POEMS Mercury Updates

May 15, 2017 | Posted by Jeremy Goh

New Order Type – OCO (One Cancels Other)

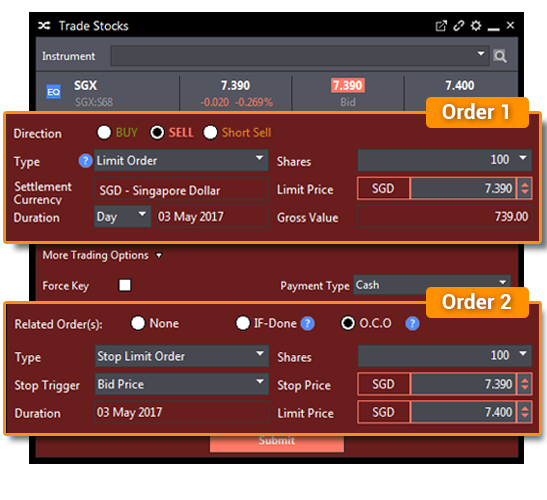

With the addition of the OCO order type, you can now submit 2 orders simultaneously to either take profit or cut loss.

Definition: An order stipulating that if one part of the order is executed, the other is automatically cancelled.

Usage: To set a limit order to take profit and a stop limit order to cut loss.

To select the OCO option, click on “More Trading Options” to extend the trade ticket to include Related Orders options. (OCO is currently only available on SGX, HKEx and US exchanges)

Execution:

An example to illustrate profit taking with an OCO order

A client has a long position on counter ABC at $3.50.

He submits an OCO order consisting of a limit SELL order set at $3.90 (order 1) to take profit, and a stop-limit SELL order set at $3.40 (order 2) to cut any possible losses.

As the price climbs and reaches $3.90, the OCO is triggered, causing order 1 to be executed, thus cancelling the stop-limit order to sell at $3.40 (order 2), which might otherwise be triggered should the price of the counter ABC drop to $3.40.

An example to show how an OCO order can be used to minimise losses

A client has a long position on counter XYZ at $1.12.

He submits an OCO order consisting of a limit SELL order set at $1.14 (order 1) and a stop-limit SELL order set at $1.06 (order 2).

As the market price of the counter starts to drop rapidly and hits $1.06, this executes the stop-limit order (order 2), which in turn triggers the OCO to cancel the limit order with the limit price of $1.14 (order 1).

ChartView Upgrades

Charting on POEMS Mercury has been updated to include Corporate Action Adjustments and a new technical indicator, NATR (Normalised Average True Range).

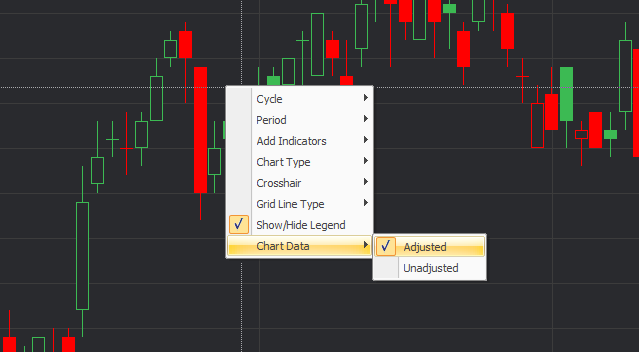

Corporate Action Adjustments (for SG stocks)

Corporate actions such as share split or share consolidation can create price gaps in charts that can be disruptive when you perform your technical analysis. For example, a share split of 3-for-1 will cause the price to become one-third of what it used to be, creating a large gap on the chart. This may create seemingly bearish signals.

Therefore, we provide the option of adjusting the historical price data to ensure that all price movements on our charts are caused by pure market forces for more informed Technical Analysis. Simply right click anywhere on the chart and change ‘Chart Data’ to adjusted.

New Technical Indicator – NATR (Normalised Average True Range)

New Global Exchanges — SZSE, LSE, TSE, FWB

Trade over 11 Global Exchanges on POEMS Mercury now with the addition of Shenzhen, London, Tokyo and Frankfurt Stock Exchanges. Visit Phillip Global Markets for more details regarding respective exchanges.

You may also be interested in…

Price Alerts

Never miss out price changes of your favourite stocks with our latest feature absolutely free of charge to you…

Chart-Live Upgrades

We know charting is one of the most important tools in trading. That is why we are constantly looking at ways to improve…

Switch to P2

Still using Classic POEMS? Time to upgrade to POEMS 2.0! Here is a comprehensive guide with all the resources you’ll need to make a smooth transition…

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.