Bonds Trading

Why Trade Bonds with POEMS?

What is a Bond?

A bond functions as a loan between a bond buyer (lender) and a bond issuer (borrower, typically a corporation or governmental entity). The owners of bonds are debtholders, or creditors, of the issuer. The investor agrees to give the borrower a specific amount of money for a specific period of time in exchangefor periodic interest payments at designated intervals. When the loan reaches its maturity date, the investor’s loan is repaid.

Bonds can be bought or sold before they mature, and many are publicly listed and can be traded with a broker. Many corporate and government bonds are publicly traded; others are traded only over-the-counter (OTC) or privately between the borrower and lender.

What Is The Purpose Of Bonds?

Issuing bonds is one way for companies or governments to raise funds. Such funds can be used to finance projects and operations, to invest in growth opportunities or to refinance existing debt. Bonds allow individual investors to lend money to such borrowers. Bonds provide a solution by allowing many individual investors to assume the role of the lender.

There are several reasons why borrowers may choose to issue bonds. Firstly, the interest rate companies pay bond investors is often less than the interest rate they would be required to pay to obtain a bank loan. This is more prevalent during periods of low interest rates, allowing companies to issue bonds with lower coupon rates, thus reducing their interest expenses. Secondly, issuing bonds also gives companies significantly greater freedom to operate as they see fit because it releases them from the restrictions that are often attached to bank loans. Consider, for example, that lenders often require companies to agree to a variety of limitations, such as not issuing more debt or not making corporate acquisitions until their loans are repaid in full.

The problem that large organizations run into is that they typically need far more money than the average bank can provide.

How To Trade Bonds

In this guide, you’ll learn the steps on how to trade bonds with Phillip Securities. This pertains to the buying and selling of wholesale bonds, which are Over-The-Counter investment products not listed on an exchange, but rather bought and sold between different counter parties directly. As such, the process of trading wholesale bonds is different from stock trading, and we’re here to help you through this process.

As an overview, we’ll run through the steps of opening a trading account, getting bond quotes, place bond trades, and lastly managing settlement and payments.

Step 1: Opening A Trading Account

Before you’re able to trade bonds, you’ll first need a trading account to transact. Open an Account now or check out our Account Opening guide here

Step 2: Viewing Bond Quotes

After your POEMS account has been set up and you’re able to log in, you may start your search for the right bond at the right price. We offer a number of ways for you to view wholesale bond quotes, both online and offline. However, due to being OTC, all bond quotes will be indicative in nature due to absence of an exchange.

For investors seeking a convenient bond quote search process, you may view quotes online via the POEMS platform or through our bonds website.

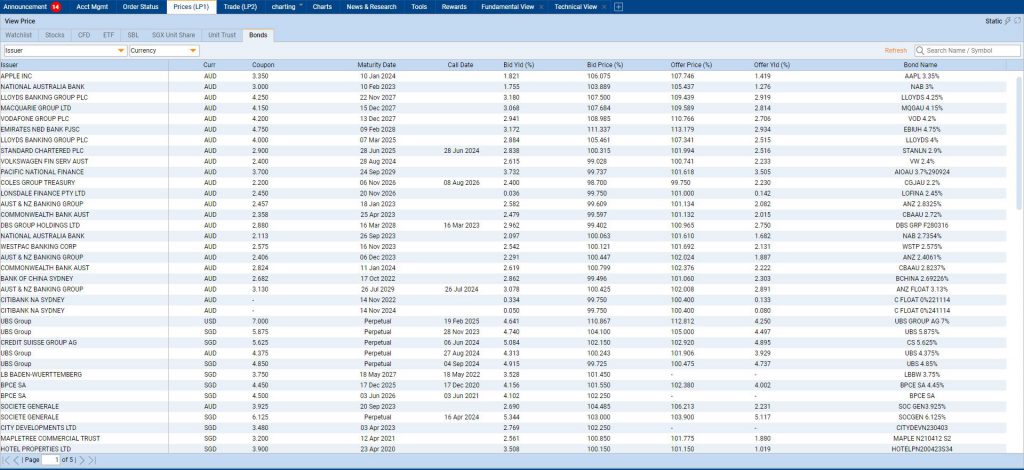

1. Viewing Quotes Online On POEMS 2.0

Step 1: Log in to POEMS 2.0.

Step 2: Go to the bonds tab in either Prices (LP1) or Trade (LP2)

Step 3: Acknowledge the Accredited Investor disclaimer, required as bonds are an OTC product

Step 4: Search for an issuer via the dropdown or a specific bond via the search bar

Step 5: View indicative bid ask prices

Step 6: View trade details by the trade window (right click on the bond and select trade) – estimated settlement amount, accrued interest, indicative yield

2. Viewing Quotes On our website

Check out our Bond Screener and search for a bond to view details.

You can also calculate trade details via the bond calculator – estimated settlement amount, accrued interest, indicative yield.

3. Getting Quotes Offline

For a more personal approach to your bond search, you may contact your respective financial advisor or our bond desk for quotes. Drop our customer care hotline a call to retrieve your financial advisor’s contact if required. You may contact our bond desk at 6212 1818 or bonds@phillip.com.sg.

Step 3: Placing A Bond Trade

Once you’re satisfied with your bond search and are happy with a quote, you may now be deciding to place a trade. Once again, we offer both online and offline trading options when placing bond trades.

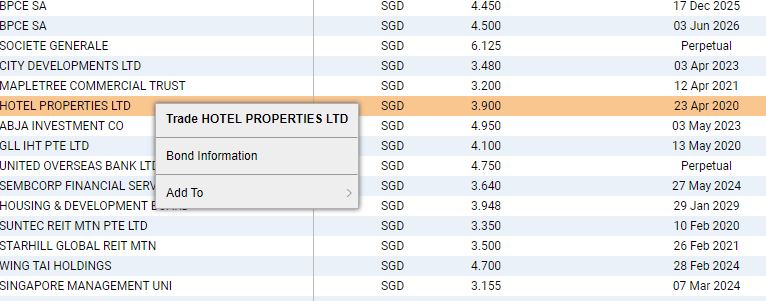

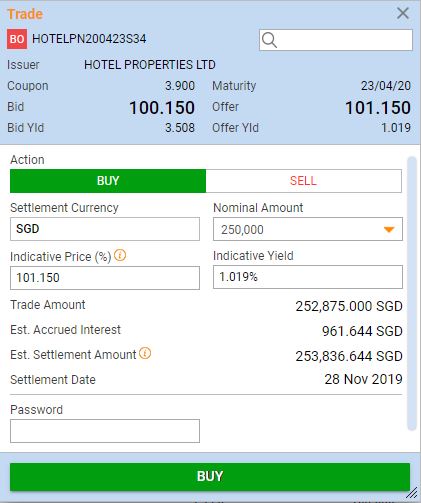

Online bond trades can be placed on our POEMS 2.0 platform.

From the Bonds tab in Prices (LP1) or Trade (LP2), right-click on the specific bond and select Trade.

The Trade window should then appear as below. You may now key in your order whether to buy or sell, desired indicative price, and your password to proceed.

Once the order is successfully placed, you may view its status under the order status tab. You may amend or withdraw your order here as well.

For offline trades, you may contact your respective financial advisor or our bond desk at 6212 1818 to place your order. Placing subscriptions for new bond issues have to be done through these channels as well.

Step 4: Settlement and Payment

Prior to bond purchases, the purchase amount of funds should be deposited into your trading account before placing the trade. Post-funding arrangements may be explored on a case by case basis. Kindly contact your financial advisor for assistance.

Alternatively, find out how you may purchase bonds without additional cash outlay with Bond Financing.

Visit our payment page to find out more about the accepted payment methods.

Key Features of a Bond

Face value

Also called the nominal or principal value of a bond, it is the amount your will get back from the issuer on the day the bond matures. Singapore Dollar bonds are mostly issued with face value of S$250,000 per bond. When a bond is trading on the secondary market, its price may fluctuate above or below the face value.

Maturity date

The date when the bond comes due and you receive your principal amount back.

Coupon rate

The rate of interest that the bond pays the bondholder in a year based on the face value. For example, a 5% coupon bond pays the bondholder S$12,500 a year.

Yield to maturity

The expected annual return on a bond if the bond is held to maturity. It is inversely related to the bond price, which means the higher the price the bond is purchased at, the lower the yield the bondholder receives.

Distribution deferral

All corporate perpetual bonds allow distributions to be deferred. In other words, the issuer can choose not to pay the distributions without providing any reason or it may have to satisfy certain conditions before such deferral. Deferral may be cumulative or non-cumulative depending on the terms of the specific preferred perpetual security. For deferral that is cumulative, the issuer will pay the deferred amount at later payment date. In the event that the deferral is non-cumulative, the issuer has no obligation to pay the amount deferred at any subsequent point of time and the bonder buyer face the risk of not getting any returns on investment.

Distribution pusher and stopper

A distribution pusher and stopper are common covenants seen in perpetual bonds

A distribution pusher constitutes a mandatory paid distribution of deferred interest to perpetual bondholders if equity/securities holders who are junior to the perpetual holders get paid dividends.

A distribution stopper or blocker means that bond issuer will not pay any dividend or distribution. The company shall not pay distribution to perpetual bondholders if the company does not pay dividends in respect of its equity/securities holders who are junior to the perpetual bondholders.

Types of Bonds

Bonds Types by Issuer

Corporate Bonds

Corporate bonds are bonds issued by companies. Companies issue bonds rather than seek bank loans for debt financing in many cases because bond markets offer more favorable terms and lower interest rates.

Government Bonds

Government bonds are bonds issued by governments such as the Singapore government or the U.S. Treasury. Such bonds issued by national governments may be referred to as sovereign debt and are characterized as the safest bonds, with the lowest interest rate. Backed by the “full faith and credit” of the sovereign government, these types of bonds are often referred to as risk-free.

Bond types by structure

The more common types of bond structures we have in Singapore include:

Bullet Bond

Bonds that pay periodic fixed coupon payments based on a fixed or floating coupon rate and the final principal amount at maturity

Perpetual Bond

Bonds that have no maturity date. Normally, these bonds contain a provision that gives the issuer the right to call (buy back) the bond before its maturity date, similar to the call provision of some preferred stocks. A company is likely to exercise this call right when its outstanding bonds bear interest at a much higher rate than the company would have to pay if it issued new but similar bonds.

Retail Bond

Bonds that are listed and investors are able to buy/sell on the exchange. They are normally traded in a smaller size as compare to the Over-The-Counter (OTC) bonds. However, prices quoted on the exchange are ‘dirty’ prices (including accrued interest) whereas for OTC bonds, prices are normally quoted as ‘clean’ prices. If you have a Phillip Securities Trading Account, you may login to the POEMS 2.0 Trading Platform to trade exchange traded bonds.

Other types of bond structures include:

Zero-coupon Bond

Zeros pay no regular interest. They are issued at a substantial discount to par value, so that the interest is effectively rolled up to maturity. The bondholder receives the full principal amount on the redemption date.

Convertible Bond

A convertible bond may be exchanged for shares of stock of the issuing corporation at the bondholder’s option. These bonds have a stipulated conversion rate of some number of shares for each bond. Although any type of bond may be convertible, issuers add this feature to make risky debenture bonds more attractive to investors.

Bonds with Stock Warrants

A stock warrant allows the bondholder to purchase shares of common stock at a fixed price for a stated period. Warrants issued with long-term debt may be nondetachable or detachable. A bond with nondetachable warrants is virtually the same as a convertible bond; the holder must surrender the bond to acquire the common stock. Detachable warrants allow bondholders to keep their bonds and still purchase shares of stock through exercise of the warrants.

Exchangeable Bond

These allow for exchange to shares of a corporation other than the issuer.

Fixed Rate Bond

These have a coupon that remains constant throughout the life of the bond. A variation is stepped-coupon bonds, whose coupon increases during the life of the bond.

Floating Rate Notes

Also known as FRNs or floaters, these have a variable coupon that is linked to a reference rate of interest, such as the SIBOR.

Understanding Bond Rankings

Bond ranking determines the priority of payout during the event of default, which determines our recovery rate for our bonds. Here is the order of ranks that bonds mainly have:

Secured corporate bonds

At the top of the ranks are the senior secured debt, which are bonds backed with collateral. They have significantly higher recovery rate in the event of default. Issuers of secured bonds may use assets such as properties, industrial equipment or factories as security for the bonds.

Senior unsecured bonds

Similar to senior secured debt, senior unsecured bondholders are given priority in payout during defaults, however their bonds are not guaranteed by a specific collateral.

Junior, subordinated bonds

Ranked after senior debt are junior, subordinated bonds. They are paid out from what assets remain after senior securities have been paid. There are no collateral guarantees for these bonds and they only have the issuer’s good name and credit rating as security.

Perpetual bonds

Also commonly known as ‘Perp’, is a fixed income instrument with no fixed maturity date. It is often considered a type of equity rather than debt. Perpetual bonds also allow early redemption at the issuer’s discretion on predetermined call dates, without guaranteed redemption.

A coupon refix may occur based on the terms if the bond is not redeemed early on call date or if the coupon is not fixed-for-life. Moreover, issuers can also cease coupon payouts without triggering a technical default.

Banks and other financial institutions frequently use perpetual bonds to generate additional tier 1 (AT1) capital, a lender’s second defence against economic shocks after equity. When the firm experiences financial hardship and its capital ratio drops below a certain threshold, it may either convert to equity or be written down to boost a lender’s equity basis, minimising systemic impact.

Convertible bonds

These bonds have the option of converting into common stock shares at a preset price. This provides bondholders with more options depending on the issuer’s prospects and stock price.

Risks of Bond Investments

(Terms and Risk Disclosures for Bond Investments)

It is essential to understand the risks of bonds before investing in them, as different types of bonds have varying levels of risks. By evaluating these risks, investors can make informed decisions about whether to invest in a particular bond or not.

The information below is only a summary of some key risk, features, terms and conditions of the bond investment product mentioned herein. Please refer to the product documentation (a copy which is available upon request) for full details of the bond investment product mentioned herein and the applicable key risks, disclosure features, terms and conditions.

Key risks of bond investments

Product risk

All investments carry an element of risk. Losses may be incurred as a result of buying and selling investment products.

Credit/Issuer risk

Bonds are subject to the risk that the issuer of the bond will default on its repayment obligations. Credit ratings assigned by credit rating agencies can be used as a reference BUT do not guarantee the creditworthiness of the issuer / guarantor (if any).

Liquidity risk

Certain illiquid bonds may not be actively traded on the secondary markets with wide bid/offer spreads. It may be difficult or impossible for investors to sell before its maturity.

Inflationary risk

Inflation will undermine an investment’s returns through a decline in purchasing power. Bond payments are most at inflationary risk because their payouts are generally based on fixed interest rates, meaning an increase in inflation diminishes their purchasing power.

Interest rate risk

Bonds are more susceptible to fluctuations in interest rates. Bond prices are inversely related to interest rates. As interest rates rise, the prices of existing bonds fall, and vice versa. Therefore, when interest rates rise, the value of a bond decreases.

Currency risk

Exchange rate fluctuations may adversely affect the investment return when the traded currency proceeds / interest coupons are converted to the original currency.

Counterparty risk

Where a counterparty defaults in its contractual obligations, significant losses of principal may incur.

For bonds that have longer investment tenors:

- There may be potential losses of principal if investors redeem their longer tenor investments before the maturity date.

For customers with leveraged trading facilities:

- Margin / Leverage trading increases the investment risk by magnifying potential losses. The cost of borrowing may increase due to interest rate movements.

Investments in other jurisdictions

- Where the issuer is incorporated in and/or has operations in jurisdiction(s) other than the investor’s home jurisdiction, the regulatory regime in such other jurisdiction(s) may offer different or diminished investor protection.

Risks linked to bond’s contractual arrangement

- A bond is a contractual arrangement between the issuer and the investor. The terms and conditions governing each bond can differ significantly and investors should always read and understand these related terms and conditions before making any investment.

Investors may only take action through the Trustee

- Under the terms of the trust deed, only the trustee may pursue remedies and/or take enforcement action on behalf of the investors. Investors may not take action directly against the issuer unless the trustee has failed or neglected to do so. The trustee is not be obliged to take any action on behalf of investors unless (a) it has received instructions or directions in accordance with the terms of the trust deed and (b) it has been indemnified and/or secured and/or prefunded to its satisfaction. Negotiating and agreeing to an indemnity and/or security and/or prefunding can be a lengthy process and may impact on when such actions can be taken.

Important Reminders and Risk Warnings (In addition to key risks of bond investment)

High-yield bonds

Higher credit risk

- High-yield bonds are typically rated below investment grade or are unrated. They are subject to market volatility and possibility of higher issuer default risk.

Increased vulnerability to economic cycles

- High-yield bonds are subject to higher market volatility and declining market value during economic downturns.

Perpetual bonds

No maturity date

- Perpetual bonds are perpetual in nature and do not have a fixed maturity date.

Coupon payment

- There is possibility of coupon payment deferral or total suspension subject to the terms and conditions of the perpetual bond issuance and at the discretion of the issuer. There is also possibility of accrued interest being non-cumulative as a result from coupon payment deferral. For non-cumulative perpetual bonds, coupon payments that are unpaid or omitted will not be paid back later.

Non-call risk

- Perpetual bonds are callable at the discretion of the issuer. If the perpetual bond is not called, there may be no stated maturity for investors to recover their principal. Investors are exposed to market price volatility and dependency on secondary market liquidity, resulting in potential loss of principal investments.

Lower priority of claims

- Bonds issued as subordinated debts have a lower priority of claims in the event of liquidation of the issuer. Investors can only get back the principal after other senior creditors are paid.

Reinvestment risk

- Bonds with a callable feature increase an investor’s reinvestment risk when the issuer exercises its right to redeem the bond before it matures or when the issuer exercises a make-whole call provision on a bond allowing the issuer to pay off remaining debt early.

Convertible bonds

Equity investment risk

- Investments in convertible bonds are subject to both equity and bond investment risk.

Equity volatility risk

- The market price of the convertible bond is likely to be affected by fluctuations in the market price of the underlying stock.

Callable bonds

Reinvestment risk

- Bonds with a callable feature increase an investor’s reinvestment risk when the issuer exercises its right to redeem the bond before it matures or when the issuer exercises a make-whole call provision on a bond allowing the issuer to pay off remaining debt early.

Subordinated bonds

Lower priority of claims

- Bonds issued as subordinated debts have a lower priority of claims in the event of liquidation of the issuer. Investors can only get back the principal after other senior creditors are paid.

Contingent convertible (Bank Coco bonds) or bail-in bonds (Additional Tier One (AT1) capital bonds)

Higher investment risks (Loss Absorption)

- Investors face higher risks as these are hybrid debt-equity instruments that may be written off or converted to common stock on the occurrence of a trigger event, (e.g. at the point of non-viability or the capital ratio falls to a specified level).

- Bonds with a contingent write down or loss absorption feature may be written-off fully or partially or converted to common stock on the occurrence of a trigger event.

- Investors face both equity and bond investment risk if the bonds are converted to common stock on the occurrence of a trigger event.

Floating rate bonds / notes

Unknown interest rate

- Floating rate bonds/notes pay a variable coupon determined by a reference rate which resets periodically. As the reference rate resets, the payment received is not fixed and fluctuates overtime. Decreasing interest rates would result in lower coupon payments when the floating rate is due for reset.

Disclaimer:

This information/document is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information. The products referred to herein are intended only for accredited investors, institutional investors and certain other persons who meet the requirements set out in section 275 of the Securities and Futures Act 2001.

Investments are subject to investment risks including the possible loss of the principal amount invested. Past performance figures as well as any projection or forecast used in this publication, are not necessarily indicative of future or likely performance of any securities.

You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualified financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement. You are advised to read the trading account Terms & Conditions, Risk Disclosure Statement (available online at www.poems.com.sg/docs/RiskDisclosure.pdf) and associated product offering documents including risk factors) before trading in this product. Where the product is issued by a third party issuer, such third party issuer and not PSPL will be liable to the investor. PSPL shall not be responsible for any inaccuracy, incompleteness or incorrectness of any information contained in the offering documents prepared by a third party product issuer. The product offering documents are provided to you on the understanding that you have sufficient knowledge, experience, and/or professional advice to make your own evaluation of the merits and risks of the product.

Reminders:

Phillip Securities Pte Ltd (“PSPL”) will generally provide you “execution only” services – see Guide and Cautionary Notes for Trading Accounts on www.poems.com.sg. You are therefore personally responsible to make your own decisions on the suitability of every transaction you do through PSPL. One exception is if you specifically apply and pay for advice from PSPL. The other exception is Execution-Related Advice on listed Excluded Investment Products (“ERA”) which may be given to you, but only subject to (a) you accepting personal responsibility to ensure any such advice is suitable before you act on it, and (b) you ensuring that you receive and understand the rationale for every ERA given to you. Materials (including market and analyst reports) are provided to you as information on an execution only basis for you to make your own suitability decisions. Materials which are not ERA are provided strictly as you asked.

General Disclaimer:

The information/materials provided, where they are not ERA, are provided for general information/circulation only and not intended and therefore should not be taken as any offer or solicitation to do any investment or trade. No assessment has been made by PSPL as to the suitability for you of any materials. As always, the decision to trade and/or invest remains solely with you. Information/materials are provided “as is” without warranty of any kind, either express or implied. Such information/materials provided have been procured from sources believed to be reliable and accurate (but whose reliability and accuracy cannot be and are not warranted); and may have been acted on by PSPL or members of the PhillipCapital group before being made available to you. All investments are subject to investment risks. Ideally you should and you may wish to seek advice from a financial adviser before making a commitment to purchase or invest in the investment product(s) mentioned. If you choose not to do so, you are then choosing to make your own decision on whether any of the said investment product(s) are suitable for you. Neither PSPL nor any fellow member of the PhillipCapital group of entities shall, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached.

Bond Terminologies

Terminology |

|

| A | |

Accrued Interest |

The amount of accumulated interest on a bond since the previous coupon payment date. |

Angel Bonds |

Bonds which have credit rating of either Baa3 to Aaa (Moodys), BBB- to AAA (S&P) or BBB- to Aaa (Fitch), or known as Investment grade bonds |

Ask price |

Price which investor acquire the bonds |

Ask Yield |

Yield that the investor received at the price that they invest in the bonds |

| B | |

Basis Point |

A basis point is equal to one-hundredth of a percentage point, or 0.01%. |

Bid Offer/Bid Ask Spread |

The amount by which the ask price exceeds the bid. It is the difference in price between the highest price that a buyer is willing to pay for bond and the lowest price for which a seller is willing to sell it. |

Bid Price |

Price which client is able to sell the bonds |

| C | |

Call date |

Date where the issuer is able to call back the bonds in part or in full |

Change of Control |

A type of bond covenant which gives the bondholder the right to sell back the bonds to the company at a certain price when there is a change in ownership |

Clean Price |

The price of a bond that does not include any accumulated interest. |

Coupon Payment |

A coupon payment is the periodic interest payment given to the bondholder by the bond issuer from issue date until maturity. |

Coupon Rate |

The rate of interest paid by the issuer of a bond. The rate is usually expressed as an annual percentage of the face value of the security. |

Credit Rating |

The credit worthiness of corporate bonds, normally done by the credit rating companies |

Credit Spread |

A credit spread, also known as a yield spread, is the difference in yield between two debt securities of the same maturity but different credit quality. |

| D | |

Default |

The failure or inability of an issuer to pay coupons and/or bond principal. |

Dirty price |

The dirty price is the clean price plus any accrued interest |

Discount |

Purchasing the bond at a price less than the face value. |

Distribution |

The payment of income from a fixed income security usually referred to as coupon. Sometimes the term distribution is associated with instruments where payment of income is conditional (for example a hybrid security) rather than an unconditional payment (for example a senior bond). |

Duration |

A measure of the sensitivity of a bond’s price, or market value, to a change in the market interest rate. Higher duration means higher sensitivity in the bond price to changes in interest rates. |

| F | |

Face Value |

The nominal value or the dollar value that the investor received at maturity. However, the nominal value might not be the price the investor has to pay |

| G | |

Gearing |

Measures the extent to which a company or an investment is funded by debt. Also known as leverage. |

| I | |

Interest Rate |

The cost of borrowing money, or the return on funds, provided by a lender |

Interest Rate Cap |

A maximised level at which an interest rate cannot go beyond |

Investment-Grade |

Bonds which have credit rating of either Baa3 to Aaa (Moodys), BBB- to AAA (S&P) or BBB- to Aaa (Fitch) |

Issuer |

Borrower (government, financial institution or company) that issues the bond or security |

| J | |

Junk Bonds |

Bonds which have credit rating below Ba1 (Moodys), BB+ (S&P) or BB+ (Fitch) |

| L | |

Liquidity |

The liquidity or marketability of an asset is a function of the difference between the bid (the price at which the market is willing to buy the security) and the offer (the price at which the market is willing to sell the security), more commonly known as the bid-offer spread. If a market is liquid it will have many participants at any given time competing to buy or sell the assets, resulting in a narrow spread. If it is not liquid it will be very difficult to buy or sell the asset without adjusting the capital price paid or received for the asset significantly, creating a wide bid-offer spread. |

| N | |

Nominal Value |

The value of a security, such as a stock or bond, which remains fixed for the duration of its life. |

Nominal Yield |

The interest paid per annum over the face value of the bond. |

| O | |

Odd Lot |

Block of bonds of less than SGD250,000/USD200,000 or less. |

Offer/ Offer Price |

An expression used in share, bond and foreign exchange markets for the price at which a broker will sell a security (that is the price at which an investor will buy). Note the offer price will typically be the capital price or clean price. Also see “Bid”. |

Open Market |

The term used to describe the market in which bonds are bought and sold after primary issuance. |

Over-the-Counter market(OTC) |

A securities market that is conducted by dealers throughout the country through negotiation of price rather than through the use of an auction system as represented by a stock exchange. |

| P | |

Par Amount |

The principal amount of a bond or note due at maturity. Also known as par value. |

Premium |

Buying a bond at price higher than the face value |

Price |

The price paid to buy/sell a bond, normally expressed as a percentage to the face value |

Primary Market |

The new issuance market |

Principal |

The nominal value or the dollar value that the investor received at maturity. However, the nominal value might not be the price the investor pays |

| R | |

Redemption |

The paying off or buying back of a bond by the issuer; also, repurchase of investment trust units by the trustee, at the bid price. |

Re-Fix coupon rate feature |

A special feature of some bonds, which allow their coupon rate to be re-fixed in the future |

| S | |

Secondary Market |

The financial market where previously issued securities and financial instruments are bought and sold. The major stock exchanges are the most visible example of liquid secondary markets. |

Senior Debt |

Senior debt is a class of corporate debt that has priority with respect to interest and principal over other classes of debt (except senior secured debt) and over all classes of equity by the same issuer. A company has no ability to defer coupon payment to senior or subordinated debt holders. |

Senior Securities |

Bonds and other debt obligations, fixed-rate capital securities and preferred stock that are considered senior to common stock within an entity’s capitalization structure. |

Settlement |

It is the process whereby securities or interests in securities are delivered, usually against payment, to fulfil contractual obligations. Usually settlement is preceded by trading, which involves entering into contracts of sale and purchase. |

Settlement Date |

The date for the delivery of securities and payment of funds. |

Spread |

The difference between the buy price and the sell price of a bond. It represents the cost of a transaction to buy or sell a bond. |

Subordinated Debt |

A type of debt that places the investor in a lien position behind or subordinated to a company’s primary creditors. Securities issued as subordinated debt will pay interest and principal but only after all interest that is due and payable has been paid on any and all senior debt. |

Swap |

A financial agreement to exchange one set of cash flows for another. A common swap in fixed income markets is an exchange of a fixed interest rate for a floating interest rate. |

| T | |

Term |

Length of the investment. Time in days months or years from the investment date till the maturity date. |

Term Deposits |

These are non-tradable fixed income investments usually with prearranged time period ranging from a month to five years or even more. When a term deposit is created, the lender (investor) understands that the money can only be withdrawn after the term has ended. If the investor wishes to withdraw the money at an earlier date, they may be charged a fee for obtaining the funds prior to maturity. |

Total Return |

Investment performance measure over a stated time period which includes coupon interest, interest on interest, and any realized and unrealized gains or losses. |

Trade Date |

The date that a trade, or sale and purchase, is consummated, with settlement to be made later |

Tranche |

A term used to describe a specific class of bonds within an offering wherein each tranche offers varying degrees of risk and return to the investor. |

| U | |

Unsecured Note |

A bond or a loan that has no security attached to issuer’s assets and repayment is reliant on the integrity or credit quality of the issuer. |

| W | |

Write Down |

Reducing the book value of an asset because it is overvalued compared to the market value. This is generally shown in the company’s income statement as an expense, reducing net income. |

| Y | |

Yield |

The annualised return the investor expects to receive from investing in a bond. A simple formula would be yield = coupon rate/price |

Yield Curve |

Shows the yields available from bonds issued by the same borrower over different terms of maturity, starting with the bond closest to maturity out to the longest maturity. |

Yield to Maturity (YTM) |

The annualised return the investor expects to receive from investing in a bond when they hold to maturity |

Yield to Next Call (YTNC) |

The annualised return the investor expects to receive from investing in a bond when the bond is called back by the issuer |

Yield to Worst |

A measure of the lowest possible return that can be received on a bond which operates within the terms of its contract without defaulting. The Yield to Worst can equal to the Yield to Maturity, but not surpass it. |

Frequently Asked Questions

No, you can use your existing Cash Management, Custodian or Margin Financing accounts to invest in bonds.

It depends on the availability of the quantity of bonds in the market at the time of purchase.

This is an illustration on how the settlement of a bond works.

For example, SGD 250 000 Corporate Bond was bought at the price of 102.00 % (of the principal amount) on 23 March 2015. (Trading account to be pre-funded) It carries a coupon of 5.90% per annum and matures on 17 July 2017. The corporate bond was issued on 18 July 2014.

Additional information

Accrued interest: 68 days. Yield to maturity: 4.96%. Coupon payment: 17 Jan & Jul

The investment is as follows (Assume the day convention is 365 days):

Principal amount payable

= Principal x Bond price

= SGD 250,000 x 102.00/100

= SGD 255,000

Accrued Interest payable

= Principal x coupon x number of days after last coupon payment

= SGD 250,000 x 5.90/100 x 68/365

= SGD 2,747.95

Total amount payable by the investor client

= Principal amount payable + Accrued interest payable

= SGD 255,000 + SGD 2,747.95

= SGD 257,747.95

Charges

• There are no commission for bond trading. A percentage spread is included in the price of the bond quoted to the client.

• There is a custody fee of 0.05% p.a of the market value and GST payable monthly for bonds under custody with Clearstream/Euroclear.

Bond prices and yields move in opposite directions. To illustrate this concept, let us assume that you are holding a bond of 1-year maturity that you bought at S$900. At maturity, you will receive your principle of S$1000. Assume the bond does not pay any coupon, so your yield-to-maturity is 11.1% at the moment:

[S$(1000-900) / S$900] x 100 = 11.1%.

If the bond price falls to S$850, the yield-to-maturity on this bond will be higher:

[S$(1000-850) / S$850] x 100 = 17.6%

Likewise, when the bond price rises to S$950, the bond’s yield-to-maturity will fall:

[S$(1000-950) / S$950] x 100 = 5.3%

Intuitively, if you bought your bond when interest rates were at 4%, and if interest rates rose to 6%, it would mean that you would be able to sell your bond at a lower price than what you paid for it. This is because investors can buy new bonds that will give them a higher yield (i.e. 6%). The price of your bond will therefore decline. On the other hand, if interest rates fall, investors will find your bond attractive relative to new bonds with lower yields. Therefore, the price of your bond will rise.

(a) Investment objectives and timeline

Bonds are one of the instruments to diversify one’s investment portfolio. Depending on the issuer’s financial/credit standing, it can potentially be a good instrument for investment, earning regular interest income.

Customer will need to decide on his/her personal investment timeline in the selection of bonds based on the maturity dates. This affects the cash flow and the amount of risk the customer is prepared to bear. Generally, the longer the period of investment, the higher the return and risk involved. Longer tenor bonds are more sensitive to movement of interest rates and the customer who invests in these bonds may potentially make greater capital gains or losses if he/she sells off the bond investments before maturity.

(b) Features of the Bonds

There are different types and grades of bonds, from simple plain vanilla bond to those with call/put or convertible covenants.

(i) Issuer

Government or corporation that borrows by issuing bonds and repays investors with regular coupons.

(ii) Principal

Nominal value of the bonds issued or amount of money borrowed by the issuer that will be repaid to the investor upon maturity of the bond. Commonly also known as face value, or par value.

(iii) Maturity

The date where the issuer must return the principal or the face value to the investor.

(iv) Coupon

Interest payment made on a bond by the issuer in regular periods to repay the investor for holding the bond. Coupons are usually paid semi-annually.. For example, a $1,000 bond paying $40 a year has a coupon rate of 4.0%.

(v) Yield

It is the annualised return earned on a bond. It is calculated by dividing the coupon rate by the price of the bond and expressed in percentage terms.

Reference: www.sgx.com.

(c) Risks of investing in Bonds

Bond investment is not without risks; some of the risks are highlighted below for discussion:

Market risk

The value of the bond is subjected to interest rate changes, as well as demand and supply forces. Bonds, in particular, are sensitive to interest rate fluctuations and the prices of bonds move in opposite direction with interest rates. Despite this consideration, this risk is more pertinent if the investor decides to sell the bond and not hold it to maturity

Credit risk

Credit risk highlights the fact that the issuer may default on payment of the coupon, and even the principal amount if the issuer has problems meeting its obligations as promised. This is also known as default risk or issuer risk.

Liquidity risk

When there is a lack of buyers or sellers in the market, the investor may not be able to execute the trade or may be forced to trade at a value significantly away from the investor’s desired price. This can be deemed as liquidity risk.

Foreign exchange risk

The investor is exposed to fluctuations in foreign exchange rates when the investor trades in bonds that are denominated in a currency other than the functional currency of the investor. This may erode the returns on the bond investment.

Reference: SGX

Customers are advised to consider all risks by reading the prospectus/information memorandum/term sheet or seeking advice from a qualified financial adviser representative before they make a commitment to purchase any bonds.

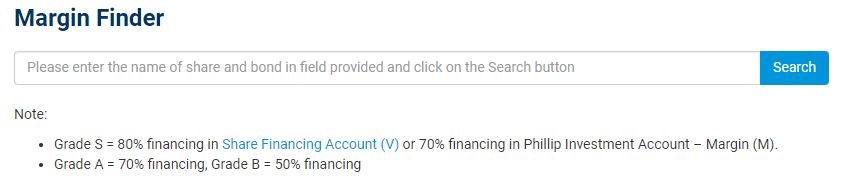

Our Margin Finder Tool allows you to find out if your bond is eligible for financing. However, the list is not exhaustive. You may contact your respective financial advisor or our bond desk at +65 6212 1818 to inquire more.

Only Grade S, A and B bonds can be used as collateral for financing. Grade C bonds cannot be used as collateral, however you may purchase grade C bonds on financing.

Investor can contact our Bond Desk or Trading Representatives to place a bond order.

Bond Desk can be reached at 6212 1818 or via email us at bonds@phillip.com.sg for more information.

No, investor can always sell the bond on the market at market price anytime subject to demand and supply.

For perpetual bond/securities with no maturities, investors can either wait for the bond next call date subject to issuer call or sell the bond on the market at market price anytime subject to demand and supply.

Those bonds listed on our website are just some of the bonds we offer, as the list is exhaustive, do contact the bond desk if you are looking for any specific bond or have requirements for tenure or yield. Our Bond Specialist will be able to customise a list that meets your requirements.

Please contact our Bond Desk at 6212 1818 or email us at bonds@phillip.com.sg for more information.

To check prices for specific bonds, investor may contact the desk directly at 6212 1818 for an indicative quote.

Investors can access more than 200,000 bonds globally trade bonds denominated in 9 major currencies.

AUD, CAD, CNY, EUR, GBP, HKD, NZD, SGD & USD

Investor can simply do an EPS (Electronic payment for share) to their own trading account. Investors will need to pre-fund their account prior to bond execution.

Investors need to ensure that the full settlement amount is available in their account on the bond settlement date. Debit interest applies (varies for different account types) for cases where there is insufficient fund on the bond settlement date.

Please visit our payment page for a list of payment methods and their respective processing times.

For bonds under Phillip custody, coupon payment will be credited into account ledger.

For bonds under CDP custody, coupon payment will be credited into bank account linked to CDP account.

Upon maturity, the proceeds will be credited into respective account’s ledger for bonds under Phillip custody. For bonds under CDP custody, proceeds will be credited into bank account linked to CDP account.

We do NOT charge brokerage or commission for wholesale bond investment. Indicative bond prices quoted are nett of fees.

No commission

No processing fee

No platform fee

No custody fee for bond cleared via CDP

*PSPL reserves the right to impose other charges or to revise the fees and charges without prior notice.

Please note that corporate (OTC) bonds are only available for sale to Accredited Investors or in minimum denominations of $200,000 per transaction

For relevant forms and documents required to be an Accredited Investor, please click here.

Definition of an Accredited Investor

An Accredited Investor (Individual) is:

An individual with net personal assets exceed in value of SGD 2 million (or its equivalent in a foreign currency) or such other amount as the Authority may prescribe in place of the first amount. Loans, overdrafts and/or credit facilities which the individual has with other banks and financial institutions will have to be deducted from his gross personal assets to generate his total net personal assets;

or

Whose income in the preceding 12 months is not less than S$300 000 (or its equivalent in a foreign currency) or such other amount as the Authority may prescribe in place of the first amount.

An Accredited Investor (Corporation) is:

The company’s total net assets (i.e. assets minus liabilities) must exceed SGD 10 million (or equivalent in foreign currency) as determined by the most recent audited balance-sheet of the company.

Custody Fees (subject to GST)

Custody fee for Singapore bonds (bonds settled through the Central Depository “CDP”)

- No charge unless otherwise notified by CDP

Custody fee for other bonds/notes

- 0.05% p.a. on market value (charged on a monthly basis)

Transfer Charges (subject to GST)

Transfer-in charges for non-CDP Bonds (Clearstream / Euroclear)

- US$18.00 per counter

Transfer-in charges for non-CDP Bonds (Non-Clearstream / Non-Euroclear)

- US$12.00 per counter

Transfer-in charges for CDP bonds

- S$10.00 CDP charges per counter

Transfer-out charges (out of Phillip Securities)

- S$100.00 per counter

*All charges above are based on Per Counter Per Transfer basis and are subject to GST.

*PSPL reserves the right to impose other charges or to revise the fees and charges without prior notice.

Visit our Fees & Charges page here.

The minimum investment for bonds will be subject to the bond issuance. For retail bonds, it is usually traded in multiple of S$1K. For wholesale bonds, it is usually traded in multiple of S$250K.

Please contact our Bond Desk at 6212 1818 or email us at bonds@phillip.com.sg for more information.

Enquiry

Have an enquiry? Get in touch with us at (+65) 6212 1818 or message us below!