programme

9.15 AM - 10.00 AM AtriumRegistration (SGX Atrium only)

Moderator: Huan Zi Teo | Dealing Manager | Phillip Securities Pte Ltd

10.00 AM - 10.15 AM AuditoriumThe Future of ETFs: Trends, Innovations and Opportunities

Geoff Howie | Market Strategist | SGX Group

10.15 AM - 11.15 AM

Auditorium

10.15 AM - 11.15 AM

Auditorium

The Macro Guide for ETFs

Paul Chew | Head of Research | Phillip Securities Research Expand for synopsis The upcoming US election, ongoing geo-political conflicts, high interest rates, and slowing economic momentum can affect different asset classes and countries in varied ways, depending on their economic conditions, geopolitical ties, and market dynamics. Join us as Paul Chew, as the Head of Research at Phillip Securities Research, highlights several factors that could influence financial markets as we move into the second half of 2024.Lucky Draw #1

Polaroid GO Generation 2

Worth $228

11.15 AM - 11.45 AM

Auditorium

11.15 AM - 11.45 AM

Auditorium

Is it the time to re-look into S-REITS?

Bruce Zhang, CFA | Head of Fixed Income | CSOP Asset Management

Expand for synopsis In the first half of 2024, Singapore witnessed several large-scale events that spurred tourism and economic activities, contributing to the growth of Singapore’s GDP, and benefitting specific sectors within the S-REITs market. However, the persistent environment of high interest rates continues to pose a significant concern for REITs. Join us as Bruce Zhang, CFA, Head of Fixed Income at CSOP Asset Management, will explore if this is the opportune moment for investors to consider re-entering the S-REITs market.

Lucky Draw #2

Fitbit Luxe Fitness Tracker

Worth $168

11.45 AM - 12.15 PM

Auditorium

11.45 AM - 12.15 PM

Auditorium

Fixed Income Investing Amidst Volatility

Lim U-Jin | Deputy Head, Asia ETF Business Development | Nikko Asset Management Asia Limited Expand for synopsis Against a backdrop of market uncertainty, a nervous economic climate, and the ongoing debate on timing of policy rate cuts, interest rates are expected to be volatile in the near term. What are some potential investment opportunities and trends? Find out more as U-Jin Lim, Deputy Head of Asia ETF Business Development at Nikko Asset Management shares his insights on this topic. 12.15 PM - 1.30 PM AtriumLunch (SGX Atrium only)

Join our Booth games and win S$20 worth of NTUC VouchersLucky Draw #3

Sony Wireless Noise Cancelling Headphones

Worth $329

1.30PM - 2.00 PM

Auditorium

1.30PM - 2.00 PM

Auditorium

Diversify your portfolio: Getting ahead in the ETF investing game

Ong Xun Xiang | ETF Business Lead | Lion Global Investors Expand for synopsis Supported by sound policies and the resilience of the Singapore market, the outlook for Singapore investment opportunities shines brightly as a safe haven among global uncertainties. Amidst this backdrop, income, growth and stability are expected to be the key anchors for investors. APAC Financials have also been deepening their strong fundamentals to bolster growth opportunities while providing stable dividends. Learn about the benefits of diversification in your investment portfolio from Ong Xun Xiang, ETF Business Lead at Lion Global Investors as he shares why the Lion-OCBC Securities APAC Financials Dividend Plus ETF can be the building block for investors seeking exposure to the APAC financial sector exposure, and Income and Growth. He will also cover how the Lion-OCBC Securities Singapore Low Carbon ETF can be a potential long-term winner for your portfolio diversification while doing good for the planet.

Disclaimer This advertisement or publication has not been reviewed by the Monetary Authority of Singapore. It is for information only, and is not a recommendation, offer or solicitation for the purchase or sale of any capital markets products or investments and does not have regard to your specific investment objectives, financial situation, tax position or needs. Please read the prospectus which is available on our website or from our distributors. Investments involve risks including the possible loss of the principal amount invested. Lion Global Investors® Limited (UEN/ Registration No. 198601745D)

2.00PM - 2.30 PM

Auditorium

2.00PM - 2.30 PM

Auditorium

Is It Time to Invest in the China Market?

Tan Teck Leng | Deputy Chief Investment Officer | Phillip Capital Management Expand for synopsis As global markets evolve, China presents a distinctive investment landscape with substantial potential. In recent years, the China market has encountered significant obstacles, such as economic deceleration, regulatory restrictions, and global trade disputes, resulting in underperformance. However, the recent months have witnessed a market recovery fuelled by policy support, economic revival, and renewed investor optimism. Join Tan Teck Leng, Deputy Chief Investment Officer at Phillip Capital Management, as we delve deeper into the opportunities available in the China market.Lucky Draw #4

Polaroid HiPrint Generation 2 2x3 Pocket Photo Printer

Worth $169

2.30 PM - 3.15 PM

Auditorium

2.30 PM - 3.15 PM

Auditorium

Panel Discussion

The Future of ETFs: Emerging Trends, Hidden Opportunities, and the Power of DCA

Moderator: Kang Wei Chin | Associate Director, Securities Trading | SGX Group Expand for synopsis During this panel session, industry experts will provide forward-looking perspectives on the future of ETFs, exploring the latest trends and untapped opportunities that could shape the investment landscape. The discussion will highlight the strategic role of Dollar Cost Averaging (DCA) and Regular Savings Plans (RSP) in enhancing portfolio performance. Participants will gain invaluable insights into how these methods can provide stability and growth, even in volatile markets, and learn practical tips to optimisze their ETF investments. 3.15 PM - 3.30 PM AuditoriumKahoot Game & Lucky Draw (SGX Auditorium Only)

Ready to win more? Be one of the top 5 winners in our Kahoot Game or one of the 6 luckiest participants to walk away with surprise gifts!Highlights

Are you the luckiest 10 to win the Grand Lucky Draw?

Ipad? Samsung Mobile? Apple Watch? And more! Join our event to discover the exciting prizes awaiting you.

*Please note that lucky draw and kahoot games are for participants in SGX only. Sign Up for Seminar

Sign Up for Seminar

Sold out!

Sign Up for WebinarFeatured Speakers

Paul Chew

Head of Research Phillip Securities Research Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as a fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds. He graduated from Monash University and has completed both his Chartered Financial Analyst and Australian CPA programme.

Geoff Howie

Market Strategist SGX Group As SGX's Market Strategist, Mr Howie regularly provides insights into the Singapore stock and derivative markets. With a career spanning over 25 years, he has earned multiple accolades for his ability to impart fresh economic perspectives, and educate investors on the workings of locally-listed stocks, sectors and portfolio products. Previously, he held leading Broking and Market Strategist roles across the APAC offices of the one of the world's largest futures and options brokers.

Ong Xun Xiang

ETF Business Lead Lion Global Investors Xun Xiang is the ETF Business Lead at Lion Global Investors. He is responsible for driving the ETF business through building and commercialising ETFs, which includes speaking at ETF events to equip the public with investment and industry knowledge. Xun Xiang holds a Bachelor of Accountancy from Nanyang Technological University and is a Chartered Financial Analyst (CFA), Chartered Alternative Investment Analyst (CAIA), Chartered Accountant (Singapore) and ASEAN CPA charterholder.

Bruce Zhang, CFA

Head of Fixed Income CSOP Asset Management Mr. Zhang Dinghai (Bruce) is the Head of Fixed Income at CSOP Asset Management and is responsible for the portfolio management of bonds, REITs and money market investment strategies. Bruce holds a Master’s degree in Economics from the University of Hong Kong and a Bachelor of Arts from Peking University. He is a CFA Charter holder and is a member of CFA Institute and the Hong Kong Society of Financial Analysts.

Raphael Goh

Vice President, Intermediary Distribution CSOP Asset Management At CSOP Asset Management, Raphael oversees the distribution of ETFs and fund solutions for intermediaries within Singapore, Malaysia, and Thailand. He is also responsible for developing sales strategies and strategic partnerships with intermediaries across the region.

U-Jin Lim

Deputy Head, Asia ETF Business Development Nikko Asset Management Asia Limited U-Jin Lim joined in 2020 as an ETF Business Development Director at Nikko Asset Management in Singapore. As an ETF Business Development Director, U-Jin is responsible for driving the growth of Nikko Asset Management’s ETFs business in Southeast Asia. He also works with brokers and liquidity providers to ensure efficient trading of Nikko AM ETFs both on exchange and over the counter.

Tan Teck Leng

Deputy Chief Investment Officer Phillip Capital Management Teck Leng is a key member of the investment team at Phillip Capital Management, covering global equity and fixed income markets, including both active funds and ETFs. He oversees the managed account portfolios and the management of the equity and balanced funds portfolios. Teck Leng obtained his Bachelor of Mechanical Engineering degree with First Class Honours from Imperial College London in 1999. Teck Leng is a CFA (Chartered Financial Analyst) charterholder.

Kang Wei Chin

Associate Director, Securities Trading, Equities - Securities SGX Group Wei Chin has over 10 years of experience in the financial industry and is responsible for ETF product management at SGX. In his role, he works in collaboration with industry participants to develop and promote ETFs to the investing community. Before taking on this role, Wei Chin was based in West Africa, taking on various roles in financial and capital markets function during his stint at Fidelity Bank Ghana. Wei Chin holds a Bachelor degree in Economics from RMIT University.

Huan Zi Teo

Dealing Manager Phillip Securities Pte Ltd Huan Zi graduated from Nanyang Technological University (NTU) in 2014 with a Bachelor’s degree in Business, majoring in Banking and Finance. He currently serves as a dealing manager with a team of more than 10 equity specialists. Additionally, he frequently conducts seminars and webinars to empower his clients with financial and investment knowledge, including fundamental analysis and technical analysis.Frequently Asked Questions

What is the maximum capacity of the seminar? The maximum capacity is 250 pax, and seats are allocated on a first-come-first-served basis. If the registration of the seminar reaches 250 pax, you can still join the event online via Zoom. Do I need a Zoom account to join the webinar? You do not need a Zoom account to join the webinar. Simply click the link in the confirmation email to join the session using the Zoom Web Client (works best on Chrome). Alternatively, you can download Zoom on your desktop or mobile device before the session begins. Will I receive a reminder to join the webinar? Yes, you will receive email reminders 1 day, and 1 hour prior to the webinar. Do check your email for the link to join. Will the webinar be recorded? The recorded webinars will be available on our YouTube channel. How does Q&A session work? For the event at SGX, our moderator would pass the microphone to the audience for questions raised on the spot. For online participants, we will be using the up-vote system where Q&A will begin with the questions with the highest number of votes. Due to time constraints, similar questions will be answered only once. The speakers will address only those questions that are specific to the topics being presented. All questions will be cleared after each session to avoid confusion for the next speaker. SBP Promotion T&CsSponsors

Subscribe to our newsletter for the latest news.

By submitting your question, you agree to receive email communication from POEMS, including recent news, events and seminars, promotions, articles.Disclaimer

Please note that by providing your personal data to register for this event, you give consent to (Phillip Securities Pte Ltd(“PSPL”)), its employees and agents, and/or third-party service providers (whether in or out of Singapore) to collect, use, and/or disclose your personal data for the following purposes:- To administer your participation in the event;

- To send information and/or updates by post, email, text messages or social media about our events or those of third parties that we think may interest you.

Investment Funds

Get Started Today

Open An Account Transfer InFor assistance, call 6531 1555 | Visit our Phillip Investor Centres

FAQs

What are some common factors to consider when selecting a fund? Your risk tolerance and life stage will be the first factors to consider when deciding which funds to invest in. The next things to consider would be to measure the performance of a fund as well as fees and expenses. Click here for more details. Can Finder guarantee investment success? No. unit trusts or funds are capital guaranteed, and past performance is not indicative of future performance. Can I use this filter for other types of investments apart from funds? The Fund Finder will only able to reflect unit trusts, which are available on POEMS. How frequently should I use this tool to review my funds investment? The Fund Finder is not able to review your investments into funds. Please log in to your POEMS Account to track its performance. Read MoreGlossary

Asset Class

An asset class is a group of financial instruments that share similar characteristics and behave similarly in the marketplace. Common asset classes include stocks, bonds, unit trusts, exchange traded funds

Benchmark index

A benchmark index is a standard against which the performance of a security, mutual fund, or investment manager can be measured. Common benchmark indices include S&P500, Dow Jones Industrial Average, Straits Times index

Dealing Cut Off Time

Dealing cut off time for unit trusts is usually 3:30pm on the working day itself

Volatility

Volatility refers to the degree of variation in the price of a financial instrument over time. It is often measured by the standard deviation of returns and indicates the level of risk associated with the investment. High volatility means that the price of the asset can change dramatically over a short period, while low volatility indicates more stable price changes. Volatility is a key consideration for investors in assessing the risk of their investments.

Return/Volatility Ratio

The return/volatility ratio, often referred to as the Sharpe ratio, measures the performance of an investment compared to a risk-free asset, after adjusting for its risk. A higher Sharpe ratio indicates a more attractive risk-adjusted return.

Dividend Payout Per unit

Dividend payout per unit refers to the amount of dividend income received for each unit of an investment, such as a share of stock or a unit of a mutual fund.

Asset Class

An asset class is a group of financial instruments that share similar characteristics and behave similarly in the marketplace. Common asset classes include stocks, bonds, unit trusts, exchange traded funds

Benchmark index

A benchmark index is a standard against which the performance of a security, mutual fund, or investment manager can be measured. Common benchmark indices include S&P500, Dow Jones Industrial Average, Straits Times index

Dealing Cut Off Time

Dealing cut off time for unit trusts is usually 3:30pm on the working day itself

Volatility

Volatility refers to the degree of variation in the price of a financial instrument over time. It is often measured by the standard deviation of returns and indicates the level of risk associated with the investment. High volatility means that the price of the asset can change dramatically over a short period, while low volatility indicates more stable price changes. Volatility is a key consideration for investors in assessing the risk of their investments.

Return/Volatility Ratio

The return/volatility ratio, often referred to as the Sharpe ratio, measures the performance of an investment compared to a risk-free asset, after adjusting for its risk. A higher Sharpe ratio indicates a more attractive risk-adjusted return.

Dividend Payout Per unit

Dividend payout per unit refers to the amount of dividend income received for each unit of an investment, such as a share of stock or a unit of a mutual fund.UBS DLCs Campaign July 2024

Get Rewarded When You Execute TWO BUY Trades of UBS DLCs from 1 July to 30 September 2024

Trade NowWhat is a DLC?

A Daily Leverage Certificate (DLC) is a form of structured financial instrument issued by banks and traded on the securities market. DLCs offer investors fixed leverage of 3 to 7 times the daily performance of an underlying index, regardless of a rising or falling market. The basic principle is simple – if the underlying index moves by 1% from its closing price of the previous trading day, the value of the 3x DLC will move by 3%.

SGX is the first in Asia to offer trading in DLCs, allowing investors to gain fixed leveraged exposure to developed Asian market indices and single stocks. Unlike options, DLC pricing is not affected by factors such as implied volatility, time decay, or margin calls.

DLCs were first introduced in Europe in 2012, where they are also known as constant leverage products or factor certificates. They quickly garnered significant interest from investors in Europe shortly after their launch.

Why Trade DLCs?

Leverage up to 7 times the daily performance of an underlying index

Flexibility to trade both rising and falling markets

Low capital outlay and loss limited to invested amount

No margins. No implied volatility impact. No time decay impact.

Transparent pricing due to tradability of the products on exchange

Find Out MoreDon’t have an Account yet? Open an Account with us!

Open An AccountFrequently Asked Questions

How do I qualify for the S$108 Cash Credit?To qualify for the S$108 cash credit, you must be a POEMS Customer who trades UBS DLCs from 1 July to 30 September 2024, and executes at least TWO BUY Trades during this period.

How do I differentiate UBS DLCs from other DLCs? You can identify the Issuer by the name of the DLC. Here is an example using the counter Tencent. TSGW – Tencent 5xLongUB241231:| TSGW | Counter Code |

| Tencent | Underlying |

| 5x | Leverage Factor |

| Long | Long/Short |

| UB | Issuer (UB = UBS) |

| 241231 | Expiry Date (YYMMDD) |

No, each Customer is only eligible to claim the cash credit once, regardless of multiple Accounts. Please see the following example.

Client A who has Accounts 1234567 & 2345678 with POEMS, has not traded UBS DLCs with PSPL between 1 April and 30 June 2024. Client A executes 2 buy trades of UBS DLCs on Account 1234567 on 2 July and executes another 2 buy trades of UBS DLCs on Account 2345678 on 2 August. Assuming that both Accounts meet all other conditions, Customer A will qualify for Cash Credit based on the Account that first traded the UBS DLCs. In this case, Customer A will receive a credit of S$108 in his POEMS Account 1234567.

Can I talk to a specialist to understand more about DLCs?Please contact your dealer or Trading Representative. Alternatively, you can contact our Customer Experience Unit at 6531 1555 or send an email to talktophillip@phillip.com.sg

Terms and Conditions

Terms and Conditions- This promotion is for Customers who trade UBS DLCs between 1 July 2024 to 30 September 2024, both dates inclusive (the Promotion Period).

- Eligibility Criteria for the Reward:

- Accounts used for trading of DLCs must be either Cash Plus, Margin (M), Custodian (C), Prepaid Custodian (CC), Cash Management (KC) or Share Financing (V) Accounts.

- At least TWO BUY trades on DLC must be executed.

- BUY Trades of the same counter listed in SGX, are placed on the same trading day on POEMS Trading Platforms using the same payment mode (cash or SRS) with the same Account are considered as one trade. This is because we only charge one commission for such trade orders. Please refer HERE for more information.

- Customers must not have traded UBS DLC with Phillip Securities Pte Ltd (PSPL) between 1 April 2024 and 30 June 2024.

- The Reward is capped at S$108 per Customer, regardless of the number of Eligible Accounts through which the Customer places DLC trades during the Promotion Period.

- This Promotion is capped to the first 150 Customers who qualify for the cash credit.

- Each Customer can only claim the Reward once. Customer(s) with multiple Accounts will not qualify for the Reward again.

- The Reward will be credited to Eligible Accounts by 31 October 2024.

- The following Customers are not eligible for this Reward, unless approved by the management of Phillip Securities Pte Ltd (“PSPL”):

- PSPL institutional Customers and corporate Customers

- PSPL Account holders whose Accounts have been suspended, cancelled or terminated

- PSPL and its associated entities and subsidiaries (direct or indirect), e.g. Staff, and Financial Advisory Representatives.

- In the event of a dispute over the Customer’s eligibility to participate in this Reward, PSPL’s decision will be final.

- PSPL reserves the right at any time in its absolute discretion to (i) amend, add to, and/or delete at any time of these Terms & Conditions without prior notice (including eligibility and qualifying terms and criteria), and all participants shall be bound by such amendments, additions and/or deletions when effected, or to (ii) vary, withdraw, and/or cancel any items or the Reward itself without having to disclose a reason, and without any compensation or payment whatsoever. PSPL’s decisions on all matters relating to the Reward are final and binding on all participants.

- By taking part in this promotion, the participant acknowledges that he/she has read and consented to these Terms & Conditions.

Do not miss this opportunity!

Trade Now Open an Account

Do not miss is this opportunity!!

Trade Now Open an AccountMacquarie Warrants 1 July to 30 November 2024

From 1 July to 30 November 2024

By executing any 1 BUY trade of Macquarie Warrants online

Trade NowWhat is a Structured Warrant?

A Structured Warrant (SW) is an exchange-traded derivative that gives the holder the right but not the obligation to buy or sell the specific underlying asset at an agreed price (exercise price) on the expiry date.

A call warrant gives investors the right, not the obligation to buy the underlying asset. Typically, the price of a call warrant increases as the underlying asset price goes up.

A put warrant gives investors the right, not the obligation to sell an underlying asset. Typically, the price of a put warrant increases as the underlying asset price goes down.

Structured warrants are available over a range of assets, including shares and share indices.

Don't have an Account yet?

Open an Account NowAlternatively, visit any of our Phillip Investor Centres or contact your trading representives.

Why Trade Warrants?

Leverage

Leverage up to 3 times the daily performance of an underlying index

Flexible Investment Strategies

Flexibility to trade both rising and falling markets

Limited Downside Risk

Warrants have a longer lifespan and do not expire worthless

Liquidity

Many warrants are actively traded on organised exchanges

Diversification

Investors can gain exposure to different sectors, industries, or regions without directly owning the underlying securities

For more information about Warrants, you might refer here.Frequently Asked Questions

How do I qualify for the S$88 Cash Credit? To qualify, you must be a POEMS Customer who trades Macquarie Warrants from 1 July 2024 to 30 November 2024, executing at least one “BUY” trades on the Warrants issued by Macquarie, and must not have placed a Macquarie Warrants trade between 1 April 2024 and 30 June 2024. How do I identify if the Warrant listed is issued by Macquarie? You can identify the Issuer by the name of the Warrant. Let’s use the Meituan Warrant for example: Meituan MB eCW240703@| SOOW | Counter Code |

| Meituan | Underlying asset |

| MB | Issuer (MB = Macquarie Bank) |

| 240703 | Expiry Date (YYMMDD) |

Terms & Conditions

Terms and Conditions 1. This promotion is for Customers who trade Warrants issued by Macquarie from 1 July 2024 to 30 November 2024, both dates inclusive (the Promotion Period). 2. Eligibility Criteria for the promotion:- Customers must not have traded Macquarie Warrants with Phillip Securities Pte Ltd (PSPL) between 1 April 2024 and 30 June 2024.

- Accounts used for trading of Macquarie Warrants must be Cash Plus, Margin (M), Custodian (C), Prepaid Custodian (CC), Cash Management (KC) and Share Financing (V) Accounts.