Navigating the Post-Inflation Landscape in 2024: Top 10 US Markets Key Events to Look out for February 23, 2024

Start trading on POEMS! Open a free account here!

In 2023, the United States experienced a gradual decline in sky-high inflation, leading the Federal Reserve to halt its rate hike measures for the time being.

2024 started with the Federal Reserve maintaining interest rates between 5.25% and 5.5% in the first FOMC meeting while the overall market reached record highs. With inflation data trending towards the ideal target of 2%, there is optimism that the market will not be adversely affected before any potential rate cuts.

Here are some key events in the US market that investors should take note of when making investment decisions:

| Key Events | Description |

| Non-Farm Payroll (NFP) | NFP is a statistical report commonly released on the first Friday of the month by the U.S. Bureau of Labor Statistics (BLS). It represents the total number of paid workers in the United States, excluding farm workers, government employees, private household employees, and employees of non-profit organisations.1

It is a crucial economic indicator that provides valuable insights into the labour market and broader economic conditions. Its impact on financial markets underscores its importance for policymakers, investors, and traders in assessing economic trends and making informed decisions. |

Unemployment Rate | The unemployment rate represents the percentage of the labour force that is actively seeking employment but unable to find a job. It is a key economic indicator used to assess the health of the labour market and overall economy.

A decrease in the unemployment rate often correlates with higher average wages. This situation can occasionally lead to inflation, as businesses adjust prices to accommodate rising labour expenses. Additionally, reduced unemployment typically coincides with elevated stock prices, as workers enjoy greater disposable income.2 |

Consumer Price Index (CPI) | The CPI tracks the general fluctuations in consumer prices using a representative selection of goods and services over a period. It serves as the primary gauge of inflation, closely monitored by policymakers, financial markets, businesses, and consumers.

A higher CPI often means a less stringent government policy is generally in place. This means that debt is often easier to obtain for cheaper and that individuals have greater spending capacity. On the other hand, lower or decreasing CPI may indicate that the government may ease policy that helps boost the economy.3 |

Gross Domestic Products (GDP) | GDP is a metric aimed at quantifying a nation’s economic production. Nations boasting larger GDPs tend to generate more goods and services internally, often correlating with a higher quality of life. As such, many citizens and policymakers view GDP growth as a vital gauge of national prosperity and it allows them to determine whether the economy is shrinking or growing, assessing whether it requires stimulation or moderation, and identifying potential threats like recession or inflation on the horizon.4 | Quarterly Earnings Season | Earnings season, occuring every quarter following the close of financial periods, witnesses a flurry of publicly traded companies releasing their earnings. This typically begins the second week of January, April, July, and October. However, it is important to note that not all firms report during these periods due to differing quarter-end periods. Stakeholders like analysts, traders, and investors keenly anticipate these disclosures, which are known to spur notable fluctuations in stock prices. The media extensively cover the event, scrutinising whether businesses have met, surpassed, or failed to meet the forecasts.5 | The Federal Open Market Committee (FOMC) meeting | The FOMC meeting, which takes place eight times per year, consists of the following components:

Federal Funds Rate The FOMC sets the federal funds rate, which is the target range for overnight borrowing and lending rates among commercial banks. This rate is adjusted eight times annually by the FOMC, based on prevailing economic conditions. fluctuations in the federal funds rate can affect short-term interest rates for consumer loans and credit cards. Investors closely monitor this rate due to its potential impact on the stock market.6 FOMC Statement The FOMC statement serves as the panel’s principal means of communicating with investors regarding monetary policy. It includes the result of the vote on interest rates, analyses the economic outlook, and provides indications regarding the direction of future votes.7 FOMC Press Conference The FOMC Press Conference is an essential event during which the Chair of the Federal Reserve provides updates on monetary policy decisions, including interest rates and the economic outlook. Economists, investors, and the media closely watch this conference for its implications on the financial markets and the overall economy. |

FOMC Meeting Minutes | FOMC meeting minutes, released three weeks after each session, provide a timely summary of discussions and decisions made by policymakers. They explain the rationale behind the Committee’s choices, helping the public understand economic and financial developments. These official records also list attendees and document policy actions, including individual members’ votes.8 | FOMC Economic Projections | FOMC Economic Projections are forecasts by members of the Federal Open Market Committee regarding key economic indicators like GDP, inflation, unemployment, and interest rates. They’re released quarterly, providing insights into the Committee’s outlook on the economy and potential future policy decisions. | OPEC Meetings | OPEC meetings are attended by representatives from 13 oil-rich nations. They discuss a range of topics regarding energy markets and agree on how much oil they will produce. OPEC is responsible for nearly 40% of the world’s oil supply.9 | G20 Meetings | G20 meetings gather finance ministers and central bank governors from the world’s largest economies to discuss global economic policy, financial stability, and international cooperation on issues like trade and climate change. They occur annually, with additional meetings held as needed to address emerging challenges.10 | Black Friday | Black Friday, which occurs on the day after the US Thanksgiving holiday, which falls on the fourth Thursday in November, has evolved into a day synonymous with exclusive shopping offers and discounts, symbolising the commencement of the holiday shopping period.

The sales data from Black Friday is frequently regarded as indicative of the broader economic well-being of the nation and serves as a metric for economists to gauge the confidence of ordinary Americans in their discretionary expenditure.11 |

Cyber Monday | Cyber Monday, an e-commerce concept, takes place on the Monday after the US Thanksgiving weekend. Much like brick-and-mortar stores on Black Friday, online retailers typically roll out exclusive promotions, discounts, and sales during this time.12 | Congressional Elections | The US Congress, comprising the House of Representatives and the Senate, forms the legislative branch of the government. Congressional elections, occurring every two years, determine state representation and the majority party in each chamber for the subsequent two years.13 | Presidential Elections | The US presidential election, which takes place every four years, determines the nation’s next president and vice president.14 |

Key Events Calendar

| Month | Dates | Events |

| January | 5-Jan-24 | Non-Farm Payroll (NFP) |

| 5-Jan-24 | Unemployment Rate | |

| 11-Jan-24 | Consumer Price Index (CPI) | |

| Mid-Jan-24 | Companies Quarterly Earnings Season | |

| 31-Jan-24 | FOMC Meeting | |

| February | 2-Feb-24 | Non-Farm Payroll (NFP) |

| 2-Feb-24 | Unemployment Rate | |

| 13-Feb-24 | Consumer Price Index (CPI) | |

| 22-Feb-24 | FOMC Meeting Minutes | |

| March | 8-Mar-24 | Non-Farm Payroll (NFP) |

| 8-Mar-24 | Unemployment Rate | |

| 12-Mar-24 | Consumer Price Index (CPI) | |

| 20-Mar-24 | FOMC Meeting | |

| 20-Mar-24 | FOMC Economic Projections | |

| 28-Mar-24 | Final Gross Domestic Products (GDP) | |

| April | 5-Apr-24 | Non-Farm Payroll (NFP) |

| 5-Apr-24 | Unemployment Rate | |

| 10-Apr-24 | Consumer Price Index (CPI) | |

| 11-Apr-24 | FOMC Meeting Minutes | |

| Mid-Apr-24 | Companies Quarterly Earnings Season | |

| May | 1-May-24 | FOMC Meeting |

| 3-May-24 | Non-Farm Payroll (NFP) | |

| 3-May-24 | Unemployment Rate | |

| 15-May-24 | Consumer Price Index (CPI) | |

| 23-May-24 | FOMC Meeting Minutes | |

| June | 1-Jun-24 | OPEC Meetings |

| 7-Jun-24 | Non-Farm Payroll (NFP) | |

| 7-Jun-24 | Unemployment Rate | |

| 12-Jun-24 | Consumer Price Index (CPI) | |

| 12-Jun-24 | FOMC Meeting | |

| 13-Jun-24 | FOMC Economic Projections | |

| 27-Jun-24 | Final Gross Domestic Products (GDP) | |

| July | 4-Jul-24 | FOMC Meeting Minutes |

| 5-Jul-24 | Non-Farm Payroll (NFP) | |

| 5-Jul-24 | Unemployment Rate | |

| 11-Jul-24 | Consumer Price Index (CPI) | |

| Mid-Jul-24 | Companies Quarterly Earnings Season | |

| 31-Jul-24 | FOMC Meeting | |

| August | 2-Aug-24 | Non-Farm Payroll (NFP) |

| 2-Aug-24 | Unemployment Rate | |

| 14-Aug-24 | Consumer Price Index (CPI) | |

| 22-Aug-24 | FOMC Meeting Minutes | |

| September | 6-Sep-24 | Non-Farm Payroll (NFP) |

| 6-Sep-24 | Unemployment Rate | |

| 11-Sep-24 | Consumer Price Index (CPI) | |

| 18-Sep-24 | FOMC Meeting | |

| 18-Sep-24 | FOMC Economic Projections | |

| 26-Sep-24 | Final Gross Domestic Products (GDP) | |

| October | 4-Oct-24 | Non-Farm Payroll (NFP) |

| 4-Oct-24 | Unemployment Rate | |

| 10-Oct-24 | FOMC Meeting Minutes | |

| 10-Oct-24 | Consumer Price Index (CPI) | |

| Mid-Oct-24 | Companies Quarterly Earnings Season | |

| November | 1-Nov-24 | OPEC Meetings |

| 1-Nov-24 | Non-Farm Payroll (NFP) | |

| 1-Nov-24 | Unemployment Rate | |

| 5-Nov-24 | Presidential Elections | |

| 5-Nov-24 | Congressional Elections | |

| 7-Nov-24 | FOMC Meeting | |

| 13-Nov-24 | Consumer Price Index (CPI) | |

| 19-Nov-24 | G20 Meetings | |

| 28-Nov-24 | FOMC Meeting Minutes | |

| 29-Nov-24 | Black Friday | |

| December | 2-Dec-24 | Cyber Monday |

| 6-Dec-24 | Non-Farm Payroll (NFP) | |

| 6-Dec-24 | Unemployment Rate | |

| 11-Dec-24 | Consumer Price Index (CPI) | |

| 18-Dec-24 | FOMC Meeting | |

| 18-Dec-24 | FOMC Economic Projections | |

| 19-Dec-24 | Final Gross Domestic Products (GDP) |

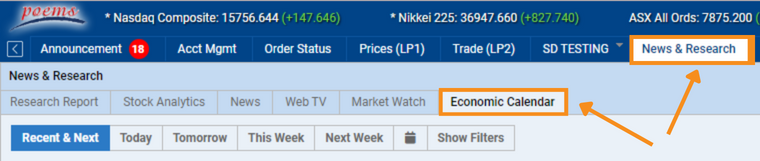

Access the latest economic data release by logging into POEMS Navigate to ‘News and Research’ and select the ‘Economic Calendar’.

You can also filter for important data specific to a certain time and country. Simply use the ‘filter’ option, select the desired date range, country, category, and adjust the volatility bar as illustrated below.

Enhance your knowledge with Join our free webinar here!

With our newly launched POEMS Mobile 3 Trading App

Explore a myriad of useful features including TradingView chartings to conduct technical analysis with over 100 technical indicators available!

Take this opportunity to expand your trading portfolio with our wide range of products including Stocks, CFDs, ETFs, Unit Trusts and more across 15 global exchanges available for you anytime and anywhere to elevate you as a better trader using our POEMS Mobile 3 App!

Alternatively, you can reach out to our Night Desk representatives at globalnight@phillip.com.sg / (+65) 6531 1225. Join us today and embark on a thrilling adventure in our lively Telegram community, where we’re eager to share even more enlightening insights!

Open an account and trade the US market today!

Reference:

- [1] “Chen, James. “Nonfarm Payroll: What It Means, and Why It’s Important.” Investopedia” Accessed 7 February 2024

- [2] ““What Is the Unemployment Rate? Rates by State.” Investopedia,” Accessed 7 February 2024.

- [3] “Consumer Price Index (CPI): What It Is and How It’s Used.” Investopedia” Accessed 7 February 2024

- [4] “Gross Domestic Product (GDP): Formula and How to Use It.” Investopedia” Accessed 7 February 2024

- [5] ” When Is Earnings Season? – Investopedia.” Accessed 2 Feb. 2024

- [6] “Federal Funds Rate: What It Is, How It’s Determined, and Why It’s ….” Accessed 2 Feb. 2024

- [7] “U.S. Federal Reserve (Fed) Statement – Investing.com.” ” Accessed 2 Feb. 2024″

- [8] “What are the Minutes of the Federal Open Market Committee?” 15 May. 2017

- [9] “OPEC Meeting – Investing.com.” Accessed 2 Feb. 2024

- [10] “What Does the G20 Do? – Council on Foreign Relations.” 11 Oct. 2023″ Accessed 2 Feb. 2024

- [11] “Velasquez, Vikki. “Black Friday: What It Means to Economists and to You.” Investopedia” Accessed 7 February 2024

- [12] “Perez, Yarilet. “What Is Cyber Monday, History, and Milestones?” Investopedia” Accessed 7 February 2024

- [13] “Congressional elections and midterm elections | USAGov.” 11 Dec. 2023″ Accessed 2 Feb. 2024

- [14] “Presidential election process | USAGov” Accessed 2 Feb. 2024

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Global Markets Desk US Dealing Team

The Global Markets Desk US Dealing team specialise in handling the US Markets in the Global Markets Desk.

Their responsibilities and capabilities extend from managing and taking orders from clients trading in the US market, to content generation, Technical Analysis and providing educational content to POEMS clients.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It