Disrupting Sectors with Thematic ETFs July 3, 2019

Introduction to Traditional Sector Classifications

A sector refers to an area of an economy in which the businesses share the same operating characteristics, related products or services. Each sector may contain a subset of industries. For example, healthcare firms may include hospitals and medical equipment providers while consumer staples firms produce essential products like food, beverages and household items.

Each sector tends to perform differently during different market conditions because of the nature of the underlying industries and consumers’ demand for their products and services.

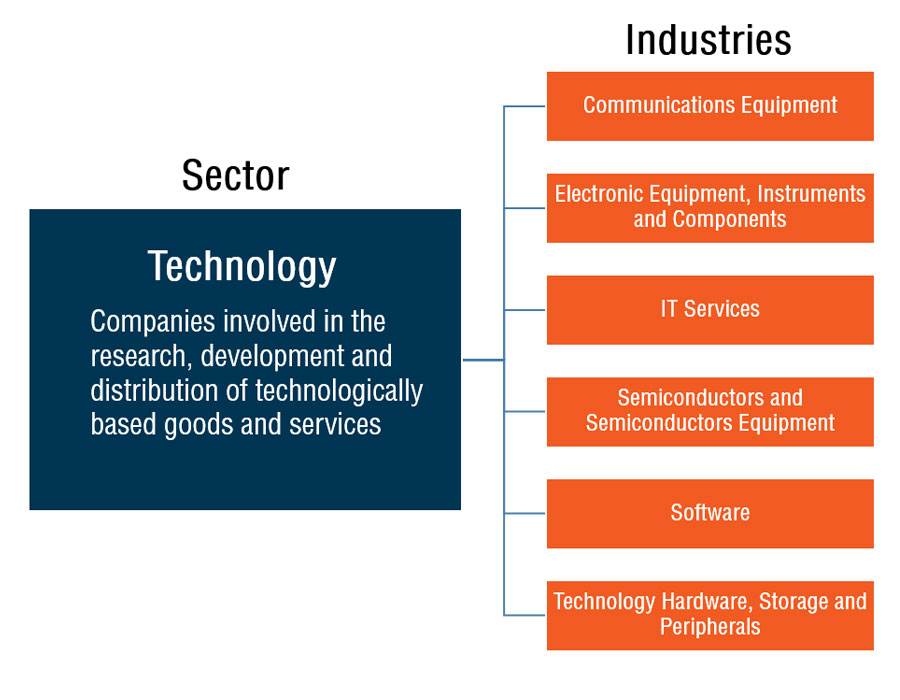

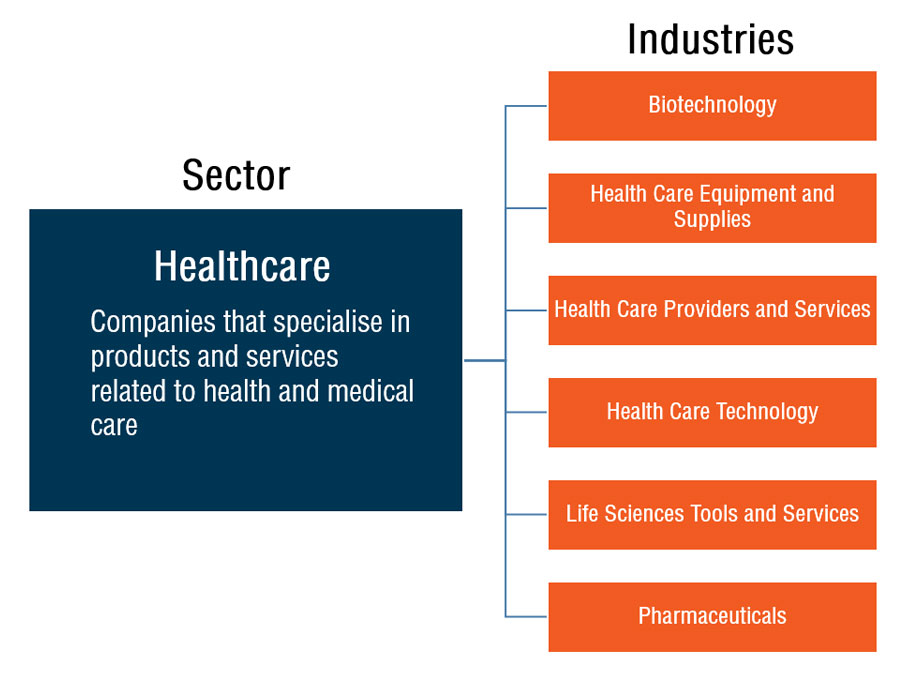

Examples of Sectors and Industries Composition

Figure 1: Technology Sector and Its Industries

Figure 2: Healthcare Sector and Its Industries

The classification of equities into different sectors enable investors to carry out their macro-level or sector rotation strategies. In addition, the low correlation between cyclical and defensive sectors allow investors to diversify their portfolios through different stages of the business cycle.

You may find more details regarding the classification of the different sectors by reading MSCI’s Report.

Sector Disruptors

From the Industrial Revolution in the 1800s to the Internet Boom in the 2000s, the economy is in a constant state of rejuvenation and renewal. Obsolete industries will be replaced by new enterprises and companies will be forced to adapt to the changing environment. This is part of natural economic Darwinism, where natural selection dictates that only the strongest survive.

Within each traditional equity sector, powerful structural trends are developing. The traditional sectors’ leaders of today are increasingly at risk of being replaced by companies, which are positioning themselves for the next socio-economic phenomenon.

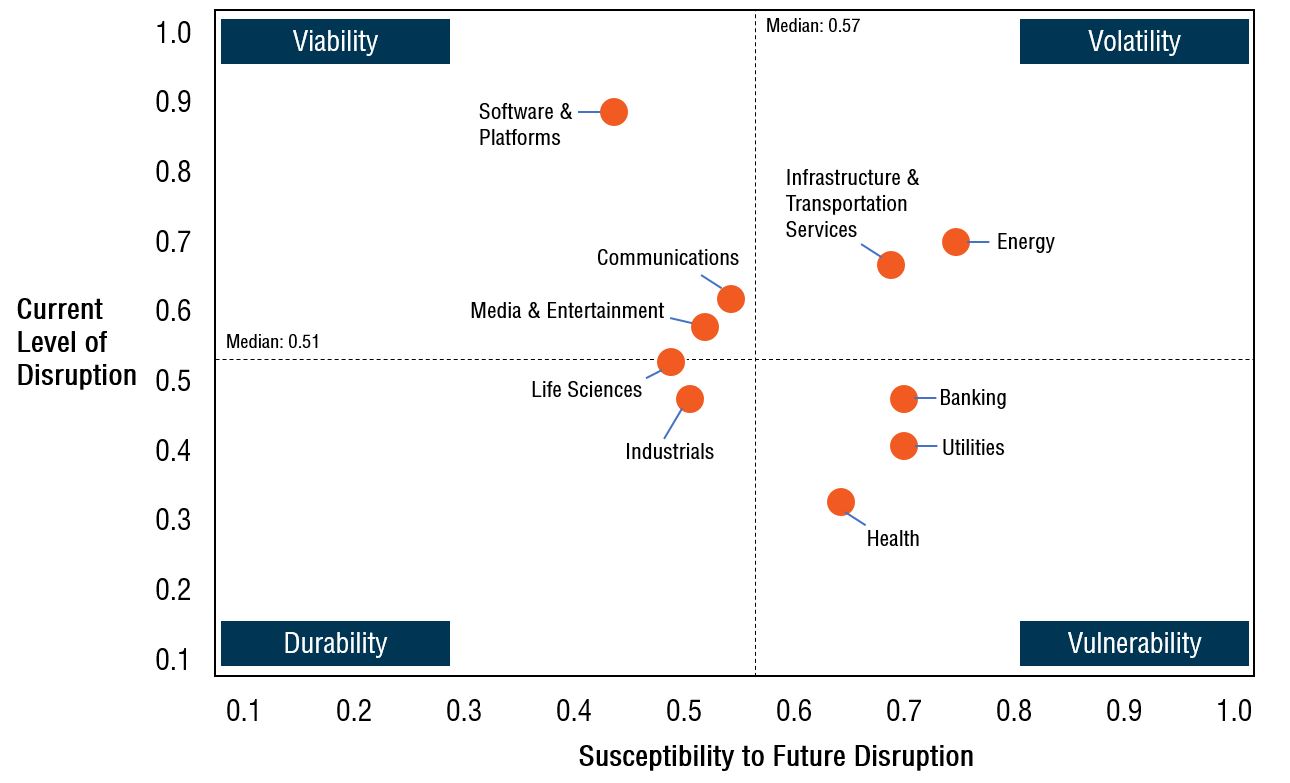

Different industries within each sector have a differing vulnerability to being disrupted. We can use the Accenture Disruptability Index to gauge an industry’s state of disruption based on its current level of disruption and its susceptibility to future disruption.1 There are four distinct states of disruption: durability, vulnerability, volatility and viability.

Figure 3: Illustration of Accenture Disruptability Index

Description of the Four States of Disruption

| States of Disruption | Description |

| Durability |

|

| Vulnerability |

|

| Volaility |

|

| Viability |

|

Investors can utilise the Accenture Disruptability Index to evaluate the risk and return profiles of the respective sectors and industries. Armed with the knowledge, investors can then better allocate their resources into industries with lower volatility or participate in growth opportunities that the disruptors may have to offer.

Traditional Sector-Based Exchange Traded Funds

Traditional sector-based Exchange Traded Funds (ETFs) allow investors to gain exposure to select sectors without having to pick specific stocks. Inclusion criteria into these traditional sector-based ETFs are usually based on the market capitalisation (Share Price x Number of Outstanding Share Units) and the primary operating business of the companies.

During rebalancing, the composition stocks underlying these traditional sector-based ETFs may change because of various reasons; companies were liquidated or replaced by better performing companies. Moreover, new sectors and industries might emerge to reflect current economic trends.

Limitations of Traditional Sector-Based ETFs

The blistering pace of technological innovations, coupled with ever-changing consumers’ preferences, meant that sector-level disruptions are occurring on a more frequent basis and at a higher order of magnitude.2

Traditional sector-based ETFs may be ill equipped for investors who are looking to capitalise on the long-term growth potential of the sector disruptors. As traditional sector-based ETFs are market capitalisation weighted, they tend to favour large cap stocks. This tilts the ETFs’ exposure to companies that have already successfully capitalised on previous and current economic trends.

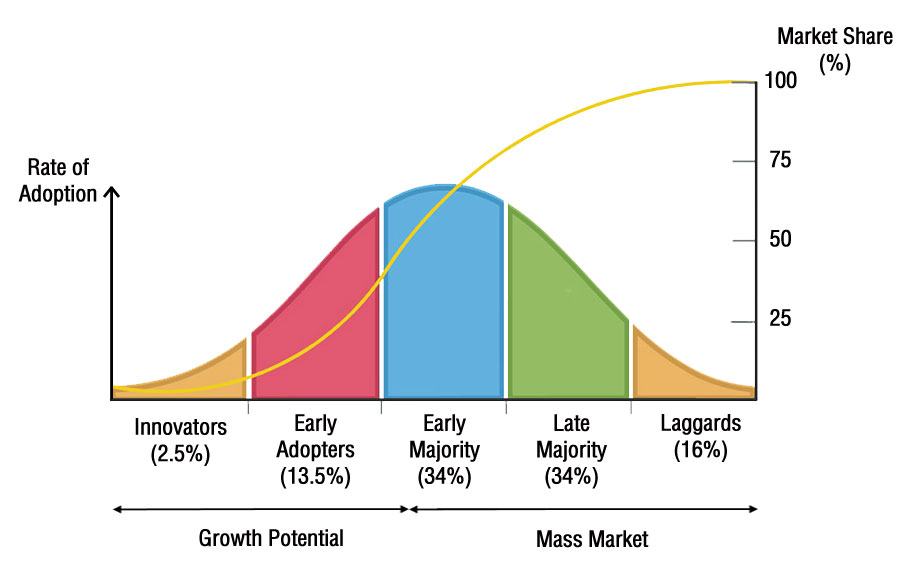

To illustrate, the Technology S-Curve shows that an innovation in its infancy stage provides higher growth potential, albeit with a higher risk of failure, than an ageing technology that is widely used by consumers.

Figure 4: An Illustration of the S-Curve (Orange Line) and Rogers Adoption Curve (Bell Curve)

Sector Disruptors: Thematic ETFs

When structural trends begin to materialise in the future, a new set of companies are likely to rise to replace the incumbent sector leaders. Instead of waiting for the traditional sector-based ETFs to filter out the old guards in favour of the new sector leaders, investors can potentially ride on the wave of new macro-level trends by targeting thematic ETFs.

Thematic ETFs may use alternative rules-based index construction strategies that adhere to specific thematic investment objectives to gain exposure to companies that develop revolutionary technologies or cater to rising consumer trends.

Traditional sector-based ETFs may not be able to offer investors such targeted investment strategies to express their views on changing socio-economic trends.

Sectors and the Potential Sector Disruptors

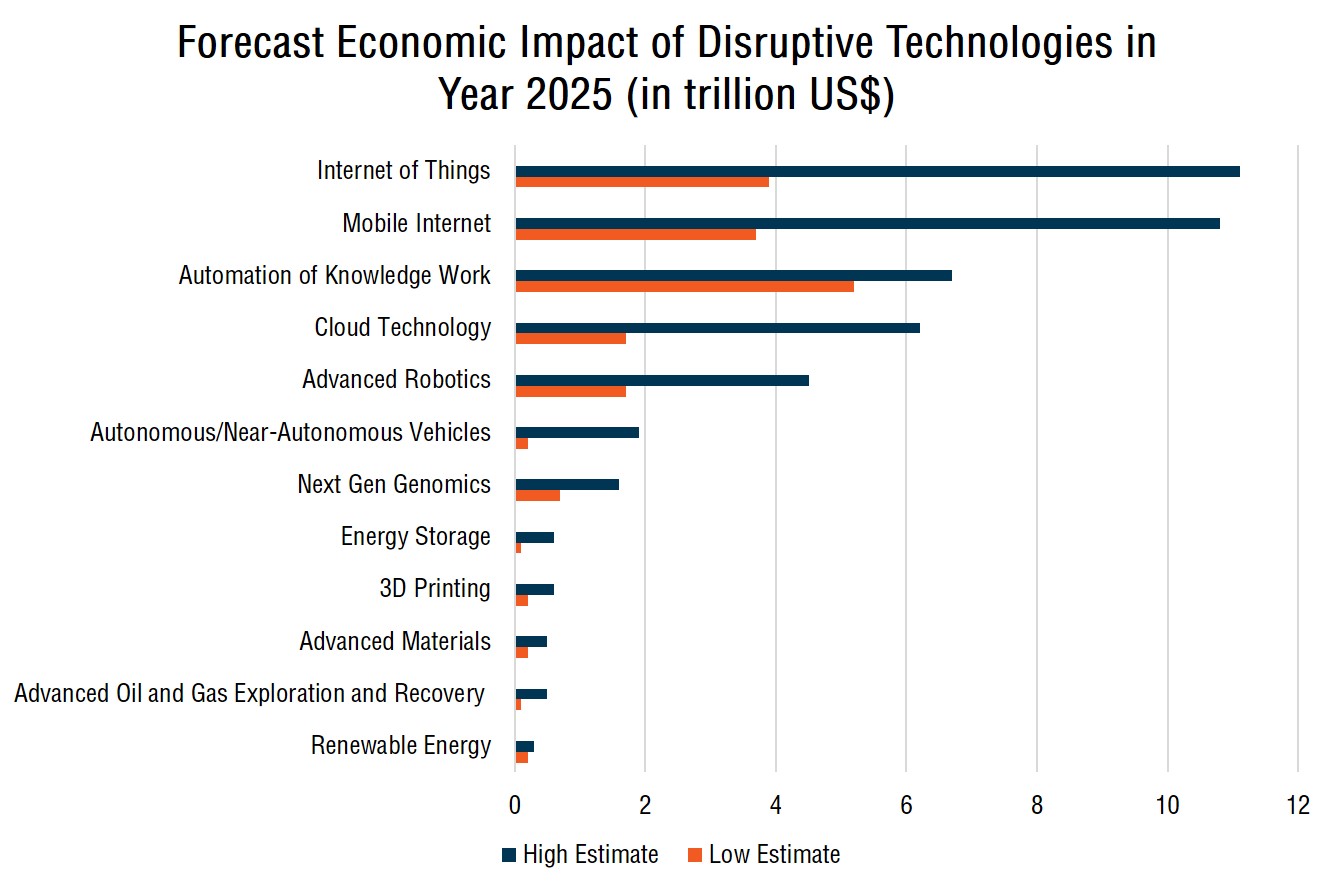

The bar chart by Statista shows the forecast of the economic impact of disruptive technologies in 2025. By 2025, the impact of the Internet of Things (IoT) industry is estimated to reach as much as US$11.1 trillion per year.3

Figure 5: Statista’s Forecast of Economic Impact of Distruptive Technologies in 2025

Below are some examples of the potential sector disruptors and the thematic ETFs that provide exposure to these trends.

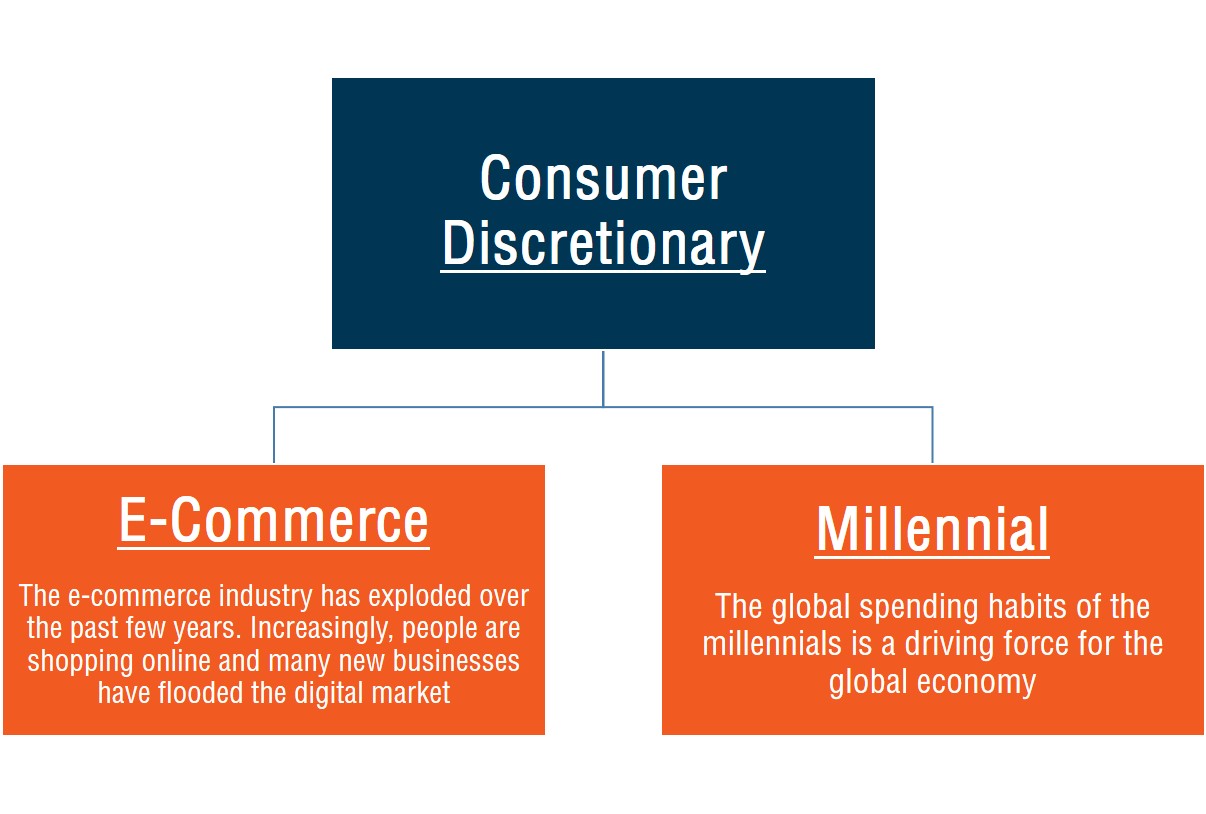

Figure 6: Consumer Discretionary Sector and the Potential Sector Disruptors

| ETF | Amplify Online Retails ETF | Global X E-Commerce ETF | Principal Millennials Index ETF | Global X Millennials Thematic ETF |

| Ticker | IBUY | EBIZ | GENY | MILN |

| Exchange | NASDAQ | NASDAQ | NASDAQ | NASDAQ |

| AUM (US$) | 251.68 million | 2.62 million | 20.20 million | 49.74 million |

| Net Expense Ratio | 0.65% | 0.68% | 0.45% | 0.50% |

| Number of Holdings | 40 | 40 | 103 | 82 |

| Top 3 Holdings |

|

|

|

|

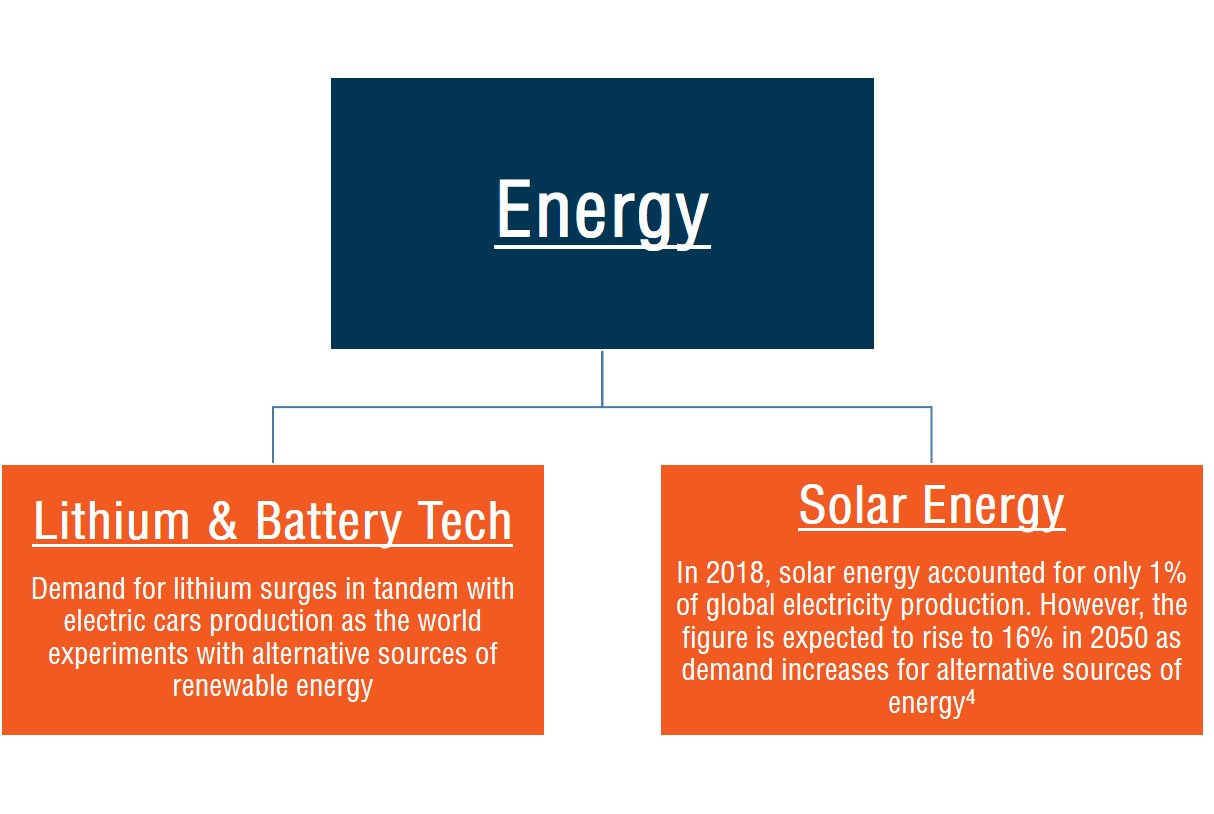

Figure 7: Energy Sector and the Potential Sector Disruptors

| ETF | Global X Lithium and Battery Tech ETF | Invesco Solar ETF |

| Ticker | LIT | TAN |

| Exchange | AMEX | AMEX |

| AUM (US$) | 498.56 million | 320.20 million |

| Net Expense Ratio | 0.75% | 0.70% |

| Number of Holdings | 47 | 22 |

| Top 3 Holdings |

|

|

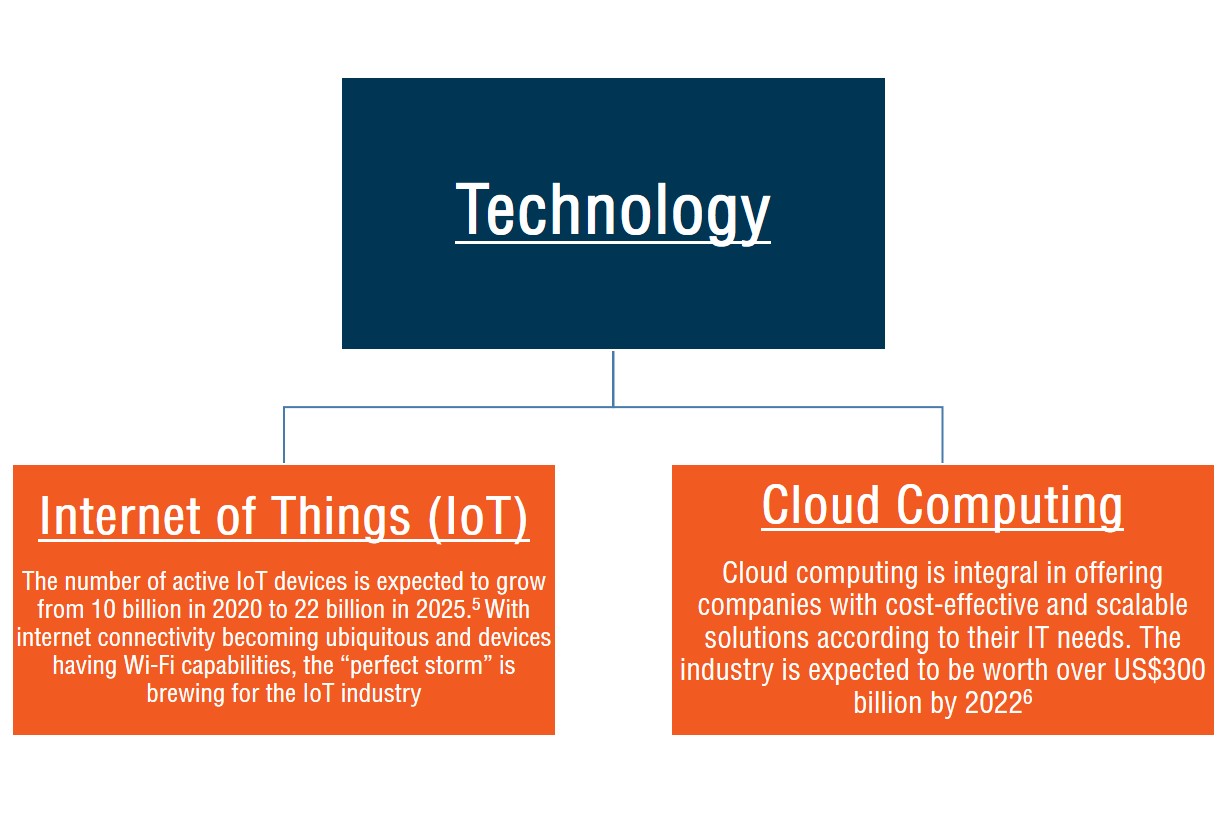

Figure 8: Technology Sector and the Potential Sector Disruptors

| ETF | Global X Internet of Things ETF | VanEck Vectors Semiconductor ETF | First Trust Cloud Computing ETF | Global X Cloud Computing ETF |

| Ticker | SNSR | SMH | SKYY | CLOU |

| Exchange | NASDAQ | AMEX | NASDAQ | AMEX |

| AUM (US$) | 84.62 million | 1.1 billion | 2.18 billion | 351.31 million |

| Net Expense Ratio | 0.68% | 0.35% | 0.60% | 0.68% |

| Number of Holdings | 54 | 25 | 28 | 38 |

| Top 3 Holdings |

|

|

|

|

All ETF information is accurate as of 11 June 2019.

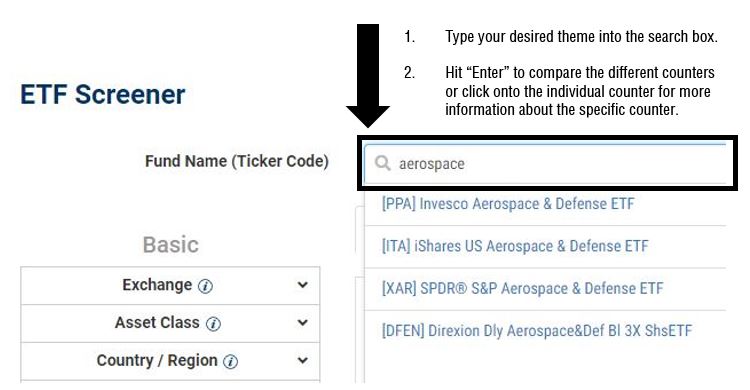

ETF Screener

You may search for ETFs with different thematic exposure by using our ETF Screener’s search box.

Figure 9: Screenshot of ETF Screener’s Search Box

Conclusion

Technological advancement, demographic and social changes will be the driving forces in dictating the mercurial landscape of socio-economic trends. Old themes will wither away and be replaced by new megatrends. The displacement of obsolete themes represents possible thematic investing strategies for investors who are looking to capitalise on the growth potential that the sector disruptors may have to offer.

Thematic ETFs represent plausible investment vehicles for investors to gain access to their desired thematic investment strategies. Instead of waiting for traditional sector-based ETFs to sift out outdated themes, thematic ETFs help identify companies with exposure to up-and-coming trends and allow investors to time their entry early into the market before the trends become mainstream.

In essence, thematic ETFs provide investors with the shortest path possible to innovation that is shaping the future.

Reference:

- [1] https://www.accenture.com/_acnmedia/PDF-85/Accenture-Disruptability-POV.pdf#zoom=50

- [2] https://www.pwc.com/gx/en/ceo-agenda/pulse/the-disruptors.html

- [3] https://www.statista.com/statistics/826712/worldwide-disruptive-technologies-economic-impact-forecast/

- [4] https://www.sepco-solarlighting.com/blog/how-will-solar-energy-be-used-20-years-from-now

- [5] https://iot-analytics.com/state-of-the-iot-update-q1-q2-2018-number-of-iot-devices-now-7b/

- [6] https://www.globalxfunds.com/cloud-computing-digital-infrastructure/

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Mr. Joel Lim

ETF Specialist

Joel graduated from Singapore Institute of Management, University of London with a First Class Honours in Business. He was the recipient of SIM University of London’s Top Student Bronze Award in 2017 and was the worldwide examination topper for the “Financial Management” module in 2016. Joel was also commended by University of London for his excellent performance in the 2014 Examinations.

Joel is involved in ETF education, providing trading ideas and support to traders, dealers and fund managers. Joel also works closely with ETF issuers to educate retail investors about new ETFs during the Initial Offering Period.

From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It  The Rise of AI – Top traded AI counters in February 2024

The Rise of AI – Top traded AI counters in February 2024