Bank of America - Stock Analyst Research

| Target Price* | 40.82 |

| Recommendation | ACCUMULATE› ACCUMULATE |

| Market Cap* | - |

| Publication Date | 29 Apr 2024 |

*At the time of publication

Bank of America Corporation - Earnings hurt by NII and FICC

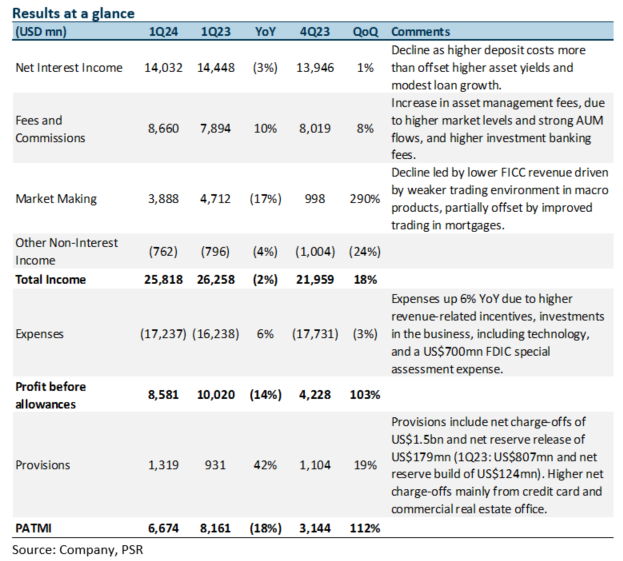

- 1Q24 PATMI was 25% of our FY24e forecast and met our estimates. BAC recorded higher asset management fees and investment banking fees offset by lower net interest income and market-making revenue. DPS raised 9% YoY to US$0.24, and 1Q24 common stock net repurchases rose 14% YoY to US$2.5bn.

- NII fell 3% YoY as higher deposit costs more than offset higher asset yields, while loans grew modestly by 1% YoY. Fees and commissions grew 10% YoY from higher asset management and investment banking fees, while lower FICC revenue dragged down market making. BAC guided NII to continue to decline in 2Q24 before modest growth in 2H24 and for expenses to be lower in 2Q24 as compared to 1Q24.

- Maintain ACCUMULATE with an unchanged target price of US$40.82. Our FY24e estimates remain unchanged. Our GGM valuation assumes 1.12x FY24e P/BV and an ROE estimate of 12.3%. NII decline will be offset by continued growth in asset management and investment banking fees, while a decline in expenses will support earnings growth.

The Positives

+ Asset management fees grew 12% YoY. Asset management fee growth came from higher market levels and strong AUM flows. Total client balances grew 13% YoY to US$3.9tn, driven by higher market valuations and positive net client flows. There were US$25bn of AUM flows in 1Q24 (1Q23: US$15bn). Merrill Wealth Management posted record client balances of US$3.3tn, AUM balances of US$1.4tn, and 6,400 net new households in 1Q24, while Bank of America Private Bank posted record client balances of US$634bn, AUM balances of US$380bn and 865 net new relationships in 1Q24.

+ Investment banking fees surged 35% YoY. Total corporation investment banking fees surged 35% YoY to US$1.6bn, and market share improved by 115bps from 1Q23. The growth came mainly from market share growth and results of investments made in BAC’s middle market investment banking teams and dual coverage teams. Notably, the middle market team has grown from 15 bankers in 2018 across 12 cities to more than 200 bankers in 24 cities. Investment banking fees of US$1.6bn in 1Q24 were the highest recorded in 7 years.

The Negatives

– Net interest income dips 3% YoY. NII fell 3% YoY to US$14bn as higher deposit costs more than offset higher asset yields, higher NII related to Global Markets (GM) activity, and modest loan growth. Net interest yield fell 21bps YoY to 1.99% as the rise in earning assets yield of 5.12% (+76bps YoY) was outpaced by the rise in interest-bearing liabilities yield of 4.10% (+117bps YoY). Loans grew 1% YoY to US$1.05tn as growth in credit cards was partially offset by declines in securities-based lending.

– FICC drags down market making. Market-making income fell 17% YoY to US$3.9bn, mainly from a decline in FICC revenue. FICC revenue fell 6% YoY to US$3.2bn, driven by a weaker trading environment in macro products, partially offset by improved trading in mortgages. Nonetheless, sales and trading revenue (which includes FICC and equities revenue) were flat YoY at US$5.1bn as the decline in FICC revenue was offset by growth in equities revenue (+14% YoY), driven by strong trading performance in derivatives.

About the author

Glenn Thum

Research Analyst

PSR

Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.

About the author

Glenn Thum

Research Analyst

PSR

Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.

SASSEUR REIT - FY24e sales will be driven by promotional events

SASSEUR REIT - FY24e sales will be driven by promotional events May 14th - Things to Know Before the Opening Bell

May 14th - Things to Know Before the Opening Bell ST Engineering Ltd - All engines roaring, but satellite no signal

ST Engineering Ltd - All engines roaring, but satellite no signal 信義光能 (968 HK) 光伏玻璃龍頭,產能擴張持續推進

信義光能 (968 HK) 光伏玻璃龍頭,產能擴張持續推進