Dead Cat Bounce: Yay or Nay? April 27, 2020

By the time of this article, my colleagues would have received countless calls from their clients. Given the recent Bull Run post Black Monday 2020, many clients have been lamenting that their favored counters have rallied past their target buy price. Some also asked if this recent Bull Run was a case of a “dead cat bounce”.

A dead cat bounce is defined as a situation where a counter experiences a small, brief recovery in the price of a declining stock. The term “dead cat bounce” is borrowed from a rather dark morbid sounding phrase, “even a dead cat would bounce if it falls from a great height.”

In this article we will use historical data to analyse past “dead cat bounce” events. We will also be using current market indicators to determine whether the markets are currently in a state of V-shaped recovery or a possible dead cat bounce.

Dead Cat Bounce or Market Recovery?

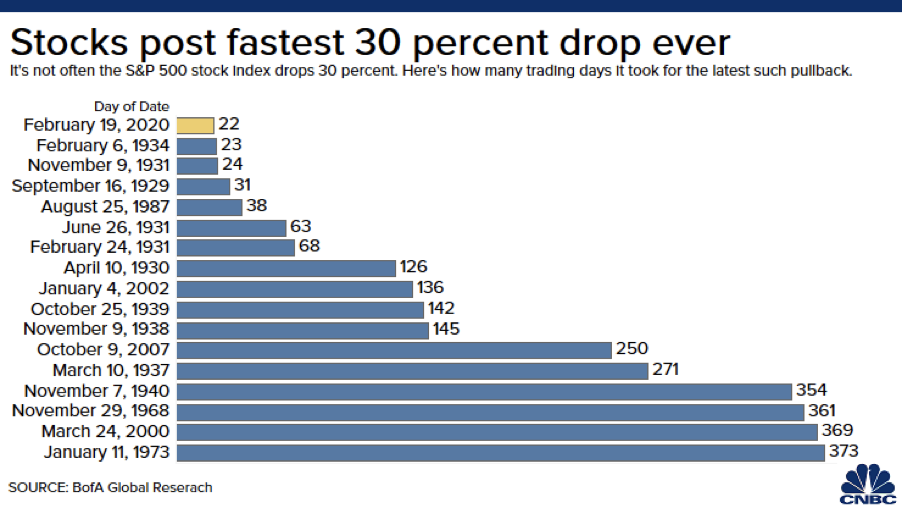

It took the S&P 500 only 22 trading days to fall 30% from its record high, on Feb 19 2020. According to Bank of America Securities, this decline is the sharpest drop in history, as illustrated in Figure 1.[1]

Figure 1.S&P 500 Pullback w.r.t amount of days[1]

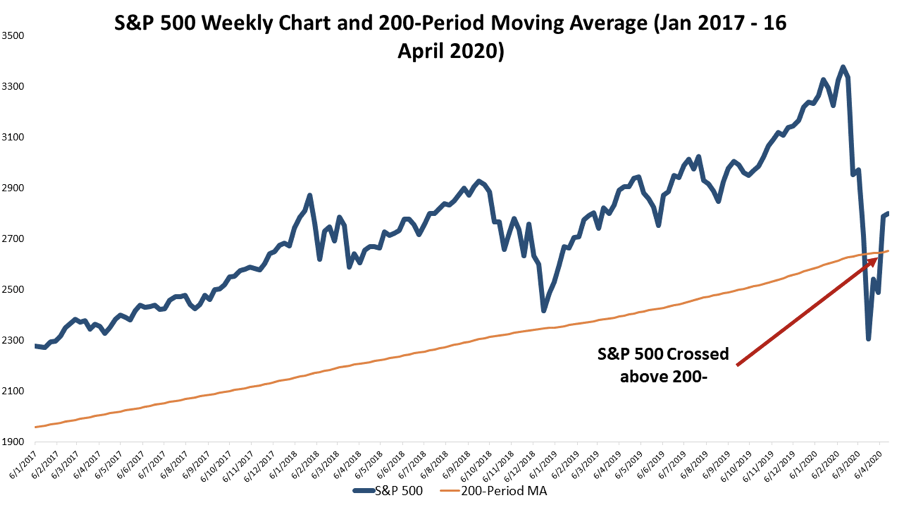

Figure 2.S&P

However, at the point of writing this article, as shown in Figure 2, the S&P 500 is back above its 200-week moving average. The S&P 500 has gained 25.13% since its steep decline on Feb 19th 2020. Does this mean that the markets are set to recover or is this just another dead cat bounce? You can use historical data and macro-economic indicators to investigate whether the recent uptrend was temporary.

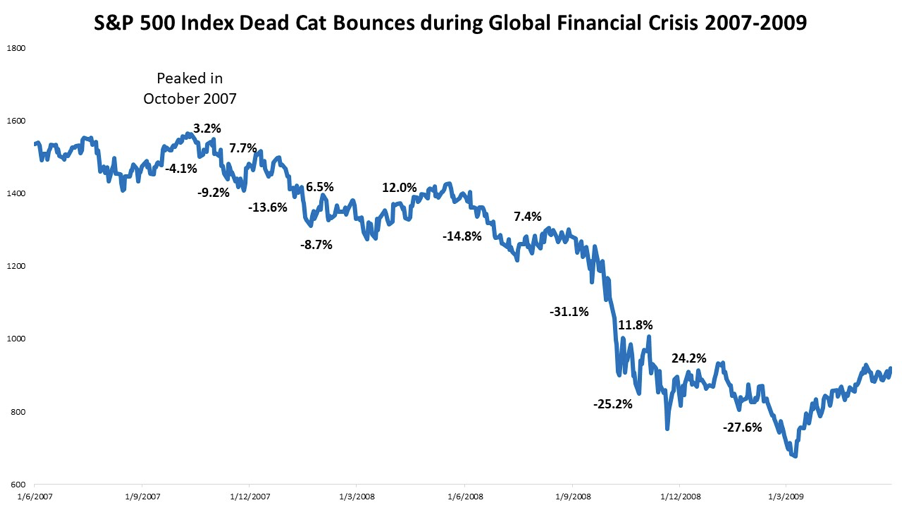

Figure 3.S&P 500 2007-2009

As shown in Figure 3, we took the S&P 500 data ranging from 2007-2009 and plotted each return magnitude.

Truth be told, it is very difficult to tell whether any recent uptrend is a recovery or a dead cat bounce. This can only be uncovered based on hindsight due to the financial markets’ forward-looking mechanism that rapidly discounts new market information.

What are Fundamental Indicators? Let’s find out!

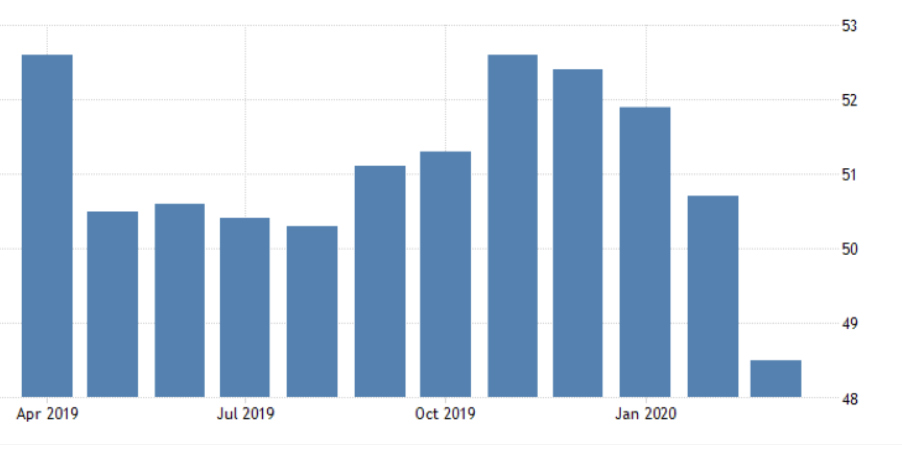

US Manufacturing PMI

Figure 5 HIS Markit US Manufacturing PMI

The US Manufacturing PMI, touted as one of the most reliable leading indicators for the US economy, was revised down to 48.5 in March 2020. The US Manufacturing PMI data for March 2020 is the lowest since 2009.

US Employment Data

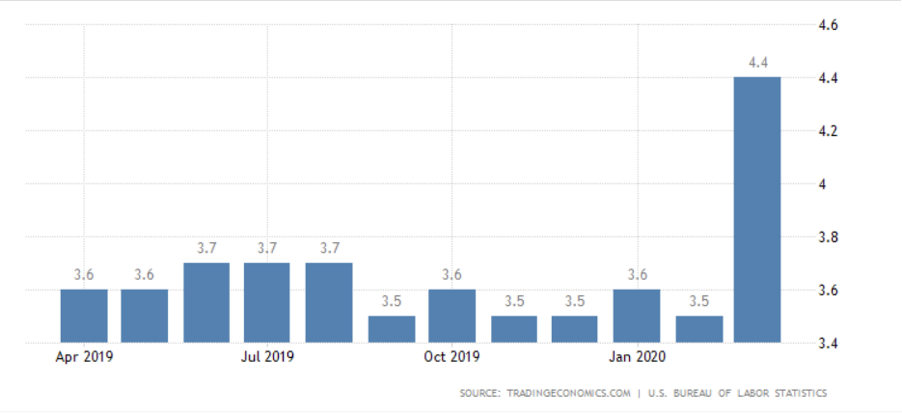

Figure 6 US Unemployment rate

The US unemployment rate jumped to 4.4 percent in March 2020, the highest since August 2017. 4.4% was above market expectations of 2.8%.

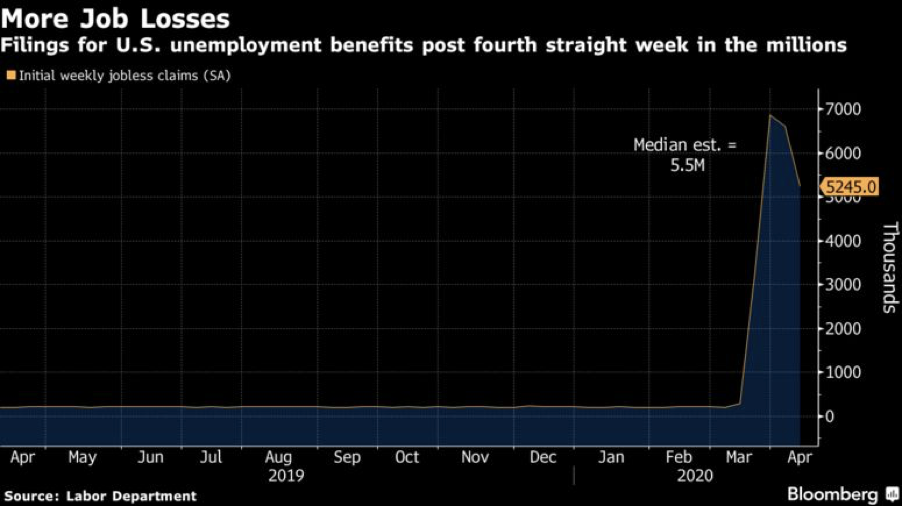

Figure 7 US Initial Weekly Jobless Claims[2]

Initial jobless claims of 5.25 million were filed for the week ending on 11 April 2020, followed by 6.62 million the week before. This brings the total job losses since the Covid-19 pandemic hit the American economy to 22 million.

In a recent interview about the market outlook, Berkshire Hathaway’s Vice President Charlie Munger issued a dire economic forecast which stated: “Of course we’re having a recession, the only question is how big it’s going to be and how long it’s going to last. It’s quite possible that never again – not again in a long time, will we have a level of employment again like we just lost,”[3]

Corporate Earnings

Wells Fargo, the world’s fourth largest bank, released their earnings of $653 million USD on 14 April 2020. This amounts to a 89% decline compared to the same quarter last year. After the earnings result release, the price of Wells Fargo declined by 6%.

By the time the article is published, many other companies have yet to report their earnings results. For Singapore listed companies such as DBS will be releasing their earnings results on 30 April 2020. Retail S-REIT counters such as Mapletree Commercial Trust, Frasers Centrepoint Trust and CapitaMall Trust will release their earnings on 22, 23 and 30 April 2020 respectively.

For many companies, especially those in the retail and tourism sectors, the question is likely how bad will their earnings be?

Recession

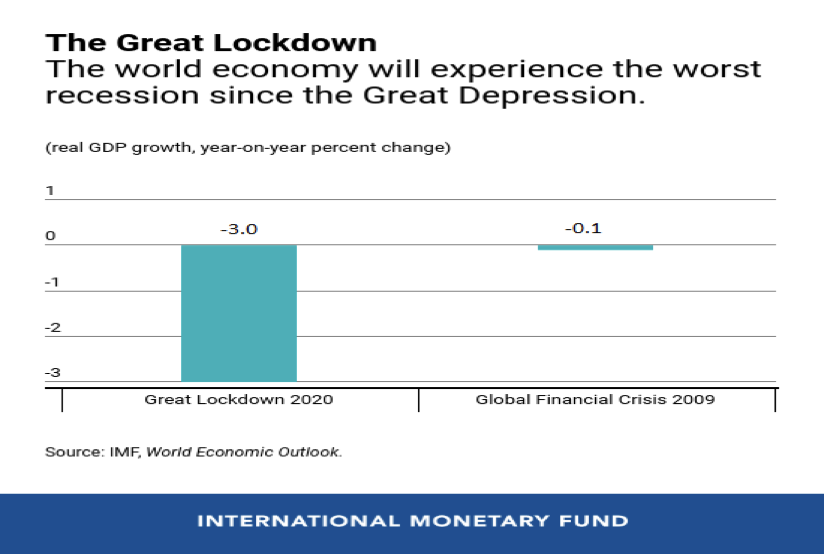

Figure 8 [4]

Figure 9 [4]

For April’s World Economic Outlook 2020, the International Monetary Fund (IMF) projects that global growth will decline by 3%, lower than the 6.3 percentage points forecasted in January. Given the short timeframe between January and April, the 6.3 percentage point magnitude downgrade is considered large. As shown in Figure 8, global growth decline is 30x compared to the Global Financial Crisis of 2009.

1. The IMF forecasted that in 2020, US GDP would shrink by 5.9%. Meanwhile, Singapore’s Ministry of Trade & Industry lowered Singapore’s GDP growth forecast to -4%, after a 2.2% contraction in the first quarter of 2020. As we can see from Figure 9, the advanced economies are expected to be impacted more than the emerging and developing economies.

Based on the 4 indicators that we presented above, we believe that the worst is yet to come. Therefore, it would be ideal to remain cautious and vigilant during this period!

Using CFDs

“The Markets generally are unpredictable, so that one has to have different scenarios. The idea that you can actually predict what’s going to happen contradicts my way of looking at the Market”

~ George Soros

CFDs are instruments that allow an investor to profit from both sides of the market. If you believe that the current market outlook is worsening and the uptrend is a Dead Cat Bounce, you may want to use CFDs for short selling.

The benefits of using CFDs for short selling is that one does not have to borrow shares nor maintain 2 separate accounts (SBL & Brokerage account). You can do it with just a CFD account! This essentially helps an investor overcome the hassle of share delivery and settlement. Check out our courses and other articles on short selling!

CFD Hedging

Contrary to popular opinion, Contracts for Differences (CFDs) are not restricted to technical traders. Long term investors can utilise CFDs to hedge their positions against unforeseen events and uncertainties. When one foresees rising uncertainty and volatility in the market, the investor can enter into a CFD contract to hedge their positions.

One can use CFDs as a hedge in these 2 possible scenarios:

1) When the price of your existing positions has already moved/is moving against you.

2) When you anticipate future gains in your existing positions to be marginal due to an increasingly negative market sentiment.

Generally speaking, assets that have a positive correlation to your position are used as an opposing hedge (Short). Whereas, assets with a negative correlation to your positions are used as a same side hedge (Long).

CFD Hedging Example

Mike owns 1000 shares of DBS and UOB at an average price of $24.93 and $25.40 respectively. His portfolio value amounts to $50330. However due to the recent market volatility, the price came tumbling down soon after.

If Mike had decided to cut loss for both his banking stocks on 20/3/2020, his losses would be:

DBS Losses = ($18.16 – $24.93) * 1000 = $6770

UOB Losses = ($18.96 – $25.40) * 1000 = $6440

DBS Commission = (24,930 * 0.28%) + (18,160 * 0.28%) = $120.652 ($129 with GST)

UOB Commission = (25,400 * 0.28%) + (18,960 * 0.28%) = $124.21 ($132.9 with GST)

Paper Net Loss = $6,770 + $129 + $6,440 + $124.21 =$13,463.2

Net Loss = $6,770 + $74.70 + $54.41 + $6,440 + $76.10 + $56.81 = $13472.02

Assuming that on 25/02/2020, after reading the financial news, Mike anticipates a change in market conditions. By utilising CFDs, Mike decided to hedge his position. He could have used either DBS, UOB, OCBC or the Straits Times Index CFD to perform an opposing hedge. However, using the Straits Times Index CFD to perform the hedge would allow Mike to save on commission charges and on initial capital outlay.

Mike decides to use the Straits Times Index CFD to hedge his exposure. As his portfolio amounted to $50330 on that day and the Straits Times Index SGD5 CFD was trading at $3159.5, he would need approximately 3 contracts to perform a partial hedge.

$50330 / ($3159.5 * 5) = 3.18

Given 6% margin, Mike’s Initial Capital outlay for the Straits Times Index SGD5 CFD would have been:

$3159.5 * 5 * 3 * 6% = $2843.55

On 20/3/2020, the Straits Times Index SGD5 CFD was trading at $2429.6. His overall position on 20/3/2020 would have been:

Straits Time Index SGD5 CFD Gain: ($3159.5 – $2429.6)*5*3 = $10948.5

Straits Times Index Sell Commission = $3 * 3 = $9 ($9.63 with GST)

Short finance charge for holding the STI Index CFD from 25/02/2020 to 20/03/2020 with a daily closing price of 3159.5:

Short FC = 2.75% / 365 * 24 * (3159.5 * 5 * 3) = $85.70

DBS Losses = ($18.16 – $24.93) * 1000 = $6770

UOB Losses = ($18.96 – $25.40) * 1000 = $6440

DBS Buy Commission = (24930 * 0.28%) = $69.81 ($74.70 with GST)

UOB Buy Commission = (25400 * 0.28%) = $71.12 ($76.10 with GST)

Net Loss = $10948.5 – $6770 – $6440 – $74.70 -$76.10 – $85.70 – $9.63 = – $2507.63 (much lower than $13472.02 without hedging)

This scenario is ideal for people seeking capital preservation for their nest egg as opposed to high frequency trading or speculation.

Conclusion

Truth be told, based on macroeconomic data, the future does not look rosy. There have been numerous queries on whether liquidation of holdings right now and picking them up again when the market recovers is a better option. However, no one knows how far the stock market will decline or when the V shaped recovery will be. As quoted by investing legend Peter Lynch, “Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections.” In our opinion, it would be better to time the market based on valuations and not on news flows. We sincerely hope that you have found value in this article, be sure to check out our other articles and the courses that we offer. Till next time folks!

References:

- [1] https://www.cnbc.com/2020/03/23/this-was-the-fastest-30percent-stock-market-decline-ever.html

- [2] https://www.bloomberg.com/news/articles/2020-04-16/u-s-jobless-claims-total-5-25-million-in-week-four-of-lockdown

- [3] https://www.businessinsider.sg/warren-buffett-berkshire-hathaway-charlie-munger-frozen-bosses-bailouts-coronavirus-2020-4?utm_medium=social&utm_source=facebook.com&utm_campaign=sf-bi-main&r=US&IR=T

- [4] https://blogs.imf.org/2020/04/14/the-great-lockdown-worst-economic-downturn-since-the-great-depression/

About the author

Jay Lin and Lee Yong Shern

Dealer

Jay graduated from the National University of Singapore with a Bachelor’s Degree in Electrical Engineering, specialising in Power Engineering. He is also an aspiring CFA Charter Holder.

In his free time, he loves to analyse and experiment with factor based investing and smart beta portfolio’s using machine learning.

Yong Shern is a passionate CFD dealer who has always aspired to discover trading opportunities via a blend of different research methodologies. Prior to joining PhillipCapital, Yong Shern was an intraday equity trader in one of the top broker firm in Malaysia. He graduated with First Class Honours in Business Administration with a major in Banking and Finance from the University of Malaya.

Yong Shern is experienced in both trading and research in various financial products. These products include equities, indices, commodities, forex trading. He has successfully crafted trading strategies to navigate this volatile oil environment. In his free time, Yong Shern enjoys following the latest market news with the aim of helping clients navigate through various market conditions.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It