All You Need to Know About Dividend Investing April 20, 2023

In this article, you will learn about dividend investing as an investment strategy, the common terminology used, pros and cons, opportunities in Singapore and dividend investing in the current macro environment of high interest rates.

Why do companies give dividends?

Companies give dividends as a way to return a portion of their net income to shareholders. Shareholders are the equity owners of listed companies and entitled to the profits these companies generate. When a company gives consistent dividends, it shows that the company is financially sound, generates sustainable profits and is willing to give back to shareholders in the form of dividends [1]. This promotes shareholder loyalty and an expectation from shareholders of future constant dividend payments [2].

Jargon and terminology

Some jargons are specific to dividend as a corporate action, ranging from financial statements to dates and the structure of dividends. Investors need to familiarise themselves with the terminologies to better understand and assess dividend stocks.

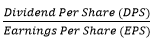

Dividend Payout Ratio

The payout ratio =  shows the proportion of net income given out as dividend. Companies with a high payout ratio of 80+% might not be sustainable as the majority of net income is distributed in the form of dividends, leaving a low proportion of net income for reinvestment, and retained earnings, and increasing equity base. The payout ratio is heavily dependent on Earnings Per Share (EPS) as Dividend Per Share (DPS) is generally stable. Therefore, if the company is experiencing a bad quarter due to a one-off event, the payout ratio might be temporarily skewed. To determine if the current payout ratio is sustainable, further investigation into the company financials is required [3]. Certain mature industries tend to have high payout ratios (financials, consumer staples and energy). This is due to their limited external and internal growth potential.

shows the proportion of net income given out as dividend. Companies with a high payout ratio of 80+% might not be sustainable as the majority of net income is distributed in the form of dividends, leaving a low proportion of net income for reinvestment, and retained earnings, and increasing equity base. The payout ratio is heavily dependent on Earnings Per Share (EPS) as Dividend Per Share (DPS) is generally stable. Therefore, if the company is experiencing a bad quarter due to a one-off event, the payout ratio might be temporarily skewed. To determine if the current payout ratio is sustainable, further investigation into the company financials is required [3]. Certain mature industries tend to have high payout ratios (financials, consumer staples and energy). This is due to their limited external and internal growth potential.

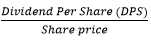

Dividend Yield

The dividend yield =  allows investors to compare the expected yields from just the dividends of companies with different share prices. Dividend yields are what shareholders can expect to get in terms of yields purely from dividends assuming dividends and share price remain the same. As companies usually only announce their dividends on the announcement date, the dividend yields are forecasted with assumptions.

allows investors to compare the expected yields from just the dividends of companies with different share prices. Dividend yields are what shareholders can expect to get in terms of yields purely from dividends assuming dividends and share price remain the same. As companies usually only announce their dividends on the announcement date, the dividend yields are forecasted with assumptions.

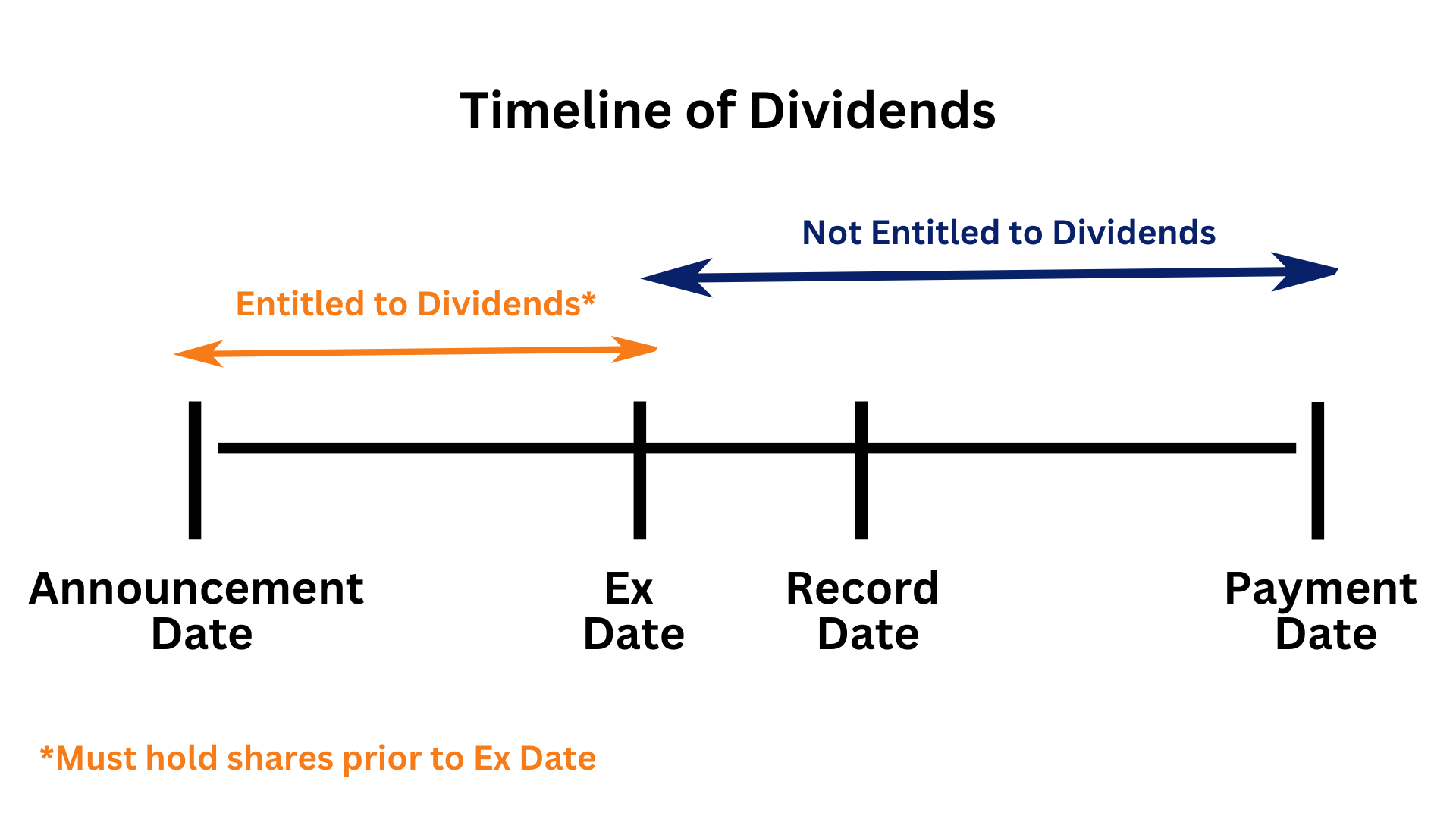

Announcement / Declaration Date

This is the date when the company will announce the upcoming dividend amount, ex-dividend date, record date, payment date and essential information regarding the dividend corporate action.

Record Date

This date is required for the company’s internal records. Investors who purchase shares on the record date will not be entitled to receive the upcoming dividend. The record date tends to be after the ex-dividend date, as it typically takes 2 business days for all shares to be delivered and the share ownership to be recorded.

Ex-Dividend / Ex-Date

The ex-dividend date is also known as the ex-date. It means investors who purchase shares on the ex-date will not be entitled to the upcoming dividend payment. Investors need to be shareholders and hold the shares at the close of the business day before ex-date to be entitled to the upcoming dividend payment.

After this date, the share price will be adjusted downwards by the same amount as the size of dividend per share to reflect the fact that new shareholders are not entitled to the upcoming dividend payment. However, for most dividends, this is usually not fully observed amid the up and down movements of a normal day’s price movement.

Payment Date

This date is when shareholders who own shares the day before the ex-date will receive their dividend payment. The duration between ex-date and payment date can vary, from a few days to a month.

Advantages of dividend investing

Realise gains without sale of asset

By using dividend investing, investors are able to realise returns through dividend payment without the sale of the asset [4], as compared to realising gains/returns through capital gain where sale of asset is required.

Being “paid” to hold stock

Dividend rewards come from holding the stock for long periods of time as compared to companies that derive returns purely on capital gains. In a way, you are being “paid” to hold the stock. So, you can get both gains from capital appreciation and dividends.

Compounding “interest” Effect

Dividend stocks provide a certain level of flexibility as they can be compounded by reinvesting the dividends back into the stock. Alternatively, dividends can be used to purchase other assets or even be used as income. Dividend stocks are sought by retirees and retirement funds for a steady stream of income. Dividend yield is a way to diversify their income streams from bond and money market instruments.

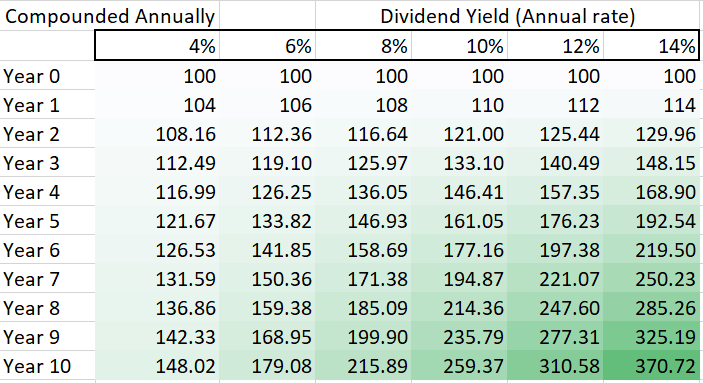

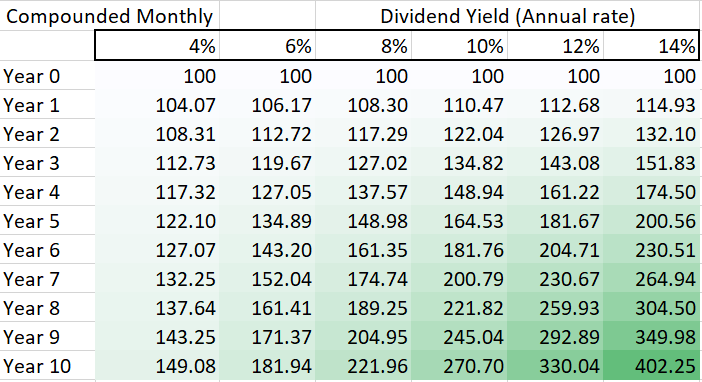

To show you the power of reinvesting dividend, take a look at the table below

Here you can see the magic of compounding dividends through reinvesting. If you start at year 0 with $100 with a 10% dividend yield, you will have $259.37 by the end of year 10, a return of 159.37%. This is assuming that dividend yield is the same throughout and there is no change in the share price.

Now, take the same starting capital of $100, and the same 10% dividend yield. In this instance, the stock gives out dividends on a monthly basis allowing for additional compounding. Then, you will have $270.70 by the end of year 10, a return of 170.70%. This illustrates that, the more frequent the distribution, the higher the returns on a compounded basis.

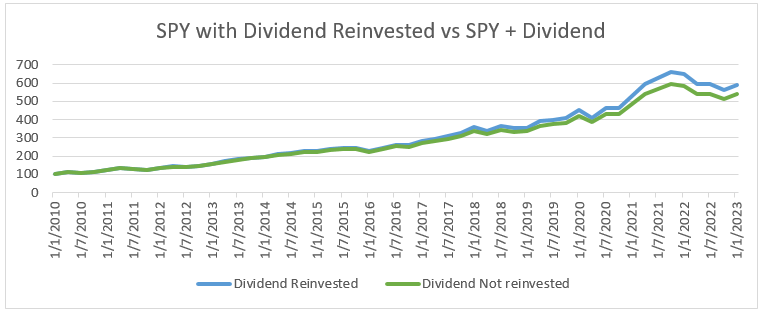

Even for low dividend yield ETFs like the S&P 500 ETF (SPY) which has an average dividend yield of ~2% for the last 12 years, the compounding effect of dividends is evident as shown below.

| Dividend Reinvested | Dividend not reinvested | |

| Total Return | 491.76% | 438.65% |

If you had to invest $100 at the start of 2010, and reinvest all the dividends into SPY, you could expect your portfolio to increase to $591.76 vs $538.65 if you did not reinvest all the dividends into SPY. The total dividend received during the period was $57.13.

Disadvantages of Dividend Investing

Dividends are not guaranteed

Dividends are not guaranteed, and can decrease or even be removed anytime and during times of financial distress. If a company is known for giving constant and increasing dividends, any decrease or suspension of dividend sends a negative signal to the market, pushing the stock price down. Funds that focus on dividend yielding stocks (like pension funds) are thus forced to rebalance their funds.

For example, Shell plc dropped its dividend by 66% (from 47c to 16c) during the first quarter of 2020, the first time since World War 2 [5]. The stock price plunged 13.13% from USD36.8 to 31.97 [6].

Dividend yields may be misleading

Dividend yields may be misleading, as they are calculated with the current share price. A significant drop in share price may falsely boost dividend yield. Not all high dividend yield investments are good. Companies may be facing financial difficulties or even giving out dividends in excess of profits they earn, resulting in an unsustainable dividend yield. Investors have to do their own due diligence when considering high dividend yield counters.

Taxes

Dividend investing is subjected to taxes. Depending on the country the company is based in, taxes will apply. For example, all dividends paid by US companies have a 30% withholding tax for foreign shareholders. Countries with income tax treaties with US might be subjected to lower withholding tax[7]. Taxes affect the effective dividend yield when they involve foreign companies, making companies with lower or no dividend taxes more attractive. Singapore has no tax on dividends in most cases.

Dividend vs growth

Dividend giving companies have a payout ratio. Dividend payout ratio is the percentage of net income the company pledges to pay out as dividend. Therefore, when the dividend payout ratio is high, investors get a large portion of the profits as dividends. However, this also signals to the market that the company has less retained profits to invest in future growth and new projects, resulting in expected growth rate of high dividend payout as compared to companies to be lower than non-dividend paying companies.

What makes a good dividend stock?

High dividend yield

A high dividend yield is essential for a dividend investing strategy to generate high dividend income per dollar invested. Companies/exchange traded funds (ETFs)/ real estate investment trusts (REITs) with a dividend yield of at least 5% (roughly doubling initial investment in approximately 15 years purely from dividends) are ideal.

Positive dividend growth

Ensuring that the 5-year dividend growth is positive shows strong fundamentals and cash flow of the company, enabling it to increase dividends constantly.

Sustainable Dividends

By looking at metrics like payout ratio, net income trends, business model and more, investors can gauge if the dividends the company is giving are sustainable in the long term. A track record and strong financials play a big role as well. Investors can expect dividend payments even when the broad market is in a downtrend.

Frequency of dividend distribution

To maximise the compounding interest effect of dividend investing, it is ideal to choose companies with more frequent dividend distributions. There are companies/ETF/REITS that give monthly to semi-annual dividends. With a frequency of once a month, the dividends can be compounded 12 times a year, while the compounding for semi-annual dividends can be only twice a year.

Portfolio allocation and dividend stocks

Dividend investing tends to be more defensive in nature compared to shares that derive a majority of returns from capital gains. Dividend stocks can be used to diversify from traditional defensive assets like bonds and T-bills [8]. They can help in achieving a similar goal of generating steady income and even potential capital growth. However, dividend stocks have a higher risk as they are in the equity asset class. Investors can layer different dividend stocks to get dividends every month. This is perfect for defensive investors like retirees and investors.

Aggressive investors can also consider dividend stocks as a diversification to gain a better risk vs reward ratio as dividend stocks are a defensive asset and aggressive stocks (growth stocks) are uncorrelated. Therefore, they can benefit from correlation diversification [9].

Common dividend stock in the Singapore market

Below are the share price, dividend yield, dividend growth and payout ratio of popular Singapore dividend companies, as of 14 March 2023.

| Company | Indicated Dividend Yield | Dividend Payout Ratio | 5 Year Dividend Growth |

| Golden Agri-Res | 6.76% | 29.40% | 2.91% |

| Keppel Corp | 6.15% | 37.38% | 12.47% |

| ST Engineering | 4.68% | 116.37% | 1.30% |

| Comfort Delgro | 3.91% | 88.47% | -9.37% |

| Singtel | 3.98% | 78.78% | -10.31% |

| OCBC | 5.66% | 53.18% | 9.24% |

| DBS | 4.66% | 62.81% | 17.98% |

| UOB | 4.83% | 43.94% | 11.38% |

Source: Bloomberg

Investors can use this to shortlist dividend giving companies before diving deeper to determine if the company is able to generate sustainable and growing dividends.

When picking companies based on dividend yields, investors must determine if the high dividend yields are due to a high payout ratio and mature industry or an inflated dividend yield due to a drop in share price. In the case of Keppel Corp, the dividend yield of 6.15% with payout ratio of 37.38% may seem very attractive. However, Keppel Corp’s share price has dropped 25.32% from 14 Feb to 14 March. Without the price drop, the dividend yield will be 4.6% assuming Keppel retains its current dividend going forward.

For the Singapore banks, the industry average payout ratio is 53% [10]. Therefore, comparing the dividend payout ratio of OCBC, DBS and UOB, we can see that UOB and OCBC have a more sustainable dividend payout ratio compared to DBS. However, with rates expected to peak soon, the banks might not be able to maintain expected future profits and the current dividend payments may be unsustainable.

On a dividend investing level, Golden Agri-Resource looks very attractive with its high dividend yield of 6.76%, dividend payout ratio of 29.40% and 5-year dividend growth of 2.91%. However, Golden Agri-Resource is in the palm oil industry and is highly sensitive to palm oil prices and the supply and demand of other vegetable oils. Investors need to understand the risk and determine if they are willing to take it on.

Current macro outlook, dividend investing and closing remarks

Dividend stocks have performed well historically in a high interest rate environment, outperforming the S&P500 in 7 out of 10 high interest rate periods between 1960 to 2017 [11]. With a potential recession looming, investing in high quality dividend stocks with strong financials and track record will still be able to generate steady cash flow and dividend payments to investors [12].

Investors need to do their own due diligence on top of what is discussed in this article. This article provides a good basis to shortlist and discover hidden gems before taking a deeper dive into the financials and business models.

Dividend investing benefits from the compounding interest effect, with a more defensive and value based investing style. Different stock markets provide different opportunities and have different dividend tax implications. Investors need to take note of the potential high dividend yield traps by examining company financials and assessing sustainability of dividend payments. There are many strategies for investors to generate long-term wealth, but dividend investing should be on investors’ radars even more due to the uncertain macro-economic environment and volatile markets.

Reference:

- [1] https://www.thebalance.com/what-is-dividend-investing-357437#:~:text=Dividend%20investing%20is%20a%20method,or%20other%20holdings%20gain%20value

- [2] https://www.sproutasia.com/blog/when-can-a-company-declare-dividends#:~:text=A%20company%20can%20only%20pay,loss%2C%20you%20cannot%20distribute%20dividends

- [3] https://corporatefinanceinstitute.com/resources/accounting/dividend-payout-ratio-formula/

- [4] https://www.fidelity.com/learning-center/investment-products/stocks/why-dividends-matter

- [5] https://www.reuters.com/article/us-shell-results-idUSKBN22C0TK

- [6] https://www.shell.com/investors/information-for-shareholders/share-prices/historical-share-prices.html

- [7] https://taxsummaries.pwc.com/united-states/corporate/withholding-taxes

- [8] https://www.thestreet.com/etffocus/dividend-ideas/dividend-growth-stocks-driver-of-retirement-strategy#:~:text=Investing%20in%20dividend%20growth%20stocks,the%20possibility%20of%20capital%20growth

- [9] https://deutschedigitalassets.com/insights/news/correlations-in-portfolio-theory/

- [10] https://www.channelnewsasia.com/business/ocbc-record-performance-higher-interest-rates-caution-outlook-3301141#:~:text=The%20bank%20raised%20its%20fourth,49%20per%20cent%20for%202021

- [11] https://finance.yahoo.com/news/11-best-dividend-stocks-rising-211302917.html#:~:text=Over%20the%20years%2C%20dividend%20stocks,periods%20from%201960%20to%202017

- [12] https://www.nerdwallet.com/article/investing/what-to-invest-in-during-recession#:~:text=Fixed%2Dincome%20and%20dividend%2Dyielding%20investments&text=Investing%20in%20companies%20with%20a,for%20routinely%20paying%20strong%20dividends

Disclaimer

This material is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs.

Accordingly, no warranty whatsoever is given and not liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information. Investments are subject to investment risks.

The risk of loss in leveraged trading can be substantial. You may sustain losses in excess of your initial funds and may be called upon to deposit additional margin funds at short notice. If the required funds are not provided within the prescribed time, your positions may be liquidated.

The resulting deficits in your account are subject to penalty charges. The value of investments denominated in foreign currencies may diminish or increase due to changes in the rates of exchange.

You should also be aware of the commissions and finance costs involved in trading leveraged products. This product may not be suitable for clients whose investment objective is preservation of capital and/or whose risk tolerance is low.

Clients are advised to understand the nature and risks involved in margin trading. You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualifies financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement.

You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement (available online at www.poems.com.sg) before trading in this product. Any CFD offered is not approved or endorsed by the issuer or originator of the underlying securities and the issuer or originator is not privy to the CFD contract. This advertisement has not been reviewed by the Monetary Authority of Singapore.

About the author

Sam Hei Tung

Dealing

Sam graduated from National University of Singapore with a Master of Science in Finance. He personally manages his own investment portfolio and does equity and economic research in his free time. Sam believes that education and information is essential to making good financial decisions.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It