City Developments Limited - Still resilient in face of adversity

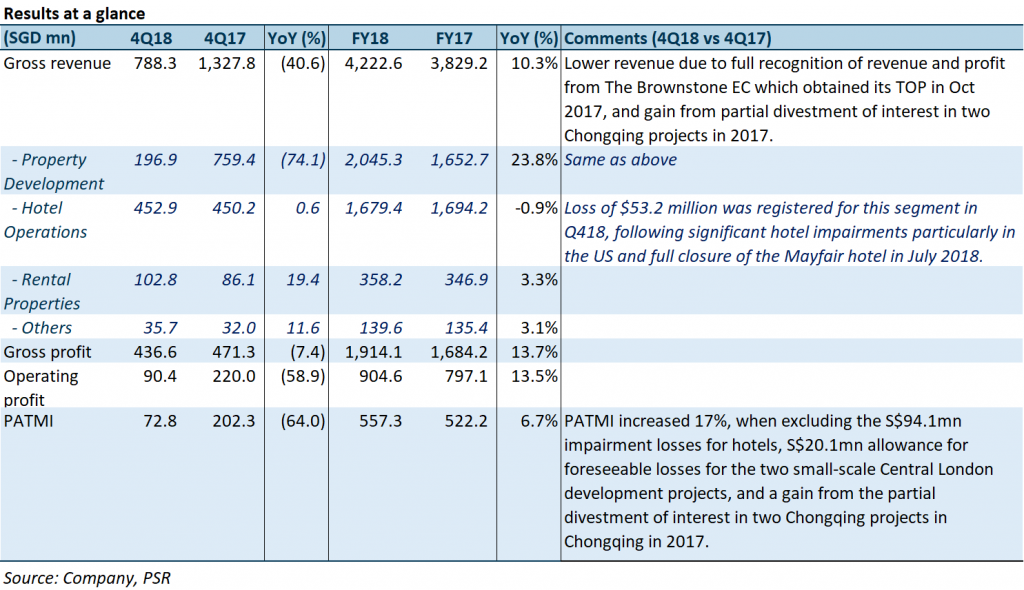

22 Feb 2019- 4Q18 and FY18 PATMI below our expectations, mainly due to impairment losses recorded.

- Dividend of 20.0 cents per share for FY18 (FY17: 18.0 cents) was declared (including a 6.0 cent special interim dividend that was paid out in Sep 2018).

- Robust demand for launched Singapore projects – including those launched after July 2018.

- Steadily ramping up recurring income stream with addition of two London commercial buildings, ongoing AEI at Republic Plaza, and other potential AEI targets.

- Sizeable impairment losses recorded on back of U.S. hotels dragged 4Q18 PATMI down by 64%. Excluding this, and on a like-for-like basis, 4Q18 PATMI would have increased 17% YoY.

- Maintain ACCUMULATE with adjusted TP of S$11.82 (change of analyst).

The Positives

+ Robust demand for launched projects – including those launched after July 2018 cooling measures. The property development segment was the clear outperformer in FY2018. Keeping in mind its non-recurring nature, this segment has traditionally reported similar revenue to the hotel operations segment. Total sales value rose 14% YoY despite a 5% YoY lower number of units sold, and this is largely owed to New Futura (c.93% sold) – which carried a record price tag of c.S$3,500psf, with S$4,009psf being the highest price transacted for a non-penthouse unit to date. In addition, projects such as Whistler Grand (S$1,380psf, 716 units) and South Beach Residences (S$3450psf, 190 units) were able to achieve a total take-up rate of c.36% and c.28% despite being launched after July 2018.

+ Steadily ramping up recurring income stream. The acquisition of the two prime Grade A freehold commercial buildings in London (Aldgate House and 125 Old Broad Street) is in line with the Group’s strategy of achieving an AUM of S$5bn by 2023 and expanding its recurring income stream to S$900mn by 2028. These two properties are currently under-rented and have an upside of up to c.27% – particularly for the latter property, of which has 24% of its leases up for expiry this year, of which half have already been committed to higher rental levels. In addition, its Yaojiang International property in China had begun its master lease agreement with Distrii (which CDL has a 24% stake in) in Nov 2018.

The Negatives

– Sizeable impairment losses on back of U.S. hotels. S$94.1mn of impairment losses were recorded in 4Q18, mainly on the back of its U.S. hotels (stemming from an industry-wide challenge on the operating cost structure). This – in addition to the S$20.1 million allowance for foreseeable losses for two small-scale Central London development projects which may potentially be leased out and the loss of revenue from the temporary full closure of the Millennium Hotel London Mayfair in July 2018 – dragged PATMI down by 64% in 4Q18. Excluding these factors and the FY17 gains from the partial divestment of two Chongqing projects, 4Q18 PATMI would have increased 17% YoY.

Spotify Technology S.A. - Raised prices and subscribers still grew

Spotify Technology S.A. - Raised prices and subscribers still grew Suntec REIT - Higher-for-longer interest rate continue eroding DPU

Suntec REIT - Higher-for-longer interest rate continue eroding DPU Apr 25th - Things to Know Before the Opening Bell

Apr 25th - Things to Know Before the Opening Bell JPMorgan Chase & Co - NII continues to rise, guidance maintained

JPMorgan Chase & Co - NII continues to rise, guidance maintained