Beating the Efficient Market Hypothesis August 31, 2018

Hi everyone,

If you have some sort of a background in finance, you may have heard of the Efficient Market Hypothesis (EMH). It’s an economic theory that states that all available information is reflected in prices. Any pricing inefficiencies are quickly arbitraged away by the others. No fundamental or technical analysis will consistently produce superior returns within the market. EMH proponents believe that we are better off holding an index fund; being the market, than trying to beat the market.

A running joke on EMH goes as such:

A economist (EMH proponent) and a friend were walking along the street.

The friend stops and says, “Look, there is a $100 note on the ground!”

The economist, without flinching, replies, “Impossible! If there was a $100 bill on the ground, somebody would have already picked it up!” And carries on walking.

I’m not sure about you, but I will definitely (at least) take a good look at whether loose $100 bills can be found near me.

Now let us talk about “momentum” – a market anomaly where stocks that have done well (or poorly) in the past, will likely continue to do well (or poorly) in the near term. Momentum has been described as a powerful and persistent market anomaly. If you are a die-hard supporter of the Graham and Dodd school of thought, momentum may be a counter-intuitive concept.

Interestingly, an EMH believer holding a S&P 500 index fund is adopting some sort of momentum. Losers are systematically kicked out of the index and replaced with new winners. The result is a constantly rebalanced group of 500 winners with an upward bias in price. Going further, as the share price of an individual index component… say… the AAPL, goes up, index tracking funds will have to purchase more AAPL shares to maintain their weightage within the index; pushing their share prices even higher.

No fluff, no bluff

Yes, there are already many academic papers on momentum (Jegadeesh & Titman 1993 comes to mind). But for further validation, I felt a need to conduct at least one experiment (I actually did many), to go through the full journey and see some results for myself. After all, seeing is believing.

Hypothesis:The best performing stocks in the past will continue to be the best performing stocks in the future.

We define “in the past” as the “lookback period”, “X” number of months into the past. Suppose it is August 2018 now, so a 6-month lookback period will cover February to August 2018. “In the future” is the “holding period”, “Y” number of months from now.

We quantify and measure “best performing in the past” as the top decile of total returns in the sampled pool, termed Q1. Q2 will be the next 10%… until Q10, the bottom 10%.

“Best performing in the future” simply measures total returns from now till “Y” months later.

So we measure and buy Q1 from “X” months, hold for “Y” months then rebalance… not rocket science!

I chose 3, 6 and 12 months as lookback periods and 1, 3 and 6 months as holding periods.

The sampled pool is NYSE, NASDAQ, and NYSE MKT. As a proxy for liquidity, only companies with market capitalization of at least USD200 million are included. I’ve also removed ETF, ETN, REITS and ADR from the pool.

The sampled period is 22 years from July 1996 to June 2018. To mitigate effects of seasonality, combinations with 6-month holding periods are done twice – 6-month A rebalanced in April/October and 6-month B rebalanced in January/July.

This gives us 12 possible combinations:

| Lookback Period (months:m) | Holding Period | Q1 (Winners) | Q10 (Losers) | Q Spread (Q1-Q10) |

| 6m | 1m | 15.41% | 1.04% | 14.37% |

| 6m | 3m | 14.28% | -0.08% | 14.36% |

| 6m | 6m B | 12.77% | 2.09% | 10.68% |

| 12m | 1m | 12.45% | 1.68% | 10.77% |

| 6m | 6m A | 11.69% | -0.68% | 12.37% |

| 3m | 1m | 10.95% | 3.79% | 7.16% |

| 12m | 3m | 9.83% | 2.89% | 6.94% |

| 3m | 6m B | 9.81% | 3.18% | 6.63% |

| 3m | 6m A | 8.64% | 1.01% | 7.63% |

| 12m | 6m B | 8.20% | 4.78% | 3.42% |

| 3m | 3m | 7.79% | 3.80% | 3.99% |

| 12m | 6m A | 6.17% | 2.80% | 3.37% |

| S&P 500 | 9.05% | |||

Source: Bloomberg

Like an avocado: Too soon, not ripe. Too long, too ripe.

So we see… winners do outperform losers! Momentum does exist.

Spread measures the difference between the highest and lowest deciles (Q1 – Q10) and is positive across all combinations!

However the outperformance varies across different combinations. We find:

A. Momentum is an avocado. It has a narrow window for optimal consumption.

A 6-month lookback period seems to be the ideal, producing double digit Q1 and Q Spreads.

3 months and momentum is not ripe. 12 months and momentum gets too ripe, especially if paired with a longer holding period.

B. The ideal holding period is more diverse. Shorter holding periods (1 to 3 months) seem to outperform, as long as momentum is properly formed.

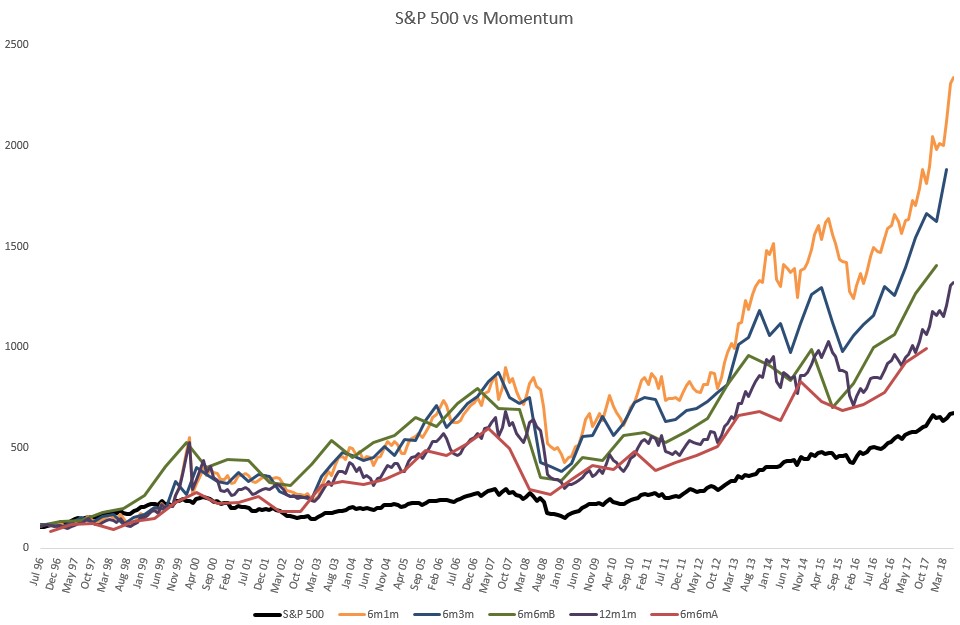

The top 5 performing combinations plotted against S&P 500 in an equity curve looks like this:

So we have… momentum busting the EMH – our first of many hypothetical $100 bills to be found. And I suspect the same model applied on Chinese or developing markets may produce even better results.

So what now?

In closing, I would like to emphasize: There is no perfect system that works all the time. The lesson to be drawn here is that the basic momentum model will serve as the backbone for our future strategies.

Thanks for taking the time to read this, and see you all next time!

(*Please note that information contained in this article is given for educational purposes only. All information and opinions provided in this piece do not constitute as investment advice.)

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Tan Chek Ann

I sleep in the day and head the dealing desk at night. In my nightly work, I attempt to do analysis and scout around for trading ideas. The work I do tends to lean towards math and science as I’m not too much of an artistically-inclined person. Join me on my journey as I share my thoughts on various topics – though mostly still financial stuff. Reach me at tanca@phillip.com.sg

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It