CapitaLand Ascott Trust - Still room for RevPAU growth

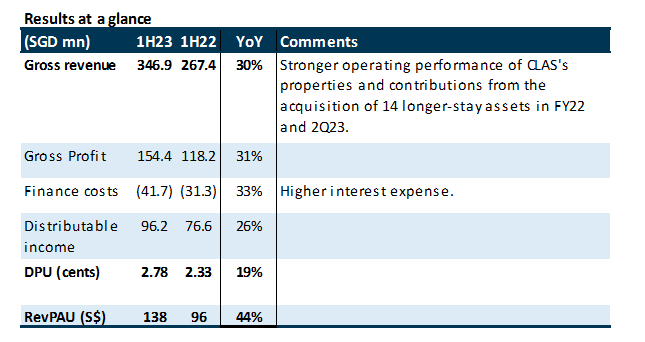

31 Jul 2023- 1H23 DPU of 2.78 cents (+19% YoY) was in line with expectations and formed 43% of our FY23e forecast, with seasonally stronger performance expected in the second half of the year. Excluding one-off items relating to realised exchange gain from the repayment of foreign currency bank loans and settlement of cross currency interest rate swaps, DPU increased 37% YoY.

- 2Q23 portfolio RevPAU rose 20% YoY to S$149, reaching 98% of pre-COVID 2Q19 levels on the continued improvement in portfolio occupancy (75% vs 70% in 2Q22) and average daily rates (ADR).

- Downgrade from BUY to ACCUMULATE, DDM-TP trimmed from S$1.26 to S$1.20. FY23e/FY24e DPU is lowered by 4%/6% on higher interest assumptions. CLAS remains our top pick in the sector owing to its mix of stable and growth income and geographical diversification. The current share price implies an FY23e dividend yield of 5.7%.

The Positives

- 2Q23 RevPAU grew 20% YoY to S$149 and is at 98% of pre-pandemic 2Q19 pro-forma RevPAU. YoY improvement was driven by both higher average daily rates (ADRs), which is up c.12% YoY in 2Q23, and higher occupancy of 75% in 2Q23 (2Q22: 70%). All markets experienced RevPAU growth YoY (see Figure 1), with Singapore, Australia, USA, UK, and Japan performing above pre-COVID levels. Japan saw a spike in RevPAU by 247% YoY after its re-opening to independent leisure travellers in Oct 2022. Performance in China and Vietnam strengthened and are currently at 78% and 83% of 2Q19 levels respectively.

- Portfolio reconstitution strategy. During the quarter, CLAS entered into conditional sale and purchase agreements to divest 4 properties in France for €44.4mn (S$63.4mn) to a third party. The price is at a 63% premium to book value and an exit yield of c.4%, unlocking a net gain of €0.2mn (cS$0.3mn). The expected completion of this divestment is in 4Q23. Standard at Columbia, the student accommodation development in South Carolina, USA, has obtained its temporary certificate of occupancy and is ready to receive students for the academic year 2023-24. It has a pre-committed occupancy of 87%. CLAS also has five properties that are currently undergoing AEIs to enhance return, as well as the redevelopment of Somerset Liang Court which is expected to complete in 2H25.

- Effective capital management. Including capitalised interest, CLAS’s effective borrowing cost remained unchanged at 2.4% QoQ. The percentage of loans on fixed rate increased from 75% to 80% as CLAS entered into more interest rate swaps during the quarter. Gearing improved marginally from 38.7% to 38.6% QoQ, leaving c.S$1.8bn of debt headroom for CLAS to reach its medium-term asset allocation of 25-30% for longer-stay accommodation (currently at c.19%). We expect cost of debt to increase marginally as CLAS refinances 13% of its total debt (c.S$372mn) due at the end of 2023 denominated in JPY, AUD and EURO. A 10bps increase in benchmark rates will impact full-year DPU by 0.02 Singapore cents.

The Negatives

- Nil

Outlook

Forward bookings remain healthy, supported by the strong demand from both international and domestic travel. We expect international travel to pick up pace as airline capacity increases – it has not fully recovered to 2019 levels. As corporates seek to optimize their expenses, many are downgrading from luxury to more cost-effective mid-tier mass market accommodation options. CLAS stands to benefit as the bulk of its portfolio comprises properties within the mid-tier segment, making it an attractive choice for cost-conscious corporate clients.

We forecast growth in ADRs to moderate as it has already surpassed pre-pandemic levels in some markets, and the driver for RevPAU growth going forward will be from higher occupancy. Portfolio occupancy at 75% is roughly 90% of pre-COVID occupancy.

Downgrade from BUY to ACCUMULATE, DDM-based TP lowered from S$1.26 to S$1.20.

FY23e/FY24e DPU is lowered by 4%/6% on higher interest cost assumptions. CLAS remains our top pick in the sector with its geographically diversified portfolio, wide range of lodging asset classes, stable income base which has proven its resilience through COVID-19, and a strong sponsor. We also like CLAS for its balanced mix of stable and growth income sources, which stands at 58% and 42% of gross profit in 1H23 respectively. The current share price implies a FY23e dividend yield of 5.7%.

About the author

Darren Chan

Research Analyst

PSR

Darren has over three years of experience on the buy-side as a fund manager. During his time as fund manager, he has managed multiple funds and mandates including dividend income, growth, customised, Singapore focused and regionally focused funds. He graduated from the University of London with a First-Class Honours degree in Banking and Finance.

About the author

Darren Chan

Research Analyst

PSR

Darren has over three years of experience on the buy-side as a fund manager. During his time as fund manager, he has managed multiple funds and mandates including dividend income, growth, customised, Singapore focused and regionally focused funds. He graduated from the University of London with a First-Class Honours degree in Banking and Finance.

Keppel Ltd - A slow quarter

Keppel Ltd - A slow quarter Frasers Centrepoint Trust - Robust operating performance in 1H24

Frasers Centrepoint Trust - Robust operating performance in 1H24 Spotify Technology S.A. - Raised prices and subscribers still grew

Spotify Technology S.A. - Raised prices and subscribers still grew Suntec REIT - Higher-for-longer interest rate continue eroding DPU

Suntec REIT - Higher-for-longer interest rate continue eroding DPU