Unlocking Opportunities: A Deep Dive into Taiwan’s Investment Potential March 6, 2024

Introduction

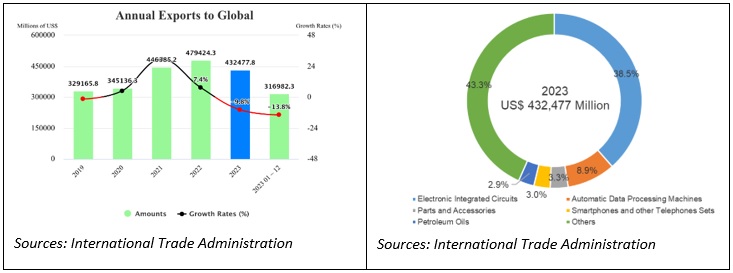

Taiwan’s stock market offers a compelling investment opportunity, fueled by a resilient technology-driven economy. Remarkably in 2023, Machinery and Electrical Equipment made up 69% of the nation’s total exports. Noteworthy global players such as TSMC (2330.TW) and Foxconn (2317.TW) underscore the market’s strength with factors such as political stability, investor-friendly regulations, and a robust legal framework that enhances Taiwan’s appeal to global investors. The commendable historical market performance of its stock market, combined with Taiwan’s pivotal role in international trade, further elevates its status as an attractive investment destination. Positioned for growth and diversification, investors can leverage the vibrant stock market and capitalise on Taiwan’s technological prowess and stable economic backdrop.

Macroeconomic Overview

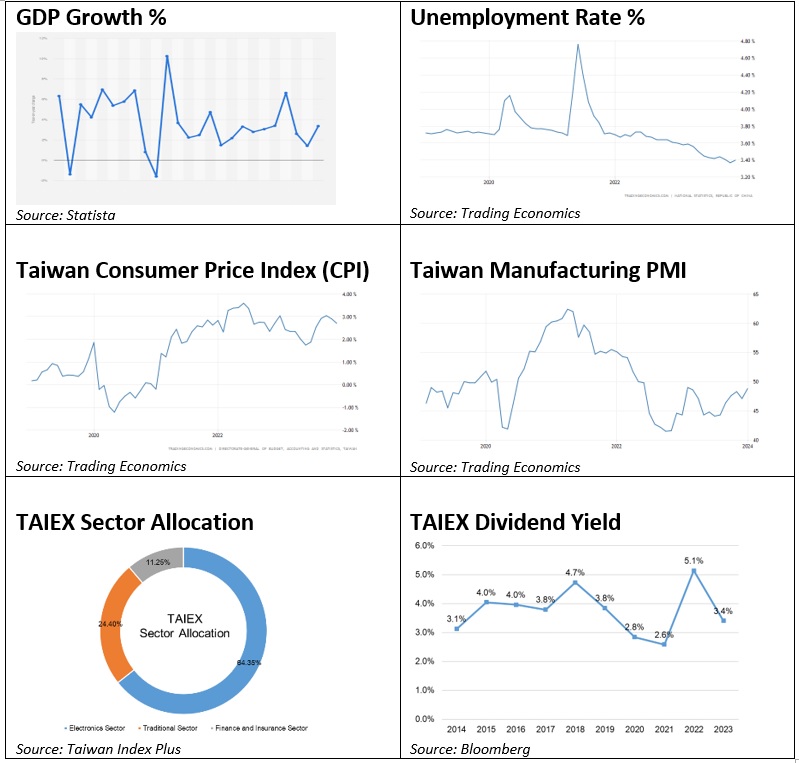

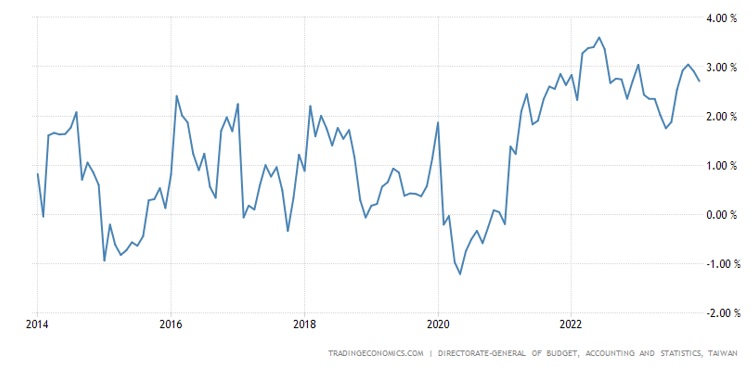

Taiwan’s recent economic narrative is one of resurgence and growth. In 2023, the nation witnessed a GDP increase of 1.4% year-on-year, a notable rebound from the 2.45% growth in 2022. Despite a continuous battle with inflation rates exceeding 3%, higher than pre-pandemic levels, Taiwan has managed to record the lowest unemployment rate seen over the last decade.

Notably, Taiwan has achieved the lowest unemployment rate in the past decade, reflecting a resilient labour market. The Purchasing Managers’ Index (PMI) for Manufacturing in Taiwan indicates a positive trajectory towards recovery, reaching 48.80 in January 2024, signaling an improvement compared to the corresponding period last year.

Examining the constituents of the Taiwan Stock Exchange Weighted Index (TAIEX), more than 64% of its constituents belong to the Electronics sector, with the Financial and Insurance sector making up another 11.3%. The remaining constituents are distributed among traditional sectors such as Industrials and Consumer Discretionary products. Over the past decade, the TAIEX has demonstrated stability, yielding an average dividend of 3.7%, positioning itself as a lucrative option for investors.

Overall, these economic indicators suggest a robust and evolving market environment in Taiwan.

Investment merits for Taiwan Market

Tech Dominance in Semiconductor and AI Industries

The Taiwan Stock Market is a magnet for investors, with its pivotal role in the global semiconductor and AI manufacturing sectors. At the forefront, industry giants such as TSMC, lead the way with pioneering technology, alongside Foxconn, the world’s largest iPhone manufacturer globally. As global demand for advanced technology grows, Taiwan’s leadership in technology positions its stock market as an enticing investment destination for those seeking exposure to the semiconductor and AI industries.

According to an ITRI report, Taiwan’s semiconductor output value will reach NT$4.9 trillion (approximately US$146.1 billion) in 2024, up 14.1% YoY. The semiconductor sector is anticipated to gradually recover momentum and achieve a record-high production value next year due to the strong demand for AI and high-performance computing applications.

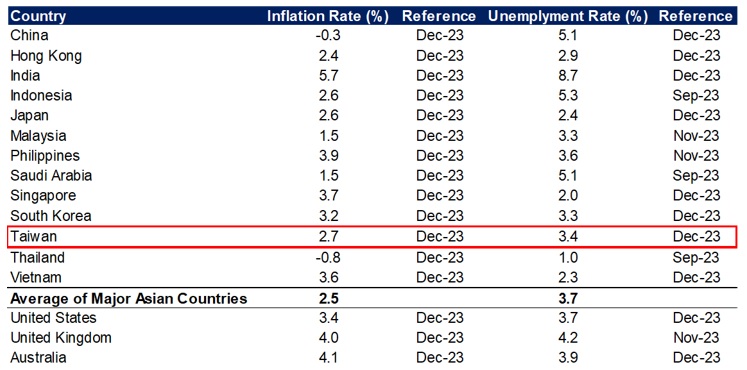

Stable consumer and labour market

In December 2023, Taiwan’s headline Consumer Price Index (CPI) experienced a 2.71% increase, slightly higher than the average inflation rate in major Asia markets of 2.5%, yet remaining below the US’s 3.4% and UK’s 4.0%. Furthermore, Taiwan’s unemployment rate in December 2023 was 3.4%, showcasing lower figures compared to the average across major Asian countries as well as the US, UK and Australia. The combination of a stable consumer and labour market, alongside moderate interest rate hikes have provided foreign investors a great opportunity to invest in Taiwan.

Source: Trading Economics

Source: Trading Economics

Taiwan Consumer Price Index (CPI)

Source: Trading Economics

Source: Trading Economics

Investment Risks for Taiwan Market

Geopolitical Risk

A significant geopolitical risk impacting investment in the Taiwan Stock Market is the long-standing tension between Taiwan and mainland China. Any escalation in cross-strait tensions could have significant implications for the stability of the region and potentially impact the Taiwanese economy and stock market. Investors should closely monitor geopolitical developments, such as shifts in military posture, political statements, or changes in diplomatic ties, as they may influence market sentiment and introduce a degree of uncertainty. A sudden shift in the geopolitical landscape could lead to increased volatility and affect the performance of the Taiwan Stock Market. Understanding and staying informed about these geopolitical dynamics is crucial for making well-informed investment decisions in the region.

Supply Chain Disruption and Destocking Risk

Taiwan’s trade in goods and services, when compared to its nominal GDP, exceeds 100%. Disruptions in global supply chains, such as those caused by trade tensions, natural disasters, or transportation disruptions, can result in shortages of raw materials or components. Companies may reduce their inventory levels in response to supply chain disruptions, leading to production delays or decreased sales.

Destocking risk in the Taiwan Stock Market pertains to potential adverse effects on companies due to reduced inventory levels. This risk is influenced by various factors, including economic downturns, supply chain disruptions, seasonal variations, technological changes, and financial constraints. Companies affected by destocking may experience decreased revenues, profitability, and market sentiment. It is important for investors to evaluate the ability of companies to withstand such risks, taking into account their vulnerability to economic fluctuations, the strength of their supply chains, and their overall financial stability.

Notable Taiwan Companies

TSMC 2330.TW

Taiwan Semiconductor Manufacturing Company, commonly known as TSMC, is the world’s largest independent semiconductor foundry, commanding a 56.4% market share in 2Q23, according to Statista. Founded in 1987, TSMC plays a pivotal role in the global semiconductor industry by providing advanced manufacturing processes for a diverse range of companies. Specialising in the production of integrated circuits, TSMC’s technological leadership, foundry model, and commitment to innovation make it a cornerstone of the global electronics supply chain. TSMC’s major customers are Apple, MediaTek, Qualcomm, AMD, Broadcom and Nvidia.

Hon Hai 2317.TW

Hon Hai Precision Industry Co., commonly known as Foxconn, is a major Taiwanese multinational electronics contract manufacturer. Founded in 1974, Foxconn is a key player in global manufacturing, producing electronic components and assembling products for prominent technology companies, including Apple . Renowned for its massive scale and operational efficiency, Foxconn serves as a critical element of the global supply chain, contributing significantly to the production of smartphones, computers, and other consumer electronics. Its importance lies in its role as a major assembler, enabling the mass production of devices and influencing the global landscape of manufacturing.

MediaTek 2454.TW

MediaTek Inc. is a Taiwanese semiconductor company founded in 1997, specialising in the design and manufacture of semiconductors for various electronic devices. It is a key player in Taiwan’s technology sector, contributing to the nation’s innovation and economic growth. MediaTek is a major global provider of system-on-chip solutions for smartphones, smart TVs, and other consumer electronics. Its efficient and cost-effective chipsets have fueled the expansion of affordable technology, influencing the global electronics industry. MediaTek’s impact extends to emerging markets, fostering connectivity and technological accessibility on a worldwide scale.

United Microelectronics 2303.TW

United Microelectronics Corporation (UMC) stands as a leading Taiwanese semiconductor foundry. Founded in 1980, UMC specialises in the manufacturing of integrated circuits and offers a comprehensive range of semiconductor manufacturing services. It plays a significant role in global manufacturing by providing advanced technology solutions for various industries. As a key player in the semiconductor ecosystem, UMC contributes to the production of electronic devices, supporting the global supply chain. Its importance lies in enhancing the accessibility of semiconductor manufacturing services, fostering innovation, and meeting the demand for cutting-edge technologies, thereby influencing the broader landscape of global manufacturing and technological advancement.

Fubon Financial Holding 2881.TW

Fubon Financial Holding Co., Ltd. is a distinguished Taiwanese financial services conglomerate. Founded in 2001, Fubon Financial plays a vital role in Taiwan’s banking sector, providing a wide range of financial services including Insurance Business (67.7%), Banking (25.5%), and Securities Business (4.5%). Its importance lies in providing comprehensive financial services, contributing to the nation’s economic stability and growth. While primarily focused on Taiwan, Fubon has expanded its global presence, enhancing Taiwan’s connectivity to the international financial landscape. As a diversified financial institution, Fubon plays a crucial role in shaping Taiwan’s financial industry and fostering economic development while contributing to global financial services.

Taiwan Exchange-Traded-Funds (ETF)

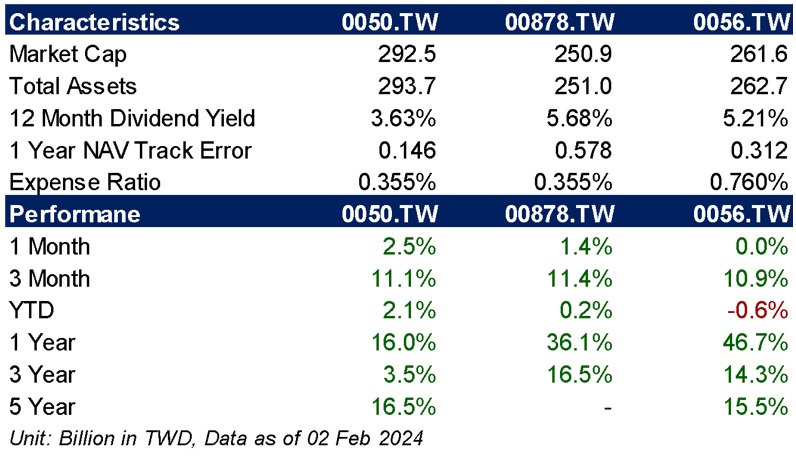

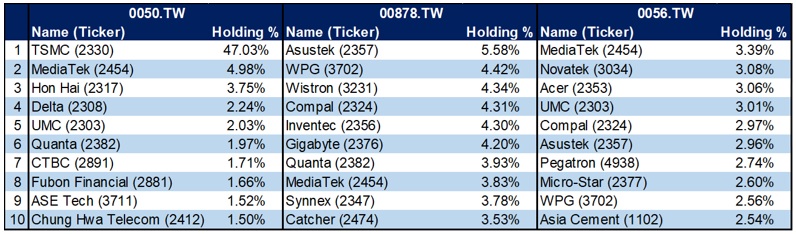

Yuanta/P-shares Taiwan Top 50 ETF (0050.TW)

The Yuanta/P-shares Taiwan Top 50 ETF is an ETF established in Taiwan to track with the TSEC Taiwan 50 Index. It invests in stocks listed on both the TSEC and OTC, offering investors the chance to invest in a collection of Taiwan’s blue-chip stocks, including TSMC, Hon Hai, MediaTek, among others.

Cathay MSCI Taiwan ESG Sustainability High Dividend Yield ETF (00878.TW)

The Cathay Taiwan Select ESG Sustainability High Yield ETF seeks to track the performance of the MSCI Taiwan Select ESG Sustainability High Yield Top 30 Index. With a 12 Month Dividend Yield of approximately 5.68%, it surpasses the TAIEX’s 10-year average dividend yield of 3.7%.

Yuanta/P-shares Taiwan Dividend Plus ETF (0056.TW)

The Yuanta/P-shares Taiwan Dividend Plus ETF focuses on diversifying risk while closely tracking the performance of the Taiwan Dividend and Index. Its 12 Month Dividend Yield stands at 5.21%.

How to trade in the Taiwan Stock Market

Trading Hours: The regular trading session runs from 9:00 am to 1:30 pm (SGT), with order entries beginning at 8:30 am

Trading Lot: The standard trading lot size is 1,000 shares.

Daily price fluctuation limit: ±10% of the market opening auction reference price

For more information about TWSE trading rules and regulations, please click here.

Clients must sign a Letter of Undertaking before investing in the Taiwan Stock Market. Once the Letter of Undertaking is signed, clients may commence trading in through a designated Trading Representative. For more information, click here.

To support investors on their investing journey, we offer complimentary webinars and seminars designed to enhance their knowledge. You can check them out here!

With our newly launched POEMS Mobile 3 Trading App

Explore a myriad of useful features including TradingView chartings to conduct technical analysis with over 100 technical indicators available! Take this opportunity to expand your trading portfolio with our wide range of products including Stocks, CFDs, ETFs, Unit Trusts and more across 15 global exchanges available for you anytime and anywhere to elevate you as a better trader using our POEMS Mobile 3 App!

Open an account and trade Taiwan Market today!

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Global Markets Desk Asia Market

Phillip Securities Pte Ltd

The Global Markets Desk Asia Market Dealing team specializes in managing Asia Markets, covering key regions like Greater China, Malaysia, Japan, Thailand, and others. In addition to executing client orders, they also provide educational content through market journals and webinars, offering insights into macroeconomics, stock picks, and technical analyses for the Asia market landscape.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It