How to short the market using ETFs October 5, 2022

Background

Global stock markets enjoyed strong gains despite the COVID-19 pandemic in 2020 and 2021. This growth was fuelled by the low-interest rate environment as well as expansionary monetary policies such as quantitative easing. However, in 2022, global markets plummeted as countries began tightening their monetary policies to overcome rising inflation. The Nasdaq 100 Index has fallen by almost 30% from a high of around 16,500 on 19 November 2021 to around 11,300 on 17 June 2022.

Under these bearish market conditions, investors’ portfolios have taken a beating. However, investors are still able to protect their portfolios or even profit from such market conditions.

Investors can consider using inverse ETFs to hedge their current portfolios or even gain profits by shorting the market. Here, we will tell you about Inverse ETFs and what to take note of when you trade them.

What are ETFs?

An Exchange-Traded Fund (ETF) is a fund that can be traded on an exchange like a stock. This allows it to be easily bought and sold throughout the day. ETFs typically track an index, sector, commodity, or assets. Thus, you own a portion of the ETF, without owning the underlying assets.

On the contrary, there is another form of ETFs known as Inverse ETFs which allow investors to bet against the direction of the underlying asset. Inverse ETFs allow investors to make money when the underlying asset declines without having to short sell.

What are Inverse ETFs?

Unlike long-oriented ETFs which invest directly in the components of the underlying asset, an inverse ETF is constructed using various derivative instruments such as futures contracts, options on futures contracts, swaps, and forward agreements, in order to profit from a decline in the value of an underlying benchmark.

For example, the ProShares Short QQQ ETF (Ticker: PSQ) seeks results that correspond to the inverse of the daily performance of the Nasdaq 100 Index. If investors anticipate that the Nasdaq 100 Index will fall, they can simply buy the PSQ ETF to profit from this downturn.

Chart: Correlation between PSQ (Orange) Vs QQQ (Light Blue) against the NASDAQ 100 Index

Chart: Correlation between PSQ (Orange) Vs QQQ (Light Blue) against the NASDAQ 100 Index

As shown in the chart above, the performance of the QQQ is positively correlated with the Nasdaq 100 Index. Therefore, it tracks the Nasdaq 100 Index very closely. On the other hand, the performance of the PSQ is negatively correlated with the Nasdaq 100 Index. So, when the Nasdaq 100 Index goes up, the performance of the PSQ goes down and vice versa.

There are also inverse ETFs that seek to deliver returns that are multiples of the benchmark’s inverse, known as leveraged inverse ETFs. Typically, an ETF’s price rises or falls on a one-to-one basis compared to the underlying asset it tracks.

A leveraged ETF is, however, designed to boost the returns to a two-to-one or three-to-one basis compared to the index.

Leveraged inverse ETFs use the same concept to deliver a magnified return when the market is falling.

For example, the ProShares UltraPro Short QQQ ETF (Ticker: SQQQ) seeks investment results that correspond to three times (3X) the inverse of the daily performance of the Nasdaq 100 index.

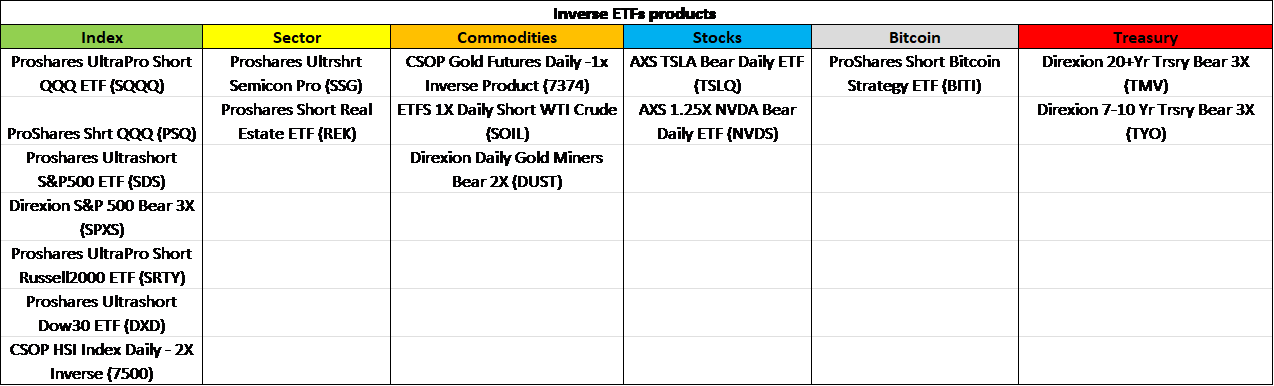

The table below shows some of the inverse ETFs that POEMS offers, allowing investors to bet against the direction of the underlying assets:

How to trade in an inverse ETF?

Trading in inverse ETFs is actually as simple as buying shares on an exchange. If you feel that the particular market, sector, or stock has a bearish outlook, you simply buy shares in the corresponding inverse ETF.

To exit the position when you think the downturn has run its course, you will just need to place an order to sell. Investors still need to be right in their market forecast in order to profit. If the market moves against you, these share prices will fall.

Advantages of using Inverse ETFs

1. Downside is limited

For other financial derivative products that allow investors to short the underlying assets, investors are able to trade them on margin. This means that if they anticipate that the Nasdaq 100 Index will move downwards, they are able to open a short position on the Nasdaq 100 Index that is multiple times more than the capital they have invested in. As for the inverse ETFs, even though investors can buy the SQQQ which corresponds to three times the inverse performance of the Nasdaq 100 Index, they are only allowed to buy based on the amount of capital they have.

Buying an inverse ETF means your downside is limited to the amount invested. The lowest price an inverse ETF can trade for is $0. If you short shares using other financial derivative products, the price can go up indefinitely. So, investors may lose more than their initial investment if the price swings drastically against their intended direction.

2. Borrowing is not required

Investing in inverse ETFs do not require investors to borrow shares like how traditional short-selling works. Borrowing of shares from the broker requires an investor to pay borrowing costs that are charged to an account on a daily basis. Therefore, the costs associated with short selling are avoided when investing in inverse ETFs.

3. Hedging

Inverse ETFs can also be used to hedge a portfolio’s exposure to market risk. A portfolio manager can easily buy inverse ETF shares rather than liquidate individual securities or go in for “holding and hoping”, both of which can be painful and costly.

For example, investors who have a high portfolio weightage in US tech stocks may buy an inverse Nasdaq 100 index ETF to hedge if they anticipate potential downward movement in the short term. Therefore, investors can still hold on to their shares while not being badly affected when the downward movement occurs.

Risks of Inverse ETFs

1. High expense ratios

Unlike traditional ETFs like the SPY or VOO which have an expense ratio of less than 0.1%, inverse ETFs on average tend to have an expense ratio of around 1%. For example, the PSQ has an expense ratio of 0.95%. If we were to compare it with the VOO which has an expense ratio of 0.03%, the expense ratio of the PSQ is significantly higher.

The reason for the higher expense ratio is because inverse ETFs are actively managed and make use of expensive financial instruments such as swaps, futures, and other derivatives. Therefore, the operating expenses to manage inverse ETFs are more costly when compared to traditional ETFs.

With that being said, it is important that investors not hold onto inverse ETFs as a long-term investment but rather, use them as a short-term hedge against a market downturn or a short-term bet against the direction of the underlying asset.

2. The returns from inverse ETFs differ from the actual drop of the underlying assets

Inverse ETFs are generally intended to only provide an inverse return on a daily basis. If the Nasdaq 100 Index moves down 5% over a week or a month, the PSQ won’t likely be up 5%.

Here is an example to illustrate the difference in returns when comparing inverse ETFs and the performance of the S&P500 Index. Assuming the S&P500 Index started at 400 on Day 1. It drops to 350 on Day 2 and goes up to 385 on Day 3, eventually falling to 350 on Day 4.

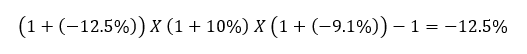

The S&P500 Index will have generated a loss of 12.5%. The calculation is as follows:

However, the inverse ETFs will generate a return of only 10.4545%. The calculation is as follows:

Due to compounding returns and losses on an increasing or decreasing ETF price, over the longer term, you can expect some disconnect between gains/losses on inverse ETFs.

Therefore, investors planning to buy inverse ETFs should only use it for the short term (ranging from days to a maximum of 2 weeks).

What are some aspects to look out for in an ETF?

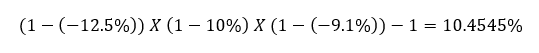

1. Expense ratio

When researching or looking for information on ETFs or mutual funds, one of the first pieces of information to look for is the expense ratio.

An expense ratio is the cost of holding ETFs that are charged to investors, to cover operating costs incurred by the fund company. These costs include administrative and operating fees the management incurs to maintain the ETF.

How do you calculate the expense ratio?

An expense ratio is calculated by dividing a fund’s operating expenses by the average dollar value of total net assets.

Operating expenses reduce the fund’s assets, thereby reducing the return to investors. If an ETF has an expense ratio of 1%, the fund’s operating expenses are 1% of the fund’s assets under management. The fund company would then deduct 1% from the fund’s assets on an annual basis. For example, if the fund has assets under management amount to $10,000, the operating expenses of this fund will be $100 per year. This means that for every $1,000 invested into that ETF, unitholders will incur an annual fee of $10.

Actively managed mutual funds tend to charge higher expense ratios than passively managed ETFs as the operating expenses will be higher.

How do fund companies charge the expense ratio to unitholders?

Investors pay this on an annual basis if they own the ETF for a year. The expense ratio will be deducted by the fund company by adjusting the net asset value (NAV) of the fund on a daily basis. Therefore, it does not mean that you can sell your ETF before hitting the one year mark to avoid the cost.

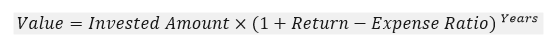

The equation below shows the value that investors will get after deducting the expense ratio.

Expense ratios directly reduce your portfolio’s rate of return. There are two things that must be considered: the impact of high operating expenses and the impact of compounding.

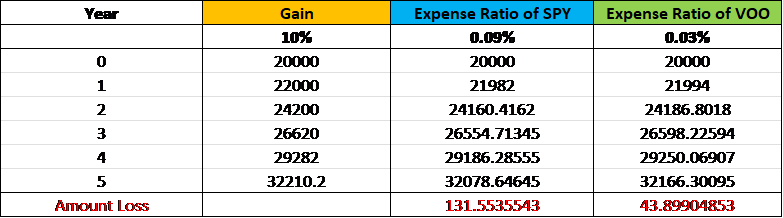

Example of how expense ratio affect the returns on investment

Considering two similar ETFs that track the performance of the S&P500, SPDR S&P500 (SPY) and VG S&P500 (VOO). The SPY has an expense ratio of 0.09% while the VOO has an expense ratio of 0.03%. If both these ETFs generate a return of 10% each year, the table below will show how the expense ratio will affect the total returns of the investment.

Based on the table above, investors who bought the SPY received a return that is lower than the investors who bought the VOO even though both generated 10% returns. Due to the higher expense ratio, investors of SPY had to pay a total of S$131.55 for holding the ETF for 5 years, while investors of VOO had to pay only S$43.90. This is due to the impact of the higher expense ratio and the impact of compounding.

Therefore, investors have to take note of the expense ratio of the ETFs before investing in them. Similar products may have different expense ratios, and this can eventually affect the total investment returns an investor will receive.

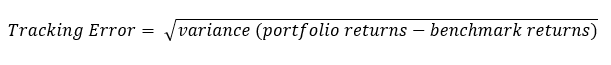

2. Tracking error

Tracking error is the divergence between the price behaviour of the ETF and the price behaviour of the underlying benchmark, which may result in an unexpected profit or loss.

Tracking error shows an investment’s consistency versus a benchmark over a given period of time. Even if the portfolios are perfectly indexed against a benchmark, they may behave slightly differently. The measure of tracking error is used to quantify this difference.

The formula to calculate the tracking error is as follows:

From an investor’s point of view, tracking error can be used to evaluate portfolio managers. If the portfolio manager is earning only low average returns and has a large tracking error, it shows that this particular fund company is underperforming. Investors can then look for other companies that are offering similar products. So, one should look out for funds that have a tracking error that is closer to 0%.

From the example above, SPY and VOO are two similar ETFs which track the performance of the S&P500. However, the SPY has a tracking error of 0.04% while the VOO has a tracking error of only 0.02%. Therefore, the performance of VOO tends to be more consistent with the performance of the S&P500 Index as compared to the SPY.

What contributes to the Tracking Error?

One of the main reasons that contributes to the tracking error is the expense ratio of the ETF. The net asset value (NAV) of an index fund is naturally lower than its benchmark because funds have operating fees that are deducted on a daily basis, whereas an index does not. A high expense ratio for a fund can have a significantly negative impact on the fund’s performance. However, it is possible for fund managers to overcome the negative impact of fund fees and outperform the underlying index by doing an above-average job of portfolio rebalancing, management of dividends or interest payments and securities lending.

Beyond the expense ratio, a number of other factors can affect a fund’s tracking error. One important factor is how identical a fund’s holdings are to the holdings of the underlying index or benchmark. Many funds are made up of the fund manager’s idea of a representative sample and weightage of the securities that make up the actual index.

Illiquid securities can also increase the chance of a tracking error as prices may differ significantly from the market price when the fund buys or sells such securities as a result of larger bid-ask spreads.

Lastly, the level of volatility of an index can also affect tracking error. There is a positive correlation between market volatility and tracking error. A higher volatility will result in a higher tracking error and vice versa.

Conclusion

With the current global inflation crisis and the rising interest rate environment, global markets have taken quite a beating since peaking in 2021. Investing in inverse ETFs does provide alternatives for investors to hedge their current portfolio against the market downturn.

An inverse ETF is constructed using various derivative instruments such as futures contracts, options on futures contracts, swaps, and forward agreements, to profit from a decline in the value of an underlying benchmark.

Investing in inverse ETFs is actually as simple as buying shares on an exchange. If you feel that the particular underlying asset has a bearish outlook, you can buy shares of the corresponding inverse ETF.

To exit the position when you think the downturn has run its course, you will just need to place an order to sell.

Investing in inverse ETFs have limited downside as the most an investor can lose is their initial investment. In addition, there is no borrowing costs needed to purchase inverse ETFs. Investors can use inverse ETFs as a form of hedging to protect their portfolio against a short-term downturn.

However, inverse ETFs generally have a high expense ratio of around 1% as compared to traditional ETFs and the returns from investing in an inverse ETF may differ from the actual performance of the underlying asset.

Some aspects that investors will need to look out for when investing in ETFs are the expense ratio and the tracking error. A high expense ratio and a high tracking error may signify that the fund company may not be performing well.

Reference:

- [1] https://www.investopedia.com/terms/e/etf.asp

- [2] https://www.investopedia.com/terms/i/inverse-etf.asp#toc-double-and-triple-inverse-etfs

- [3] https://screener.fidelity.com/ftgw/etf/snapshot/keyStatistics.jhtml?symbols=VOO

- [4] https://screener.fidelity.com/ftgw/etf/snapshot/keyStatistics.jhtml?symbols=SPY

- [5] https://www.investopedia.com/terms/t/trackingerror.asp#:~:text=Tracking%20error%20is%20the%20divergence,an%20unexpected%20profit%20or%20loss.

- [6] https://finance.yahoo.com/news/better-bear-short-selling-vs-130030065.html#:~:text=Inverse%20ETFs%20may%20not%20act,up%20having%20to%20pay%20dividends

- [7] https://quantdare.com/inverse-etfs-versus-short-selling-a-misleading-equivalence/

- [8] https://www.tradingview.com/chart/Ebff33Le/

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Alvin Teo

Alvin Teo graduated from Nanyang Technological University with a Bachelor’s Degree in Economics. Coming from an Economics background, he strongly believes in the importance of understanding macroeconomic policies before making investment decisions. Alvin started investing in Singapore equities at the age of 21 and thus, he has relevant experience in the Singapore market.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It