Raffles Medical Group Ltd - Margins still at record levels

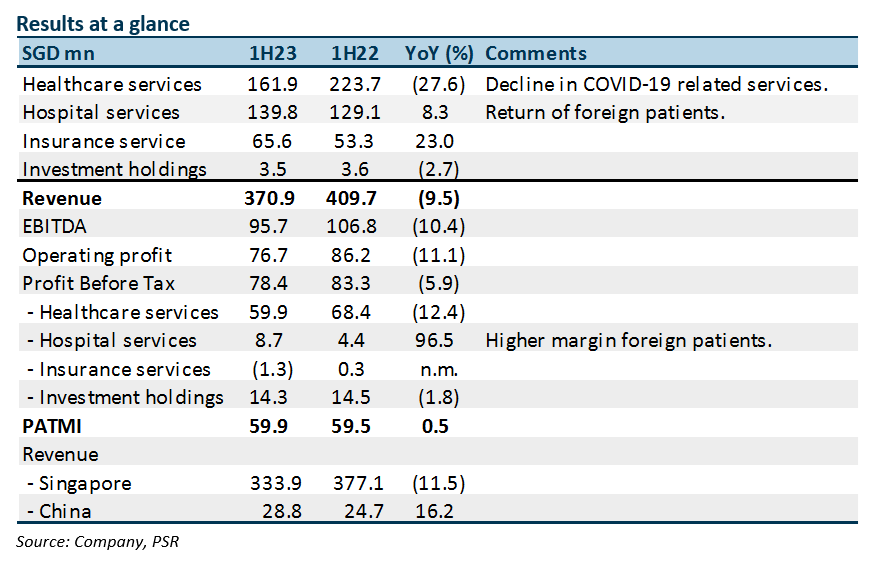

2 Aug 2023- 1H23 revenue and PATMI were within expectation at 49%/42% of our estimates. The jump in healthcare services earnings was higher than expected. PATMI was up a modest 0.5% YoY to S$59mn.

- Revenue for healthcare service was lower due to the absence of COVID-19-related services at the clinics. Hospital revenue is boosted by the return of foreign patients and transitional care facilities. Operating margins remain at record levels of around 21% despite losses in China.

- We maintain our FY23e forecast and BUY recommendation. Our DCF target price of S$1.76 is unchanged. We expect 2H23e earnings will be supported by price increases and a higher volume of foreign patients. However, the reduced contribution of COVID-19 services and lower margins from transitional care facilities (TCF) will place pressure on group margins.

The Positives

+ Resilient hospital services revenue and margins. Hospital services enjoyed growth from increased foreign patients, which are 70-80% of pre-pandemic level. Patients from Vietnam and China have not returned to pre-pandemic levels. Operating margins in 1H23 was 20.7%, higher than pre-pandemic levels of around 16%. The company managed to lower staff costs by S$34mn or 17% YoY by reducing part-time workers. Meanwhile, 1H23 PBT margin is also supported by S$4.6mn improvement in net finance income.

+ Healthy FCF* with lower capex cycle. 1H23 FCF remains strong at S$111mn (1H22: S$117mn), driving up net cash to S$230mn (1H22: S$135mn). Annualised capex is trending towards S$30mn. This compares to S$45mn p.a. over the past three years.

*Free cash flow = Operating cash-flow less Capex less Lease payments

The Negative

+ China is still a drag. Despite revenue growth of 16% YoY in 1H23, China continues to experience operating losses. The losses are estimated at between S$12mn and $14mn. The next few years are the investment phase to build brand awareness of the hospital amongst the locals. We believe locals still prefer government hospitals for their perceived pool of more experienced doctors.

Outlook

We expect 2H23 to be stable supported by the inflow of foreign patients and higher prices. Meanwhile, headwinds will stem from loss of COVID-19 PCR tests and lower margins for TCFs. Insurance will also continue suffering losses as claims rebound with the increase of more insured patients. During the pandemic, patients generally avoided the hospital if the illness was less serious.

About the author

Paul Chew

Head of Research

Phillip Securities Research Pte Ltd

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.

About the author

Paul Chew

Head of Research

Phillip Securities Research Pte Ltd

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.

Trade of the Day - SATS Ltd (SGX: S58)

Trade of the Day - SATS Ltd (SGX: S58) Block Inc - Cost-cutting boost earnings

Block Inc - Cost-cutting boost earnings Trade of the Day - Oracle Corporation (NYSE: ORCL)

Trade of the Day - Oracle Corporation (NYSE: ORCL) Lendlease Global Commercial REIT - Rental upside to come from Sky Complex Milan

Lendlease Global Commercial REIT - Rental upside to come from Sky Complex Milan