Netlink NBN Trust IPO July 10, 2017

The internet has formed an integral part of our lives, ranging from personal entertainment to business needs. In this week’s article, I will be sharing some information and my personal opinion on Singapore largest IPO since 2013 – Netlink NBN Trust.

Netlink is the foundation of Singapore’s Next Generation Broadband Network, which supplies high speed internet across mainland Singapore and its connecting islands. In simpler terms, this company installs and supply high speed fibre networks to residential homes and others.

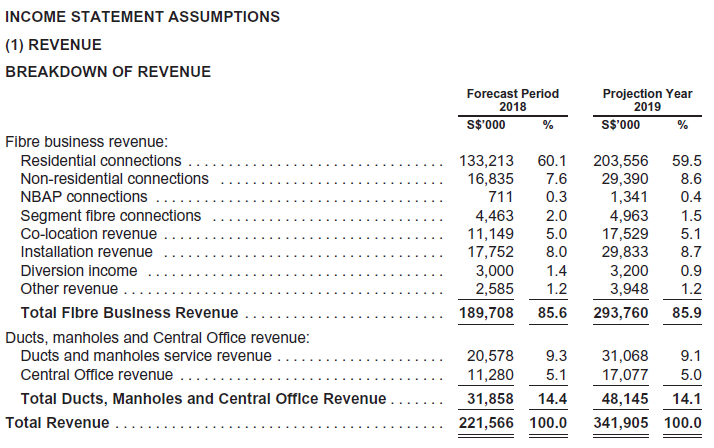

1) Business Model and Breakdown Revenue

Source: Preliminary Prospectus for Netlink IPO

Source: Preliminary Prospectus for Netlink IPO

From the forecasted earnings for 2018, 68% of the revenue is derived from residential connections and non-residential connections. While Netlink doesn’t maintain a direct relationship with end-users, this revenue is generated through the requesting licensees, which are our telecommunication companies. For the usage of the fibre connection, these licensees (Singtel, M1, Starhub, MyRepublic, etc) will need to pay a recurring connection fee to Netlink.

Other main revenue contribution also includes one-off installation revenue, ducts and manhole revenue as well as leasing of their Central Office for others to house their network equipment.

2) Growth Prospects

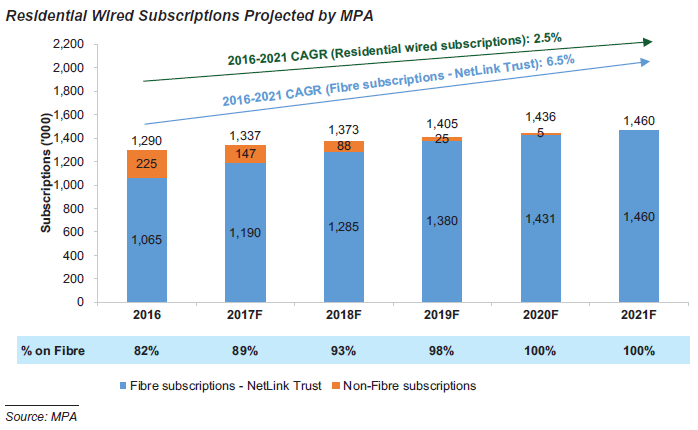

Source: Preliminary Prospectus for Netlink IPO, complied by MPA

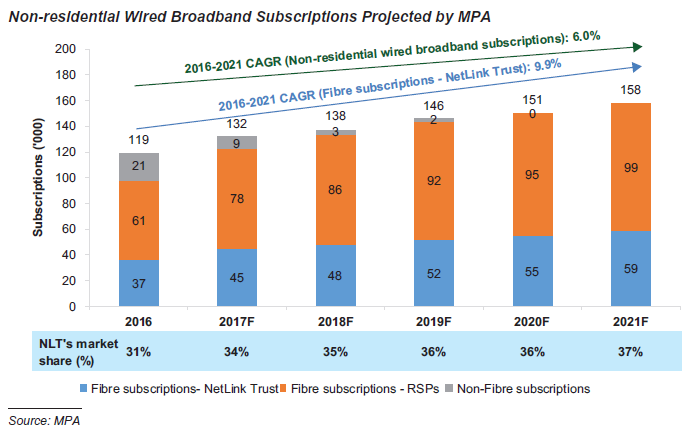

Source: Preliminary Prospectus for Netlink IPO, complied by MPA

Recurring revenue from the subscription of fibre connection is perhaps the most attractive part of this business. Looking into the 2 biggest revenue segments, both present a good growth story.

Residential – With fibre infrastructure running through Singapore and competitive pricing by telecommunication companies, more end users will transit into fibre connections while phasing out slower technology such as ADSL and cable broadband. On top of the transition to faster internet speed, new BTO launches also pave the way for organic growth in the number of users. These will contribute to their top line numbers.

Non-Residential – While some telecommunication companies maintain their own fibre network, these are mostly concentrated in Central Business District (CBD) where larger organisations are located. Netlink in contrast, aims to expand its market share by targeting SMEs which are located in areas outside CBD. With more businesses tapping on cloud technologies such as SAAS (Software-as-a-Service) to improve productivity, these areas represent a good opportunity for Netlink to grow their customer base.

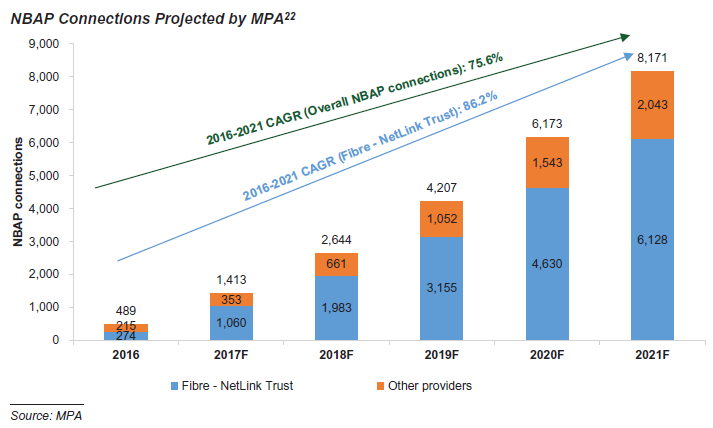

Source: Preliminary Prospectus for Netlink IPO, complied by MPA

Source: Preliminary Prospectus for Netlink IPO, complied by MPA

NBAP (Non-Building Address Point) – NBAP refers to any location without a physical address such as bus stops or ATMs at public area. Transforming Singapore into a “Smart” Nation, the Singapore government has mandated an increase in connectivity speed offered as well as doubling the number of hotspots under the public Wi-Fi hotspot initiative (“Wireless@SG”). While the contribution for this segment is relatively low at less than 1%, there is a high growth potential with a projected CAGR of 86% on the number of connections over the next 5 years based on their prospectus.

3) Distribution Yield

With the IPO price fixed at $0.81 per share, this translates to a projected annualised yield of 5.43% for 2018 and 5.73% for 2019.

4) Time Table for Public Placement

Public Offer Opening Date: 10 July 2017, 7pm

Public Offer Closing Date: 17 July 2017, 12pm

Expected Listing Date: 19 July 2017, 3pm

Conclusion

High speed internet is extremely important in this day to many end users, ranging from students to businessmen. The demand for faster internet speed will be here to stay and fibre optic still remains one of the better and affordable solutions.

In my personal opinion, Netlink is a resilient business with proven profitability track records, operating in a tightly regulated environment with high entry barriers. The defensive nature of this industry may prove to be a good addition to a portfolio.

While the attractiveness of the listing price is anybody’s guess, investors looking to subscribe to the shares should be comfortable with the distribution yield and in for the long haul.

If you wish to know more information about stocks, you can speak to your designated Trading Representatives or a Dealer at a Phillip Investor Centre near you.

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Mr Michael Tay

Equity Dealer

Mr. Michael Tay currently provides dealing services to over 17,000 trading accounts and is part of the POEMS Dealing, the core in-house dealing department of Phillip Securities Pte Ltd. Michael is a strong believer of value investing, focusing on companies with strong fundamentals and good dividend policy. Apart from his dealing role, he often provides training seminars on Fundamental Analysis topics to further enrich his clients’ financial knowledge. Michael holds a Bachelor Degree of Finance from the SIM University (UniSIM) and was awarded the CFA Singapore Silver Award in 2012.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It