Metaverse: From Fiction to Reality January 10, 2022

Introduction

I am sure that by now you would have heard of the “metaverse” with Facebook announcing its decision to officially change its name to Meta Platforms Inc. This was a rebranding effort to distance the company from its original Facebook product, a social network, and to be viewed as a “metaverse” company instead.

Other big tech companies are also repositioning themselves for the metaverse, and Microsoft’s CEO aims to have the company play a role in the “enterprise metaverse” [1].

Games engine companies such as Unity and Epic Games are also positioning themselves as metaverse world builders [2].

Separately, a note from investment bank Morgan Stanley in November [3] said that it views the metaverse as the next big investment theme as it is already seeing some stock sectors benefiting from it.

With all the media coverage and hype about the metaverse, will this concept turn into reality or is it all just marketing hype? To figure that out, let us first understand what is the metaverse.

What is the metaverse?

The metaverse is a term coined by Neal Stephenson in the 1992 dystopian sci-fi novel “Snow Crash”, describing a place where people remotely hang out while wearing virtual reality (VR) headsets.

The word metaverse is a portmanteau of the prefix “meta” (meaning “beyond”) and the suffix “verse” (shorthand for “universe”) [2]. Thus it literally means a universe beyond the physical world. More specifically, this “universe beyond” refers to a computer-generated world that fully blends digital and physical existence.

Essentially, the metaverse refers to a fully immersive 3D digital environment where people are represented by digital avatars and one can work, play video games, buy digital items, socialise with friends, and consume media within the metaverse itself, as compared to the 2D cyberspace that we are all using today where we browse and scroll through the internet on our screens.

Hence, the metaverse is best understood as a quasi-successor state of the internet. It is similar to the mobile internet that has been built upon and expanded the hard line internet of the 1990s and 2000s [4].

Unfortunately, at this point of time, there is no specific definition of metaverse as it is still in its early days and is being actively defined.

However, if you are still having a hard time visualising the metaverse concept, sci-fi films such as the 2018 Ready Player One or this year’s Free Guy may provide some fanciful versions of the metaverse to spark your imagination.

Characteristics of a “true” metaverse

While the metaverse is still in its early days and there is no single agreed definition of the metaverse yet, there are still certain core characteristics that define a “true” metaverse.

1. Persistent

In the metaverse, there should be real-time persistence, meaning there is no ability to pause it and when users come back, there should be some sort of continuity and not a reboot. Essentially, the metaverse should continue to exist and function even after users have left, allowing the metaverse to be a digital representation of the physical world and a continuum of time and space.

2. Immersive

One of the keywords for the future metaverse is “presence” where it is not just to emulate reality, but rather to be reality in itself. This goes beyond what current VR technologies can do which mainly involves surround sound and images. This is where the “Internet of Senses” comes in. This is a term coined by Ericsson, where visual, audio, haptic, and other technologies will in future augment our senses beyond the boundaries of our bodies, giving us augmented vision, hearing, touch, and smell, and providing us with similar experiences as the ones we have in the physical world [5].

In order to engage ourselves in a fully immersive digital world, next-generation technology will need to have the ability to “hack” our six perceptual inputs (vision, hearing, taste, smell, balance, and haptics), driving the perceptual system, and sensing and reconstructing reality.

3. Own a fully functioning economy

A fully developed metaverse will possess its own fully functioning economy, where users can earn and spend in it, in order to create a parallel universe of the real world. As such, the technology surrounding payment services and ownership of assets in the metaverse is important. We can expect technologies such as cryptocurrencies and non-fungible tokens (NFTs) to drive these services in the metaverse in the future.

Payments in the metaverse can be made using cryptocurrencies via decentralised, peer-to-peer networking systems that operate without the need for a central authority (such as a government or central bank). Meanwhile, NFTs provide the necessary security for owning digital assets in the metaverse.

NFTs are unique, non-divisible, and non-interchangeable units of data stored on the blockchain. Essentially, they attach a unique identifier to prove ownership of an asset cryptographically, allowing the owner of the digital asset to prove its ownership as well as verify the asset’s origin, eliminating the possibility of digital replicates.

4. Open architecture

Today, most of the early version of the metaverse (such as Roblux and Fortnite) operate on closed architecture systems where shareholder supremacy trumps user centricity, software and/or hardware are incompatible between different platforms and different platforms are often designed for different primary use cases (such as gaming, working, shopping and socialising).

A “true” metaverse would need to operate on an open architecture system where there is interoperability across all the companies (allowing users to move seamlessly across experiences/virtual worlds and have access to the broader internet) and that all parties (users, developers, and companies) are able to participate on equal terms. This would require much more cross-company collaboration, development of new technology standards as well as new hardware and software.

Metaverse market growth outlook

The metaverse is expected to create wide-ranging revenue opportunities across multiple industries, and we will start to see disruptive themes, such as social media, video games, e-commerce, 5G & 6G networks, cloud & edge computing, brain-computer interface and blockchain converging as the metaverse slowly takes its form and grows.

But before taking a look at growth projections for the metaverse market, let us take stock of how well the metaverse has been performing.

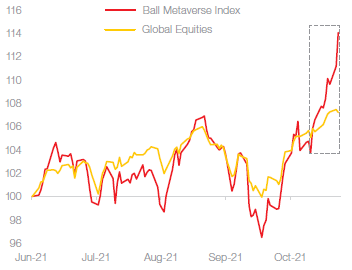

To gauge the performance of the metaverse theme, we will be using the Bal Metaverse Index as a proxy.

The Ball Metaverse Index, launched in June 2021, is the first index globally designed to track the performance of the metaverse.

The index consists of a tiered weight portfolio of globally-listed companies which are actively involved in the metaverse, and are classified based on seven key enabling capabilities [6]:

1. Compute

2. Networking

3. Virtual Platforms

4. Interchange Standards

5. Payments

6. Content, Assets, and Identity Services

7. Hardware

Based on the graph above, we can see that the index has generally outperformed global equities since launch and from October 2021 onwards, the index has outperformed the global equities substantially. This momentum is likely to continue given its exposure to innovative and disruptive companies in the technology space.

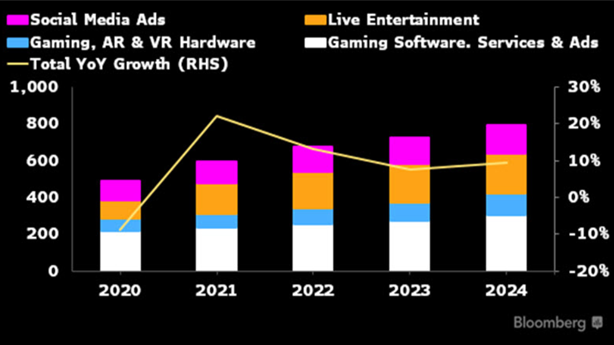

Looking ahead, the market opportunity for the metaverse is estimated to be US$390bn- US$800bn by the mid-2020s.

Ark Invest estimates that revenue from the virtual worlds could approach US$390bn by 2025, up from the approximate US$180bn in 2021 [8]. And Bloomberg Intelligence believes the market opportunity for the metaverse can be a more bullish US$800bn by 2024, an increase in its estimate from about US$500 billion in 2020 [7]. This represents a CAGR of 13.1% over the 5-year span. However, this only represents the primary market for online game makers, gaming hardware, live entertainment, and social media. While these will all be crucial parts of the ecosystem, which will be driven by interactive experiences, the longer-term metaverse must include relevant computing, networking, and payments companies as part of its infrastructure.

While the metaverse is still in its early days, with more and more companies jumping in to get a piece of this market, the metaverse is likely to be driven by three factors in its initial phase of development.

1. Social media: With Facebook (or Meta), the world’s largest social media company, making a pivot itself as a metaverse company of the future, we will likely see more social media companies jumping on the bandwagon as well. That being said, with internet penetration growing at 5.2% per annum [2], we will see the number of social media accounts increase in tandem. These social media networks will collectively help drive the metaverse market in its initial phase.

2. To put things into perspective, Facebook with 3.6 billion monthly users [9], will be able to drive half of the world’s population into the metaverse alone (hypothetically).

3. Remote work: The phenomenon of remote work is here to stay even in the post-pandemic world and will not be a transitory trend that will fade. Research by PwC has shown that the majority of the employers and employees viewed remote working arrangements as a success and feel that productivity has increased substantially. That being said, we are starting to see more developments in the metaverse space, such as Facebook’s recent release of Horizon Workrooms, Microsoft’s own metaverse via its Teams conferencing program as well as innovation in the Internet of Senses, which will make remote working more immersive by bridging the physical and digital worlds, and driving the growth of remote work in the metaverse.

4. Video games: Data from Newzoo shows that the number of gamers worldwide was 2.7 billion in 2020 and is expected to grow to 3.1 billion by 2023 [10]. Meanwhile, data from the International Data Corporation (IDC) also shows that revenue from the video gaming industry grew more than 20% to US$180 billion in 2020 [11]. With gaming companies such as Fortnite, Roblox, and Minecraft being the forerunners in the metaverse space, we can expect them to set the foundation for early versions of the metaverse. On top of that, gaming companies are also starting to act as platforms for blockbuster events. Here, we have seen Fortnite allowing users to gather in the game to watch concerts on a big screen [12], as well as Roblox’s collaboration with Gucci to host a “Gucci Garden Experience” for players to try on or buy in-game Gucci accessories for their digital avatars [13], turning millions of gamers into a ready pool of customers.

Nonetheless, the metaverse is much more than just the above three factors, and there will be many other addressable markets of the metaverse in the coming years or decades that investors can look at for investment opportunities.

Key components of the metaverse ecosystem

The metaverse, like the internet and mobile internet, is a network of interconnected experiences, applications, devices and products, tools and infrastructure. So, it is not possible for a single company to build a “true” metaverse, and as mentioned earlier, a “true” metaverse would have to be in the form of an open architecture system where companies cross collaborate and embrace interoperability.

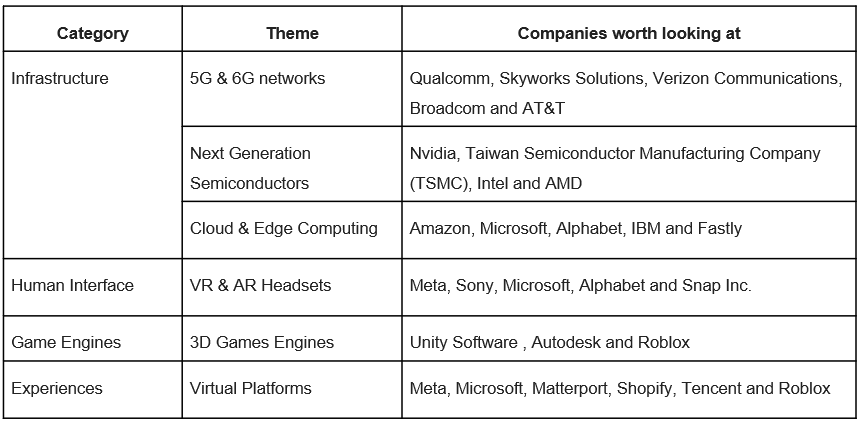

As a result, there will be hundreds of companies that will benefit from the development and adoption of the metaverse. But let us focus on the key players in the metaverse that will likely be big winners.

Infrastructure providers

The infrastructure layer of the metaverse forms the foundation of the other components of the metaverse. And it includes the technology that enables our devices, connects them to the network, and delivers content and computing power.

Firstly, telecommunications network companies will need to provide real-time connections, high bandwidth and data services to consumers as the metaverse would be rendered in real-time and based on sensor data capturing real-world 3D objects, gestures, audio and much more. 5G networks will substantially improve bandwidth while reducing network contention and latency. And with the ongoing development of the 6G network, we will most likely see much greater speed increments required to support the metaverse.

Secondly, much immersive computing will be required to support the diverse and demanding functions in the metaverse, as well as the ability to allow billions of humans to access it in real time.

In fact, in Intel’s recent statement, the company mentioned that we would need a 1,000 times increase in computational efficiency from today’s state of the art to support the metaverse [14]. Enabling the untethered functionality, high performance, and miniaturization required by the next generation of mobile devices, smart glasses, and wearables will require increasingly powerful and tinier hardware (such as semiconductors).

Then, apart from the need for next generation chipsets, edge computing will also be essential to support the low latency required for millions of people to connect and have continuous real-time virtual experiences in the metaverse.

We will start to see cloud computing get more distributed and move closer to the edge where AI and data intensive applications of the metaverse need it.

Public cloud leaders like Amazon (NASDAQ: AMZN), Microsoft (NASDAQ: MSFT), Alphabet (NASDAQ: GOOGL), IBM (NYSE: IBM) and Fastly (NYSE: FSLY) are all well positioned in migrating computing power from the cloud to the edge.

Human interface

Human interface refers to the physical devices that help us access and interact with the metaverse. This ranges from smartphones to VR headsets to future technologies like advanced haptics, smart glasses, smart contact lenses, miniaturized biosensors and brain-computer interfaces.

Nonetheless, at this point, VR/AR headsets remain to be the devices that will likely receive mainstream adoption by users to access the metaverse as we wait for more advanced technologies to take shape and prove their viability for mass market adoption.

Some examples of existing human interface devices in the market now include Facebook’s (or Meta’s) Quest 2 VR headset, HTC’s Vive Flow VR headset, Sony’s PSVR 2 headset, Snap’s (the company that developed Snapchat) AR spectacles glasses and the Magic Leap One VR headset.

Another notable mention would be FeelReal’s Sensory Mask that allows users to smell and feel the virtual world by easily mounting on the device to existing compatible VR headsets like the Samsung Gear VR and Oculus Rift.

Game engines

Game engines play a foundational role in the metaverse creation to create every pixel, asset, and interaction in the virtual world. Game engines have moved rapidly beyond games to be interactive high-fidelity graphics and environment engines. They provide the foundation on which the true next generation of interactive experiences can be built. Previously reserved for high-end visual effects houses and game development studios, these tools have become increasingly affordable, accessible and pervasive enough to work on a global scale with the necessary fidelity for a new generation of creators.

Currently, the two most dominant leaders in this space of game engines are Unity Software (48% market share) and Unreal Engine from Epic Games (13% market share) [2]. Both companies are involved in creating a graphics pipeline for developing 3D environments, and provide an environment for translating geometry into images on the screen.

Experience

“Many people think of the metaverse as 3D space that will surround us. But the metaverse is not 3D or 2D, or even necessarily graphical; it is about the inexorable dematerialization of physical space, distance, and objects.” Jon Radoff, CEO & co-founder of Beamable [15]

This component of the metaverse relates to companies which — through their virtual platforms — offer users unique and immersive experiences in the metaverse which would previously have been difficult or impossible to experience in the physical world. These experiences include:

- Immersive commerce: Shopping enhanced by virtual and augmented reality. An example would be Shopify which allows merchants and developers to collaborate to deliver immersive AR, VR, and 3D shopping experiences [17].

- Entertainment: Games such as Fortnite, Roblox and Rec Room have already incorporated live entertainment such as music concerts and immersive theater for their users. And we will also start to see companies offering immersive “front row” seats at a sporting event, concert, or fashion show through the use of the metaverse.

- Education: Universities have begun working with AR software, bringing 3D visualisations into the college classroom. Case Western Reserve University has teamed up with Microsoft HoloLens to create holographic anatomical images [18]. Students can examine things like white-matter, fibres, and tissues in detail, or rotate organs to get a better view.

- Real estate: Matterport, a software and video capture company, is allowing prospective buyers or tenants to do a virtual walk-through of the apartment, house or commercial space from the comfort of their living rooms, saving time and energy from physically going for a viewing [19].

- Automotive: Through the use of AR, car dealerships are bringing augmented reality experiences to prospective car buyers online. Some examples would be Audi’s fully digital car showroom, Audi City, and Toyota’s iPad app, Toyota Hybrid AR, that allows buyers to take a look “inside” its C-HR model [20]. Apart from use cases for car dealerships, there are also see use cases for automotive manufacturers. For instance, the NVIDIA DRIVE-SIM is a simulation platform designed for end-to-end simulation of autonomous vehicles (AV) in Nvidia’s own Omniverse 3D environment [21]. These simulations can be used for validating AV functions or for training AI perception networks.

- Architecture, Engineering, and Construction (AEC): The NVIDIA Omniverse, a collaboration and simulation virtual platform, is allowing AEC professionals to have more efficient collaboration during design, faster iteration on renders, and a true-to-reality immersive simulation anywhere even while working remotely [22].

Investing in the metaverse

Currently, there are hundreds of companies, from seed-stage startups to tech giants, that are finding their places in the metaverse ecosystem and would benefit from the metaverse theme but I have detailed some of the main ones that investors can look at based on the four main key components of the metaverse that I have discussed.

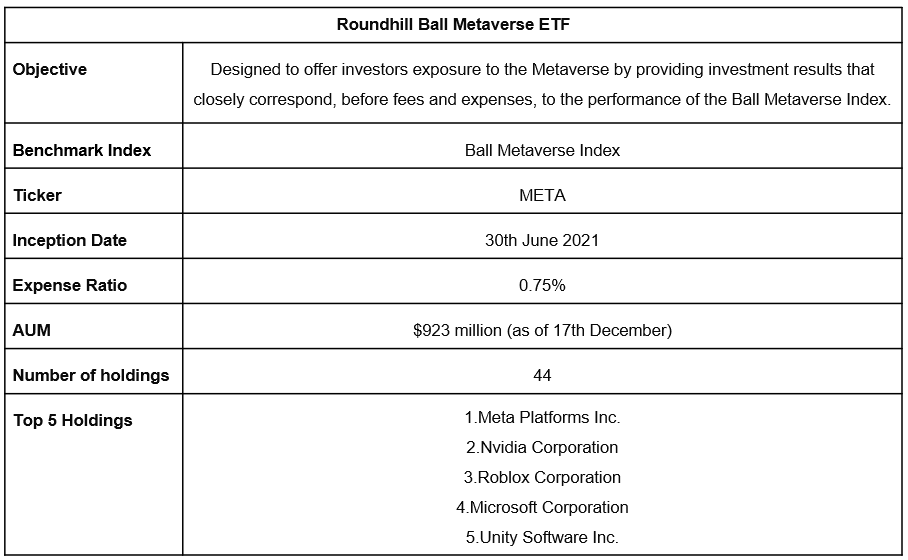

However, if you are an investor who prefers a more diversified exposure to the metaverse theme and dislikes the hassle of doing research to stock pick for your portfolio, you can consider investing in an ETF that offers exposure to the metaverse. One ETF you can consider is the Roundhill Ball Metaverse ETF, which is also the world’s first metaverse ETF and was just launched in June this year.

The Roundhill Ball Metaverse ETF is designed to offer investors’ exposure to the Metaverse by providing investment results that closely correspond, before fees and expenses, to the performance of the Ball Metaverse Index. The Ball Metaverse Index is the first index globally designed to track the performance of the metaverse. The index consists of a tiered weight portfolio of globally-listed companies that are actively involved in the metaverse. How the tiered weighting works is that the index gives greater weightings and rankings to companies it considers pure plays while giving smaller positions to “core” and “non-core” names.

Conclusion

The metaverse is still in its early days and it could be years, if not decades, before we see a “true” metaverse fully formed. Nonetheless, the metaverse is no longer a fiction that we see only in movies and books, but it is slowly becoming a reality as more and more conversations about this as an industry are taking place, more companies are jumping in to build the metaverse piece by piece and consumer interest and acceptance is growing.

The metaverse offers billions of dollars of new opportunities as it will revolutionize every industry and function, from healthcare, payments and consumer products to entertainment and education. This will open up lots of investment opportunities for investors to take advantage of and to ride the wave to the next generation of the internet.

How to get started

Looking for ways to trade metaverse shares and ETFs? You can now trade with POEMS!

1) Trade metaverse shares and ETFs from US$1.88 flat

As the pioneer of Singapore’s online trading, POEMS’ award-winning suite of trading platforms offers investors and traders more than 40,000 financial products across global exchanges.

Explore an array of US shares with brokerage fees as low as US$1.88 flat* when you open a Cash Plus Account with us today. Find out more here. T&Cs apply.

2) Trade metaverse CFDs like Meta, Microsoft, Unity and Nvidia, with or without leverage

Investors and traders with a bigger risk appetite may consider using Contracts for Differences (CFDs) to invest in the metaverse theme. CFDs are versatile tools for investors, particularly those who take an active approach to investing. CFDs can be used for hedging, short-selling and even leveraged trading. They only require minimum investments upfront, which are known as the margin requirement.

CFDs are also ideal tools for people with less capital but who wish to capitalize on the growth potential of certain industries. Or they may simply want to take advantage of the latest market movements regardless of direction.

CFDs, however, may not be suitable for investors whose investment objective is to preserve capital and/or whose risk tolerance is low.

To understand more, read our article on “Understanding Contracts for Differences”.

We hope that you found value reading this article! If you do not have a POEMS account, you may visit this link or scan the QR code below to open one with us today!

Open a POEMS account within minutes and trade instantly!

For enquiries, please email us at cfd@phillip.com.sg. If you are interested in active discussions, you can also join our Telegram community here.

Reference:

- [1] https://www.investors.com/news/technology/metaverse-is-it-sci-fi-hype-or-the-next-big-thing/

- [2]https://www.dbs.com.sg/private-banking/aics/templatedata/article/generic/data/en/CIO/112021/211115CIOVP.xml?linkId=100000085638875

- [3] https://markets.businessinsider.com/news/currencies/metaverse-big-investment-theme-morgan-stanley-roblox-facebook-tech-gaming-2021-11

- [4] https://www.matthewball.vc/all/forwardtothemetaverseprimer

- [5] https://www.ericsson.com/en/6g/internet-of-senses

- [6] https://www.roundhillinvestments.com/etf/meta/

- [7] https://www.bloomberg.com/professional/blog/metaverse-may-be-800-billion-market-next-tech-platform/

- [8] https://research.ark-invest.com/hubfs/1_Download_Files_ARK-Invest/White_Papers/ARK%E2%80%93Invest_BigIdeas_2021.pdf

- [9] https://www.statista.com/chart/2183/facebooks-mobile-users/

- [10] https://newzoo.com/insights/articles/games-market-engagement-revenues-trends-2020-2023-gaming-report/

- [11] https://gameworldobserver.com/2020/12/28/idc-gaming-revenue-2020

- [12] https://www.epicgames.com/fortnite/en-US/news/your-first-drop-into-party-royale-getting-to-the-big-screen

- [13] https://blog.roblox.com/2021/05/gucci-garden-experience/

- [14] https://latestpagenews.com/technology/metaverse-requires-a-1000-fold-increase-in-computing-power/

- [15] https://medium.com/building-the-metaverse/the-metaverse-value-chain-afcf9e09e3a7

- [16] https://medium.com/@sbroock/beyond-broadcast-and-social-media-game-engines-are-the-new-reality-engines-27af8014ca8

- [17] https://www.shopify.com/partners/blog/ar-vr

- [18] https://case.edu/hololens/

- [19] https://matterport.com/industries/real-estate/virtual-tours

- [20] https://bernardmarr.com/the-amazing-ways-augmented-reality-is-transforming-car-retail/

- [21] https://developer.nvidia.com/drive/drive-sim

- [22] https://www.nvidia.com/en-us/omniverse/architecture-engineering-construction/

- [23] https://medium.com/building-the-metaverse/market-map-of-the-metaverse-8ae0cde89696

- [24] https://www.roundhillinvestments.com/research/metaverse/intro-to-the-metaverse

- [25] https://ambcrypto.com/metaverse-grabbing-eyeballs-morgan-stanley-calls-it-next-big-investment-theme/

- [26] https://www.ballmetaverse.co/why-a-metaverse

- [27] https://www.wundermanthompson.com/insight/defining-the-metaverse

- [28] https://www.indiatimes.com/technology/news/what-is-nvidia-omniverse-how-its-making-remote-working-more-efficient-550412.html

- [29] https://hellofuture.orange.com/en/a-journey-into-the-metaverse-marketing-opportunities-in-a-connected-and-persistent-world/

- [30] https://nwn.blogs.com/nwn/2020/10/edge-computing-samsung-metaverse.html

- [31] https://www.gamedesigning.org/gaming/virtual-reality-companies/

- [32] https://www.thestreet.com/etffocus/trade-ideas/invest-in-metaverse-an-etf-for-that

- [33] https://www.globalxetfs.com/the-metaverse-takes-shape-as-several-themes-converge/

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Jeremy Chua

Dealer

Jeremy graduated from Nanyang Technological University with a Bachelor’s Degree in Business and is a member of the largest dealing team in Phillip Securities. He strongly believes in the importance of staying invested in the financial markets and evaluates stocks using fundamentals to make informed investment decisions.

In his free time, he enjoys researching on market events and disruptive investment themes to generate new investment ideas for the short and long term.

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth  Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition

Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition  United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability

United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability  CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile

CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile