LHN Ltd – Co-living revenue doubles

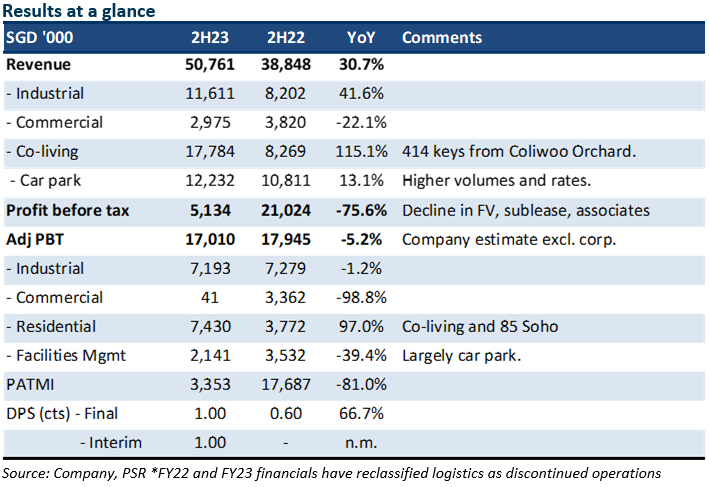

13 Dec 2023- 2023 revenue was within expectations, but earnings were below expectations. Revenue and adjusted PATMI were 98%/90% of our FY23e forecasts (excluding logistics). 2H23 adjusted PBT was 5% YoY lower due to reduced sublease gains in the commercial segment.

- Co-living revenue and earnings jumped an estimated 115% and 97% YoY, respectively in 2H23. A special dividend of 1 cent was announced from the S$18.1mn gain from the disposal of LHN Logistics. Bulk of the proceeds will be redeployed to expand the co-living franchise in Singapore with a target of 800 keys p.a. for three years (or 30% CAGR).

- We lower our FY24e earnings by 24% following the disposal of LHN Logistics. Consequently, our target price is reduced from S$0.47 to S$0.39. We peg our valuations to 6.5x FY24e P/E, while the industry is trading around 13x. Growth for LHN in FY24e will be driven by the Coliwoo expansion of 347 keys in the pipeline in Singapore and potential overseas expansion. FY25e earnings will be supported by a food factory development project worth an estimated S$70mn. We maintain BUY. LHN is scaling up its co-living franchise and brand name in Singapore. The stock pays a dividend yield of 6%, and trades at a 39% discount-to-book value of S$0.53.

The Positive

+ Strong growth in co-living. Co-living revenue more than doubled to S$17.8mn. Growth was driven by the new 411 key Coliwoo Orchard, launched in Feb 23. Room rates have been rising for Coliwoo and occupancy remains high at 94.7%. We expect 1H24 growth will be driven by Coliwoo Orchard and additional new projects, 404 Pasir Panjang (63 keys) and 48 & 50 Arab Street (26 keys). Both assets will be operational in 2Q24.

The Negative

– Lumpy commercial earnings. 2H23 PBT for commercial declined significantly due to lower gains from sublease. Such gains are lumpy and represent the fair value of the remaining lease of the asset once tenanted. Commercial recognised a S$5.8mn upfront gain in FY22, based on pre-IFRS 16 reconciliation.

Outlook

We expect another year of growth for LHN in FY24e

- Residential: Co-living growth will stem from 411 Coliwoo Orchard contribution in 1H24, an additional 347 new keys (Figure 1) and firm rental rates in Singapore

- Facilities management: Growth in car park usage and new locations will be a driver to revenue. LHN currently manages 80 car parks (including 1 in Hong Kong), with over 26,000 parking lots.

- Industrial: Supply is tight due to difficulty in obtaining approval to sublet space. LHN’s work plus store concept catering to small and medium e-commerce operators will enjoy healthier demand.

- New areas: Other potential growth opportunities include co-living projects around the region and management of healthcare dorms.

The sale of 49 units of the food factory development project in 55 Tuas South Ave 1 will be the major engine for earnings growth in FY25e. Our forecast does not incorporate these development earnings.

Maintain BUY with lower TP of S$0.39 (prev. S$0.47)

We maintain a BUY with a lower TP of S$0.39. Our valuations are pegged to 6.5x FY24e P/E, while the industry is trading around 13x. LHN is trading at 5x PE and a 39% discount to book value of S$0.53.

About the author

Paul Chew

Head of Research

Phillip Securities Research Pte Ltd

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.

About the author

Paul Chew

Head of Research

Phillip Securities Research Pte Ltd

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.

Keppel Ltd - A slow quarter

Keppel Ltd - A slow quarter Frasers Centrepoint Trust - Robust operating performance in 1H24

Frasers Centrepoint Trust - Robust operating performance in 1H24 Spotify Technology S.A. - Raised prices and subscribers still grew

Spotify Technology S.A. - Raised prices and subscribers still grew Suntec REIT - Higher-for-longer interest rate continue eroding DPU

Suntec REIT - Higher-for-longer interest rate continue eroding DPU