Turning Trash into Treasure March 17, 2023

Introduction to Global Recycling Day

Did you know that the Global Recycling Day falls on 18 March every year?

Started out by the Global Recycling Foundation (GRF) in 2018, this special day aims to help recognise and celebrate the importance of recycling and preserving our precious primary resources to secure the future of our planet. It is a day for the world to come together and put the collective interests of our planet first.

The GRF highlights the six essential resources of water, air, oil, natural gas, coal, and minerals. These finite resources are rapidly running out.

What can we do to make a difference? It’s actually simple and everyone can play a part and recycle. The GRF refers to recycling as the ‘Seventh Resource’.

Through recycling, we can help preserve our precious primary resources and secure the future of our planet. From another perspective, recycling also offers interesting investment opportunities, and is worth exploring.

The problem of wastage

The problem of proliferating waste is not unfamiliar. In fact, school-going children are taught the ‘3Rs’: Reduce, Reuse and Recycle. These principles are more relevant in today’s environment where increased urbanisation and industrialisation have led to more waste production.

Here are some statistics on waste that you may not be aware of.

Did you know that 60% of clothing is buried or burned within a year of being made, 33% of edible food is thrown away uneaten, and 50% of all plastics are single use?

According to the World Bank, waste levels could be growing twice as fast as the global population by 2050.

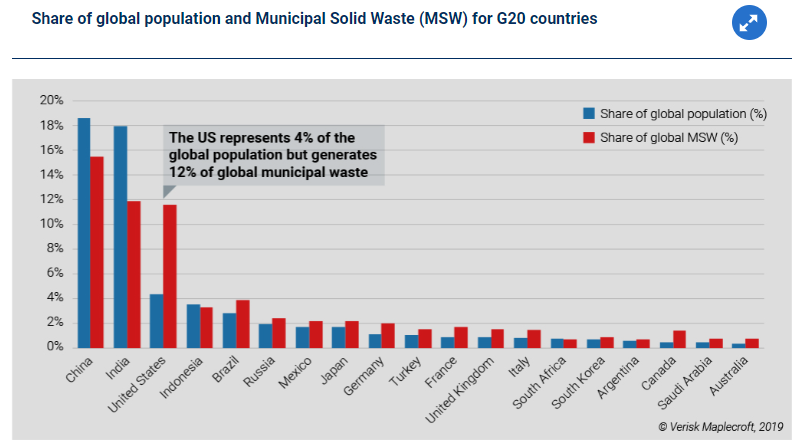

Source: Verisk Maplecroft [1]

Source: Verisk Maplecroft [1]

In order to give you a rough idea of where we currently stand in terms of waste generation, the data above shows the share of global population and the share of global Municipal Solid Waste (MSW) for the G20 countries. Unfortunately, the US generates the most waste per capita compared to other countries. Regardless, the world can work towards reducing waste and protecting our planet.

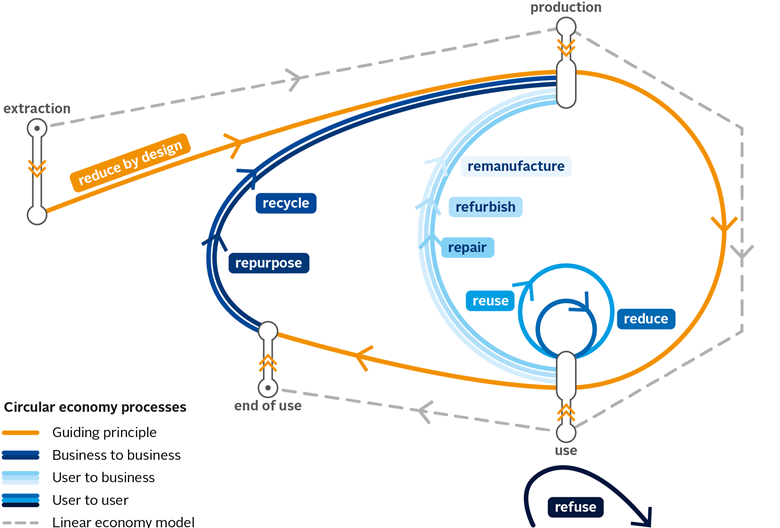

If the world cannot handle waste generation, products must be used to their maximum potential. This requires moving away from the linear model of modernity, where resources are extracted, turned into products, used, and then disposed of as waste, and towards a circular economy.

The circular economy prioritises the greater reuse of waste as a new resource as well as the extension of life of existing products, and encourages wider principles of leasing and sharing.

Recycling plays a key role in the circular economy by protecting our natural resources. Each year, the ‘Seventh Resource’ (recyclables) saves over 700 million tonnes of CO2 emissions, and this is projected to increase to 1 billion tonnes by 2030. [2] There is no doubt that recycling is at the forefront of the battle to save our planet and humanity.

Now you may be wondering how recycling relates to you as an investor but before that, let’s understand what the term ‘circular economy’ means.

What is a circular economy?

A circular economy is a model of production and consumption designed to decouple economic growth from the consumption of finite resources. In contrast to the current linear take-make-waste model, it is based on three design-driven principles as follows [3]:

- Eliminate waste and pollution

- Circulate products and materials (at their highest value)

- Regenerate nature

Its purpose is to:

- slow the depletion of scarce natural resources

- reduce environmental damage from the extraction and processing of raw materials

- reduce pollution from the processing, use and disposal of materials

Below is an illustration of the approach to circularity as shared by the United Nations Environment Programme (UNEP).

Source: Principles for Responsible Investment [3]

Source: Principles for Responsible Investment [3]

Why should you care?

Waste as an investment theme seems to be gaining popularity lately.

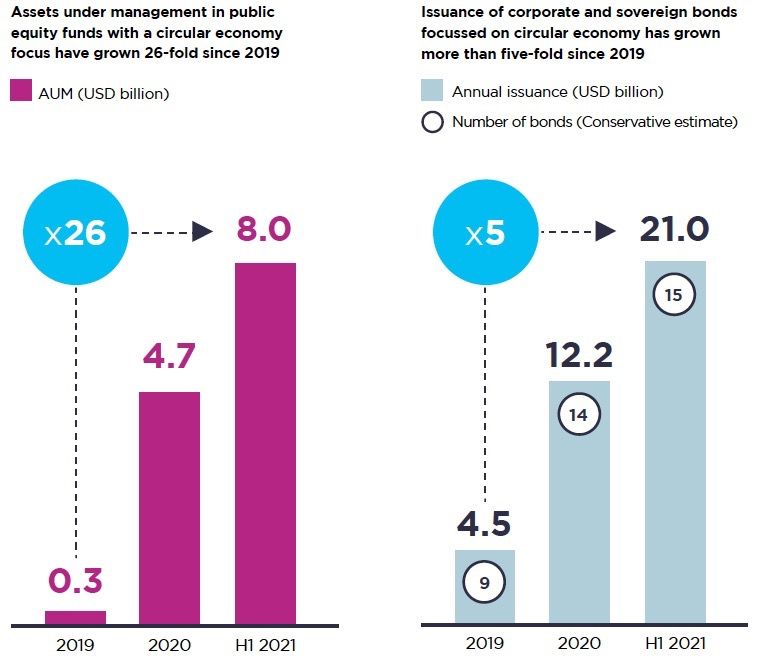

Source: ISS Insights [4]

Source: ISS Insights [4]

The number of circular economy-themed public equity and private market funds, and bond issuances has been increasing over the last few years.

The global waste recycling service market was valued at US$57.69 billion in 2021 and is expected to reach US$88.01 billion by 2030, indicating a compound annual growth rate of 4.8% during the forecast period from 2022 to 2030 [5]. The high volume of global economic activities has heightened the demand for recycling of waste materials.

Apart from the growing size of the circular economy and its growth projections, it is essential to note that the principles of a circular economy affect almost all industries and their global value chains. Addressing sectors that have a high environmental impact and high potential for circularity can provide investment opportunities and economic growth.

With regard to regulations, the EU Green Deal’s Circular Economy Action Plan and the EU Taxonomy are supporting the promotion of the circular economy in Europe. France passed a circular economy law in 2021, while other countries, such as China and Chile, have presented circular economy plans. Regulatory drivers are expected to increase pressure on private actors, and investors should stay ahead of the game and leverage circular economy investment opportunities.

Regulations, technology, and consumer demand are rapidly evolving and driving the transition to a circular economy.

At this point, you might be wondering how you can take advantage of this opportunity as an investor.

From an investor’s perspective

Investors looking for opportunities while supporting the transition to a circular economy through their investments can follow a simple investment process outlined by the Principles for Responsible Investment (PRI) [3] when screening for a particular company.

The screening process involves:

- identifying sectors with high linear material use and environmental impact – including their associated physical and transition risks, and considering risks and opportunities. Investors should prioritise the most impactful circularity processes, such as reuse and remanufacture.

- allocating capital to sectors or business models that support circularity and present financial opportunities.

- measuring progress against recognised global sustainability goals, such as the SDGs and the Paris Agreement, where they want to shape sustainability outcomes.

Apart from stock picking, Exchange-Traded Funds (ETFs) are another way investors can approach this investment theme. ETFs are suitable for investors who do not have the time to research on stock picks and offer a cheaper way to gain exposure to a diversified portfolio of companies.

Here’s one easily accessible ETF that focuses on the theme of recycling/circular economy:

VanEck Environmental Services ETF (AMEX: EVX)

- Underlying Index: NYSE Arca Environmental Services Index (AXENV)

- The index is comprised of a diversified group of selected companies involved in the management, removal and storage of consumer waste and industrial by-products, and related environmental services

Investors can also put their money into an actively managed fund, run by professional investors who select stocks they believe will outperform the benchmark.

One such fund, launched by the world’s largest asset managers, BlackRock, is the BGF Circular Economy Fund. The Circular Economy Fund seeks to maximise total return by investing at least 80% of its total assets in the equity securities of companies globally that benefit from or contribute to the advancement of the ‘Circular Economy’.

That being said, if you decide to align your investments with the circular economy, don’t waste the opportunity to pick wisely.

How to get started with POEMS

As the pioneer of online trading in Singapore, POEMS’s award-winning suite of trading platforms offers investors and traders more than 40,000 financial products across global exchanges. Explore a range of US shares with brokerage fees as low as US$1.88 flat* when you open a Cash Plus Account with us today.

Find out more here(terms and conditions apply).

We hope that you have found value reading this article. If you do not have a POEMS account yet, you may visit here to open one with us today.

Lastly, investing in a community is much more enjoyable. You will have the opportunity to interact with us and other experienced investors who are generous in sharing their knowledge and expertise.

In this community, you will have access to quality educational materials, stock analysis to help you apply the concepts and insights from seasoned investors.

We look forward to sharing more insights with you in our growing and enthusiastic Telegram community. Join us now!

For enquiries, please email us at cfd@phillip.com.sg.

Promotion

POEMS CFD MT5 Welcome Gifts and Bundles

From 1 March 2023 to 30 June 2023 (both dates inclusive), open a POEMS CFD MT5 account and trade with us to receive Apple AirPods, Trading Credits and Grab Vouchers.

This promotion is valid to all Phillip Securities Pte Ltd (PSPL) customers who have not opened a POEMS CFD MT5 Account.

*T&Cs Apply.

For more information, click here.

Reference:

- [1] https://www.maplecroft.com/insights/analysis/us-tops-list-of-countries-fuelling-the-mounting-waste-crisis/

- [2] https://www.globalrecyclingday.com/about/

- [3] https://www.unpri.org/sustainability-issues/environmental-social-and-governance-issues/environmental-issues/circular-economy

- [4] https://insights.issgovernance.com/posts/what-goes-around-comes-around-investment-and-the-circular-economy/

- [5] https://finance.yahoo.com/news/11-best-recycling-stocks-buy-165844433.html

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Jeremy Chua

Dealing

Jeremy graduated from Nanyang Technological University with a Bachelor’s Degree in Business and is a member of the largest dealing team in Phillip Securities. He strongly believes in the importance of staying invested in the financial markets and evaluates stocks using fundamentals to make informed investment decisions.

In his free time, he enjoys researching on market events and disruptive investment themes to generate new investment ideas for the short and long term.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It