3 Takeaways on Grab’s SPAC IPO April 27, 2021

Singapore-based Grab and Southeast Asia’s most valuable unicorn backed by SoftBank is set to finalise its listing in New York. This is said to be the biggest-ever US listing through a SPAC or special purpose acquisition company, if successful. SPACs are shell companies that help private companies list without going through the traditional IPO process.

Before listing, Grab will first merge with Altimeter Growth Corp. (AGC.US), the SPAC, in a deal that is valued at US$40bn. This is expected to close in July. Altimeter has committed to a 3-year lockup period on its sponsor shares.

Grab will trade on Nasdaq under the ticker, “GRAB”.

Here’s the lowdown on Grab’s IPO #PhillipIPOWatch:

1. Super-app Grab

Grab was founded in 2012 with the mission to drive Southeast Asia forward by creating economic empowerment for everyone. It offers an array of services, from transportation to food, grocery and parcel deliveries. In recent times, it has gone into digital payment services via its all-in-one app. Grab’s taxi, private-hire, GrabHitch and other services can be found in 400 cities in eight countries: Singapore, Malaysia, the Philippines, India, Thailand, Vietnam Indonesia and Cambodia.

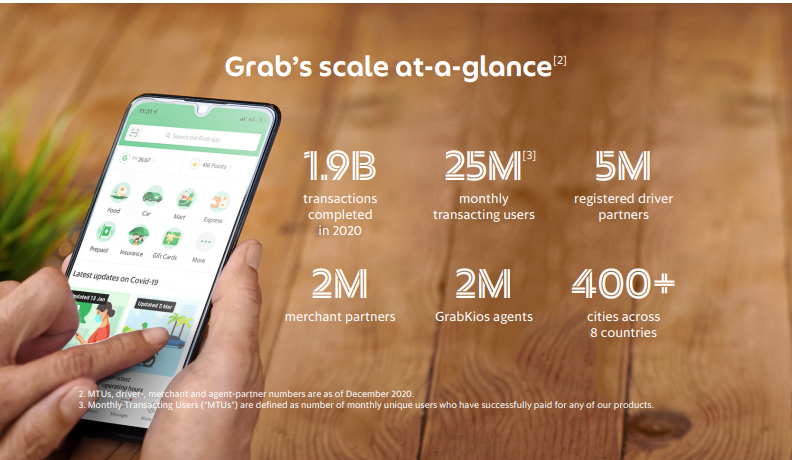

Grab’s acquisition of Uber’s Southeast Asian businesses thrust it into the global spotlight in 2018. By 2020, it had 25m monthly users who completed 1.9bn transactions. Grab partners 5m registered drivers, 2m merchant partners and 2m GrabKios agents. It takes pole position in food delivery, mobility and digital-wallet payments by gross merchandise value in Southeast Asia. Gross merchandise value is used in the online retail industry to indicate total merchandise sold through a marketplace.

With one swipe, Grab’s users can tap its super app to hire anything that rides on wheels, including taxis, private cars, bicycles and bike taxis. As Grab has forayed into multiple consumer services such as hotel booking, on-demand video streaming and ticket purchasing, these services have also been launched on its super app. Grab clearly intends to meet more and more of its users’ everyday needs.

Source: Grab

2. Grab’s profitability target

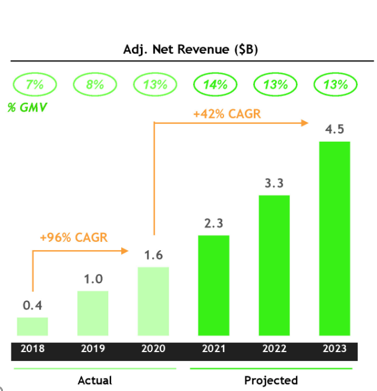

Grab’s adjusted net revenue was US$1.6bn in 2020, up 70% YoY. This was during the pandemic, when ride-hailing practically dried up and delivery services had to come to the rescue.

Deliveries

Mobility

Source: Form 8-K Altimeter Growth Corporation

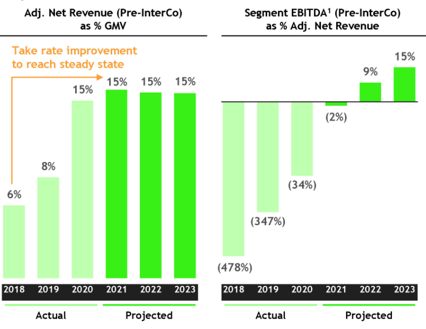

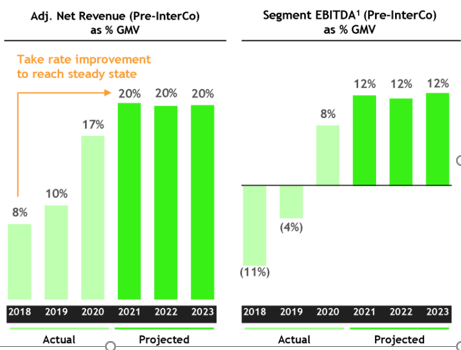

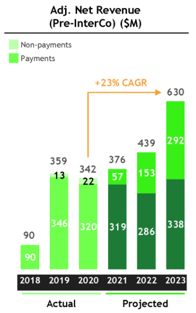

Grab’s delivery services, in fact, have been growing the fastest since 2018, by a CAGR of 203%. The next to follow was financial services, with a 102% CAGR. Financial services are set to grow the fastest in the next three years, as new businesses like merchant working-capital loans and driver insurance gain traction.

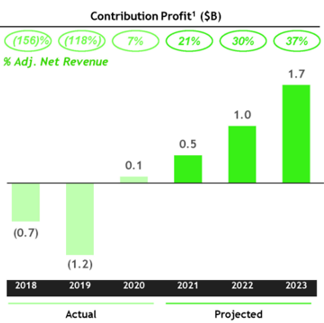

In terms of profitability, mobility – Grab’s original ride-hailing business that put it on the map – started achieving positive EBITDA in Q4 2019. Delivery is expected to break even at the EBITDA level in the second half of this year.

Grab expects its net revenue to rise to US$4.5bn in 2023, which would help turn the group profitable at the EBITDA level.

But according to Tech In Asia:

Grab’s EBITDA margin in 2020 was -47%. Uber’s EBITDA margin in 2018 – the last full year before its US listing in 2019 – was -18%.

To reach profitability in 2023, Tech In Asia believes Grab would have to scale up its financial services significantly and improve its mobility and delivery margins.

Deliveries

Mobility

Financial Services

Source: Form 8-K Altimeter Growth Corp

3. Grab’s unique selling points

a. Large mobile user base

In a 2020 report, Google, Temasek and Bain & Co. estimated that Internet users in Southeast Asia had reached 400m. This user base was responsible for bumping up online gross merchandise value to US$100bn. Food delivery, e-commerce, online payments, online media and ride-hailing took the lead. As a super app combining multiple consumer services, Grab has been able to tap this user base effectively.

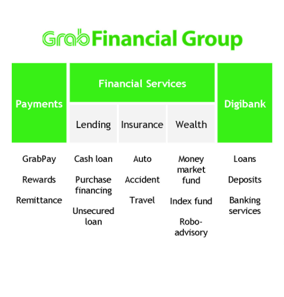

b. Digital banking licence in Singapore

Grab teamed up with Singtel to pick up a prized digital banking licence in Singapore in 2020. Grab has been driving innovation in financial services with its GrabPay, GrabInsure and GrabFinance. Today, it has extended to Pay Later, a post-paid and instalment service for people to pay for Grab services at month-end without additional interest or costs.

Users have been reaping the benefits and convenience of Grab’s core service: ride-hailing. These include easy booking, insured drivers, rider ratings and confirmed waiting time. First and foremost, Grab ensures reliability by making sure its drivers are licensed and insured. Its 5m driver partners are bound by its terms and conditions. These include the need to register as a local business, convert cars to commercial usage, sign up in person and purchase insurance to cover passengers and their belongings. Second, Grab charges flat rates upfront before a ride starts. This enables customers to choose the best ride. Third, Grab provides a rating platform for customers to offer feedback after their rides.

Why watch this IPO?

Grab is Southeast Asia’s biggest start-up heading for a bumper US listing.

Grab will go public in New York in partnership with Altimeter Growth Corp.

Altimeter Growth Corp. is the Nasdaq-listed (AGC.US) special purpose acquisition company of Silicon Valley venture-capital firm, Altimeter Capital Management. Altimeter Capital manages over US$15bn of assets.

While SPACs are not new, they’ve become hot investment vehicles on Wall Street in recent times. They’ve also been making inroads in Asia, with six regional-focused SPACs collectively raising US$2.7bn so far in 2021.

To sum up, Grab is looking for a way to achieve sustainable growth in the digital economy. There remain risks that the deal might not go through, as the SPAC merger is still subject to regulatory approval. Grab is separately considering a secondary listing on the SGX, closer to home.

With such a high-profile listing, we can be sure of more exciting developments. Stay tuned as we bring you updates nearer its listing date!

Trade US shares on POEMS from US$1.88 flat with no platform fees or foreign custody fees from now till 31 December 2021! This promotion is only applicable to Cash Plus Accounts. Open an account online here today if you do not have one!

For more information on US markets, please visit: https://globalmarkets.poems.com.sg/markets-we-offer/united-states-nyse-nyse-mkt-nasdaq/

Have a view on the above? Join our global investment community on Telegram and share your thoughts with us today!

Follow #PhillipIPOWatch market series for more upcoming IPOs.

Sources:

1. https://www.cnbc.com/2020/11/10/southeast-asia-40-million-new-internet-users-in-2020-report-finds.html

2. https://www.grab.com/sg/press/others/grab-go-public-in-partnership-with-altimeter/

3. https://www.techedt.com/everything-you-need-to-know-about-grab/

4. https://www.straitstimes.com/business/companies-markets/grabs-bumper-us-listing-what-you-need-to-know-about-south-east-asias

5. https://www.sec.gov/Archives/edgar/data/1823340/000114036121012518/nt10022857x2_ex99-2.htm

6. https://www.businesstimes.com.sg/companies-markets/grab-mulls-secondary-listing-in-singapore-home-market-sources

7. https://www.reuters.com/business/finance/grab-southeast-asias-biggest-startup-set-bumper-us-listing-2021-04-13/

8. https://www.cnbc.com/2021/03/26/spacs-growing-interest-in-asia-toward-blank-check-companies.html

9. https://www.grab.com/sg/press/tech-product/grab-introduces-four-new-services-in-singapore-in-its-super-app/

10. https://www.techinasia.com/learned-grabs-latest-financials

11. https://www.bain.com/insights/e-conomy-sea-2020/

12. https://www.ig.com/en/news-and-trade-ideas/grab-to-list-in-the-us-via-largest-ever-blank-cheque-deal-210409

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Yanlin Fan

Equities Dealer

Yanlin graduated from Nanyang Technological University in 2019 with a master’s Degree in Accountancy. She is an Equity Dealer in the Global Markets Team and specialized in HK, US, SG, and China markets.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!