3 Reasons to Invest in the Hang Seng TECH Index September 15, 2020

Introduction

In recent times, numerous established Chinese technology giants such as Alibaba (HKEx: 9988), JD.com (HKEx: 9618) and Netease (HKEx: 9999) have filed for secondary IPO in Hong Kong Exchange (HKEx) to raise capital. The move also helps to provide a safety net against the potential delisting of Chinese stocks from U.S. exchanges.

In addition, it is expected that more foreign-listed Chinese companies or “unicorns”, privately-held start-up firms valued at more than USD1 billion, will return or begin to file for IPO in Hong Kong, Shanghai and Shenzhen exchanges.

The secondary and new listings of Chinese technology companies have bolstered the financial market in Hong Kong, which was shaken by months of anti-government protests in 2019.

The listings of technology companies on HKEx have led to the launch of the Hang Seng TECH Index on 27 July 2020. The new index will have a technology-focused exposure as compared to the “old economy” stocks represented in the Hang Seng Index.

As such, many believe that the Hang Seng TECH Index will be the flagship index for the technology sector in Asia.

Methodology of the Hang Seng TECH Index

Technology and growth stocks tend to have higher volatility than traditional large cap stocks. The Hang Seng TECH Index helps to reduce the volatility through diversification, and provides access to the growth potential of technology stocks.

Below are the three beneficial features and reasons to invest in the Hang Seng TECH Index:

1. Diversification

The Hang Seng TECH Index comprises 30 of the largest Hong Kong-listed companies with high business exposure to technology themes. It contains companies from five different sectors; industrials, consumer discretionary, healthcare, financial, and information technology.

A 8% cap is applied on individual securities to avoid overweighting any single stock in the index. This problem is especially prominent in the top-heavy S&P 500 index, which is dominated by Facebook (FB), Amazon (AMZN), Apple (AAPL), Microsoft (MSFT), and Alphabet (GOOG) (formerly known as Google), collectively known as the FAANG stocks. The top five stocks in the index encompass more than 20% weightage in a portfolio of 500 U.S.companies. Hence, the cap on individual security weighting in the Hang Seng TECH Index helps to prevent over exposure to any particular company.

2. Growth Potential

Unlike traditional technology indexes, the Hang Seng TECH Index is a thematic index with diversified coverage in technological themes such as Internet (including Mobile), FinTech, Cloud Computing, E-commerce and Digital Activities.

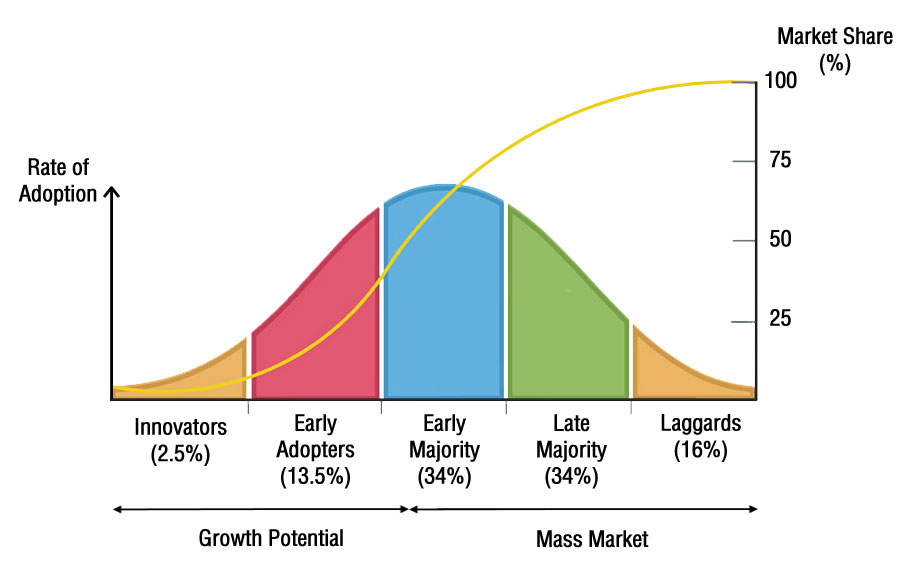

These themes currently occupy the early stages in the Technology S-Curve and can provide higher growth potential than an ageing sector.

Figure 1:

An Illustration of the S-Curve (Orange Line) and Rogers Adoption Curve (Bell Curve)

Besides having business exposure to the themes mentioned earlier, technology companies must also meet at least one of the below criteria for inclusion into the Hang Seng TECH Index.

1. Technology-enabled business model delivered via the Internet or Mobile platform

2. R&D Expense to Revenue Ratio of more than or equal 5%

3. Year-on-Year Revenue Growth of more than or equal 10%

The stringent screening measures ensure that the companies included in the index boast strong fundamentals and tremendous growth potential.

3. IPO Fast Entry

The Hang Seng TECH Index has a unique IPO fast entry mechanism to prepare for the homecoming of foreign-listed Chinese companies and the new listing of Chinese “unicorns” in HKEx. The rule enables sizable newly listed technology companies to be included in the index in a timely manner without the need to wait until the quarterly review.

The newly listed security will be added to the index if its full market capitalisation ranks within the top 10 holdings of the existing constituents on its first trading day.

With this mechanism in place, the index will be able to capture potential investment appreciation opportunities brought about by the listing of Chinese concept stocks in HKEx. To illustrate, JD.com and Netease have joined the index via the fast entry mechanism.

China has the world’s largest number of “unicorns” with Ant Financial topping the list at a valuation of USD 150 billion.1 The possibility of these start-ups listing in HKEx has the potential to further boost the Hang Seng TECH Index.

It is believed that under the prevailing listing trend of Chinese” unicorns”, the index will enjoy even greater room for growth.

Exchange Traded Funds

Investors can gain exposure to the Hang Seng TECH Index by buying its selected component stocks. However, there is a minimum lot size for each stock ticker listed in HKEx and the investment amount can be substantial for investors using this tactic.

For example, it will cost investors more than HKD 100,000 / USD 13,000 just to invest in one lot for each of the top five constituents in the index.

A more cost-effective solution is to utilise Exchange Traded Funds (ETFs) as investment vehicle. There are several ETFs listed in HKEx that tracks the Hang Seng TECH Index and the minimum investment amount can be as low as a few thousand HKD.

The ETFs will also be rebalanced on a quarterly basis and/or whenever a new stock listing qualifies for inclusion under the IPO Fast Entry mechanism. The management fees and transaction costs are already factored into the Total Expense Ratio of the ETFs, which save time and costs for investors.

| ETF | CSOP Hang Seng TECH Index ETF | ChinaAMC Hang Seng TECH Index ETF | Hang Seng TECH Index ETF | iShares Hang Seng TECH ETF |

| Ticker | 3033 | 3088(HKD)9088(USD) | 3032 | 3067(HKD)9067(USD) |

| Exchange | HKEx | HKEx | HKEx | HKEx |

| AUM | HKD 4.32 billion | HKD 399.59 million | HKD 301.15 million | HKD 994.42 million |

| Expense Ratio | ~1.05% | ~0.60% | ~0.87% | 0.25% |

| Number of Holdings | 30 | 30 | 30 | 30 |

| Minimum Board Lot Size | 200 | 200 | 200 | 100 |

| Top 3 Holdings |

|

|

|

|

ETF information is accurate as of 17 September 2020.

Conclusion

China has emerged on the world stage with a number of tech companies. However, there are over 200 Chinese “unicorns” that are yet to be publicly-listed in exchanges. The rising U.S.-China tension will inevitably cause these privately-held companies to seek listing in HKEx and China exchanges.

The increasing number of potential IPO in HKEx featuring tech “unicorns” can uplift HKEx’s offerings and enhance the Hang Seng TECH Index.

Investors can capture the diversification benefit and growth potential of Hang Seng TECH Index via the ETFs that track the index.

For a more detailed write-up on China’s Internet and Technology industry, you may visit “Rise of the China Internet Dragons“.

Reference:

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Joel Lim

ETF Specialist

Joel is the ETF Specialist from the ETF desk in Phillip Securities. He helps to provide sales support and trading ideas to retail investors, remisiers, in-house dealers, and fund managers. Joel also works closely with ETF issuers on new product and business development projects.

Gold ETFs for Singapore Retail Investors: Diversification and Inflation Protection

Gold ETFs for Singapore Retail Investors: Diversification and Inflation Protection  ETF Market Review: February Outlook Signals Strong Performance

ETF Market Review: February Outlook Signals Strong Performance  ETF Market Analysis: Oil & Hang Seng Set for January Gains

ETF Market Analysis: Oil & Hang Seng Set for January Gains  Buffer ETFs — What Are They and How Do They Work?

Buffer ETFs — What Are They and How Do They Work?