Introduction to Shenzhen Stock Exchange (Series 2) December 5, 2016

The Small and Medium Enterprise Board (SME Board) was launched by the government on the Shenzhen Stock Exchange in May 2004. It is a sub-board of the Shenzhen Stock Exchange for the listing of small and medium-sized enterprises (SMEs). The goal is to help those SMEs with growth prospects, to have a listing on the Shenzhen Stock Exchange. With an emphasis on private firms, the SME board has become a unique and indispensable segment in China’s multi-tier capital market system.

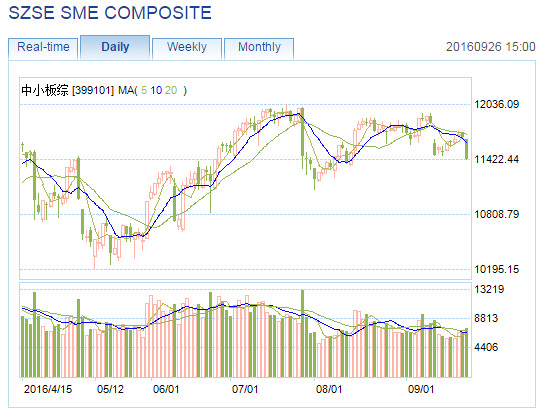

The SME board in Shenzhen Stock Exchange (SZSE) has grown fast in the past 12 years. As of 22 Sep 2016, the SZSE SME composite increased from 1000 points to more than 11,000, while firms listed on the board has climbed from 38 to 800. The total market capitalization is CNY 9455 billion (about USD 1418 billion) and total trading value is CNY 95.8 billion (USD 14.4 billion), average P/E ratio was 49.46

Source: Shenzhen Stock Exchange

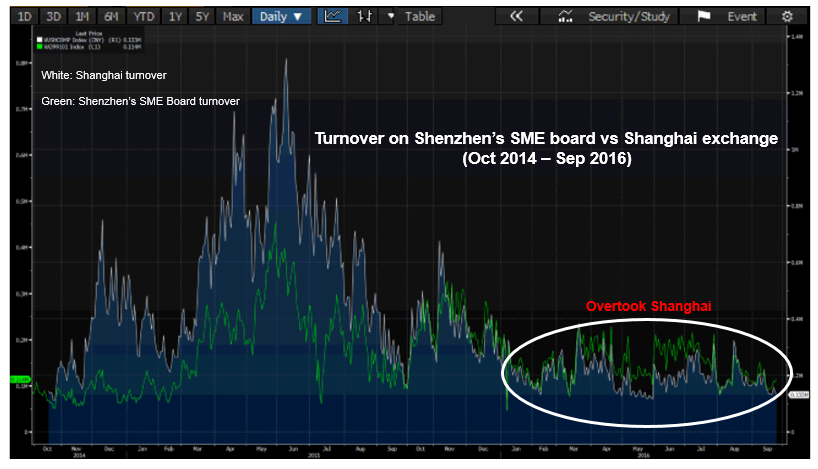

According to Bloomberg, investors are dumping Shanghai stocks, they shun government-run firms in favor of “new economy” stocks that dominate the SME board, as they think that the traditional sectors do not have much growth potential, while the SMEs are labelled with high growth and new future. Shenzhen’s SME Board is now the new leader after surpassing Shanghai’s trading volume on 17 May, 2016.

Source: Bloomberg

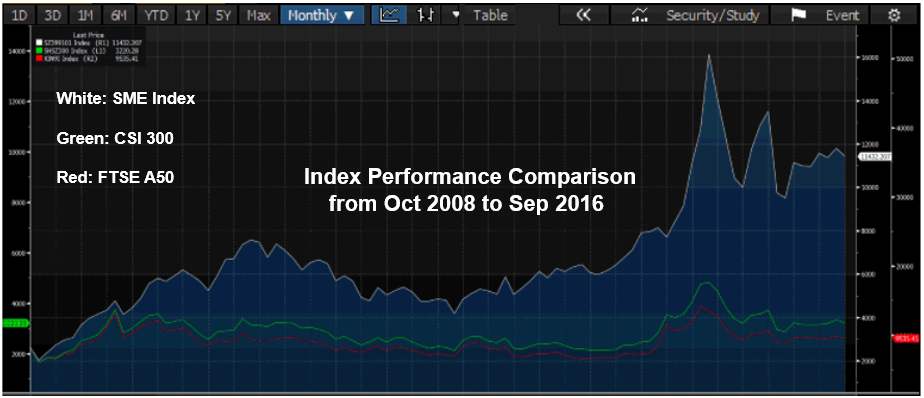

The SME Board witnesses steady growth and has developed into the largest segment of Shenzhen market in terms of listed companies, market cap and turnover. SME Board-listed companies outperform those blue chips and large caps significantly when the overall market is weak.

Source: Bloomberg

“More than 700 SMEs on the Shenzhen Stock Exchange’s SME Board have better profitability than those on the main board. More than 300 of them are top players in their industries. And more than 100 of them are leading players in the global markets,” said Zhao Changwen, Director General of the Department of Industrial Economy, DRC of the State Council.

For example, Zhejiang NHU (002001), the largest vitamin manufacturer in China; Suning Commerce (002024), one of the largest privately owned retailers in China, ranks among top Chinese B2C companies; Hualan Biological Engineering (002007), the leading blood products & vaccines manufacturer in China; BYD Company (002594), the most innovative independent national automobile brand and the largest supplier of rechargeable batteries in the globe; Xinjiang Goldwind Science & Tech (002202), the largest manufacturer of wind turbines in China and the world’s largest manufacturer of permanent wind turbine generator sets.

To view the full list of SME Board component stocks, please click HERE.

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them. The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

About the author

Shengyu Xu

Senior Dealer

Global Markets Department

Xu Shengyu graduated from the National University of Singapore with a master degree in Chemistry and joined Phillip Securities since 2011. He is currently a Senior Dealer in the Global Markets department. Shengyu is proficient in stock trading using both technical and fundamental analysis and frequently conducts educational seminars such as Market Outlooks, “Why Invest Globally” and trading platform introductions to enable his clients to make informed decisions in their investment. Shengyu specialises in China and Hong Kong markets.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It