Union Gas Holdings IPO: Investment Merits and Risks July 20, 2017

Netlink NBN trust IPO did not gain traction and closed at IPO price on the first day of listing. Recent IPO listing performances have been mixed. Notably, UnUsUal, Sanli Environmental and Kimly put up stellar performances.

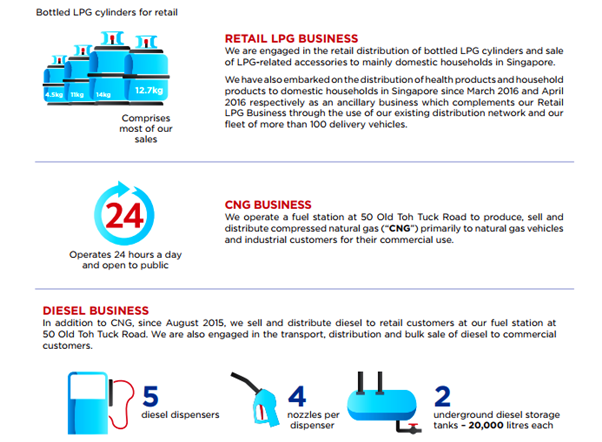

The next upcoming IPO is Union gas holdings (UGH). UGH has a 40 years track record of providing fuel products in Singapore. Its businesses can be divided into 3 segments:

Excerpt from UGH IPO Prospectus

Excerpt from UGH IPO Prospectus

Estimated net proceeds from this IPO will be approximately S$5.72 mil. Bulk of the proceeds will be used to fund acquisition for the purpose of expanding its domestic network. Company also intends to enter the piped natural gas business and potentially venture into the foreign market.

Should Investors subscribe for the IPO? We list down the key investment merits and risks. Below are the key investment merits:

1) Earning Growth Catalysts

The potential acquisition of the local retail LPG dealers and venture into piped gas business offer earnings growth potential. Secondly, increase in Singapore population and households will also provide the company with the opportunity to grow their core business organically.

2) High Return on Equity

Net asset value (NAV) and unaudited pro forma earnings per share (EPS) will be 8.58 cents and 3.06 cents post IPO invitation. Return on equity (ROE) has been in excess of 20% since FY14. All things being equal, a high ROE generally implies that the company is effective in utilising Shareholders’ equity to generate returns for Shareholders.

3) Competitive Advantage

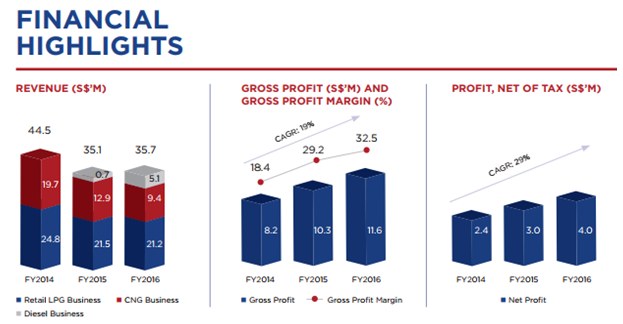

UGH’s financial highlights revealed a gross margin expansion since FY2014 due to lower purchase cost of Liquefied Petroleum Gas (LPG) cylinders. Company also claimed to have extensive distribution capabilities and quality products/ services offerings in the IPO prospectus. While these claims can be contentious, the gross margin expansion does suggest that the company holds certain competitive advantage and/or pricing power over its direct competitors.

Excerpt from UGH IPO Prospectus

Excerpt from UGH IPO Prospectus

Here are the key risks:

1) Changing Business Landscape and Declining Sales Volume

New generation of homeowners may not be familiar with Union gas. This is because piped natural gas facilities are easily accessible in new housing developments for Homeowners to tap onto. Citygas, a provider of piped natural gas and a Competitor of UGH, registered YOY increase in volume of piped natural gas sold in 1H17. UGH’s LPG cylinder sales volume paled in comparison. The company registered YOY decline in LPG cylinder sales volume for each of the last two financial years.

Increasingly, homeowners are also turning to electrical appliances and this alternative eliminate the need for natural gas products altogether. Company’s CNG and diesel business may also be affected by the proliferation of electric vehicles in the longer term.

2) Lease expiry

Company operates its CNG and diesel business through its fuel station which is on a 15 years lease term from JTC. This lease term expires in Dec 2023. The segments contributed 40% revenue for FY16. The lease expiry will cast uncertainty to the operations of these business segments.

Conclusion

Facing structural changes in business landscape, it will be challenging for company to grow its existing retail LPG and CNG businesses. It remains to be seen whether future acquisition in retail LPG sector can translate into long term earnings growth.

Low natural gas price gave UGH an earning boosts for FY16. Given the cyclical natural of commodity price, natural gas price may creep up in the future and affect company’s margin. In my opinion, using normalised earnings can give Investors a better sense of company’s long term profitability.

A simple calculation can be performed to estimate normalised earnings. This is done by averaging FY14 & FY15 Pro forma earnings (excluding write backs) which will give an EPS of around 2.1 cents. Adjusting for future acquisition and sales volume decline, I opined S$0.22 or lower as a good entry price.

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Chiang Jin Liang

POEMS Dealer

Jin Liang is currently providing dealing services to over 8000 trading accounts and is part of the POEMS Dealing, the core in-house dealing department of Phillip Securities Pte Ltd.

Jin Liang believes in applying both fundamental and technical analysis in equities investing. He likes companies that can grow their earnings, stay relevant in an ever-changing landscape and focus on investor relations. Jin Liang frequently conducts educational seminars with the objective of imparting financial knowledge to the general public.

Jin Liang holds a Bachelor Degree in Electrical Engineering from Nanyang Technological University (NTU) and passed Level II of the Chartered financial Analyst (CFA) exam.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It