4 Things to know about Trip.com’s IPO April 28, 2021

At a glance:

- China travel titan Trip.com is set to raise US$1.1bn in a secondary listing in Hong Kong on 19 April, offering shares at HK$268 a share.

- Trip.com is one of the biggest one-stop global travel platforms with a 2.3% market share. It is also the largest online travel agency in China, with a 13.7% market share.

- Effective containment of COVID-19 and vaccine rollout have kickstarted the global recovery and China’s travel business. Trip is expected to benefit.

Nasdaq-listed and Shanghai-based China travel firm Trip.com is en route to a secondary listing in Hong Kong, backed by China’s Internet behemoth, Baidu (BIDU.com). With an IPO valuation of more than US$1bn, Trip will be offering 31.6m shares at HK$268 each to raise US$1.1bn. Proceeds will be used to fund business expansion and technology improvements. Trading will start on 19 April under the stock code “9961”.

Here’s the lowdown on Trip.com #PhillipIPOWatch:

1. Largest online travel agency in China, one of the largest one-stop travel platforms globally

Trip.com operates online travel agencies such as Trip.com, Qunar, Skyscanner and Ctrip. Listed on Nasdaq in 2003, Trip.com has a Nasdaq market cap of around US$23.8b. With more than 400m members, it is one of the leading online travel service providers in the world. It accounts for 2.3% of the global online travel service market and 13.7% of China’s travel agency market. Services include the booking of flights, accommodation, car rental, airport transfers, train tickets, packaged tours and other forms of transportation and travel-related services. Trip provides access to more than 1.4m hotels in 200 countries and regions and more than 2m flight routes connecting over 5,000 cities around the world.

Trip.com primarily targets the Chinese market, both domestic and international travellers. The bulk of its sales are from Shanghai, Beijing, Shenzhen and Guangzhou. In recent years, Trip.com has forged strategic partnerships to extend its global reach and enrich its offerings to outbound Chinese customers, including TripAdvisor.

2. Return of travel, kickstarted by China

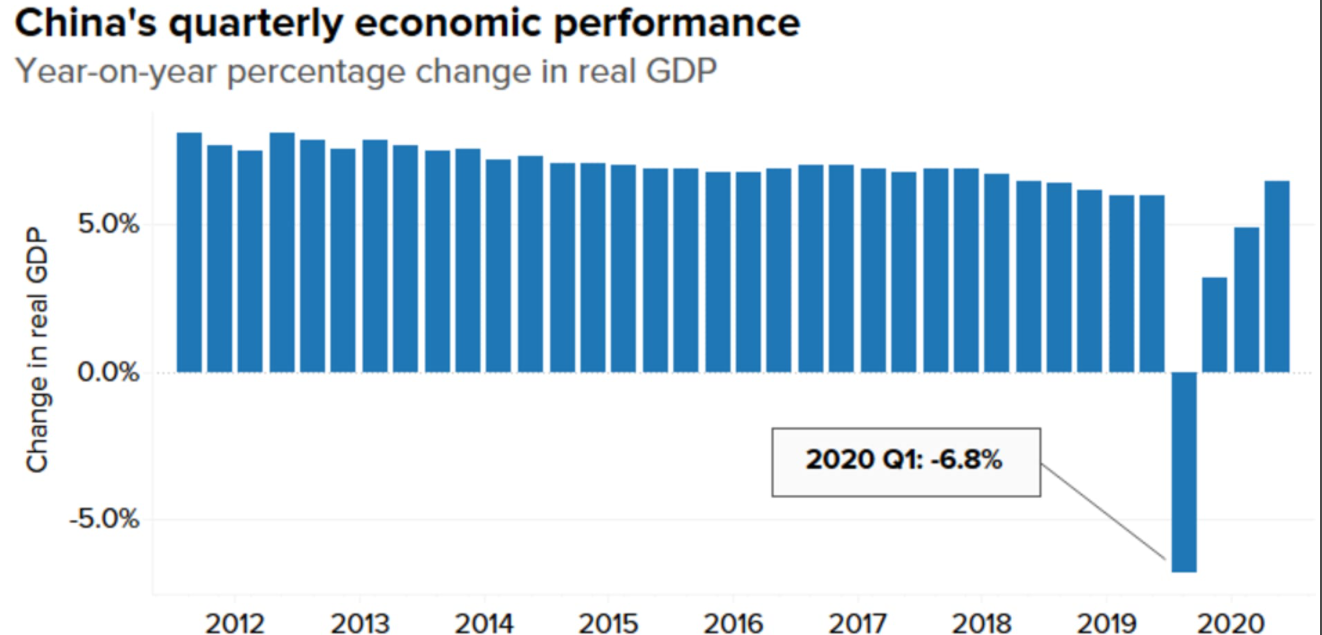

The Chinese government and rest of world are optimistic about the pace and scope of the economic recovery, given the unprecedented speed of COVID-19 vaccine development. China staged an impressive recovery in 2020, growing 2.3% despite long lockdowns in the first quarter. Its recovery is V-shaped and the IMF is projecting that its economy will grow by 8.1% in 2021.

Source: National Bureau of Statistics of China

As a sign of the recovery, Trip.com’s recent travel data shows total bookings on its platforms increasing 300% YoY during the Qingming Festival. Bookings in multiple business areas spiked for the first time this year.

China has become the biggest global travel market by number of domestic and inbound trips. The total deal value amounted to US$6.3bn in 2019 when the market size of domestic and inbound travel in China was US$1tr, which accounts for 18% of the global travel market.

The China Tourism Academy expects China’s domestic travel to rebound by 42% to 4.1bn domestic tourist trips this year. Domestic tourism revenue is expected to increase 48% to RMB3.3tr or US$511bn. The Academy also expects international travel to recover to about 30% of pre-pandemic levels in the second half of 2021. Although outbound travel is expected to restart, Chinese tourists still appear to prefer domestic travel.

3. Steady financial progress, before COVID-19

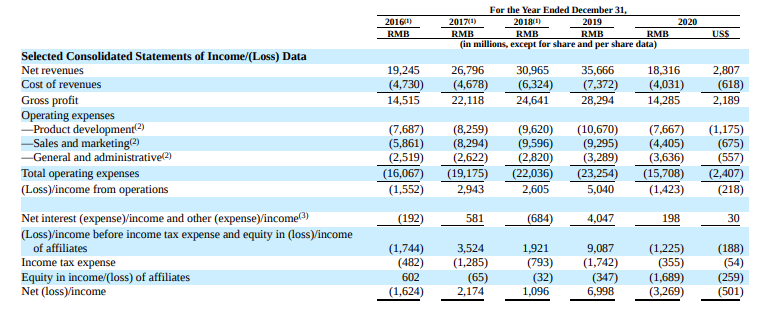

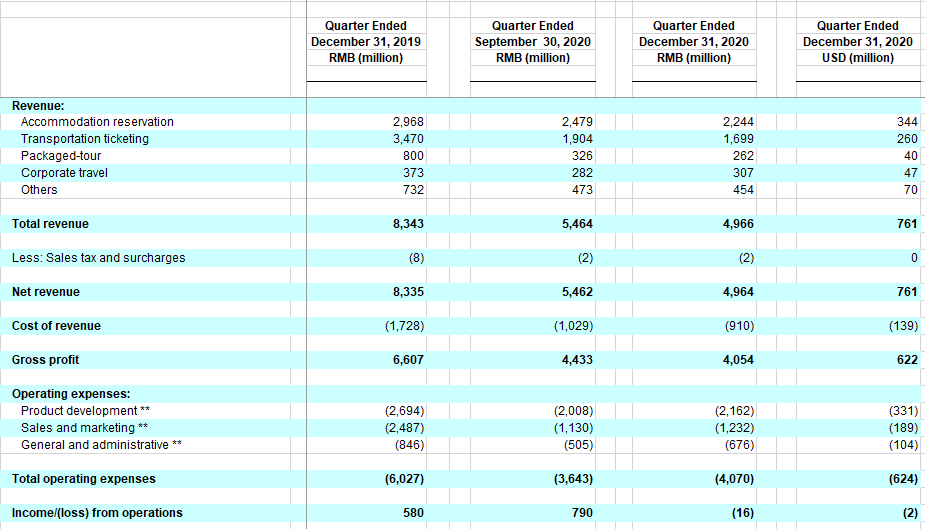

Before 2020, Trip.com was making steady financial progress. Revenue grew 60% from US$2.9bn in 2016 to almost US$4.5bn in 2018. This was largely powered by three divisions: accommodation reservation, transportation ticketing and packaged tours. By 2019, Trip.com’s revenue had reached US$5.12bn. Before trouble struck, it was forecast to grow over 30% YoY to US$6bn in 2020.

COVID-19 plunged the entire travel industry into the doldrums. Trip.com reported revenue of US$2.8bn in 2020, down 40% from 2019. Its package-travel segment was the worst hit, with a 73% drop in revenue to US$40mn from 2019. Accommodation reservation, which accounted for 38% of revenue, was down 47%. Transportation ticketing, which accounted for 39% of revenue, skidded 49%. All in, Trip.com lost US$501m in 2020.

Source: Trip.com’s 2020 Annual Report

4. Challenges

- COVID-19 pandemicAs global travel nosedived last year, both international and domestic travel industry ground to a halt. Additional costs were also incurred when customers cancelled their bookings or requested for refunds. As a result, Trip.com suffered a loss of US$503.8m in 2020 vs. a profit of US$1.1bn in 2019. Effective containment of the virus in China, however, plus vaccine rollout and pent-up demand for travel are expected to lead to an industry recovery in 2022.

- Risk of expulsion from US exchangeThe Trump administration signed into law a Holding Foreign Companies Accountable Act in December 2020, primarily targeting Chinese tech companies. Under the Act, Chinese companies will be delisted from US exchanges if they do not comply with US auditing standards. As a Chinese tech company, Trip.com joins the recent exodus of Chinese companies heading for secondary listings in Hong Kong to hedge against possible expulsion from the US.

Why watch this IPO?

The global travel market contracted by more than 50% in 2020, to US$2.6tr from US$5.8tr in 2019. But the industry is expected to rebound to pre-pandemic levels in 2022.

The 17-year-old Trip.com is betting that it will be one of the beneficiaries, as a leading one-stop travel shop and one of the largest travel service providers.

https://sg.news.yahoo.com/trip-com-sets-shares-hk-025813329.html.

A potential return to profitability and plans to improve its technology and service offerings make this one of the IPOs to watch out for in 2021.

Interested to trade Trip.com’s new shares?

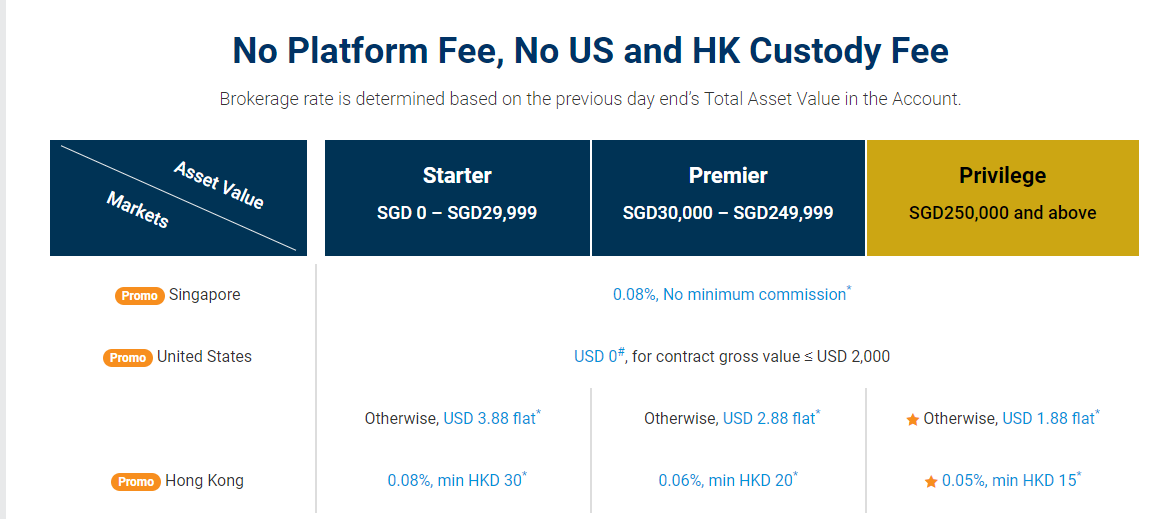

Good news! From now till 31 December 2021, trade Hong Kong shares on POEMS with commission fees as low as 0.05%, minimum HK$15* with no platform fees and foreign custody fees! The rate is applicable to Cash Plus Accounts only. Open an account online here if you do not yet have one with us!

For more information on Hong Kong trading, please visit:

https://globalmarkets.poems.com.sg/markets-we-offer/hong-kong-hkex/

https://globalmarkets.poems.com.sg/markets-we-offer/hong-kong-pre-ipo/

Have a view on the above? Join our global investment community on Telegram and share your thoughts with us today!

Follow #PhillipIPOWatch market series for more upcoming IPOs.

Reference:

1. https://investors.trip.com/static-files/08bd6175-f635-419c-9b88-f9f4eefe79ff

2. https://investors.trip.com/static-files/2c9deeb0-eafd-4d75-9f8d-87fe702a614f

3. https://www.phocuswire.com/Tripcom-Group-sees-out-2020-with-revenue-halved

4. https://asia.nikkei.com/Business/Markets/China-s-Trip.com-plans-1bn-Hong-Kong-secondary-listing#:~:text=Trip.com%20listed%20on%20the,is%20valued%20at%20%2423.8%20billion

5. https://www.cnbc.com/2021/01/18/china-economy-release-of-fourth-quarter-full-year-2020-gdp.html#:~:text=China%20says%20its%20economy%20grew,2020%2C%20but%20consumer%20spending%20fell&text=China%20reported%20GDP%20rose%202.3,National%20Bureau%20of%20Statistics%20showed

6. https://www.revfine.com/online-travel-agents/#online-travel-agents-your-hotel-should-be-working-with

7. https://investors.trip.com/news-releases/news-release-details/tripcom-group-and-tripadvisor-announce-strategic-partnership

8. https://www.chinatravelnews.com/article/143715

9. https://www.forbes.com/sites/greatspeculations/2020/02/10/how-soon-can-tripcoms-revenues-reach-the-6-billion-mark/?sh=36d8770e57e5

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Yanlin Fan

Equities Dealer

Yanlin graduated from Nanyang Technological University in 2019 with a master’s Degree in Accountancy. She is an Equity Dealer in the Global Markets Team and specialized in HK, US, SG, and China markets.

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth  Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition

Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition  United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability

United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability  CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile

CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile