Pan-United Corporation Ltd. - Construction recovery hit slight snag in 1H22

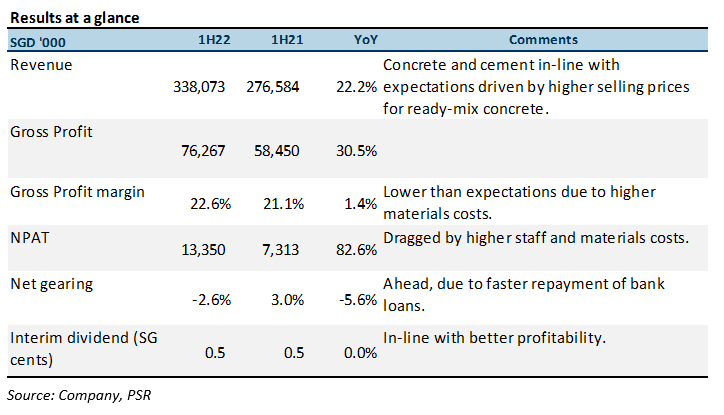

12 Aug 2022- 1H22 revenue in line with our expectations, at 51%. Profit however, came in lower at 34% as result of higher staff and materials costs.

- Net profit grew 83% YoY driven by higher ASP of ready-mixed concrete (RMC) +18% YoY, higher GPM +1.4% and a higher share of results from associates of $3.6mn.

- Workplace fatalities and dengue hampered recovery. Volumes declined 10-15% as a result of the spate of stop-work orders issued by the authorities to construction sites.

- Maintain BUY with lower target price of S$0.54, from S$0.68. We trim FY22e/FY23e earnings by 26%/11% respectively on account of higher staff, utilities and materials costs. Our TP is based on 12x FY22e P/E, a 20% discount to its 10-year historical average P/E on account of the still uncertain business environment.

The Positives

+ 1H22 net profit grew 83% YoY, driven by construction recovery and better GPM. We estimate that higher demand +5% (Figure 1) and ASP of RMC +18% higher YoY (Figure 3) drove revenue growth of 22% YoY for 1H22. The Group also saw better GPM during the period as it successfully passed on cost increases to its customers. Overall, the construction sector continued to see a healthy recovery in the 1H22 (Figure 2) in part due to the relaxation of border restrictions on the inflow of migrant workers.

+ Higher contributions from associates of $3.6mn +168% YoY lift profits. The uplift in contribution was from the sale of coal from PT Lanna Harita Indonesia, which benefitted from higher coal prices during the period. Coal prices in 1H22 averaged US$300 and are up 182% YTD.

The Negative

– Workplace fatalities and dengue hampered recovery. In the first six months of 2022, the Ministry of Manpower (MOM) reported 28 workplace fatalities, many of which were in the construction industry. This led to a call for companies to conduct a safety time-out on 9 May 2022. In addition, in 1H22, more than 12,000 cases of dengue cases were reported, far exceeding the 5,258 cases logged in the whole of 2021. This resulted in a spate of stop-work orders issued by the authorities to construction sites, which impeded construction progress. Management guided that the volume decrease as a result of such stop-work orders adversely impacted volumes by 10-15%.

ESG

Pan-United has committed to supplying only low-carbon concrete by 2030 and pledged to offer carbon-neutral concrete products by 2040. It is committed to reducing its carbon output by 50% from 2005’s level by 2030. The company has already started its journey towards being more carbon-neutral. In 2021, it provided Surbana Jurong with concrete that was created with carbon mineralisation technology. As the concrete is mixed, carbon dioxide is injected to form calcium carbonate. This not only captures and stores carbon, but also strengthens the material.

We believe its move to more green products is not only more sustainable for the environment but also opens up new markets for them. In January this year, the Group signed a memorandum of understanding with Shell to collaborate on ways to repurpose carbon dioxide and industrial waste from the oil major’s Singapore operations as raw materials to produce low-carbon concrete.

Outlook

Construction sector sees faster pace of recovery in 1H22; tailwinds remain intact. HDB has announced that it will ramp up the supply of new build-to-order (BTO) flats over the next two years to meet the strong housing demand from Singaporeans. It plans to launch up to 23,000 flats per year in 2022 and 2023, which represents a significant increase of 35% from the 17,000 flats launched in 2021. Changi Airport’s Terminal 5 project will resume after being put on hold for two years due to the Covid-19 pandemic.

BCA’s forecasts of average construction demand over 2022-2026 of $25-32bn will support construction demand in the next few years.

In the near term, projects in the pipeline that will likely support the group’s growth are the Singapore Science Centre’s relocation, the Toa Payoh integrated development, Alexandra Hospital redevelopment, Bedok’s new integrated hospital, Phases 2-3 of the Cross Island MRT Line and the Downtown Line’s extension to Sungei Kadut.

With an approximately 40% market share in the industry, we continue to see PanU as a key beneficiary of the construction sector recovery. PanU’s batching plants still have capacity to take on a 10-15% increase in RMC demand in Singapore.

Maintain BUY with a lower TP of $0.54, from $0.68. We trim FY22e/FY23e earnings by 26%/11% respectively on account of higher staff, utilities and materials costs. Our TP is reduced to $0.54 from S$0.68 based on 12x FY22e P/E, a 20% discount to its 10-year historical P/E on account of the still uncertain business environment. Stock catalysts are expected from higher contract volumes and better margins.

About the author

Terence Chua

Senior Research Analyst

Phillip Securities Research

Terence specialises in the consumer, conglomerate and industrials sector. He has over five years of experience as an analyst in the buy- and sell-side. As an institutional fund management analyst, he sat on the China-Hong Kong desk. Terence was ranked top 3 for Best Analyst under the small caps and energy category in the Asia Money poll 2018.

He graduated from the Singapore Management University with a major in Finance (Honours), and is the honoured recipient of the CFA scholarship.

About the author

Terence Chua

Senior Research Analyst

Phillip Securities Research

Terence specialises in the consumer, conglomerate and industrials sector. He has over five years of experience as an analyst in the buy- and sell-side. As an institutional fund management analyst, he sat on the China-Hong Kong desk. Terence was ranked top 3 for Best Analyst under the small caps and energy category in the Asia Money poll 2018.

He graduated from the Singapore Management University with a major in Finance (Honours), and is the honoured recipient of the CFA scholarship.

Keppel Ltd - A slow quarter

Keppel Ltd - A slow quarter Frasers Centrepoint Trust - Robust operating performance in 1H24

Frasers Centrepoint Trust - Robust operating performance in 1H24 Spotify Technology S.A. - Raised prices and subscribers still grew

Spotify Technology S.A. - Raised prices and subscribers still grew Suntec REIT - Higher-for-longer interest rate continue eroding DPU

Suntec REIT - Higher-for-longer interest rate continue eroding DPU