3 Ways to Invest During Inflation August 11, 2021

At a glance:

- Rising inflation has taken markets by surprise. While the Fed may label it as transitory, there is evidence of more persistent drivers of the price surge.

- Gold is a traditional inflation hedge but studies show it yields mixed results. Gold tends to underperform in times of inflation and appears more effective for longer-term hedging.

- Commodities such as industrial metals can be more effective, especially if inflation is partly fuelled by economic expansion. Commodities are also expected to benefit from President Biden’s infrastructure bill.

- TIPS are another inflation hedge as they are indexed to inflation. Their principal value and coupon payments rise and fall with inflation. The downside is they are expensive and their returns may underperform conventional securities.

We have come to the third and last part of our series on inflation.

In this final part, we look at the different ways to hedge inflation: gold, which is the traditional hedge; commodities such as industrial metals; and Treasury Inflation-Protected Securities known as TIPS.

This article includes ETFs that provide exposure to the above asset classes.

Without doubt, the biggest question on investors’ minds this year has been inflation. As reported by CNBC1, the latest US Consumer Price Index rose 5% YoY in May, its highest since the summer of 2008 when oil prices skyrocketed.

Excluding food and energy, core CPI rose 3.8%. This was its fastest clip since 1992. A third of the increase was attributed to a sharp 7.3% jump in used-car and truck prices.

Fed officials have assured markets that the inflation is temporary. Elevated prices are said to be due to pent-up demand and supply-chain lags. Last year’s weak inflation also provided a low base for comparison, when the economy was mostly shut down due to the pandemic.

But the latest data from the Bureau of Labour Statistics also indicated that 850,000 Americans found work in June. This was higher than the Wall Street’s estimate of 720,000 and May’s revised number of 583,000. June’s reading was also above the “whisper number” of 800,0002 – the unofficial true position in the market.

Non-farm payrolls are analysed closely for trends in economic growth and inflation. If non-farm payrolls are expanding, the economy is likely growing. If the expansion is strong, this will almost certainly increase inflation and may be viewed negatively for the economy.

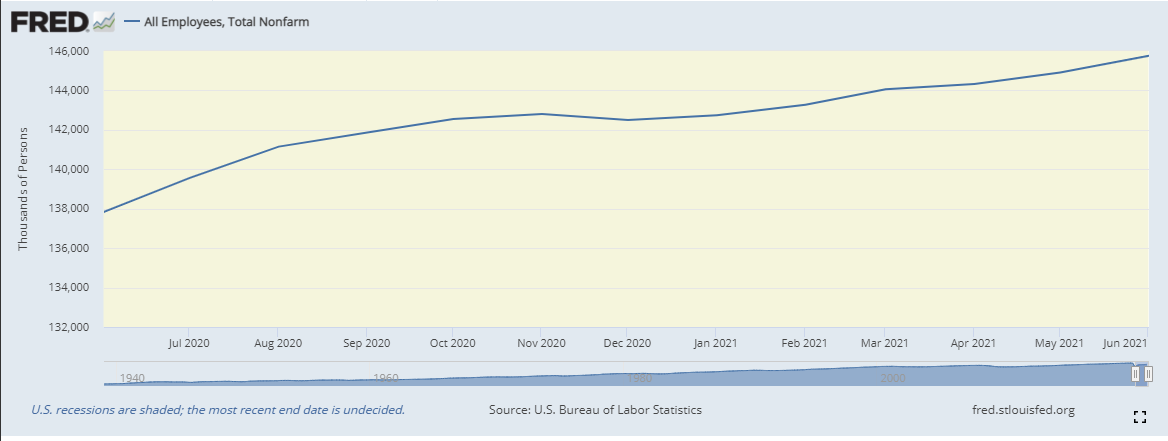

While domestic employment has been erratic so far this year, the trend is unmistakeably up. This can be seen in the chart below from the US Bureau of Labour Statistics.

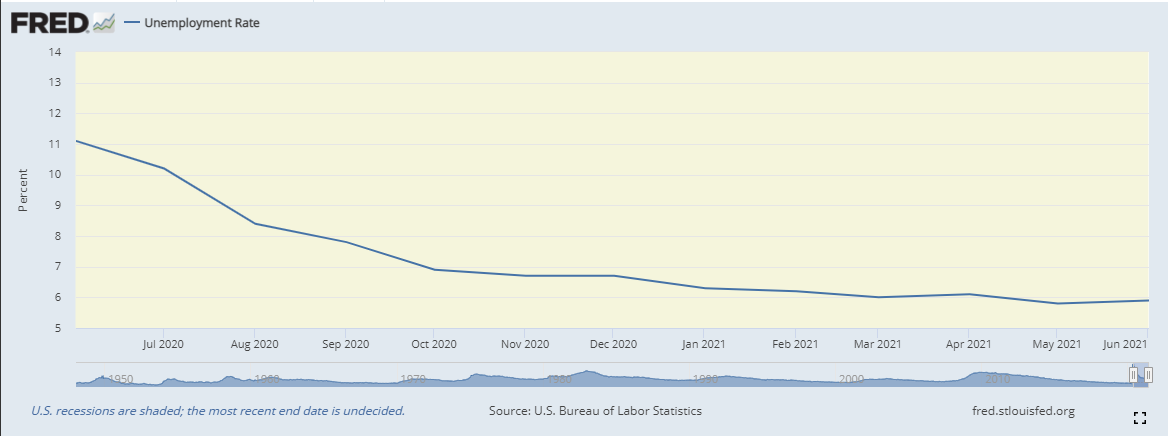

Unemployment is also noticeably lower, as shown in the chart below.

Any divergence between non-farm payrolls and unemployment is favourable, indicative of stronger economic prospects.

Unlike commodity prices which can rise and fall more rapidly, wages are much more “stickier”. As the economy improves and employers compete aggressively for workers, they inevitably offer higher wages.

Wage growth in the first quarter, when employers were struggling to find workers, was 3%, the strongest rise since the 1990s.4

Even now, with the threat of the pandemic dwindling on the back of vaccinations, companies are still finding it difficult to hire workers. All sectors face the same problem. As workers earn more, they have more spending power. This fuels inflation. And once wages rise, they are hard to reduce, unlike commodity prices that can rise and fall much more fluidly and quickly.

Through quantitative easing, the Fed has also flooded financial systems with trillions of dollars since the pandemic started.5 Tantamount to printing money, quantitative easing’s biggest risk is inflation. As the supply of dollars increases, the extra dollars chase after the same amount of goods and services, driving up prices.

Even if inflation is explained away by Fed officials as transitory, other important economic indicators such as non-farm payrolls, wage growth and money supply may tell us that inflation is creeping up on us.

What is inflation?

Inflation is a general rise in the prices of services and goods, resulting in a fall in the value of money.

Inflation is accompanied by a decline in purchasing power overtime. The rise in prices, often expressed as a percentage, means that a unit of currency can buy less than it did before.

3 assets to protect against inflation

So how best can you protect your portfolio against inflation? What are the best investments during inflation?

There are generally three strategies to cope with inflation.

1. Gold

For centuries, the answer to inflation has been hedging with gold. Gold used to perform well when inflation was high, holding its value even in countries where inflation soared to the double digits, according to a study by academics Elroy Dimson, Paul Marsh and Mike Staunton for Credit Suisse8.

This year, however, the price of gold has fallen even as inflation doubled from 1.3% to 2.6%9.

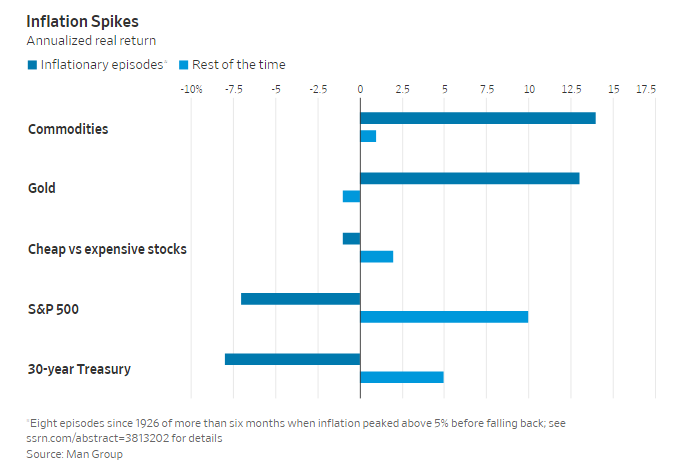

The chart below indicates that only during periods when inflation peaked above 5% for more than six months did gold shine. At other times when inflation was tamer, stocks and 30-year Treasuries fared much better10. Another problem with gold is that it does not provide income, either in normal times or during inflation.

Remember also that the Fed’s go-to solution to combat inflation is to increase interest rates11. Investors will need to factor in the opportunity cost of holding gold as interest rates rise against holding cash, bonds and stocks. They may miss out on higher interest payments and dividends.

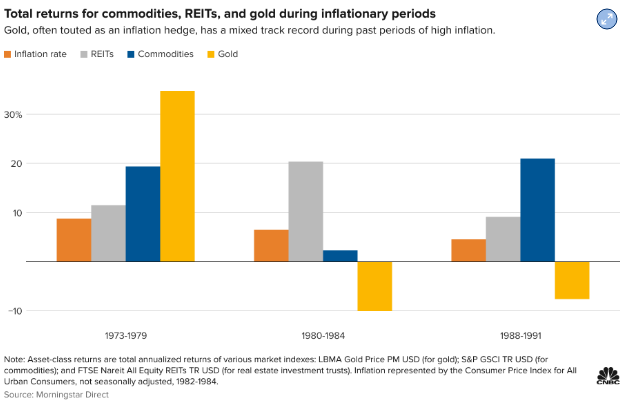

According to Amy Arnott, a portfolio strategist at Morningstar, investors who are worried about rising consumer prices may consider asset classes other than gold.12

In her analysis, gold investors lost 10% on average from 1980 to 1984, when the annual inflation rate was about 6.5%.

Similarly, gold yielded a negative 7.6% return from 1988 to 1981, when inflation was about 4.6%.

However, investors won big from 1973 to 1979, when the annual inflation rate averaged 8.8% and gold returned a whopping 35%. This was during an unprecedented oil crisis.

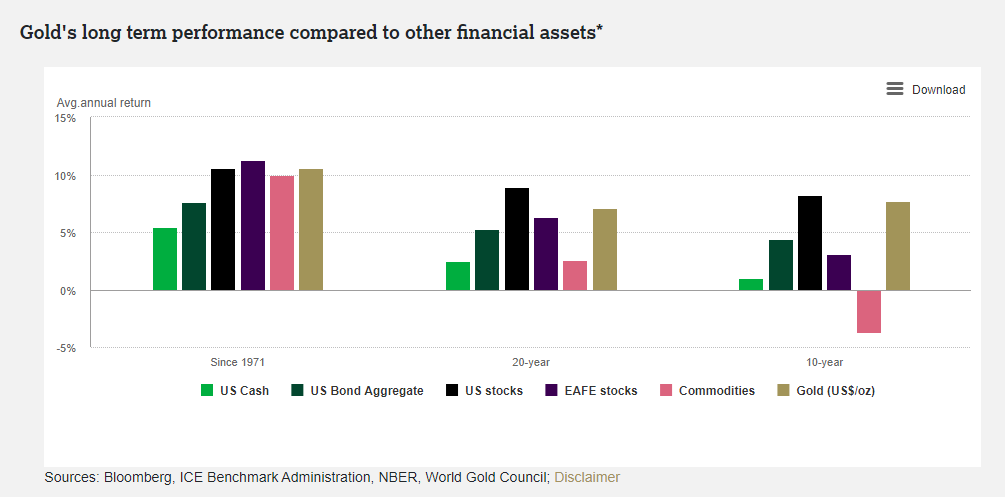

Regardless of its mixed results, gold is still widely viewed as a reliable and time-tested inflation hedge for the longer term. In a World Gold Council report13, gold is said to have delivered positive returns over the long run, outperforming major asset classes over 10 , 20 and 50 years.

Investors who are interested in gold can look at ETFs such as GLD and IAU. The table at the end of this article also includes an ETF that offers 2x daily leverage to gold prices, for hedging against inflation.

You may read more on gold in our previous articles on Gold in the Post-COVID World and 4 Reasons to Buy Gold.

2. Commodities: Industrial metals

From steel and copper to corn and lumber, commodities started the year with a bang. They have surged to levels not seen in years14. This rally threatens to raise the cost of goods from your regular sandwich to major infrastructure construction. With the U.S economy pumped up on fiscal and monetary stimuli and Europe’s economy starting to reopen as its vaccination rollout shifts to high gear, there is little chance the direction will reverse anytime soon.

Inflation means rising prices and commodity prices usually rise the most, as it takes a long time to build new capacity to satisfy demand. Copper and oil are up more than 30% this year15. Lumber prices have almost doubled16. The stocks of global mining companies and oil majors have strongly beaten market indices.

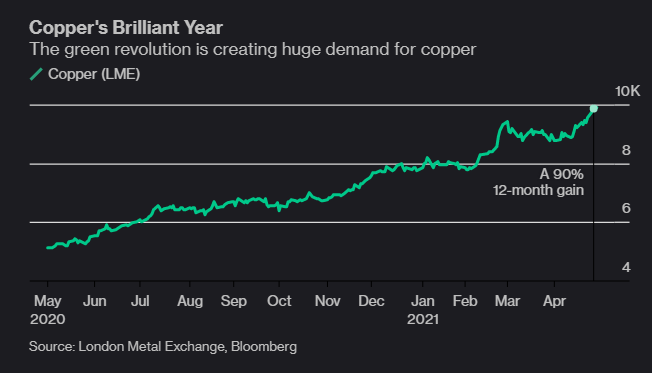

Copper, particularly, has been rallying for more than a year. This is thanks to pledges made by governments to boost renewable energy and electric-vehicle usage. That makes all forms of green technology that rely on metals more expensive.

Additionally, about 1.9mn tonnes of copper were used to build electricity networks in 202017. This led to a more-than-90% increase in the price of the red metal. Copper usage will almost double by 2050, supported by demand from other low-carbon technologies like electric vehicles and solar panels.

US President Joe Biden’s plan to rebuild infrastructure is expected to generate further demand. Electricity grids, railways and building refurbishments are among the items on his shopping list that will use up large amounts of industrial metals.

Consultancy CRU estimates that the Biden programme will add 5mn tonnes of steel to the existing 8mn the US uses each year, with similar boosts to aluminium and copper demand18.

Adding commodities such as industrial metals via ETFs is thus one way of protecting your portfolio against inflation.

The table at the end of this article includes two industrial/copper ETFs, DBB and CPER, that provide exposure to industrial metals.

3. TIPS: Treasury Inflation-Protected Securities

TIPS are US government securities that account for inflation. They are inflation-protected bonds whose principal value rises when there is inflation and falls when there is deflation. They pay interest twice a year at fixed rates, which are applied to the adjusted principal. These interest payments increase with inflation and decrease with deflation19.

Unfortunately, they are expensive. Ten-year TIPS pay below 0.8% to 0.9% of inflation and TIPS usually pay lower interest rates than other government or corporate securities.20 Inflation needs to rise at least more than 0.8-0.9% over the decade just so that you can maintain your purchasing power. If inflation fears pick up, TIPS prices are likely to rise as more people buy them.

If inflation is lower than expected, returns from conventional non-inflation-indexed bonds may be better. Even though TIPS are a well-known inflation hedge, because their yields are so low, they may not be as appealing.

Investors who want to diversify their portfolios during inflation may do so via TIPS ETFs.

Putting it all together: Inflation hedges to consider

One of the biggest problems investors face today is how to create a portfolio that will safeguard against inflation and yet not lose out if the Fed raises interest rates to kill inflation.

Investors will need to evaluate which inflation hedges or stocks will best meet their needs. The three strategies described above have their own merits and demerits.

Please refer to the table below for related ETFs you may be interested in.

Sophisticated traders looking for leveraged exposure to gold via a gold futures ETF may consider UGL’s 2x Long Gold ETF.

Do note that leveraged ETFs are not suitable for beginners and retail investors as losses will be magnified as well. Leveraged ETFs are also not meant to be held for the long term as daily rebalancing comes with added costs. The added costs can be significant over longer periods of time in very volatile markets.

Read here to find out more about leveraged and inverse ETFs.

Gold ETFs:

| Ticker | TOTAL ASSETS | AVERAGE VOLUME | EXPENSE RATIO | INCEPTION DATE | NAV on 8 Jul 2021 | LEVERAGE | PHYSICAL COMMODITIES |

| GLD (US) | US$59.85bn | 8.75mn | 0.4% | 18 Nov 2004 | US$168.90 | NO | YES |

| IAU (US) | US$28.7bn | 11.22mn | 0.25% | 28 Jan 2005 | US$34.36 | NO | YES |

| SGOL (US) | US$2.38bn | 1.03mn | 0.17% | 9 Sep 2009 | US$17.33 | NO | YES |

| UGL (US) | US$24.87mn | 145K | 0.95% | 3 Dec 2008 | US$59.26 | 2x | NO |

Industrial metal ETFs:

| Ticker | TOTAL ASSETS | AVERAGE VOLUME | EXPENSE RATIO | INCEPTION DATE | NAV on 8 Jul 2021 | LEVERAGE | PHYSICAL COMMODITIES |

| DBB | US$382.4mn | 343.756K | 0.84% | 5 Jan 2007 | US$20.190 | NO | NO |

| CPER | US$305.56mn | 396.07K | 0.8% | 15 Nov 2011 | US$26.50 | NO | NO |

TIPS ETFs:

| Ticker | TOTAL ASSETS | AVERAGE VOLUME | EXPENSE RATIO | INCEPTION DATE | NAV on 8 Jul 2021 | LEVERAGE | REPLICATION OF THE CASH FLOWS OF TREASURY BONDS |

| TIP | US$28.241bn | 3.06mn | 0.19% | 5 Dec 2003 | US$127.96 | NO | OPTIMISED |

| SCHP | US$18.608bn | 2.48mn | 0.05% | 5 Aug 2010 | US$62.63 | NO | FULL |

| VTIP | US$15.06bn | 2.32mn | 0.05% | 16 Oct 2012 | US$51.95 | NO | FULL |

Source: Bloomberg, 8 July 2021

Like what you have read? Join our Global Markets Investment Community on Telegram to share your thoughts with us and other like-minded investors!

Reference:

- [1]https://www.cnbc.com/2021/06/10/inflation-hotter-than-expected-but-transitory-wont-affect-fed-policy.html

- [2]https://www.reuters.com/business/us-job-growth-picks-up-june-unemployment-rate-rises-59-2021-07-02/

- [4]https://www.cnbc.com/2021/05/22/wages-rise-at-the-fastest-pace-in-years-firms-profits-could-take-a-hit.html

- [5]https://www.statista.com/statistics/1121416/quantitative-easing-fed-balance-sheet-coronavirus/

- [8]https://www.credit-suisse.com/media/assets/corporate/docs/about-us/research/publications/credit-suisse-global-investment-returns-yearbook-2021-summary-edition.pdf

- [9]https://www.wsj.com/articles/gold-falters-on-brightening-economic-outlook-11617269503?mod=article_inline

- [10]https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3813202

- [11]https://www.federalreserve.gov/faqs/money_12856.htm

- [12]https://www.cnbc.com/2021/06/08/gold-as-an-inflation-hedge-history-suggests-otherwise.html

- [13]https://www.gold.org/what-we-do/gold-investment/why-invest-in-gold/gold-as-an-investment

- [14]https://www.wsj.com/articles/commodity-price-surges-add-to-inflation-fears-11623079860

- [15]https://www.wsj.com/articles/bets-on-economic-rebound-push-copper-prices-to-record-high-11620384716?mod=article_inline

- [16]https://www.wsj.com/articles/record-lumber-prices-lift-sawmills-while-homeowners-do-it-yourselfers-pay-up-11620034201?mod=article_inline

- [17]https://www.livemint.com/market/commodities/why-prices-of-commodities-from-metals-to-food-are-soaring-11619857342043.html

- [18]https://www.crugroup.com/knowledge-and-insights/insights/2021/electric-vehicles-renewables-and-covid-19-what-next-for-base-metals-demand/

- [19]https://www.investopedia.com/terms/t/tips.asp

- [20]https://www.wsj.com/articles/investors-stay-hungry-for-inflation-protected-bonds-11619461270?mod=article_inline

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Lee Yong Heng (Dealer) & Roger Chan (Manager)

Yong Heng joined Phillip Securities in June 2020 this year as an Equity Dealer in the Global Markets Team. He specializes in the US and Canada markets assisting clients and also supports the UK and Europe markets. Yong Heng graduated with First Class Honours from Singapore Institute of Management, University of London (SIM-GE) in 2015 with a Bachelor’s Degree in Economics & Finance. He also completed his CFA studies last year.

Roger holds a Business Degree in Electronic Commerce from the Monash University and is also the recipient of the Golden Key Scholarship Award for outstanding academic performance. He currently heads the Global Markets Night Trading team assisting clients with the US and European markets.

Prior to the night desk, he was a bond trader at the Debt Capital Markets desk and brings with him a wealth of equity and debt market knowledge.

Outside work, he trains and is an active competitor in the martial art of Brazilian Jiu-Jitsu. He finishes at the podium frequently and is also the 2015 Pan Asian BJJFP champion. His other interests include chess and reading.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!