Xiaomi IPO – Things You Need To Know June 12, 2018

Xiaomi is bringing its blockbuster initial public offering to Hong Kong, where it could raise about $10 billion in the largest listing globally in almost 4 years.

Facts about Xiaomi

Beijing Xiaomi Technology Co., Ltd. is a mobile internet company founded in April 2010 specialising in the research and development of smart hardware and electronic products.

1. Xiaomi is the world’s 4th technology company after Apple, Samsung, and Huawei to have mobile phone chip self-development capabilities.

2. Presently, Xiaomi has become the world’s 4th largest smartphone manufacturer.

3. In Q4 2017, global sales of Xiaomi smartphones were ranked 4th behind Apple, Samsung, and Huawei.

4. As of March 2018, Xiaomi has penetrated 74 markets worldwide and ranked top five for smartphone shipments in 15 markets.

5. Through its eco-chain brand Mijia, Xiaomi has built up an expansive network interactive product line which includes; peripherals such as smartphones and headphones, mobile power supplies, mobile smart hardware, smart wristbands, computers to TVs, routers, and air purifiers.

XiaoMi recent development

In recent years, Xiaomi has been aggressively expanding and scaling up its operations. According to statistics, on January 13, 2018, the number of Mi Home stores in China exceeded 300. In 2017, Mi Home stores covered 170 cities, added 235 stores and 2 brand stores, and received a total of 67.13 million customers.

In terms of overseas markets, Xiaomi’s overseas market revenues in 2015, 2016, and 2017 were 4.05 billion yuan, 9.15 billion yuan, and 32.08 billion yuan respectively, representing a year-on-year increase of 250%.

In 2017, Xiaomi’s iconic smartphone was ranked in the top 5 for sales figures in more than a dozen countries including India, Russia, Singapore, and the Czech Republic.

Xiaomi Financials

As of December 31 2017, Xiaomi Group had a net debt of RMB127.2 billion and a cumulative loss of RMB129 billion, which was mainly attributable to the large fair value losses of convertible redeemable preference shares.

Xiaomi’s revenue is divided into four business segments, namely, smartphones, IoT and consumer products, Internet services and others. Among them, the smartphone business is its main source of income. In 2017, revenue from its smartphone business was 80.564 billion yuan, accounting for 70.3% of total revenue; revenue from IoT and consumer products was 23.448 billion yuan, accounting for 20.5%; revenue from Internet services was 9.896 billion yuan, accounting for 8.6%.

Insights from the prospectus

Xiaomi plans to use 30% of the funds raised through IPO for R&D of core products such as smartphones, TVs, notebook computers and AI audio; 30% will be used to expand investment and strengthen the consumer goods and mobile Internet industry. Chain; 30% for global expansion; 10% for general business use.

Xiaomi’s revenue in 2017 was RMB 114.6 billion, and its operating profit was RMB 12.216 billion; 2016 revenue was RMB 68.4 billion, operating profit was RMB 3.785 billion; 2015 revenue was RMB 66.8 billion, and operating profit was RMB 1.373 billion.

Trade HK shares one day before their official listing!

For those who are interested to trade Xiaomi stock, you may do so one day before their official listing in our new market, the Hong Kong Pre-IPO market!

What is Pre-IPO Trading?

The Pre-IPO market typically takes place one day before official listing. In addition, only shares listed on the mainboard are eligible for the Pre-IPO session. Shares listed on Growth Enterprise Market (GEM) are currently not eligible for Pre-IPO trading.

Due to lower levels of transparency and volume, performance of stocks in the Pre-IPO Trading session should not be considered as an indicator of its price and demand in the official trading session.

Phillip Securities is proud to be the first broking house in Hong Kong and Singapore to offer customers this trading channel.

Pre-IPO Trading Hours

Trading hours for the Pre-IPO session are usually from 4:15pm to 6:30pm. In the event of half-day trading, hours will be from 2:15pm to 4:30pm.

All timings stated are in SGT.

Notable Company Stocks that have been traded in the Hong Kong Pre-IPO market:

China Literature (closing price as of 5 Jun 2018 HKD 76.25)

A subsidiary of Tencent, China Literature was listed in Hong Kong on November 8 2017, triggering exceptional demand from investors. Shares were priced at 55 HKD with a lot size of 200 shares. This was oversubscribed by 625 times. During the Pre-IPO session, China Lit opened at 77.90 HKD, reaching a high of 92 HKD, before finally closing at 89.65, representing a 63% gain over the IPO price.

On the first day of trading, China Lit opened at 90 HKD, quickly gaining momentum to hit a high of 110 HKD, a 100% increase from the issue price. It subsequently underwent a slight correction but found a strong resistance level at 100 HKD before finally closing 102.4 HKD, up 86.4% from issue price, with a market cap of 92.8 billion HKD.

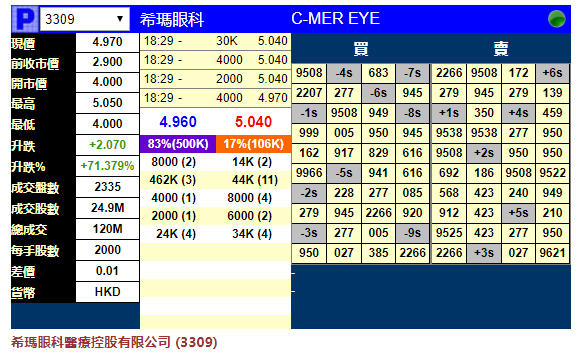

C-Mer Eye Care Holdings (closing price as of 5 Jun 2018 HKD 9.12)

C-Mer Eye Care Holdings was listed on the Hong Kong Exchange on January 15 this year, its IPO was oversubscribed by 1500 times, exceeding the 620x of China Literature. Priced at 2.35 HKD – 2.90 HKD with a lot size of 2000, C- Mer Eye raised 73 million USD from its IPO, of which 10% were from retail investors.

From their IPO prospectus, 197 million shares were sold; 19.7 million were sold in Hong Kong with the remainder being sold internationally.

Setting a new record for the highest over-subscription in history, the Pre-IPO Trading session for C-Mer Eye was exceptionally popular. Based on Phillip Hong Kong’s records, the price reached a high of 4.97 HKD, a 71% increase over the IPO price, with a total turnover of more than HK$ 120 million.

On the first day of trading, the stock opened at HK$5.35, 84.5% higher than issue price. For the next 4 days, the stock price continued to soar, reaching a high of HK$19.90, an impressive 686.2% increase from the issue price, and an increase of 371.96% from the opening price on the first day of trading.

For those who are interested to in Pre-IPO trading and would like to know more, do visit: https://globalmarkets.poems.com.sg/markets-we-offer/hong-kong-pre-ipo/

Sources: HKEX, Bloomberg, Phillip Securities, Xiaomi Prospectus

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Mr. Shengyu Xu

Senior Dealer

Global Markets Department

Xu Shengyu graduated from the National University of Singapore with a master degree in Chemistry and joined Phillip Securities since 2011. He is currently a Senior Dealer in the Global Markets department.

Shengyu is proficient in stock trading using both technical and fundamental analysis and frequently conducts educational seminars such as Market Outlooks, “Why Invest Globally” and trading platform introductions to enable his clients to make informed decisions in their investment.

Shengyu specialises in China and Hong Kong markets.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It