BRC Asia - Proposed entry of a solid substantial shareholder

30 Aug 2021- BRC Asia has proposed to issue 31,015,000 new shares (12.7% of outstanding) to Hong Leong Asia Investments at S$1.48 a share in a private placement to raise S$45.9mn.

- Concurrently, Hong Leong Asia Investments will purchase from several vendors an additional 15mn shares at the same price. This is conditional on the placement’s success.

- The proposed placement will strengthen the group’s balance sheet as it navigates out of the current crisis, in our view. Net gearing would have improved from 112% to 83% had the transaction been completed last quarter.

- Maintain BUY and target price of S$1.79. No change to our forecasts pending regulatory and shareholder approval, which we expect to be completed in about six weeks. Our TP remains based on 11x FY22e P/E, a 15% discount to its 10-year average on account of the uncertain environment. Catalysts expected from higher foreign-worker inflows to Singapore.

The news

BRC Asia has entered into a subscription agreement with Hong Leong Asia Investments to raise S$45.9mn through a placement by way of an exempt offering, which exempts small placement offers from the need to issue prospectuses, amongst others. The company will issue 31,015,000 new shares to Hong Leong Asia Investments at S$1.48 a share. This represents a 2.06% discount to BRC Asia’s volume-weighted average price of S$1.5111 on 27 August 2021. Net proceeds are estimated at S$45.8mn, which BRC Asia will use to repay bank borrowings.

Concurrently, Hong Leong Asia Investments has entered into a conditional sale and purchase agreement with Xinsteel Singapore Pte. Ltd., NuoCheng International Trading & Investments Pte. Ltd., Toe Teow Heng, Wu Ai Ping and Shi Yong (collectively, the Vendors) to buy 15mn shares from them at S$1.48 apiece. The agreement is conditional on the proposed placement taking place. The subscription and vendor shares will represent approximately 16.77% of BRC Asia’s enlarged share capital. Following completion, Hong Leong Asia Investments will hold about 20.00% of this enlarged share capital.

The Positives

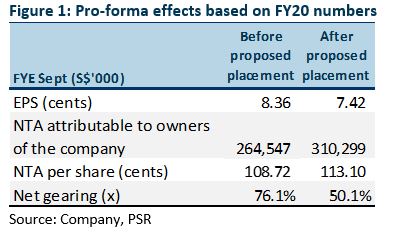

+ Balance sheet boost. The proposed placement is expected to strengthen the group’s balance sheet and help it navigate out of the current crisis. Pro forma net gearing would be 50.1% instead of 76.1%, assuming completion of the placement in FY20. Net gearing would also have improved from 112% to 83% should the transaction have been completed in its latest quarter, 3Q21.

+ New substantial shareholder to enhance overseas expansion. With 20.00% ownership after the transaction, Hong Leong Asia Investments will become a substantial shareholder of the group, assuming all goes to plan. Parent Hong Leong Asia is a household name in Singapore, particularly in the industrial space. The group owns leading brands in ready-mix and precast for the construction sector. We believe Hong Leong Asia Investments’ entry will speed up BRC Asia’s international expansion in the sustainable and innovative building solutions space. Singapore accounted for 84.5% of BRC Asia’s revenue in FY20.

Outlook

Resurgence of Covid-19 in Malaysia and Singapore. Record daily Covid-19 cases in Malaysia (Figure 2) triggered a full lockdown on 1 June for 14 days. This has since been extended twice, with no end date in sight. As many building materials come from Malaysia, the lockdowns have affected construction progress in Singapore. This, in turn, has slowed down the drawdown of reinforcing steel. In Singapore, a resurgence of Covid-19 in April (Figure 3) also led to a re-tightening of foreign-labour supply, exacerbating construction delays and delaying the industry’s recovery.

Construction demand to improve to S$23-28bn in 2021. The Building and Construction Authority has finalised 2020 construction demand at S$21bn. It expects construction demand to improve to S$23-28bn in 2021. The public sector is expected to contribute 65% of the new contracts or S$15-18bn, to meet stronger demand for public housing and infrastructure.

BCA also forecasts that average construction demand in 2022-2025 will be S$25-32bn per year, excluding the development of Changi Airport Terminal 5 and expansion of the two integrated resorts. The public sector is expected to contribute 56% to the demand.

As our forecasts have not included these projects, there is upside if they become live. In the near term, pipeline projects that will likely support the group’s growth are the Singapore Science Centre’s relocation, Toa Payoh integrated development, Alexandra Hospital redevelopment, Bedok’s new integrated hospital, Phases 2-3 of the Cross Island MRT Line and Downtown Line’s extension to Sungei Kadut.

Maintain BUY with unchanged TP of S$1.79

We maintain our BUY with an unchanged target price of S$1.79. Our valuations is based on 11x FY22e P/E, a 15% discount to its 10-year historical average P/E on account of the uncertain environment.

About the author

Terence Chua

Senior Research Analyst

Phillip Securities Research

Terence specialises in the consumer, conglomerate and industrials sector. He has over five years of experience as an analyst in the buy- and sell-side. As an institutional fund management analyst, he sat on the China-Hong Kong desk. Terence was ranked top 3 for Best Analyst under the small caps and energy category in the Asia Money poll 2018.

He graduated from the Singapore Management University with a major in Finance (Honours), and is the honoured recipient of the CFA scholarship.

About the author

Terence Chua

Senior Research Analyst

Phillip Securities Research

Terence specialises in the consumer, conglomerate and industrials sector. He has over five years of experience as an analyst in the buy- and sell-side. As an institutional fund management analyst, he sat on the China-Hong Kong desk. Terence was ranked top 3 for Best Analyst under the small caps and energy category in the Asia Money poll 2018.

He graduated from the Singapore Management University with a major in Finance (Honours), and is the honoured recipient of the CFA scholarship.

Trade of the Day - SATS Ltd (SGX: S58)

Trade of the Day - SATS Ltd (SGX: S58) Block Inc - Cost-cutting boost earnings

Block Inc - Cost-cutting boost earnings Trade of the Day - Oracle Corporation (NYSE: ORCL)

Trade of the Day - Oracle Corporation (NYSE: ORCL) Lendlease Global Commercial REIT - Rental upside to come from Sky Complex Milan

Lendlease Global Commercial REIT - Rental upside to come from Sky Complex Milan