Investing in the Thailand market through Singapore Depository Receipts (SDRs) June 14, 2023

Overview

Thailand has experienced significant growth and development over the years. With a diverse range of industries and a strong emphasis on exports, Thailand has emerged as one of the leading economies in the region. Thailand’s economy is classified as an emerging market and is considered the second-largest economy in Southeast Asia, after Indonesia. The country has undergone a transformation from being an agrarian-based economy to a more industrialised and service-oriented one. The major sectors driving Thailand’s economic growth include agriculture, manufacturing, tourism, and services.

Economic Landscape

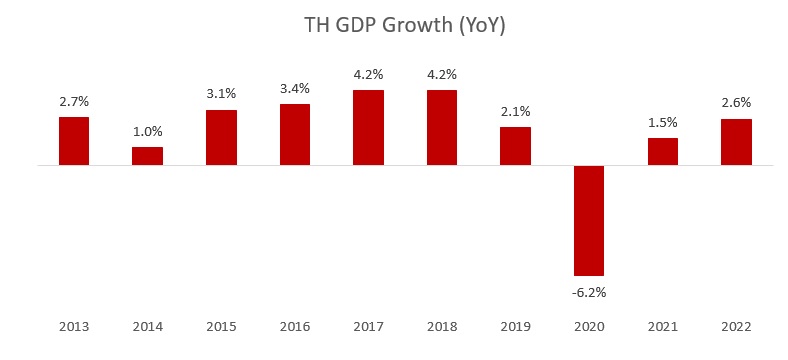

The Thai economy has shown increased growth momentum in 2023, with a year-on-year GDP growth rate of 2.6% in the first quarter, a significant improvement compared to the previous quarter. The growth was driven by a rapid expansion in private consumption, which increased 5.4% year-on-year. The surge in international tourism arrivals contributed to an 11.1% increase in expenditure on services, particularly in the hotels and restaurants sector. However, private and public investments experienced more modest growth rates.

In 2022, Thailand’s economic growth rate was relatively moderate as compared to other major ASEAN economies. Real GDP grew by 2.6% in 2022, indicating a modest pace of recovery from the pandemic-induced recession. The improvement in economic growth was driven by the recovery of private consumption and investment, while public investment contracted.

The increase in private consumption and investment, along with rising energy import prices, led to a significant rise in imports by 15.3% in 2022. On the other hand, exports experienced a more modest increase of 5.5% in USD terms.

Source: World Bank

Source: World Bank

Sector Drivers

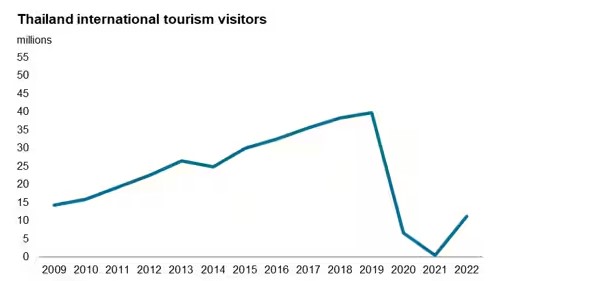

Prior to the COVID-19 pandemic, international tourism played a significant role in Thailand’s GDP, contributing about 11.5% in 2019. However, the pandemic resulted in a sharp decline in foreign tourist visits, as international borders, including those of Thailand, were closed in April 2020. In 2022, as COVID-19 restrictions were gradually eased, international tourism began to recover, with 11.15 million arrivals as compared to just 430,000 in 2021. Nonetheless, this was still considerably lower than the peak of 39.8 million visits in 2019.

In the first quarter of 2023, there was a significant surge in international tourism, with 6.5 million visitors, which accounted for over half of the total international tourist visits in 2022. Tourism receipts for both domestic and international spending in the first quarter reached 499 billion THB, a substantial increase of 127% year-on-year.

The Tourism Authority of Thailand has set a higher target of 25 million international tourism visits for 2023, more than double the number of arrivals in 2022. This suggests the potential for further rapid growth in the tourism sector in the coming year.

Source: Thai Ministry of Tourism

Source: Thai Ministry of Tourism

Political Developments

Recently, Thai voters voted for the two main opposition parties. The result leaves the progressive Move Forward Party (MFP) seeking to form a coalition government with Pheu Thai and five other parties.

But in a kingdom with a long history of coups – at a least a dozen – and judicial intervention in politics, the road to power is not certain. Furthermore, another military intervention is not seen as likely.

Investment options

From the above, you can see that the Thai market offers Singapore investors an opportunity to profit from the country’s growth.

If you wish to invest in top Thai companies, Singapore Depository Receipts (stock code: TPED), or SDRs, listed on SGX, offer investors an attractive combination of stability, liquidity, and convenience. As a listed security on the Singapore Exchange, SDRs provide easy access and liquidity to investors seeking exposure to these companies without the need to deal with the complexities and costs associated with purchasing shares directly in Thailand.

- Convenience: Trade in a single marketplace during the Singapore market hours and trading days. SDRs are traded and settled in Singapore Dollars, providing certainty and transparency in execution prices.

- Cost simplification: SDRs are traded in Singapore Dollars (local brokerage and exchange fee applies, with no FX charges).

- CDP custody: SDRs are custodised with CDP, hence investors will be able to view their aggregated holdings, including other SGX listed securities, via the SGX investor portal.

In addition, the Singapore market opens earlier than the Thai market, and allows SGX to be the venue of choice for price discovery whenever there are corporate announcements related to these companies, before the Thai market opens at 11.30am (Singapore time).

Currently, the SDRs offer exposure to three Thai companies – PTTEP; AOT; and CP All.

PTT Exploration and Production Public Company Limited, or PTTEP, conducts businesses in petroleum exploration, development, and production to support Thailand’s energy security and the energy demand of countries they operate in. As of 1Q2023, the net profit increased by 36% from USD417 million to USD569 million. Net profit was largely impacted by key project completions, acquisitions, and divestments. [5]

The Airport Authority of Thailand, or AOT, is one of the largest airport operators in the Asia-Pacific region, with a proven reputation for delivering high-quality, reliable services to travellers. For the past two quarters, the air traffic volume of the six airports under AOT’s responsibility increased 91.06% or 314,083 flights as compared to the prior year’s, this result corresponds with the full re-opening of the country for travel. [6]

CP All Public Co. Ltd., or CP All, engages in the largest convenience store chain operations under the 7-Eleven trademark in Thailand, operating over 11,000 7-Eleven stores throughout the country. As of 2022, the company recently opened 702 new 7-Eleven stores both in Bangkok and provincial areas of Thailand, meeting their target expansion plans despite pandemic concerns. [7]

Reference:

- [1] https://www.worldbank.org/en/country/thailand/overview#:~:text=According%20to%20the%20Thailand%20Economic,2022%20and%203.6%25%20in%202023

- [2] https://www.spglobal.com/marketintelligence/en/mi/research-analysis/thailands-economy-rebounds-in-early-2023-as-tourism-surges-may23.html

- [3] https://www.adb.org/sites/default/files/linked-documents/tha-cps-2021-2025-ld01.pdf#:~:text=Thailand%20experienced%20severe%20droughts%2C%20subdued%20exports%2C%20political%20unrest%2C,enabled%20moderate%20economic%20expansion%2C%20averaging%203%25%20during%202013%E2%80%932019

- [4] https://gulfnews.com/world/asia/what-next-for-thailand-after-election-rejects-military-rule-1.95772055

- [5] https://www.pttep.com/en/Investorrelations.aspx

- [6] https://investor.airportthai.co.th/

- [7] https://www.cpall.co.th/en/investor

Disclaimer

This material is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs.

Accordingly, no warranty whatsoever is given and not liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information. Investments are subject to investment risks.

The risk of loss in leveraged trading can be substantial. You may sustain losses in excess of your initial funds and may be called upon to deposit additional margin funds at short notice. If the required funds are not provided within the prescribed time, your positions may be liquidated.

The resulting deficits in your account are subject to penalty charges. The value of investments denominated in foreign currencies may diminish or increase due to changes in the rates of exchange.

You should also be aware of the commissions and finance costs involved in trading leveraged products. This product may not be suitable for clients whose investment objective is preservation of capital and/or whose risk tolerance is low.

Clients are advised to understand the nature and risks involved in margin trading. You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualifies financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement.

You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement (available online at www.poems.com.sg) before trading in this product. Any CFD offered is not approved or endorsed by the issuer or originator of the underlying securities and the issuer or originator is not privy to the CFD contract. This advertisement has not been reviewed by the Monetary Authority of Singapore.

About the author

Elston Soares and Marcus Yeo

Elston Soares is an editor with Phillip Securities Research. Marcus Yeo, an intern with PSR, also contributed to this article.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It