5 Reasons Why You Should Buy US Stocks June 19, 2019

Pinpointing market tops is difficult. In recent years, market reports and commentaries from financial analysts to investment gurus have warned their readers and viewers about “how the US bull market is losing steam…”1, “how the US market correction is way overdue…”2 and that the “Trump Rally will eventually fail”.3

While Wall Street sceptics have been warning of a big drop for years, ironically, the US bull market keeps proving them wrong, and has risen almost 433.8 percent since March 2009.4

Even legendary investor George Soros was not spared losing money betting against the Trump rally. The Wall Street Journal had reported that the billionaire hedge fund manager lost nearly $1 billion betting that stock prices would decline in the wake of the November 8 election in 2016.5

Despite what the naysayers say about the US stock market, the facts and the track record clearly speak for themselves – you cannot afford not to be invested in the biggest stock market in the world. And if you are not invested in the US stock market, now might be an opportune time to examine some of the reasons to buy and invest in US stocks.

1. When You Buy US Listed Companies, You are Buying the World

Big US companies are a lot less dependent on the American economy than most investors believe. According to a USA Today report in 2017, the overseas market accounts for almost half (44.4%) of the sales of S&P companies. Many of the industries that the US lead in – such as technology, energy and heavy equipment makers in the industrial sector – obtain half or more of their total sales beyond U.S borders.6 In fact, many of the US listed companies are actually foreign companies themselves. An investor’s actual US exposure when investing in US listed securities is a lot less than one might think. When you purchase American stocks, you are effectively investing globally.

Now, why would that be important to an investor? Well for one, it makes a company more resilient when it comes to profit generation as they have multiple sources of income. Foreign economies where the companies have exposure to will help to pick up the slack if the US economy slows down.

According to a 2019 global market outlook report by Morgan Stanley, the investment bank issued a double upgrade for emerging markets, moving them from underweight to overweight. Their forecast calls for an 8% price return for the MSCI EM index in 2019. Looking to developed markets, the investment bank also has an overweight position on Japan, where the outlook calls for an 11% return for the benchmark Topix index, while the outlook for the US market estimates a 4% increase for the S&P 500.7

So when you are invested in US listed companies with presence in foreign economies, you stand to benefit from the foreign profit boost. However, if you don’t buy American stocks, you are missing out on opportunities globally.

Here are some of the most global companies listed on the US exchanges:

- Anheuser-Busch Inbev (BUD.US) is the world’s largest beer company. The company owns and produces hundreds of different beers around the world, including seven of the 10 biggest brands. Just how big is this mega-brewer? You may want to sit down before you read this: About one in every three beers drunk on the entire planet came out of an AB Inbev brewery.8

- Johnson & Johnson (JNJ.US) is one of the biggest innovators in the healthcare industry whose products are sold everywhere in the world. Best-known for consumer brands including Band-Aid and Tylenol, the healthcare giant is also a major medical device and pharmaceutical manufacturer.

- Procter & Gamble (PG.US) is one of the most valuable makers of branded consumer products in the world. The company’s most recognizable brands include Head & Shoulders, Olay, SK-II, Oral-B, Crest, Gillette, Pampers, Tide, and Vicks, but that’s just a handful of the more than 60 brands the company makes and sells in over 180 countries.

- Amazon (AMZN.US) is one of few companies to emerge from the late 1990s tech bubble a success. Amazon sells just about everything today, and tens of millions of people subscribe to its Prime membership program for free shipping, free TV, and free movie streaming. Amazon’s shares reached $2,000 per share in August 2018 for the first time. Shortly after, Morgan Stanley analysts raised their 12-month price target on Amazon to $2,500 from $1,850, putting the firm at an expected market cap of $1.2 trillion.

- Walt Disney Company (DIS.US) began as a cartoon and animation studio and has now become one of the biggest entertainment companies worldwide. It was formed by two brothers, Walt and Roy Disney on October 16th 1923. It is a reputable company that has provided entertainment to many families across the world for many years. Today it owns several television networks and theme parks, as well as blockbuster movie-producing arms like Pixar Animation Studios, Lucasfilm and Marvel Studios covering franchise brands like Star Wars and the Marvel Cinematic Universe.

- Visa (V) Corporation is a global payments technology company and works to enable consumers, businesses, banks and governments around the world to use digital currency. Electronic payments are only a small fraction of global transactions, but that’s quickly changing as mobile computing and the global middle class converge.

- Starbucks Corporation (SBUX.US) is an American coffee company and coffeehouse chain. The company was founded in Seattle, Washington in 1971. As of early 2019, the company operates over 30,000 locations worldwide.

2. The US is the Biggest Stock Market in the World

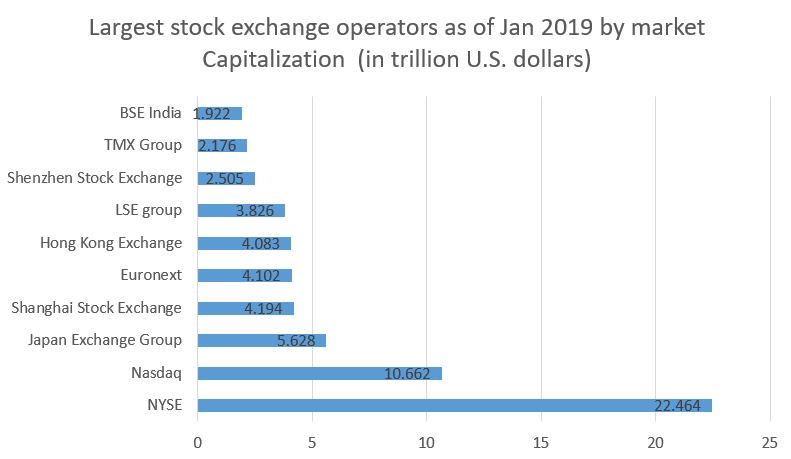

The chart below shows the largest stock market operators based on market capitalization.9

Chart 1: Largest Stock Exchange Operators by Market Capitalisation

Source: https://www.world-exchanges.org/our-work/statistics

Source: https://www.world-exchanges.org/our-work/statistics

As you can see, the US is the biggest market in the world. Why is this important?

The sheer size of its stock market naturally attracts the listings of some of the largest and most vibrant of companies. Why are these companies so sought after?

Well, there are a few reasons. Large-cap companies often have a reputation for producing quality goods and services, a history of consistent dividend payments, and steady growth. They are often dominant players within established industries, and their brand names likely familiar to the global audience. For example, Walmart (WMT.UK) – the world’s largest retailer – has consistently increased its dividends since 2014, keeping up with its 44-year streak of consecutive annual payouts.

Large global companies will always consider listing on the US exchanges first, because only the biggest markets will be able to support their capital-raising and trading needs. Additionally, the US exchanges are some of the most heavily regulated with the most stringent of checks and requirements.

3. Some US Sectors still Present Value

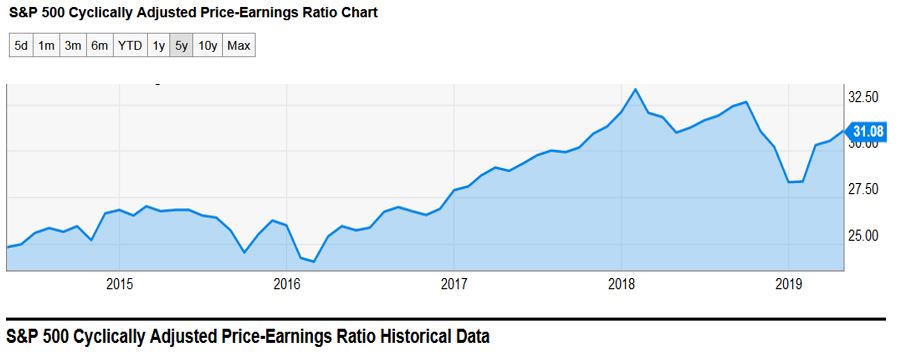

One of the best ways to measure market value is to use the cyclically adjusted price to earnings (CAPE) ratio. It’s a longer term inflation-adjusted measure that smooths out short-term volatilities to give a more comprehensive measure of market value.

As of April 2019, the chart below shows that the CAPE ratio for S&P 500 is at 31.08.

Chart 2: S&P 500 CAPE Ratio Historical Data

Source: https://ycharts.com/indicators/pe10

Source: https://ycharts.com/indicators/pe10

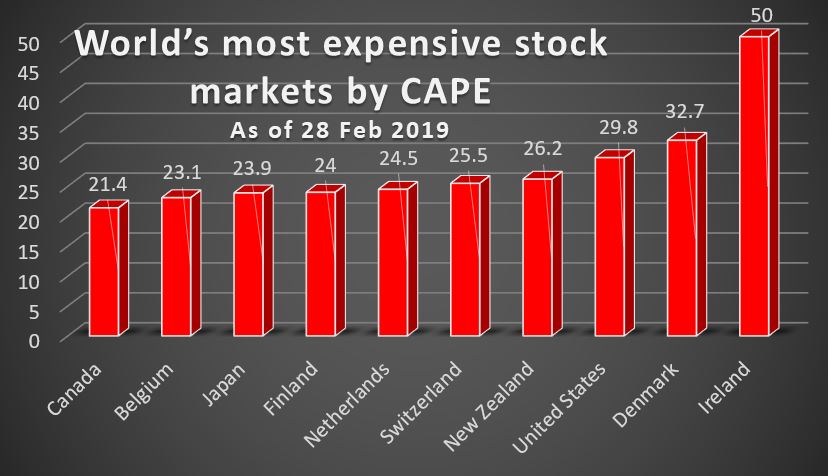

Comparing the US stock market with the rest of the world, you will see that it is relatively expensive. As of 28 February 2019, the US stock market ranks as the 3rd most expensive stock market by CAPE.

The Technology S-Curve and Rogers Adoption Curve

Chart 3: Word’s Most Expensive Stock Markets by CAPE

Source: Starcapital.de/en/research/stock-market-valuation/

Source: Starcapital.de/en/research/stock-market-valuation/

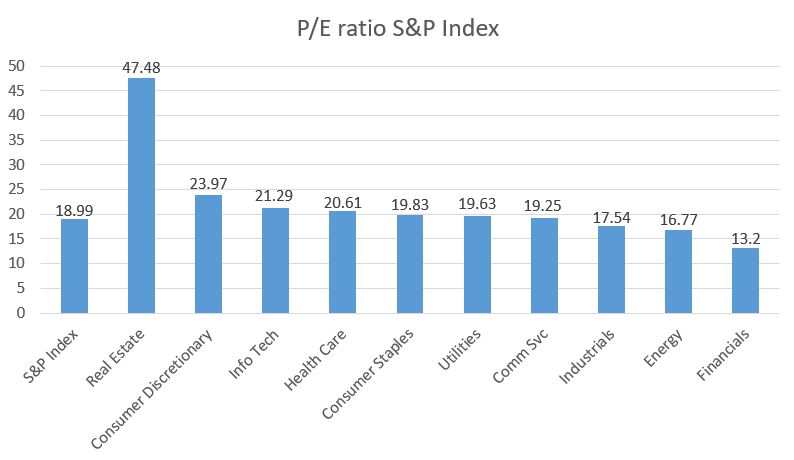

If we were to look at the current P/E of the S&P 500 by sector however, we see pockets of value in the index.

Chart 4: P/E Ratio of S&P 500 Index and Sectors

Source: Bloomberg data as of 12 Apr 2019

Source: Bloomberg data as of 12 Apr 2019

Given that the current P/E ratio of the S&P index is at 18.99, we see that there are sectors that trade below it. In particular, the industrials, energy and financial sectors trade lower than the index and the US CAPE ratio as a whole –and potentially represent better value opportunities.

The table below shows some of the industrials, energy and financial Exchange Traded Funds (ETFs) listed on the US exchanges.

Table 1: List of some Industrials, Energy and Financial ETFs listed on the US exchanges

| Ticker | Fund Name | Segment | AUM (USD) | Expense Ratio |

| XLI.US | Industrial Select Sector SPDR ETF | U.S. Industrials | $10.33 B | 0.13% |

| VIS.US | Vanguard Industrials ETF | U.S. Industrials | $3.4 B | 0.1% |

| XLE.US | Energy Select Sector SPDR ETF | U.S. Energy | $14.05 B | 0.13% |

| VDE.US | Vanguard Energy ETF | U.S. Energy | $3.76 B | 0.1% |

| XLF.US | Financial Select Sector SPDR ETF | U.S. Financials | $23.89 B | 0.13% |

| VFH.US | Vanguard Financials ETF | U.S. Financials | $7.22 B | 0.1% |

Source: Bloomberg

4. U.S. Fiscal Policy and Federal Reserve Monetary Policy

According to a recent article from Reuters, the S&P rose 28 percent since US President Donald Trump’s election in November 2016 to the eve of the congressional midterm elections. This surpassed the market’s performance over the same time frame, compared to under any other president in the past 64 years. Under President Dwight Eisenhower, the S&P 500 rose 29 percent from his election in November 1952 through November 1954.10

The US President has taken credit for the stock market’s performance during his tenure in the White House, and those claims are reasonable given the impact of tax cuts and pro-business policies on investor sentiment.

Sweeping corporate tax cuts, an initiative driven by Trump, supercharged US companies’ earnings and helped lift the cash-rich technology sector. The Republican Party passed the biggest overhaul of the US tax code in over 30 years just last year, boosting US companies’ corporate earnings.

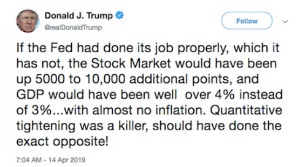

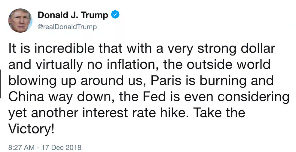

The US President is also known, although not without controversy, to be a strong proponent for halting the Federal Reserves’ increase in interest rates. In an interview with the Washington Post late last year, President Donald Trump stated he was unhappy that the US Federal Reserve under the Chairman he chose, Jerome Powell, was raising interest rates.11

This is further evidenced in his frequent tweets against the Federal Reserve. Although the Fed is considered to be an independent central bank as its monetary policy decisions do not have to be approved by the President or anyone in the executive branches of government, one cannot deny Trump’s seeming influence in the year so far.12

CNBC also reported that the Fed has clearly caved in to the President’s wishes, putting it in line with all of the other banking regulatory agencies. If the Federal Reserve does continue to hold interest rate increases at bay, as per the President’s “wishes”, it may well propel the US stock market to greater heights in 2019.

Image 1,2,3: Trump targets Fed Interest Rate Hikes in Tweets and Interview

Customers who wish to take advantage of the movement of US interest rates and its effects on the US financial services sector may look at the below ETF table.

Table 2: List of Financial Services Sector ETFs

| Ticker | Fund Name | Segment | AUM (USD) | Expense Ratio | Leverage |

| FAZ.US | Direxion Daily Financial Bear 3X shares | Financial Services | $178.47 M | 0.75% | 3X |

| FAS.US | Direxion Daily Financial Bull 3X shares | Financial Services | $1.546 B | 0.75% | 3X |

| IYG.US | IShares U.S. Financial Services ETF | Financial Services | $1.397 B | 0.43% | NO |

However, do note that leveraged ETFs are not suitable for novice and retail investors as the loss will be magnified. Furthermore, leveraged ETFs are not meant to be held long term as the daily rebalancing will cause the value of the investment to erode over time. Read more about leveraged and inverse ETFs.

5. Presidential Election Cycle Theory

The Presidential Election Cycle Theory is a theory developed by Yale Hirsch that states that US stock markets are weakest in the year following the election of a new US president. According to this theory, after the first year, the market improves until the cycle begins again with the next presidential election.14

In years one and two of a presidential term, the President exits campaign mode and works hard to fulfil campaign promises before the next election begins. It is theorized that because of these circumstances surrounding the President’s work, the first year after their election is the weakest of the presidential term, with the second year being not much better.

In years three and four of a Presidential term, it is thought that the President goes back into campaign mode and works hard to strengthen the economy in an effort to earn votes. Possible policies to be implemented in such a situation include economic stimuli such as tax cuts and job creation. As such, the third year is often the strongest of the four-year term and the fourth year, the second-strongest year of the term.

Trump is currently in the third year of his Presidential term. If the theory does hold water, we should be in the strongest performing year where the US President and the government work to “prop” up the economy to keep voters happy, possibly resulting in a strong showing in the US stock market.

To sum up, there are certain opportunities for investors in the US stock market, and despite what the naysayers say, great potential exists for the stock market to continue a bull run in the foreseeable future.

Information accurate as of 30 May 2019.

Reference:

- [1] https://www.marketwatch.com/story/signs-this-bull-market-is-running-out-of-steam-2015-05-20

- [2] https://www.forbes.com/sites/kenrapoza/2018/02/06/hsbc-market-correction-long-overdue/#702f71ca7b75

- [3] https://www.cnbc.com/2017/01/19/george-soros-calls-donald-trump-a-would-be-dictator-who-is-going-to-fail.html?__source=yahoo|finance|inline|story|story&par=yahoo&doc=104230834

- [4] https://www.bloomberg.com/news/articles/2019-03-28/asia-stocks-set-for-mixed-start-bond-rally-eases-markets-wrap

- [5] https://www.wsj.com/articles/billionaire-george-soros-lost-nearly-1-billion-in-weeks-after-trump-election-1484227167

- [6] https://www.usatoday.com/story/money/markets/2017/05/03/wall-street-earnings/101168864/

- [7] https://www.morganstanley.com/ideas/2019-global-strategy-outlook

- [8] https://www.fool.com/investing/2017/12/05/the-30-largest-companies-on-the-stock-market.aspx

- [9] https://www.world-exchanges.org/our-work/statistics

- [10] https://www.reuters.com/article/us-usa-election-stocks/two-years-in-trump-holds-stock-market-bragging-rights-idUSKCN1NB0GY

- [11] https://www.washingtonpost.com/business/all-the-ways-trump-can-and-cant-influence-the-fed-quicktake/2018/11/28/8b43cb5e-f329-11e8-99c2-cfca6fcf610c_story.html?utm_term=.3d90b6b813a7

- [12] https://www.nytimes.com/2019/01/30/us/politics/fed-interest-rate.html

- [13] https://www.cnbc.com/2018/11/29/the-fed-has-caved-to-president-trumps-wishes-and-thats-a-game-changer.html

- [14] https://www.investopedia.com/terms/p/presidentialelectioncycle.asp

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Roger Chan

Roger holds a Business Degree in Electronic Commerce from Monash University. He is also the recipient of the Golden Key Scholarship Award for outstanding academic performance.

He is currently part of the Global Markets Night Trading Team assisting clients with the US and European markets. Before being on the night desk, he was a bond executive at the Debt Capital Markets desk and brings with him a wealth of equity and debt market knowledge.

Outside work, he trains and is an active competitor in the martial art of Brazilian Jiu-Jitsu. He finishes on the podium frequently and is also the 2015 Pan Asian BJJFP champion.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It