Enhancing your trading experience: Further reduction in SG market brokerage for your Cash Plus account! October 3, 2023

In a dynamic financial landscape, adaptability is the name of the game. At Phillip Securities, a member of PhillipCapital, we have always prided ourselves on being at the forefront of market trends, with tailored services to better serve our clients. On that note, we’re excited to share this significant update that reaffirms our commitment to your success – a reduction in our Cash Plus Brokerage Fees!

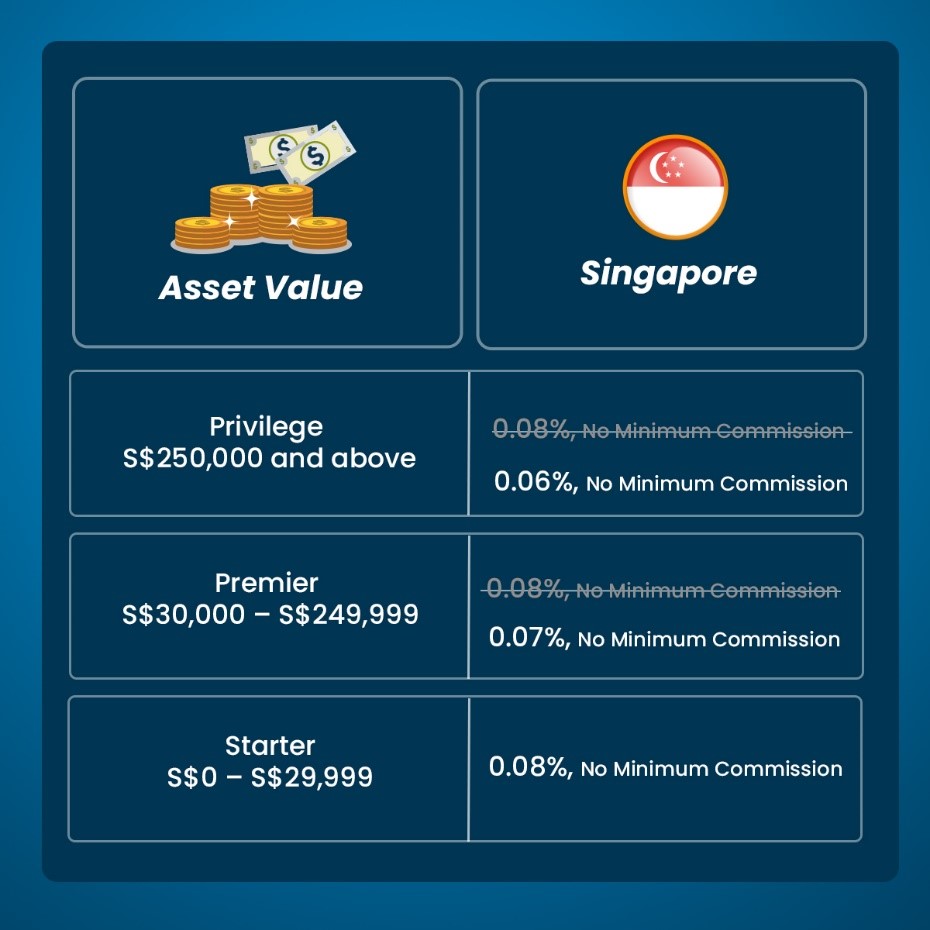

The New Rates:

Effective from 2 Oct 2023, we will be adjusting our brokerage fees for the Singapore Market as follows:

How This Impacts Your Future Trades:

With lower brokerage fees, you gain the flexibility to fine-tune your trading strategies. Frequent traders will see a noticeable reduction in transaction costs, while long-term investors will enjoy improved returns on their overall portfolio. These lower fees also make it more appealing to hold onto your investments for extended periods, maximising your potential gains.

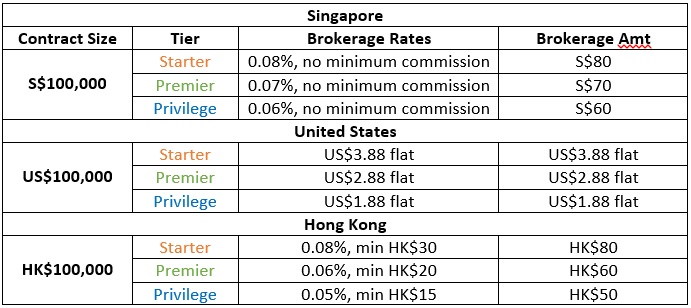

For Example:

With S$200,000 in your Cash Plus account, you would qualify for the Premier Tier Brokerage Rate at 0.07%, with no minimum commission. With a single trade of S$100,000, your brokerage fees would be S$70. However, do note that there would be account maintenance and foreign share custody charges if you do not make any trades for three months.

On the other hand, by topping up another S$50,000 into your account, you would be able to reach the Privilege Tier where a $100,000 contract would let you enjoy a brokerage rate of S$60 for Singapore Market, US$1.88 for US Market and HK$50 for Hong Kong Market. For this tier, account maintenance and foreign shares custody charges as well as cash dividend processing fees for SGX would be automatically waived for qualified clients.

Hence, with the lower rates on the Premier and Privilege Tier, you stand to save S$10 and S$20 respectively!

Why Phillip Securities Remains Your Ideal Partner:

With the new rates, you stand to gain a competitive edge regardless of whether you are an active trader or a long-term investor. The reduced rates will let you retain more of your earnings as lower brokerage fees will give substantial cost savings over time. These savings can significantly boost your overall portfolio performance and provide you with the financial freedom to explore new avenues of investments and diversification.

Apart from offering these lower rates to you, we remain committed and steadfast in our endeavor to provide you with exceptional customer service. Our team is dedicated to supporting your financial journey and ensuring you have all the tools you need for success.

We hope this information can help you plan better. Please visit here if you are ready to open an account with us! If you are still unsure on which account type suits you best, you may contact your Trading Representative or Dealing Team. Alternatively, you can contact our Customer Experience Unit at 65311555 or email us at talktophillip.com.sg.

Happy Trading!

Disclaimer

This material is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs.

Accordingly, no warranty whatsoever is given and not liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information. Investments are subject to investment risks.

The risk of loss in leveraged trading can be substantial. You may sustain losses in excess of your initial funds and may be called upon to deposit additional margin funds at short notice. If the required funds are not provided within the prescribed time, your positions may be liquidated.

The resulting deficits in your account are subject to penalty charges. The value of investments denominated in foreign currencies may diminish or increase due to changes in the rates of exchange.

You should also be aware of the commissions and finance costs involved in trading leveraged products. This product may not be suitable for clients whose investment objective is preservation of capital and/or whose risk tolerance is low.

Clients are advised to understand the nature and risks involved in margin trading. You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualifies financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement.

You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement (available online at www.poems.com.sg) before trading in this product. Any CFD offered is not approved or endorsed by the issuer or originator of the underlying securities and the issuer or originator is not privy to the CFD contract. This advertisement has not been reviewed by the Monetary Authority of Singapore.

About the author

Amelia

Amelia is a fresh graduate from Singapore Management University with a Bachelor’s Degree in Business Management, double majoring in Finance & Marketing. Currently an Equity Margin Dealer in the POEMS Dealing Team with a keen interest in Fundamental & Technical Analysis.

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth  Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition

Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition  United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability

United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability  CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile

CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile