Alphabet-C - Stock Analyst Research

| Target Price* | 144.00 |

| Recommendation | BUY› BUY |

| Market Cap* | - |

| Publication Date | 27 Oct 2023 |

*At the time of publication

Alphabet Inc. - Advertising rebound, but Cloud lags

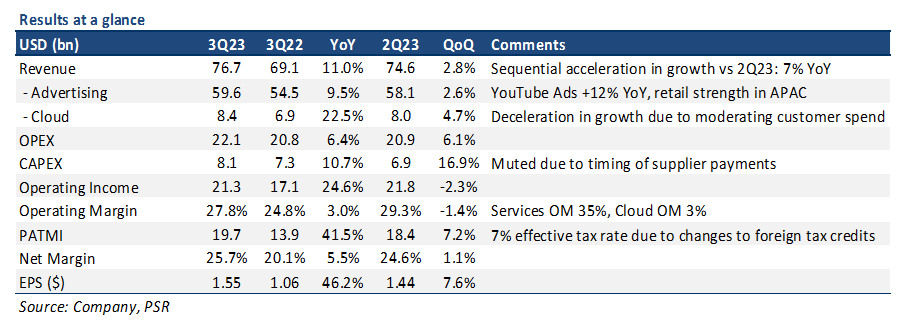

- 3Q23 results were within expectations. 9M23 revenue/PATMI were at 72%/71% of our FY23e forecasts. PATMI grew 42% YoY on higher operating leverage.

- Ad revenue rebounded for a 3rd straight quarter as retail advertisers began preparing for the holiday season. Ad revenue growth tripled sequentially to 9% YoY.

- Cloud was a disappointment, with revenue growth decelerating to 22% YoY due to moderating client spend, losing ground on competitor Microsoft’s Azure (29% YoY).

- We maintain BUY with an unchanged DCF target price of US$144, with a WACC of 7.3% and a terminal growth rate of 3.5%.

The Positives

+ Rebound in Search and YouTube ad revenue driven by Retail. Advertising continued to rebound for a 3rd straight quarter, with a 9% YoY increase in 3Q23 ad revenue. Search and YouTube advertising saw growth of 11% and 12% YoY, respectively, driven by its Retail vertical as AI-powered solutions like Performance Max continued to deliver more reliable and better ROI to advertisers preparing for a long holiday season. Overall Ad revenue growth tripled sequentially to 9% YoY vs 3% in 2Q23 (Figure 2), which is encouraging after lacklustre growth over the last 12-15 months. We anticipate a further recovery in ad revenue this holiday season as US consumer sentiment remains resilient, and forecast a 13% YoY growth for total revenue in 4Q23e.

+ Net margins expanded on higher operating leverage. GOOGL expanded its net margins by 110bps/550bps QoQ/YoY to 25.7%, with PATMI also growing by 42% YoY – its largest growth in 18 months. The main reason for the margin expansion is due to GOOGL beginning to see the full effects of its cost optimisation initiatives – smaller office footprint and less fixed costs, with 3Q23 earnings also lapping prior periods which incurred optimisation-related charges. We believe that GOOGL’s continued focus on efficiency should help to drive margins further as topline growth accelerates again.

The Negative

– Cloud growth continued to moderate, losing ground on Azure. GOOGL’s Cloud business saw revenue growth continue to decelerate to 22% YoY, down from 28% in 2Q23. The weakness was mainly due to continued optimisation in spend for some of its clients, which was slightly disappointing given competitors like Microsoft’s Azure saw a rebound to 29% YoY growth vs 26% YoY in the prior quarter. Cloud’s operating margin was also a slight disappointment, declining sequentially to 3%, from 5% in 2Q23, as GOOGL ramped up its infrastructure investments to support future AI-related Cloud growth. We expect Cloud margins to remain muted in the near-term given the expected elevated levels of CAPEX in data centres and servers.

About the author

Jonathan Woo

Research Analyst

PSR

Jonathan covers the US technology sector focusing on internet companies. Formerly a national and professional athlete, he graduated from the University of Oregon with a Bachelor’s Degree in Social Sciences.

About the author

Jonathan Woo

Research Analyst

PSR

Jonathan covers the US technology sector focusing on internet companies. Formerly a national and professional athlete, he graduated from the University of Oregon with a Bachelor’s Degree in Social Sciences.

May 13th - Things to Know Before the Opening Bell

May 13th - Things to Know Before the Opening Bell BRC Asia Ltd - Bountiful five years ahead

BRC Asia Ltd - Bountiful five years ahead Memiontec Holdings Ltd. - Fully integrated water infrastructure provider

Memiontec Holdings Ltd. - Fully integrated water infrastructure provider Oversea-Chinese Banking Corp Ltd - Non-interest income the growth driver

Oversea-Chinese Banking Corp Ltd - Non-interest income the growth driver